CoreLogic's latest quarterly review is a tool that brokers can use to make confident decisions in the face of industry changes

The housing market could take a hit from the royal commission’s ongoing probe into misconduct in the financial services sector. Constrained credit and a slump in customer confidence are looming challenges.

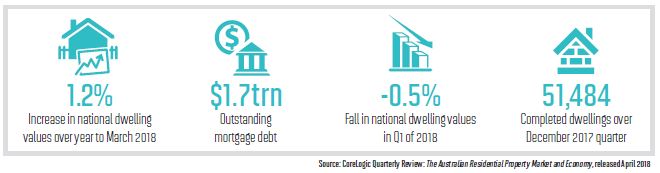

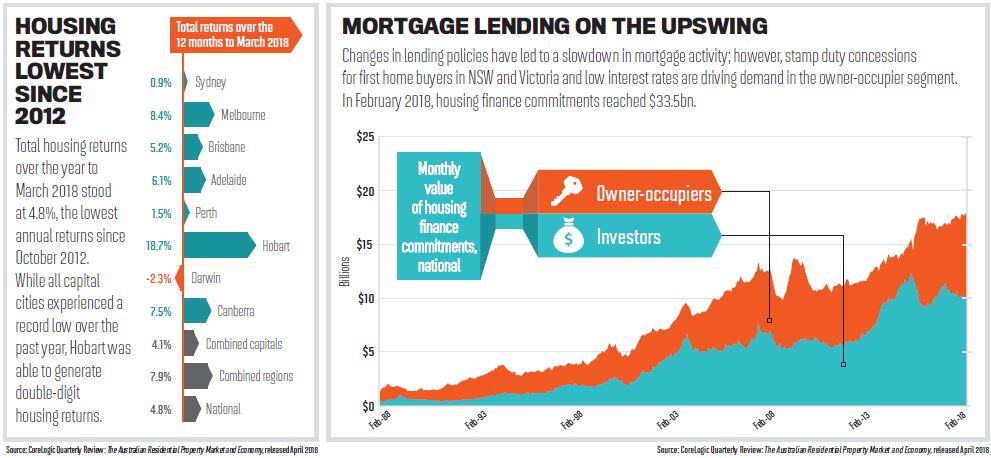

In CoreLogic’s quarterly review on the residential property market, it said national growth in dwelling values had essentially stopped in its tracks. In March 2018, values increased by an annualised 1.2% – much lower STATISTICS than the 9.1% a year earlier and the slowest annual rate of growth since December 2012. “With a royal commission underway into banking it is reasonable to expect that getting a new mortgage is set to become even more difficult. Given this, it is reasonable to anticipate that values are likely to continue to decline over the coming quarters, particularly in Sydney and Melbourne where mortgage demand is strongest,” the report said.