SMEs' troubles accessing finance could prove to be an economic vulnerability

SMEs' troubles accessing finance could prove to be an economic vulnerability

Any business owner – brokers included – who has tried to get more than $100,000 at a decent rate to refit or grow their business knows that it’s close to impossible without putting up their home as collateral.

This leaves the economy vulnerable to a growing problem: those in their entrepreneurial prime cannot afford to buy houses in Australia, which could negatively affect their chances of qualifying for a business loan.

Home ownership among 25- to 34-yearolds has dropped by a third in the last 25 years, and yet 80% of small business lending on term loans provided by the major banks in 2017 was secured.

“Increasingly in Australia there are a lot of people who don’t have significant equity in their homes; they’re still renting but they still have great businesses,” Australian Small Business and Family Enterprise Ombudsman Kate Carnell tells MPA.

So if young entrepreneurs can’t get the capital they need to invest in their businesses because lenders are more focused on real property security than the holistic credit- worthiness of the business and its cash flow, the ‘engine room of the economy’ – as the booming SME market that employs 45% of the workforce is often described – will inevitably suffer.

There’s a division between the business owners who come from means versus those who do not.

“If you have wealthy parents who can lend you the money to go into business, then you’ve got a shot,” Carnell says.

“The engine room [of the economy] isn’t going to be firing very well if it can’t access affordable energy” - Kate Carnell, Australian Small Business and Family Enterprise Ombudsman

“Smart young entrepreneurs who don’t have wealthy parents will have lots more trouble starting up businesses than those that do, and I think that’s a problem.”

The emphasis on property security can create a dangerous dilemma. It’s not unheard of for SME owners to put the homes of their pensioner parents up as security, Carnell says. If that business fails, it’s the family’s home and relationships on the line.

This is something that greatly concerns Carnell, whose office is conducting an inquiry to investigate initiatives here and abroad that might address the funding gap.

“All sides of politics are very happy to talk about the SME sector being the engine room of our economy, and it is … [but] the engine room isn’t going to be firing very well if it can’t access affordable energy or petrol for the engine. You can’t have a business without access to affordable capital.”

What SMEs are up against

The Productivity Commission’s draft report into competition in the financial system looked at the issues affecting finance options for SMEs and found that while nearly 90% of SMEs who applied for finance in 2015/16 were successful – a bounce-back since post-GFC lows – new businesses in particular struggle.

The challenges include having to pay more for finance and use real estate as security, as well as having to rely on the large banks that dominate in this area of lending and deal with the often-one-sided contracts placed on SME loans. There’s also the fact that smaller banks have less appetite for SME lending, which is riskier and less profitable than residential property, the PC report says.

From a lender’s perspective, however, assessing whether a new business can service a loan is difficult when there’s no history or financial information; therefore they typically assess the borrower based on character, capacity and collateral, the commission’s report shows.

Some lenders “highlighted that the provision of housing collateral was an indicator of the borrower’s character; it provided the small business borrower with strong incentives to repay, with the borrower clearly having ‘skin in the game’,” the report says.

“The amount of growth opportunities that SMEs miss due to lack of finance is enormous” - Lachlan Heussler, Spotcap

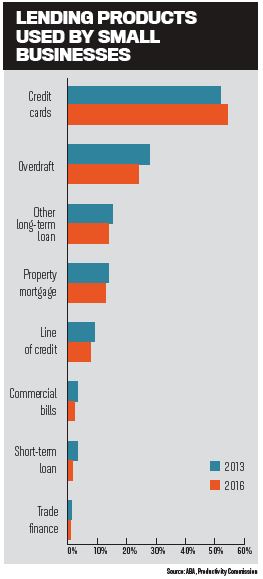

Without a house to put on the line, however, business owners have few options. Unsecured finance – usually credit cards – tend to fill the gap, but the interest rates charged can be staggering. The RBA found that, at June 2017, the interest rate gap between residentially secured small business term loans and low-rate credit cards was over 6%, and over 13% for standard-rate credit cards.

Fintech lenders and savvy brokers have started to fill some of that gap for SMEs, but there’s still a lack of awareness generally that brokers do more than just residential mortgages, says Lachlan Heussler, managing director of online small business lender Spotcap Australia and New Zealand.

“The amount of growth opportunities that SMEs miss due to lack of finance is enormous. A huge problem for small businesses is an even bigger opportunity for smart residential mortgage brokers to diversify their offering by embracing alternative commercial lending and not risk falling behind.”