Figure tipped to hit record highs with potential RBA rate hikes

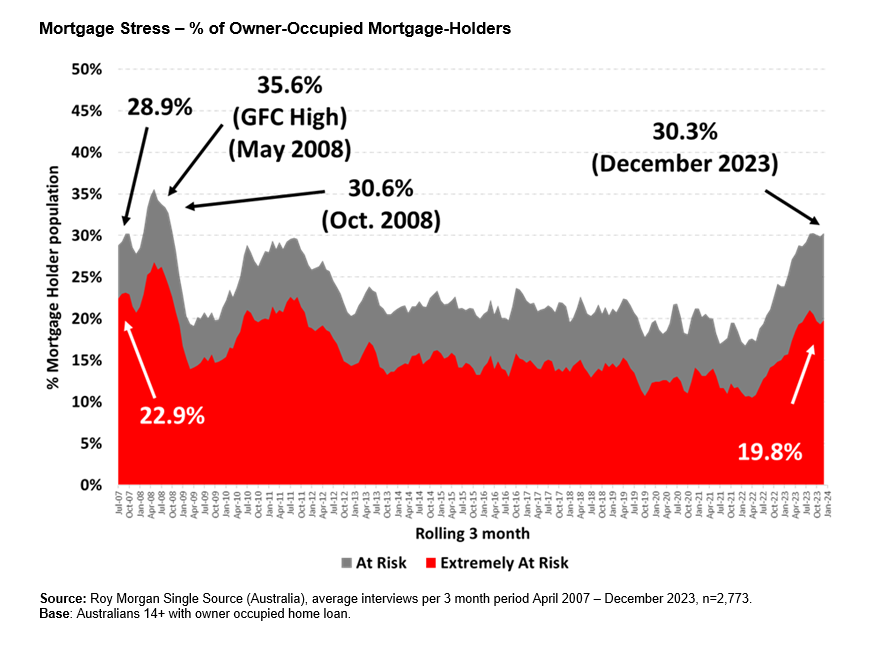

Mortgage stress increased in December, affecting 1,527,000 mortgage holders (30.3%), following the Reserve Bank’s (RBA) interest rate hike of +0.25% on Melbourne Cup Day, bringing the official rate to 4.35%, new research from Roy Morgan has revealed.

Michele Levine (pictured above), CEO of Roy Morgan, said that while mortgage stress increased in December, it remained below the mid-year highs of more than 1.56 million mortgage holders “at risk” in both August and September.

This marks only the fourth time in the index’s history that more than 1.5 million mortgage holders are considered “at risk.” Over the past 18 months, 720,000 more households have entered the “at risk” category since RBA commenced its cycle of interest rate increases, reaching the highest rates seen since December 2011.

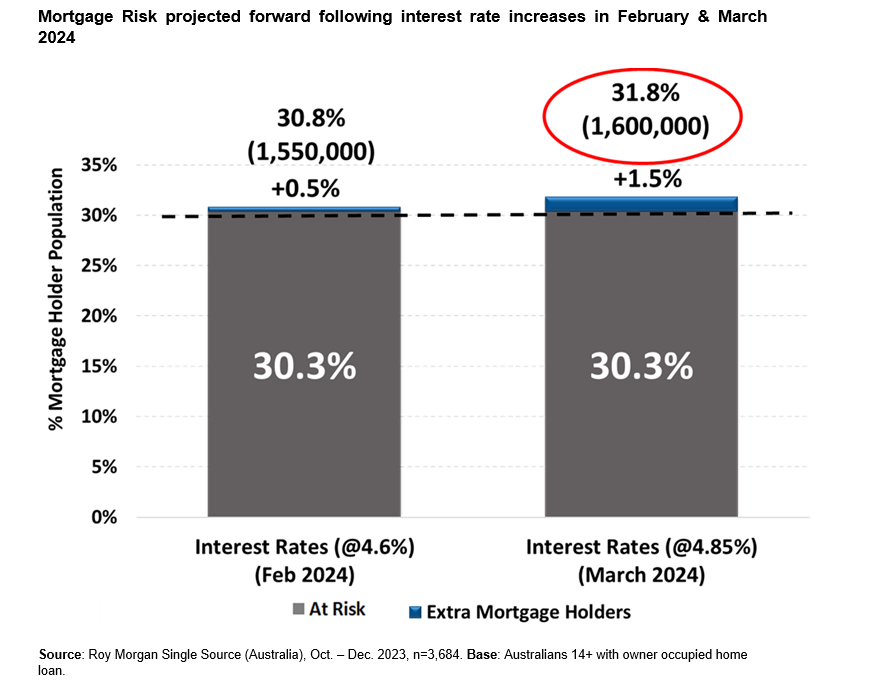

Mortgage stress projection

Roy Morgan has projected the impact of potential RBA interest rate hikes in February (+0.25% to 4.6%) and March (+0.25% to 4.85%). If these increases occur, the number of mortgage holders “at risk” is expected to rise to 1,550,000 in February and further to 1,600,000 in March. This would represent a 0.5%- and 1.5%-point increase, respectively, compared to the figures from December 2023.

Factors contributing to mortgage stress

Roy Morgan determines mortgage stress based on two criteria: if mortgage repayments exceed a certain percentage of household income, or if the “interest only” component surpasses a specified proportion of household income.

“An analysis of the underlying factors affecting mortgage holders shows a combination of factors leading to the easing of mortgage stress since mid-year,” Levine said.

“Household incomes and employment have increased while there’s been a reduction in the amounts borrowed and outstanding although the most recent increase in interest rates has provided renewed upward pressure on mortgage stress.”

Levine stressed the importance of understanding that interest rates are just one variable impacting mortgage stress and that household income, directly tied to employment, is the primary factor. Despite the recent dip in inflation, potential interest rate increases in 2024 could push mortgage stress to record highs.

Roy Morgan's findings are based on the Single Source Survey, conducted through in-depth interviews with over 60,000 Australians annually, including over 10,000 owner-occupied mortgage holders.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.