CBA also opens door to investor with a smaller deposit

The majority of the rate actions this week were hikes, as opposed to cuts, with Bank Australia lifting select fixed loans rates by 0.1%, and Teachers Manual, and its subsidiaries, raising select new customer variable rates by up to 0.25 percentage points, RateCity.com.au has reported.

From Oct. 18 to 24, just three cuts were recorded, with Greater Bank and Newcastle Permanent both trimming their lowest advertised owner-occupier rates by 0.05 percentage points.

See table below for the major moves of the week.

Related story: RateCity.com.au’s weekly wrap-up shows major moves

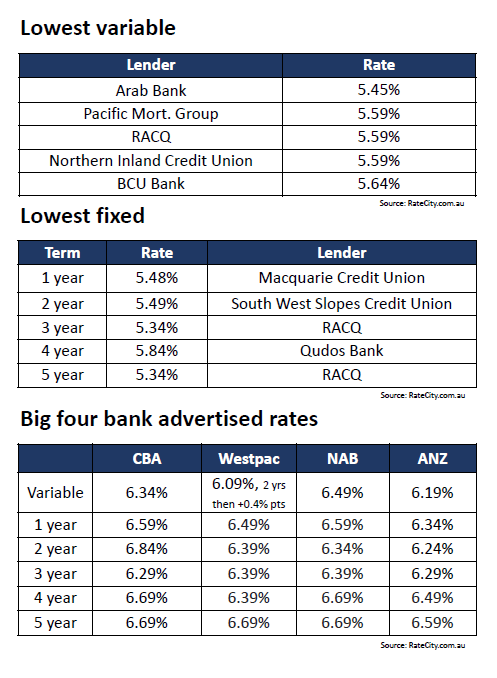

For the lowest variable and fixed rates, as well the big for bank advertised rates for the week, refer to the table below.

Also this week, CBA decided to open the door to investors with small deposits, which means the bank would now consider investor loan applications with an LVR of up to 95%, provided these borrowers commit to paying principal and interest.

“The bank is increasing its appetite for borrowers that were previously considered high-risk but are now being held up by a strong rental market,” said Sally Tindall (picture above), RateCity.com.au research director.

Tindall said a few more banks would likely make their move ahead of the next Reserve Bank meeting.

“With a higher-than-expected CPI figure announced by the ABS, the chances of a rate hike continue to rise, keeping borrowers on their toes and mortgage rates front of mind for many families,” she said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.