Phillip Nguyen, director of Perth brokerage IFG Home Loans and an MPA Top 100 Broker, reflects on two decades of industry change

Phillip Nguyen, director of Perth brokerage IFG Home Loans and an MPA Top 100 Broker, reflects on two decades of industry change

MPA: What are the biggest changes you’ve seen as a broker in the past 20 years?

Phillip Nguyen: The mortgage industry has undergone incredible change since brokers first started offering their services two decades ago. The biggest changes, in my opinion, are in competition, technology, regulation and the housing market.

Competition: There are more and more players in the market. Brokers have to identify themselves from the crowd by continuing to improve their knowledge of the lender’s products and processes, and to work for the best interests of the client.

Technology: We now have a lot of systems to assist broker businesses, such as valuation systems, loan submission and tracking systems, CRM systems, and ID verification processess. Technology changes so quickly, and brokers always need to learn how to utilise the systems to gain competitive advantage.

Housing market: The housing market used to be a hot topic to discuss when there was a major increase from 2001 to 2007, thanks to the resources boom during this period. It created a significant increase in brokerage needs during that time and we were flooded with applications and had limited time for finance as everyone rushed into buying properties. The market became stable after that.

MPA: How has the brokerage changed and adapted during this time?

PN: The brokerage has come a long way over the last 20 years. Technology does play an important role in improving the brokerage business. Brokers used to complete the application form manually and get it signed by the client and sent to the lenders by fax. Now we can submit electronically, meaning one system for multiple lenders and documents can be emailed or uploaded directly to the assessors.

.PNG) Though it takes some time to learn and get used to a new system, the process becomes more streamlined and consistent once the broker becomes familiar with it. Thanks to the automatic valuation model, we can now have a quicker and more accurate estimation on the housing market to support the application. I hope that technology can become more and more advanced to assist the broker’s decisionmaking as well as improve the exchange of information between lenders and brokers.

Though it takes some time to learn and get used to a new system, the process becomes more streamlined and consistent once the broker becomes familiar with it. Thanks to the automatic valuation model, we can now have a quicker and more accurate estimation on the housing market to support the application. I hope that technology can become more and more advanced to assist the broker’s decisionmaking as well as improve the exchange of information between lenders and brokers.Besides, brokers have to continually learn new products as lenders’ policies change, depending on the state of the economy. A good broker is always thirsty for knowledge and willing to learn and act in the client’s best interests to achieve their financial needs while meeting all industry regulations and requirements. In terms of regulations, it is an ongoing learning curve for each broker, so they have to pay a lot more attention to every detail and spend more time on each application, from customer identification to anti-money laundering, since the AML/CTF Act was introduced in 2006.

MPA: Why specialise in loans to non-Australian residents looking to invest in or move to Australia?

PN: We are glad we have a great clientele, and the majority of our clients are from the community who want to migrate to Australia, or WA in particular, under a temporary working visa. They contribute greatly to the WA economy and help resolve the skills shortage. Therefore we are endeavouring to assist them in getting a place of residence. With changes in foreign investment requirements and banks’ policies, there are both challenges and opportunities for us to become experts in this niche market.

MPA: What are the strengths and weaknesses of the WA property market currently?

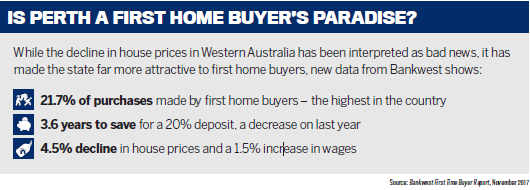

PN: The property market is quite flat at the moment, and we are noticing declines in some areas. It makes properties more affordable for homebuyers and small investors. I reckon the WA market is more stable and not as much of a bubble as other eastern states, plus the WA state government has started some multimillion-dollar projects to sustain the growth of the market, so hopefully prices will recover in the next few months. The weakness, however, is the reliance on mining and the overall economy. Overall, the WA housing market still has a lot of potential to grow and fit into the pocket of a lot of homebuyers.

MPA: What are IFG’s plans to grow further in 2018?

PN: We would like to thank all of our customers and business partners who have supported us in creating a successful year. In the new financial year 2018, we plan to achieve at least a 10% increase in our settlement volume, as well as focus on improving our business efficiency with the help of technology, in terms of improving our business processes, reducing turnaround time and eliminating rework.