In a residential mortgage sector where brokers dominate market share, customers have never had so many brokers to choose from

It’s no longer enough for mortgage brokers to just explain to customers what services they provide and then expect valuable leads to flow. Potential clients want to know much more about the brokers themselves – their values, their goals, their personalities – before they choose a broker.

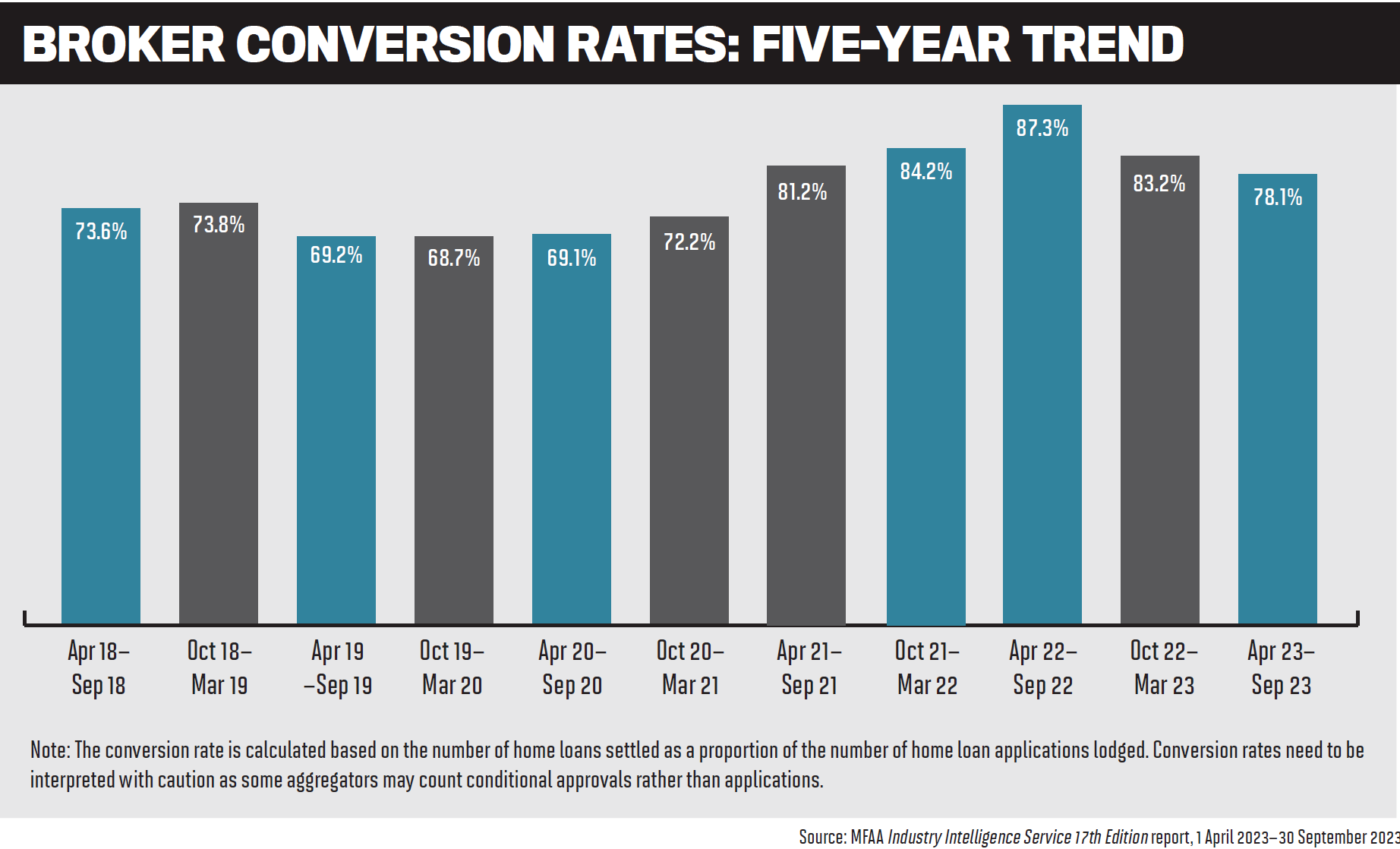

In an industry in which almost 74% of all new residential home loans are written by brokers, a smart and well-executed marketing strategy can help brokers cut through a crowded market. It’s all about creating a personal brand and tailoring your marketing plan to your client base.

