But risks remain as RBA eyes future hikes, says Roy Morgan

Following the Reserve Bank of Australia’s (RBA) decision to maintain interest rates at their current levels for the third consecutive time, there was a noticeable decrease in mortgage stress among Australian homeowners, according to recent research.

Independent research firm Roy Morgan said 1.53 million mortgage holders, or 30.3%, were at risk of mortgage stress in March – a reduction of 98,000 from the previous month and the lowest level of mortgage stress recorded this year.

The current proportion of at-risk mortgage holders is substantially below the peak of 35.6% observed during the global financial crisis, thanks to the expansion of the Australian mortgage market.

According to Michele Levine (pictured), chief executive at Roy Morgan, mortgage stress eased in March as a strong jobs market and rising household incomes has helped lower mortgage stress to its lowest for three months.

“The pause in rate increases for the last five months since November 2023 has reduced the pressure on mortgage holders and allowed growth in several areas of the economy to catch up,” Levine said.

“Rising household incomes so far this year have been a significant driver of reducing mortgage stress from the highs above 1.6 million reached in recent months. The same reduction in mortgage stress was seen after the RBA paused rate increases for four months from July to October 2023.”

Despite this improvement, Roy Morgan stressed that the situation remains serious when compared to historical data. The number of homeowners at significant risk has risen by 724,000 since May 2022 when the RBA commenced a series of rate hikes.

Currently, 918,000 homeowners are considered extremely at risk of mortgage stress, notably higher than the 10-year average of 14.4%. With official interest rates at 4.35%, the highest since December 2011, the potential for increased mortgage stress looms if rates continue to climb.

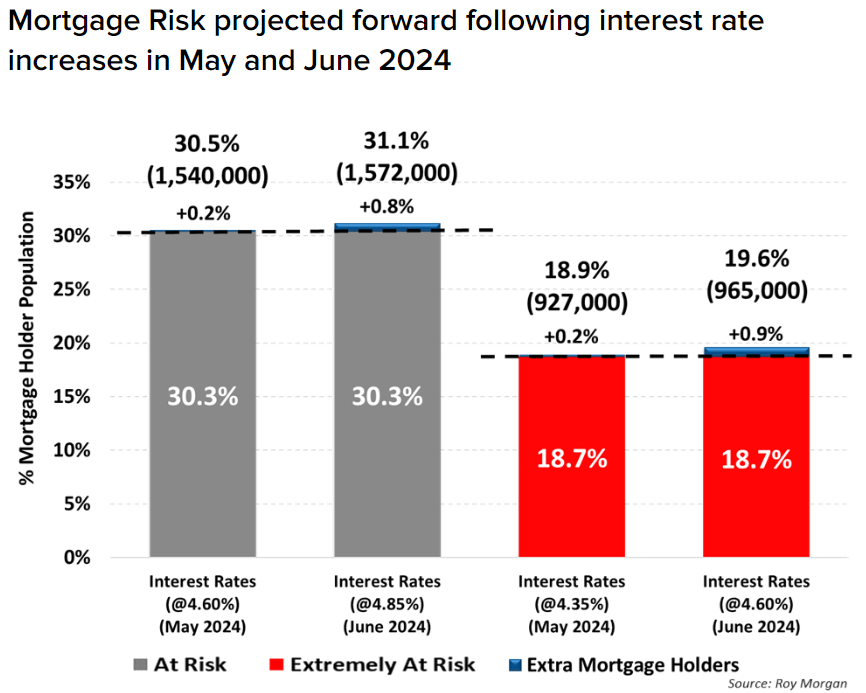

Roy Morgan has projected further increases in the RBA’s interest rates by 0.25% in May and June 2024, which could elevate the proportion of at-risk mortgage holders to 31.1%, affecting approximately 1.57 million individuals.

“Although inflation pressures have eased, the level of inflation remains above the Reserve Bank’s preferred target range of 2 to 3% and inflation indicators such as petrol prices remain high,” Levine said.

“For these reasons we have modelled further interest rate increases of plus 0.25% in May and June 2024. If the RBA raises interest rates by 0.25% in May and June to 4.85%, Roy Morgan forecasts mortgage stress would increase to 1.57 million mortgage holders (31.1%) considered at risk.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.