All 38 experts and economists surveyed say the RBA will maintain the cash rate today

Ahead of the Reserve Bank of Australia’s (RBA) cash rate decision today, June 18, one in five experts surveyed by Finder has predicted that the rate will remain on hold until July 2025.

Results of Finder’s RBA Cash Rate Survey revealed that all 38 experts and economists, who weighed in on future cash rate moves and other economic issues, believe the RBA will maintain the cash rate at 4.35% in June.

Graham Cooke (pictured right), head of consumer research at Finder, said the consensus is that the RBA will hold the cash rate due to persistent inflation and mixed economic data.

“Despite some signs of a weakening economy, inflation remains above target, making a rate cut unlikely,” Cooke said. “Nobody saw COVID-19 or the war in Ukraine coming, and these have been the driving factors behind our current situation.

“What the next few months have in store will determine whether Aussie homeowners emit a sigh of relief or anxiety by year’s end.”

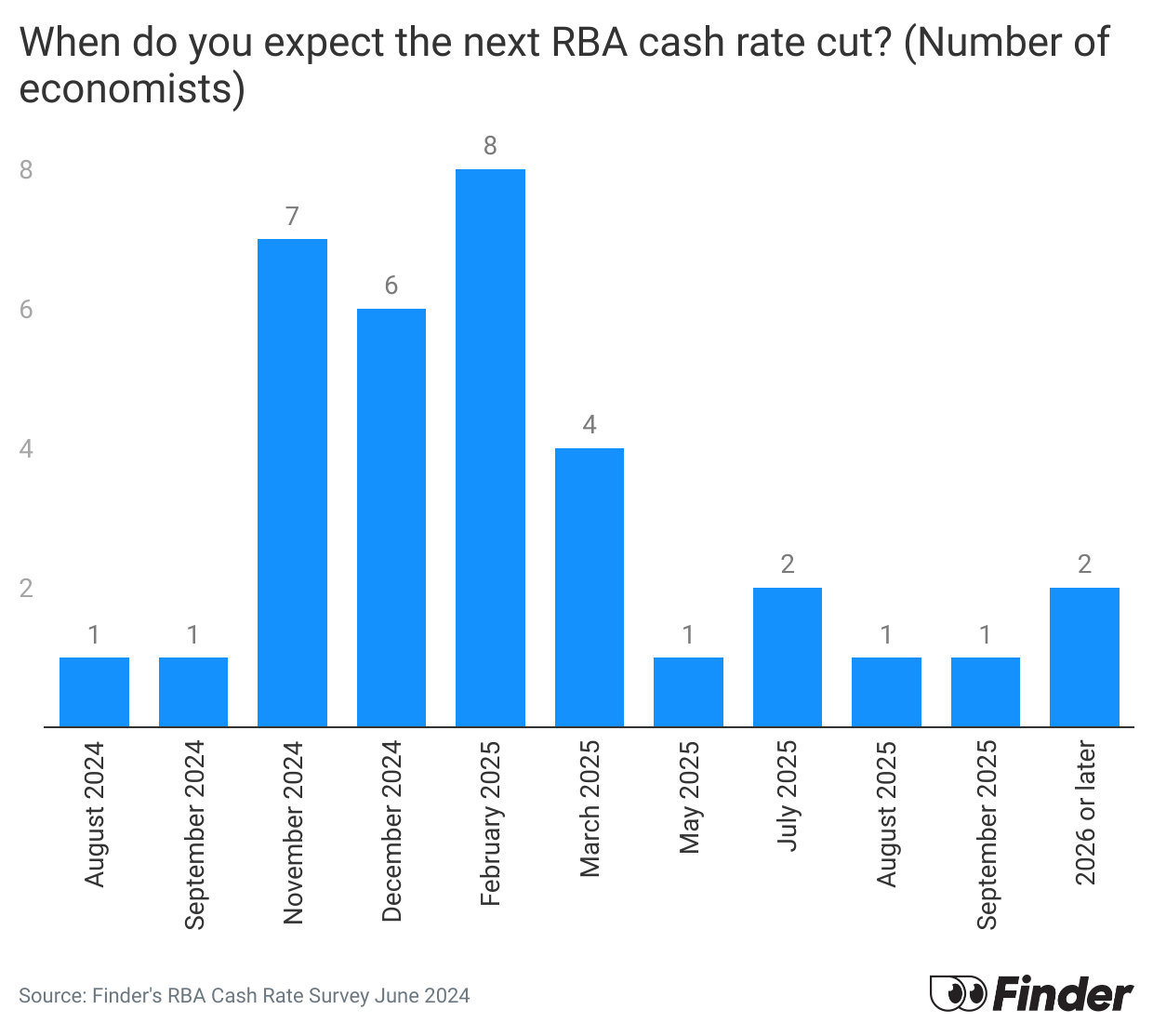

Experts are, however, divided on future rate cuts. Over two in five, or 44%, believe a rate cut will occur before the end of 2024, while 38% do not anticipate a rate cut until at least 2025. Almost one in five, or 18%, foresee a longer period of holding rates steady, with rate cuts off the table until July 2025 or later.

“I expect the Reserve Bank will keep the cash rate on hold in June, given persistently high inflation,” said Anthony Waldron (pictured above left), chief executive of Mortgage Choice.

Tim Reardon (pictured above centre), chief economist at the Housing Industry Association, believe inflation will be increasingly sticky.

“Embedded inflationary pressures are increasingly evident,” he said. “Fiscal policy will continue to add to inflationary pressures, especially through the cost of labour. The RBA will disregard the impact of fiscal measures that mitigate ‘cost-of-living pressures’ on inflation.”

Shane Oliver (pictured above right), chief economist at AMP, said the RBA still lacks the confidence to start cutting rates following recent higher than expected inflation data.

“The central bank will hold for the next few meetings, with the risks still being on the upside for rates,” he said. “But weaker growth and lower inflation should allow a cut by year end.”

According to Cooke, the biggest concern is if inflation remains elevated for an extended period of time.

“The RBA will need to tread carefully – while many shoppers have tightened their purse strings, money is still pumping into the economy,” he said. “Households are at their wits’ end, paying more and more for their groceries and housing costs, so something has to give.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.