After the royal commission recommendation that brokers should be required to work in their customers’ best interests, the duty is set to come into play this year – but concerns remain over the current legislation

After the royal commission recommendation that brokers should be required to work in their customers’ best interests, the duty is set to come into play this year – but concerns remain over the current legislation

Legislation for the best interests duty was introduced into Parliament towards the end of 2019, but industry groups will continue to work through the remaining concerns with the government.

The legislation follows Commissioner Kenneth Hayne’s recommendation in the royal commission’s final report that such a duty be implemented. The Financial Sector Reform (Hayne Royal Commission Response – Protecting Consumers (2019 Measures)) Bill 2019 says the mortgage broker must act in the best interests of the consumer in relation to credit assistance.

As it stands, it outlines that if the broker is aware of, or “reasonably ought to know of ”, a conflict between the interests of the consumer and the interests of the broker or their associate or representative, the broker must give priority to the consumer.

The legislation will apply to any credit assistance given on or after 1 July 2020.

Treasurer Josh Frydenberg said that in line with Hayne’s recommendations the duty would apply to the provision of consumer credit assistance and not to business lending.

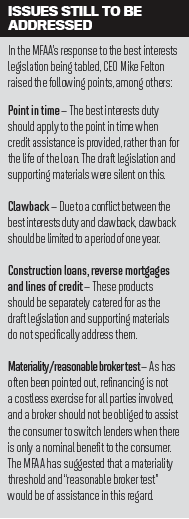

According to MFAA CEO Mike Felton, the association supports the introduction of the duty, but while the government has addressed a number of the concerns the MFAA raised during the consultation period, there are still areas the association believes do not align with optimal customer outcomes.

What concerns were resolved?

In a communication to brokers, Felton said issues such as the commission calculation period for the use of offset funds had been amended; originally the draft legislation had it at 90 days, but this has been extended to 365 days.

However, he said mortgage brokers should be defined by their activities, rather than the business they carried out or what they called themselves. He pointed out that the duty currently applies specifically to mortgage brokers, so a finance broker could offer a mortgage without being restricted by the duty. Also, the duty applies to mortgage brokers no matter what they offered. Therefore, it would extend beyond mortgages and would restrict mortgage brokers from assisting their customers with other forms of credit, such as personal loans and credit cards.

Connective director Mark Haron said this last point was a particular concern, especially as many home loans were offered in a bundle with a credit card.

“There’s enough work to be done when you’re comparing products in and around the professional package with the home loan,” Haron said.

“Then, to have to also get all the attributes of the credit cards that are part of those packages and compare them and make sure you’re applying the best interests duty, brokers will say it’s too hard, I’m not getting paid for that, so I’m not going to do it.”

While he did say there were “some wins”, he explained that the legislation in its entirety was not exactly what he had hoped for. Despite that, he said the industry now needed to embrace the duty and work with government and regulators in terms of how it would be implemented, because it gave brokers “the capacity to provide consumers with a much better outcome”.

“We have had some good, careful consideration and overall acknowledgement that the mortgage broking industry is a crucial component to competition in the home loan lending space, so they’ve made some substantive changes to ensure that mortgage brokers are still able to operate effectively,” Haron added.

Next steps towards a workable duty

“However, we see that the shift for brokers will centre around having access to the right technology that supports a broker’s process and how a broker can prove they’ve met their best interests duty for each and every client each and every time,” he added.

The aggregator has its own platform, MyCRM, which White said was ready to help brokers navigate the duty. “Loan Market is well underway in building a process for our brokers to keep them safe during this time of change, and we look forward to sharing the prototype and gaining valuable feedback from our brokers before we go live on July 1,” he said.

“Loan Market will continue to work with ASIC, the MFAA and other industry leaders in understanding how the legislation will be interpreted and a framework developed.”

Following Parliament’s break over the summer, the bill is expected to go to the Senate, when any proposed amendments will be tabled.

Haron said he and other industry bodies would be busy making sure changes for the customers’ best interests were considered and hopefully amended. ASIC is also expected to provide guidance on the duty. With the duty scheduled to come into force on 1 July 2020, the industry would be asking for a non-enforceable 12-month period to ensure it could make the necessary adjustments without penalties.

“That being said, I don’t believe that is such a big issue or a big effort for brokers, because I genuinely do believe that the majority of brokers, in the way they conduct themselves, put customers’ interests ahead of their own. And that is largely why the broking industry exists and why it has grown,” he said.