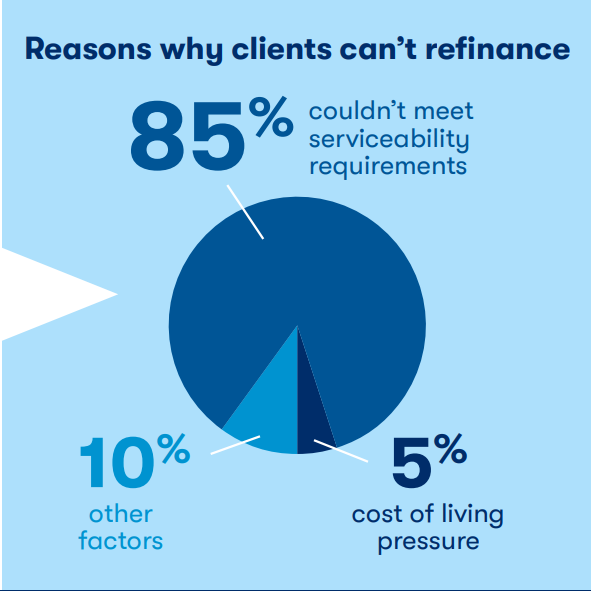

Find out the top reasons why clients can't refinance

Mortgage and finance brokers are seeing a large number of new clients using a broker for the first time to understand options around their home loan, according to a recent Mortgage & Finance Association of Australia (MFAA) member survey.

The survey of 466 MFAA members showed that 95% of brokers have had clients who have never used a broker before coming to them to refinance their current home loan, which, according to MFAA CEO Anja Pannek (pictured above), highlighted the “value of using a broker given the complexity of the lending market.”

The top reason the brokers’ clients were unable to refinance was their inability to meet servicing requirements, with eight in 10 brokers saying up to half of their refinancing clients were facing this issue, the survey found.

Survey results also showed that most brokers have had clients who were mortgage prisoners – those who were in a position where they don’t qualify for refinancing. In contrast, known instances of clients seeking hardship assistance remained extremely low, indicating that broker clients were receiving strong guidance on their credit options.

Worryingly, though, more than 90% brokers reported that they believed their clients were more concerned about meeting mortgage repayments compared to the start of 2023.

“We expect this concern about mortgage repayments to increase over the coming months with more than 1.2 million borrowers coming off very low fixed-rate terms throughout 2023 and into 2024,” Pannek said.

The MFAA said the insights from the survey at “at the coalface” insights from its members have enabled the group to work with the government, regulators, and Treasury, so they can get the best outcome possible for their clients.

“The data also highlights the critical role of mortgage brokers for consumers,” Pannek said.

Use the comment section below to tell us how you felt about this.