MPA and Advantedge look at the technology making white label products easier than ever to write

MPA and Advantedge look at the technology making white label products easier than ever to write

If you were designing a lender from scratch, would you even care about its brand? Advantedge has led white label lending for almost a decade, yet its brand remains about its products and, increasingly, its processes. This year Advantedge wants to make it easier than ever for brokers and customers to access its products.

For general manager Brett Halliwell, a recent round of net promoter score surveys indicated how the Advantedge brand could benefit brokers. Overall, end customers rated Advantedge quite favourably (at +23), but those same customers rated the brokers three times higher (at +70) for the services they provided. “It really validated our position that customers rely on the broker’s recommendation,” Halliwell explained.

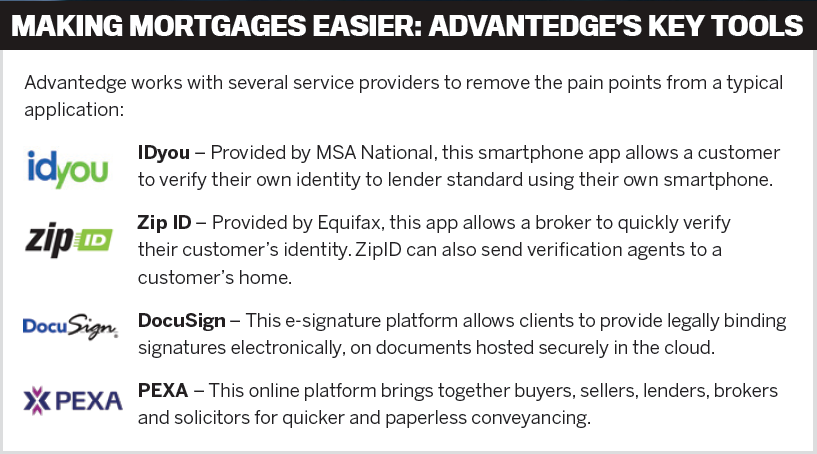

While last year Advantedge did indulge in a rebrand, revitalising the ChoiceLend, FASTLend and PLANLend brands, their main improvements have been to process, not product. For brokers, Advantedge introduced three new services: the IDyou and ZipID identification apps and the DocuSign electronic signature platform. For customers, a new SMS service will help them arrange a valuation as soon as the broker submits the loan for approval.

“We’re really keen for brokers to embrace the new technology and the convenience it brings,” Halliwell says, “but we are finding that there are some brokers who are reluctant and haven’t taken it up yet.”

Halliwell argues that IDyou is “a really easy and convenient option for brokers and customers to fulfil the customer identification process”. The app allows a customer to verify their identity themselves using their mobile.

Halliwell is particularly excited about DocuSign. “We think we’re a little different to others in the market,” he says. “Where state legislation allows, you can also sign the mortgage documents using DocuSign, so that really becomes incredibly convenient for customers.” Advantedge plans to move its entire application form onto DocuSign by the end of 2018, further reducing the need for wet signatures.

“We’re really keen for brokers to embrace the new technology and the convenience it brings” Brett Halliwell, Advantedge

Not only has Advantedge benefited from improving broker technology, but it has helped drive technology forward. Halliwell was deeply involved in realestate.com.au’s move into broking, which will use NAB and Advantedge products to introduce home finance earlier than ever before into the home search process. At the other end of the process, Advantedge is working with PEXA to cut down the amount of paperwork involved in conveyancing.

“We believe it’s the direction the entire industry will take,” says Halliwell, “so we implore brokers to jump on board and reap the benefits.”

A broker’s experience

One broker who has jumped on the bandwagon is Andrew Carra, a broker and financial planner who runs Red Sparrow in Melbourne’s Docklands.

Carra says he has been aware of white label products for about five years, first as a financial planner. “What I’m looking for is a long-term low rate for my client, and that’s why I like to use a white label product,” he explains. Over those five years service has been consistent, meaning “quick approvals, easy to make changes to loans, easy to do business with”, Carra says. As a financial planner, he has also benefited from being able to compile and print clients’ loan statements in his office at tax time.

Clients’ demands of white label products are straightforward, Carra believes. “I think what clients understand is the interest rate, and they don’t really care about the brand attached to it. It does help that PLANLend is part of the NAB Group. It gives people comfort; it gives me comfort as a broker.”

Over the past year, Carra has started using ZipID and DocuSign. “The biggest and most amazing innovation I’ve seen is DocuSign,” he says. “That’s been the game changer I think, in favour of brokers.”

Put simply, DocuSign has allowed Carra to slash turnaround times. “Last year I had a loan – I submitted it on Monday afternoon, had the approval come through Tuesday morning; the clients had the loan documents emailed to them that afternoon, and they signed them that afternoon electronically, so I had submission to approval to documents being returned to the solicitor in 24 hours.”

Not only has DocuSign reduced the number of meetings Carra has had to arrange with clients, but he rarely needs to explain the system. “It’s so easy,” he says. “The only part on which clients get a little bit confused is that you can pick one of two fonts to sign with, which clients tend to agonise over.”

Carra has since integrated other apps into his business, such as the CashDeck platform for collecting bank statements, “which takes a one-hour process into about three minutes”. For Carra, it’s clear who’s benefiting from technology and the white label products in the industry. Taking up DocuSign “was my Kodak moment in the industry: disruption’s here and it’s really working in favour of brokers,” he says.

Brett Halliwell

Advantedge