Social media is also vital and requires a regular, high-touch approach that engages your audience and prompts further action.

To understand how an effective marketing plan can help brokers succeed, MPA sought the views of Blake Buchanan, general manager of Specialist Finance Group (SFG); Sally Chadwick, executive manager, corporate communications, events and franchise marketing at Mortgage Choice; and Emily Lonsdale, general manager – growth at Lendi Group.

Support with marketing strategies

“If you fail to plan, you are planning to fail” is a well-worn phrase, but apt when it comes to brokers promoting their businesses.

Chadwick says brokers should set up marketing strategies aligned with their aspirations. “An effective marketing strategy will enable you to stand out from the competition, connect with new and existing customers and grow your business,” she says.

“At Mortgage Choice, our brokers’ priority is supporting their customers. We don’t expect them to be marketing experts, which is why we provide our brokers with personalised support to create effective marketing strategies.”

Mortgage Choice franchisees are encouraged to complete an annual Marketing Planner to structure their local marketing activity. Chadwick says being more strategic enables brokers to benefit “from the significant investment we make into the Mortgage Choice brand, and our connection with the realestate.com.au brand”.

“We help brokers leverage that national brand presence by providing a huge range of marketing tools, resources, campaign assets, technology and expert advice that they can use locally to build their brand, generate leads and nurture customer relationships.”

Buchanan says brokers have marketing opportunities through many channels, including existing clients, referrers and especially the open market. “Our role is to provide

information, strategic advice and, importantly, access to systems such as SFGconnect that can digitise much of the marketing you do in your business,” he says.

Buchanan says if brokers don’t have particular strengths in certain areas, they should look to outsource these systems and seek out experts who can help them with their marketing journey.

Lonsdale says Lendi Group invests heavily in digital advertising campaigns across multiple platforms, including Google and Meta, to increase brand awareness and drive customer appointments to Aussie retail stores and broker businesses.

“Earlier this year, we launched our Aussie mobile app, which has put our brokers’ businesses in the palms of their customers, facilitating broker-customer connection more easily than ever before. The app is equipped with a range of features, including referral tools, that support lead generation.”

Digital marketing is not just about top-of- funnel lead generation, says Lonsdale. Lendi Group uses a sophisticated CRM strategy to nurture low-intent leads into high-intent customers and to re-engage past customers, bringing them back into the funnel.

“Our journeys program places customers into bespoke nurture journeys where they receive tailored communications relevant to their situation,” says Lonsdale. “We’ve adopted an ‘always on’ approach to competitions, allowing brokers to leverage promotions year-round to drive customer growth and incentivise appointments.”

Mortgage Choice’s CRM platform delivers targeted communications using advanced email segmentation and content personalisa- tion. The aggregator also works closely with brokers to refine their SEO strategies and improve search rankings.

Social media: an essential tool

Buchanan says social media is a cost-effective way for brokers to get their message out and is preferred by those who know how to capitalise on it. “Two important things to remember – have an impactful message and a hook to increase enquiries but also to ensure you have an audience.”

Brokers can build their own audience on social media by requesting that people like

and follow their page. “Alternatively, why not get your message out to an already-built audience,” says Buchanan. “For this, community or interest groups are a great way to advertise and participate in conversations about finance needs. With social media it takes consistency, and it will deliver results over time if your message is great.”

More than 95% of Australians own a smartphone, says Lonsdale, so social media is a vital avenue for connecting brokers and customers and meeting customers where they hang out – online.

“For many people, their property search journey starts on social media,” she says. “Property buyers are looking for experts to answer their questions, and brokers have a key role in educating them.

“Mortgage broking is a people-centric industry; social media is an effective tool for brokers to showcase their human side, build a personal brand and create an online community,” Lonsdale says.

Lendi Group provides training and resources to help brokers grow their social presence, including social media masterclasses and a comprehensive suite of collateral they can customise for their business. “We’re constantly capturing video and visual content and encourage our brokers to get involved – our brokers are the stars of the show,” she says.

Chadwick says TikTok, Instagram, Facebook and LinkedIn are invaluable for building an online presence, connecting with new audiences and staying top of mind for existing customers. “We encourage brokers to include social media as a core part of their marketing strategy.”

