Vast majority of regions across Australia will experience a rise in business failures over the next year

New South Wales has emerged as the worst state in Australia for business insolvencies, according to a report from Business NSW highlighting that the state accounted for 42% of the country’s insolvencies in 2023-24, despite only comprising 31% of the national population.

The report, which analysed data from the Australian Securities and Investments Commission (ASIC), noted that NSW is the only state where average yearly insolvencies have increased since the pandemic.

Business NSW chief executive Daniel Hunter (pictured above left) expressed concern over the rising insolvencies, attributing the trend to a combination of high taxes, regulatory pressures, and the federal government’s recent industrial relations changes.

“The federal government likes to say that it is on the side of small business, yet all we see is more and more businesses go to the wall,” Hunter said.

“To keep good businesses thriving, the NSW government needs to take a serious look at lowering payroll tax levels, bed down proper reform of the Emergency Services Levy to reduce the pressure on insurance premiums and establish a new energy advice and support program targeting the SME sector. Federally, we need both a rethink of the recent industrial relations changes and a permanent increase to the size and scope of the instant asset write-off.”

NSW has the highest rate of business insolvencies in Australia. In 2023-24 NSW had 42% of Australia’s 4634 insolvencies yet only 31% of the country’s population.

— Business NSW (@business_nsw) August 19, 2024

Read what our CEO Daniel Hunter told the Sydney Morning Herald: https://t.co/lDlHgvt2nV pic.twitter.com/Ne6UIvgjsl

Hunter warned that without changes, large corporations could further dominate the market, squeezing out smaller players. He also pointed to the Australian Taxation Office’s crackdown on unpaid debt and the post-pandemic adjustment period, during which many previously unsustainable businesses are now failing, as significant contributors to the surge in insolvencies.

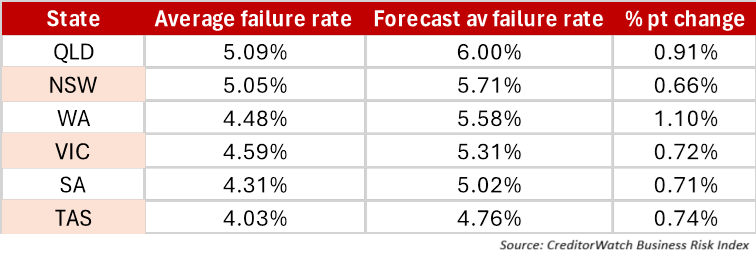

Adding to the grim outlook, CreditorWatch’s July Business Risk Index predicts that 87.2% of regions across Australia will experience a rise in business failures over the next year.

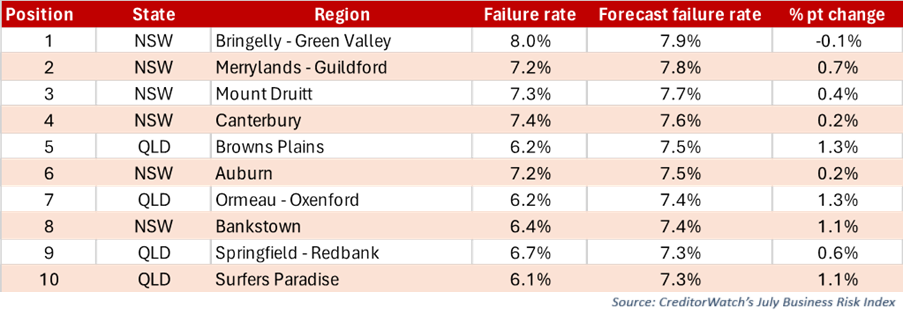

Queensland is forecast to have the highest rate of business failures, with Western Australia expected to see the largest increase. Western Sydney and South-East Queensland are identified as particularly vulnerable areas due to high interest rates and commercial property costs.

Patrick Coghlan (pictured above centre), chief executive of CreditorWatch, highlighted the broad pressures facing businesses nationwide, including rising costs and declining consumer demand.

“The fact that almost 90% of regions will see an increase in the rate of business failures indicates that the current pressures from interest rates, cost increases and declining consumer demand are being acutely felt right around the country – particularly those areas with younger populations and a higher proportion of businesses in high-risk sectors,” Coghlan said.

“Our hope is that the Stage 3 tax cuts will continue to boost consumer confidence to some extent, but we don’t expect a significant improvement in conditions for businesses until the impacts of one or two rate cuts are felt by households.”

The report also noted that court actions for debt collection have surged to above pre-COVID levels as businesses struggle to stay afloat.

According to Anneke Thompson (pictured above right), chief economist at CreditorWatch, consumer confidence is unlikely to trend upward for some time yet.

“Consumer confidence is still incredibly low, even though consumers reported to Westpac in its August survey that confidence was slightly up,” Thompson said. “While consumers are now less fearful of an increase in interest rates, and also report a small positive sentiment increase from tax cuts, the increase in confidence is not nearly enough to suggest that household consumption will recover any time soon.

“As long as households are spending less, and we know from retail trade data that spending per head of population has decreased for eight straight quarters, businesses will continue to battle high interest rates and continuing high input costs with falling demand.”

CreditorWatch said the challenging business environment is expected to persist until at least the first quarter of 2025, with relief possibly coming only after the Reserve Bank of Australia cuts interest rates.

However, the impact of these pressures is uneven across the country, with areas populated by younger demographics and those with high exposure to the construction and retail sectors expected to face the most significant challenges.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.