Ever wondered whether you’re bringing in more than the people responsible for approvals at the other end of the phone at the banks? Now you can find out.

Ever wondered whether you’re bringing in more than your counterparts at the other end of the phone at the banks? Now you can find out.

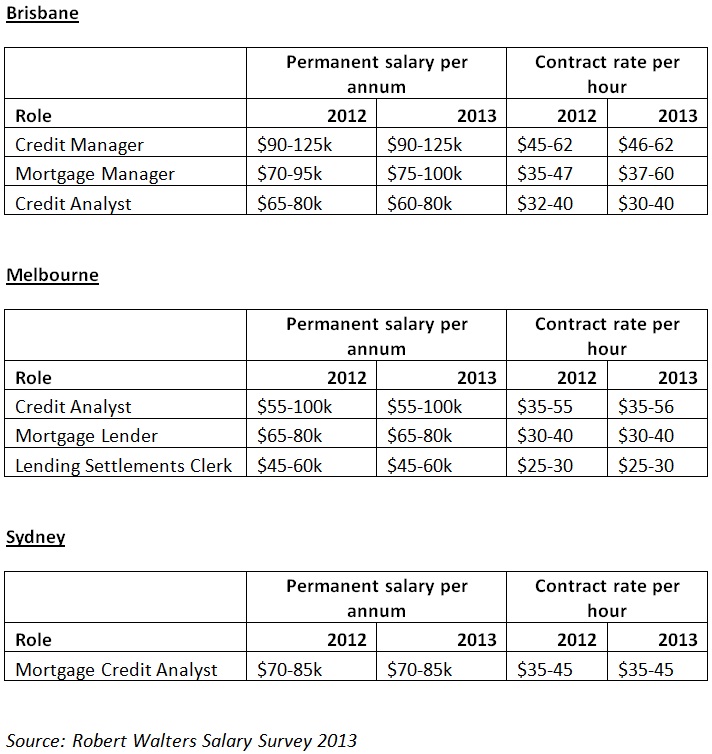

According to the latest Robert Walters Salary Survey, a credit manager in Brisbane could be bringing in as much as $125k this year, while mortgage managers could also be on a six-figure salary. Credit analysts in Melbourne could be on up to $100k, while Sydney-based mortgage credit analysts sit further down the scale with a value of up to $85k per annum.

“While poor market conditions impacted recruitment within international institutions, it had a less severe effect on domestic banks due to their lack of exposure to international markets. Two market segments – namely mortgages and wealth management – were the main drivers behind the majority of recruitment activity,” said the survey of the Sydney market.

“While recruitment levels within the mortgages sector are typically steady due to the nature of the industry, we saw notable growth in this area in 2012. This was primarily because of continued demand and increased refinancing due to the abolishment of exit fees in 2011 which led to these products becoming more important to banks.

“Strong client services and processing-focused candidates for both mortgages and superannuation were highly sought-after.

“Retail banks will hire in the highest volumes, with demand remaining for professionals with knowledge of mortgages and superannuation but also more generic deposit and lending products as firms continue to seek to strengthen balance sheets.”