Buying a home is the biggest financial decision many people will make, so trust is hugely important. “Building an authentic identity through social media can help to build and reinforce that trust,” she says.

Building a personal brand

Lonsdale says brokers need to be visible and present, online and in their community. “Building and sustaining a personal brand requires a consistent cadence of activity for cut-through; it’s not something you can stop and start.

“To resonate with your target customers, you need to know who you are and what your audience wants. Consistency is key – stay true to your brand and be consistent with your visual style, your tone of voice and the type of content you produce.”

“Don’t be shy to ask for referrals. Word of mouth can be a huge driver of business, and great businesses are built on referrals. Look for avenues to add credibility to your personal brand, including industry awards and thought leadership opportunities in media.”

Aussie brokers are assisted in building their personal brand through community activations; support with establishing and maintaining an online and social media presence; media opportunities to showcase their expertise; support with industry award submissions; and dollar-for-dollar matching incentives to encourage local area marketing initiatives.

When building a personal brand, she says it’s important for brokers to reflect on both their own and their business’s strengths and values. “Understand your target audience and define your unique selling proposition. This is where you define what makes you different and how this will benefit your target audience.”

Thought leadership is also important, says Chadwick. “Having a view on relevant topics and informing and educating your target audience about the issues that matter to them can create more powerful connections and build trust.”

She suggests making short social media videos, for example highlighting government incentives for first home buyers, and notes that customer testimonials and positive Google reviews are also powerful tools.

Buchanan says brokers need to have a customer journey process attached to their service. This will not only ensure consistency of service but also bring the wow factor to clients.

“If you do this, you can grow your audience by asking for reviews and promoting these through your marketing. Don’t forget to also offer to assist any of your clients or referrer networks as these are the low-hanging fruit when you do an excellent job.”

Targeting niche markets

Brokers need to also target specific audiences such as first home buyers, property investors and SMSFs. Buchanan says a cheap and easy way to do this is to join groups focused on these interests or niche markets. “If there isn’t one out there, you can build your own community and offer insights to your desired market. There are also plenty of seminars and networking groups that you can join, but again, these take time and consistency to be able to create a known profile for yourself which will gain trust and grow enquiries.”

Chadwick says, “You need to meet your audience where they are. That means understanding their needs and what matters to them and being active on the channels they use. It’s also important to deliver content in a language and tone that will resonate with your target audience.” For example, younger first home buyers are more active on TikTok than other platforms.

Tailoring and personalisation is crucial in email marketing, Chadwick says. She advises brokers to personalise content and use a segmented database, so audiences are not being sent irrelevant content.

On social media, she says paid activity – such as ‘boosting’ social media content or running campaigns – can help brokers target social media users with specific interests or from specific demographics. Local area marketing activity, such as sponsoring community events during the Hindu holiday of Diwali, is a good way to reach specific clients.

Leveraging data analytics

So, once your strategy is place and your marketing activities are in full swing, how do you gauge success? This is where data analytics come in.

Lonsdale says it’s vital for brokers to be across cost-per-lead, cost-per-acquisition and conversion metrics. “This will help you develop an understanding of what strategies have

been successful and which haven’t, so you can direct your time, energy and marketing spend toward activity that converts efficiently and successfully.”

Buchanan says brokers need to understand how their client base performs by looking at their data, and design marketing strategies accordingly. “An example might be the average life of a loan that you introduce. If you know that on average your clients are refinancing every four to five years, what are you telling them in the lead-up to this period?”

Brokers could have a digitised marketing strategy that informs clients that they’re doing this and the reasons why, Buchanan says. That would position this review period as normal or something that they should be doing.

“Whether it be repricing or refinancing, this strategy has seen reduced attrition rates across many businesses. This in turn can reduce the need to fill the funnel at the front as you are having fewer leave your service at the back.”

Chadwick says understanding and leveraging data analytics enables brokers to optimise marketing strategies and spend, make more informed decisions, refine targeting and create more effective campaigns – ultimately leading to improved conversion.

It’s important to understand key metrics – tracking where leads are coming from, looking at engagement metrics such as email open and click-through rates, and measuring the percentage of leads that convert to clients.

Mortgage Choice provides brokers with reporting on their top social media posts each month. “We also take an enterprise view of engagement, which informs our marketing team’s decisions when planning social media and other marketing content for the months ahead,” says Chadwick.