Specialist lending is on the rise as borrowers and brokers alike look for alternatives outside of the mainstream lenders. Di Robinson of Pepper Money explains to MPA what's driving this trend

Since entering the market 10 years ago, Pepper Money has aimed to help more Australian families reach their home-ownership goals. The company’s goal has always been to work closely with people whose circumstances aren’t catered for by the major players in the industry – and for Di Robinson, head of north west retail sales at Pepper Money, that mission statement remains unchanged in 2021.

“I think there’s always going to be a need for lenders who can think outside the box and use non-traditional means to provide solutions for brokers and clients alike,” Robinson says.

“There’s a significant group of Australians who are underserved by mainstream lenders, and that’s where we step in.”

Over the last few years in particular, Robinson has seen a growing awareness of the importance of non-bank lenders.

“There’s been a shift in the market – customers that used to be considered ‘prime’ are now often falling outside of prime criteria,” Robinson explains.

“One example that we see is investors with larger portfolios. While making repayments is well within their capabilities, mainstream lenders are often tightening their appetite around working with this kind of customer.”

Accordingly, more brokers are seeking the assistance of specialist lenders, particularly for their clients who are self-employed or investors, Robinson says.

She suggests that refinancing may also lead to using a specialist lender, particularly if the borrower is looking to consolidate tax or business-related debt into a mortgage.

“I think previously there’s been some hesitation around using specialist lenders,” Robinson says. “There’s been a widespread perception that they primarily cater to customers who have credit impairment, which isn’t really the case. Given the way that prime criteria have evolved since the GFC, borrowers from all walks of life are looking for new financial solutions.”

Robinson points to prospective borrowers who are self-employed as a key example. While tax returns have traditionally been used as a form of income verification, self-employed borrowers often require a lender who will consider alternatives such as BAS statements.

“You’ve got a subset of customers who are very successful on their own merits, but they’re shut out of ‘prime’ loans simply because they don’t fit the orthodoxy,” Robinson says.

Similarly, the typically faster approval time of specialist lenders can also be a strong selling point for both brokers and their clients – banks often have lengthier processes, which can prove problematic when dealing with business deadlines and specific finance clauses.

Certainly, there’s also room for borrowers who have previously had a credit incident. After all, as Robinson points out, “Prime is just a moment in time”, and past negative credit history is not necessarily indicative of future potential – not to mention the ways that borrowing potential can be impacted by simple ignorance.

“One thing we often see is prospective borrowers not meeting the criteria for lenders mortgage insurance because they’ve had multiple enquiries on their credit file recently,” Robinson says. “For example, they might have been shopping around with multiple lenders for a car loan in the last 12 months or so. Many people don’t realise that exploring finance options with many different providers will impact their credit score.”

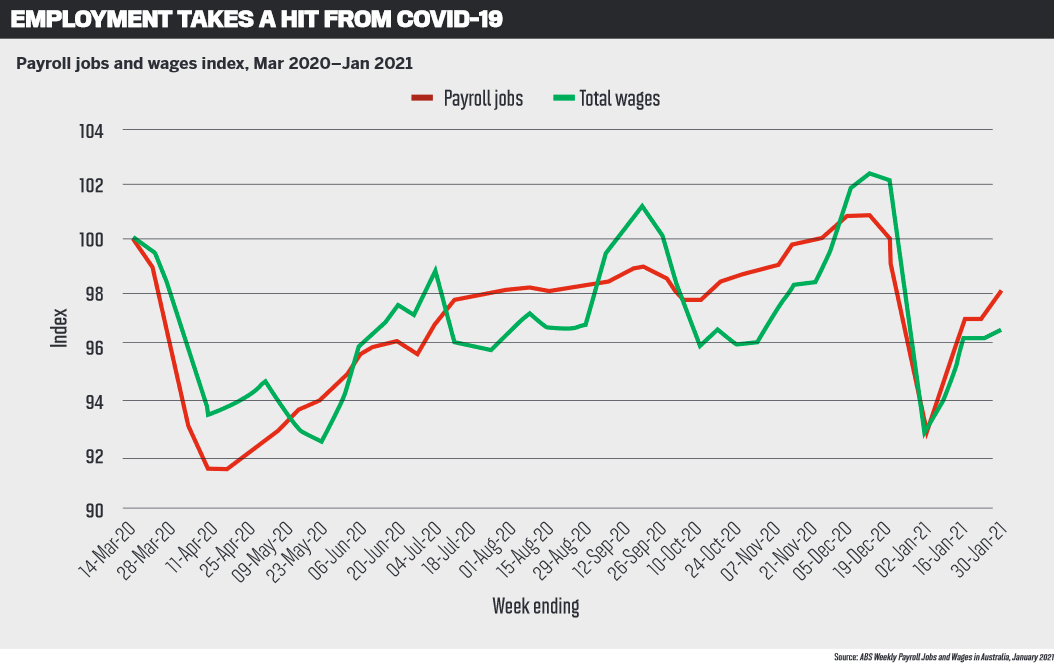

All these and other factors are likely to have a longer-term impact on the lending industry, particularly in the wake of COVID-19. People have had their long-term employment interrupted, their income reduced and their savings patterns disrupted.

While Robinson believes the full effects of COVID-19’s impact are still to be realised, she thinks it’s clear that customers who have never had to consider a specialist loan in the past may have to do so in the future.

“The great news is that this provides brokers across Australia with new opportunities to connect with more customers and assist them with their lending needs,” she says.

“I think we’ll see even more of this in 2021 as customers will be looking to brokers for guidance and support as they navigate through a different, and sometimes difficult, landscape. Brokers are uniquely placed to offer the broadest range of product options that a customer may need to find a solution.”

Clearly, Robinson notes, it’s of key benefit for brokers who haven’t previously worked with non-bank lenders to start now.

To this end, Pepper Money offers an online Product Selector Tool that can provide brokers with an indicative offer in under five minutes, which helps provide options to clients in the moment, as the broker requires. Additionally, Pepper Money also has BDMs and a scenario team who are able to discuss any queries either over the phone or via email.

“Brokers have the opportunity to show-case their expertise to their customers like never before,” Robinson says. “We’re going to see even more customers looking to brokers for guidance and support as they navigate through different and sometimes difficult situations.”

That’s not to say it’s always easy, of course. The challenge for brokers, she says, can arise from recommending a near prime product to the client when they may have never needed to consider an alternative lender in the past. It’s not a purely financial consideration; for many borrowers, there’s a psychological component too.

“At Pepper, we have a 5 Step Process,” Robinson says. “Brokers can use this as a guide on how to successfully offer an alternative lending solution, as well as to get some tips on navigating the emotional aspect of the customer’s lending experience. Borrowers need to have confidence that you’re doing the right thing by them, and good communication is a key part of that process.”

Robinson believes brokers are uniquely placed to access a range of different product options that can help a customer in every situation, whether they need a quick response to a loan enquiry or a lender that will help them work through a life event that has led to some credit impairment.

“The value proposition of a broker has never been more relevant,” Robinson says. “Being able to commit to the customer to see them through the loan journey from start to completion is a critical benefit for many borrowers.”

Looking ahead into 2021 and beyond, Robinson is convinced that specialist lending will continue to provide solutions for borrowers who don’t meet the main-stream lending criteria and require a lender that will consider their individual circumstances. Specialist lending has also become more relevant after customers’ experiences, both emotional and financial, of the unprecedented events of the last year.

“For many it was a very rewarding year financially, but many other customers and businesses were challenged by the events,” Robinson says.

“As we navigate through this year, a lender that can support self-employed customers by considering their current income and situation will be important to helping those businesses continue moving forward.”