Mounting scam cases prompt increased focus on tech solutions

The threat of scams continues to grow, with recorded cases rising nearly 50% over the past financial year, according to a new report.

Bankwest’s 2024 Safe and Savvy Report, released to coincide with Scams Awareness Week, highlights the increasing sophistication of scam tactics and the crucial role of technology in protecting customers.

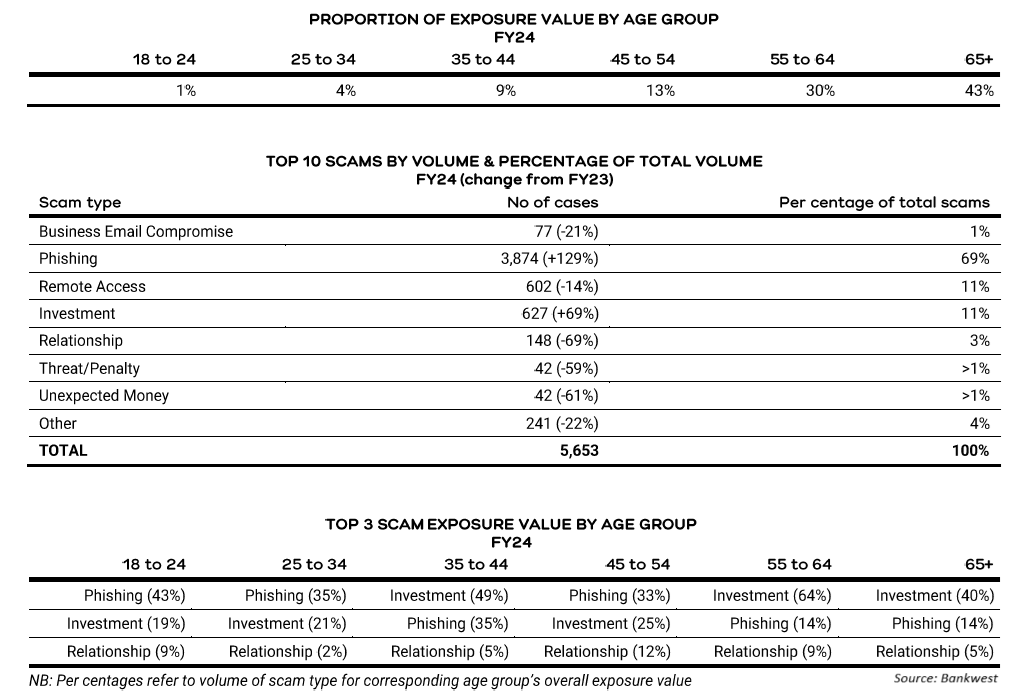

The report revealed a 129% year-on-year increase in phishing scams, making it the most prevalent method used by scammers. Remote access and investment scams, each accounting for 11% of cases, were the second most common tactics.

Older Australians, particularly those over 55, were disproportionately targeted, representing three-quarters of the total exposure value across all scams.

In response to the surge in scams, Bankwest said it has invested in new technologies to enhance customer security. Among these is the ‘NameCheck’ feature, launched in June, which allows customers to verify account payment details. Since its introduction, NameCheck has been used over 354,000 times, with more than 44,500 transactions prompting customers to recheck account details due to potential discrepancies.

Bankwest is one of three Australian banks to implement NameCheck, which cross-references entered account information with available payment data to alert customers to possible mismatches and scams.

In addition to NameCheck, Bankwest has strengthened its security measures by locking down its Alpha Tags, which are the name identifiers on SMS messages. Scammers often attempt to hijack these tags to send fraudulent messages that appear to come from legitimate businesses. Bankwest, in collaboration with telecommunications companies, has secured the “Bankwest” and “BW Collect” tags, significantly reducing the risk of phishing scams.

The bank has also introduced real-time digital holds and declines on cryptocurrency transactions, preventing over $221 million worth of potentially fraudulent transactions since June 2023.

“Most scams originate outside of the regulated banking system, be that phone calls, fake investment ads on social, and SMS and email, requiring a holistic response from big tech, telcos and banks, focused on scam sources,” said Philippa Costanzo (pictured above), head of payments, scams and fraud at Bankwest.

“Bankwest has committed to significant investment in its digital channels to support customers in banking safely and securely, but the best defence will always be for customers to stay vigilant and informed of the threats.

“We encourage customers to remember three simple steps – stop, check, and reject – to ensure they pause and think before acting, check with a trusted contact or organisation, and reject any contact they’re unsure about.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.