Why Choice is championing increased professionalism across the board

Why Choice is championing increased professionalism across the board

MPA: What does increasing profession-alism in the industry mean to you?

Stephen Moore: Professionalism is about putting the customer first. It’s about raising the bar and improving quality in everything we do – both in how we run our businesses and, most importantly, how we interact with customers and the community. Brokers already act with professionalism today; however, expectations of our industry are continuing to increase.

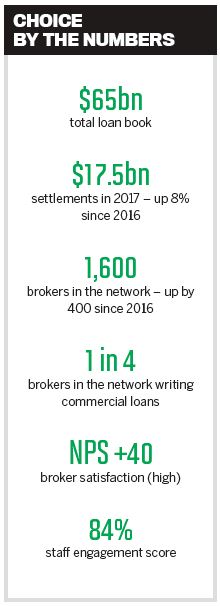

MFAA data shows broker market share is now close to 54% of all home loans – the highest the industry has ever seen. This is not only a reflection of the great experience brokers provide but an affirmation of the industry’s growing role in the lives of many Australians. It is a natural evolution that expectations increase, because we all expect leaders to act as leaders. For us to continue to increase market share we need to raise the bar to meet customers’ needs and expectations.

MPA: Why has this become so important recently?

SM: As the industry continues to grow, we need to ensure we are set up in the right way to deliver good outcomes for customers.

Recently industry reviews have affirmed the critical role brokers play. They have also confirmed that the status quo is not an option, and changes to improve customer outcomes are needed. We must continuously strive to lift the bar, and this is a combined responsibility of brokers, lenders and aggregators.

Indeed, it has been very positive to see the industry’s collective desire and ability to work together to navigate change and develop solutions. We should never forget we are in the people business, which means continuing to provide fantastic customer experience is paramount.

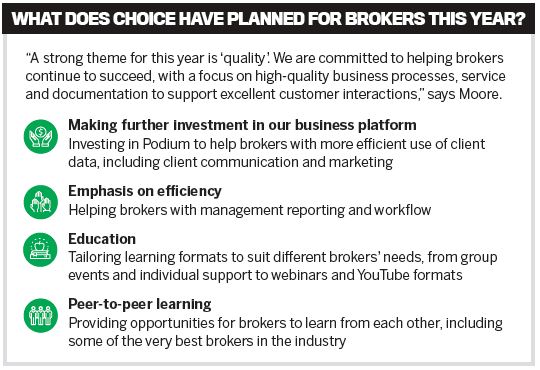

MPA: How does Choice plan to increase professionalism through education, training and support?

SM: Education, training and support have always been hallmarks of Choice’s offering and will remain a key focus moving forward.

Choice believes the most successful aggregators offer more than basic training and product access. We act as a genuine business partner to brokers. Our partnership managers are specialist business coaches who will continue to drive collaboration and shared learning across or network.

For us, increasing professionalism will focus on several facets. It means a continued focus on professional development events and opportunities that enable our brokers to develop new skills and strategic business planning expertise, as well as to keep abreast of industry changes and trends.

We will also work with brokers to continue to raise the bar in terms of developing and implementing quality processes in their businesses and managing risk and compliance.

MPA: Do you have any examples of brokers who are raising industry professionalism? What can other brokers take away from these stories?

SM: We are seeing a lot of great examples of increasing professionalism throughout the Choice network. An increasing focus on education and upskilling is a key trend. For example, principals are demanding that not only their loan writers but also their administration staff are up to date with the current compliance and lending environment. They recognise that it’s everyone’s responsibility to make sure the business is compliant and that customers have a great customer experience.

We have also observed an increase in the number of members taking up business coaching for both themselves and their staff to make sure their entire team delivers the same high standards of customer service. This also ensures everyone is on the same page when it comes to the direction of the business.

One of our established businesses has an in-house mentoring program for all new brokers, covering things such as product knowledge, technology and engagement with referral partners. The team share best practice across the group and facilitate a buddy system between newer and experienced brokers so that great customer outcomes are consistently delivered.

Other things we are seeing include an increase in the use of digital technology to drive efficiencies as well as engage with clients. Our members are also looking for lenders that offer a more streamlined process that will allow them and their customers to do as much online as possible.

MPA: Why is it important that brokers become business operators, and what does this mean?

MPA: Why is it important that brokers become business operators, and what does this mean?

SM: Being a broker requires specific skill set. However, when it comes to operating your own business, you need to be prepared to build and expand on these skills to remain competitive.

Becoming a successful business operator requires finding the time to step away from the day-to-day to develop these skills and then create and implement strategic plans and processes. Successful business owners work ‘on the business’ as well as ‘in the business’. It is critical to spend time to set a business up for long-term success.

Being a business operator also involves growing and managing a team, marketing, developing business efficiencies and managing compliance requirements – ensuring their business as it grows, has the right process in place.

This can be a lot for a broker to manage, and that is where the role of a quality aggregator becomes so important.

MPA: How do you envision the industry in the next five years? How would you like to see it evolve?

SM: The Australian mortgage broking industry has evolved significantly over the past 20 years, becoming stronger and more professional than ever before. In the coming years, we expect the pace of change to accelerate, but we believe the future is bright for those who are willing to embrace change and adapt.

Technology will also change the way the industry operates, and we expect to see the blending of different channels – face-to-face, phone and digital – to deliver the best possible customer experience. It will be critical for most businesses to embrace digital means of interacting with clients. Management of client data will also become a core competency. With brokers having access to more client data than any other channel, it really puts them in the box seat into the future.

As the industry continues to grow, I believe broking will continue to attract new entrants, including professionals seeking a career change from other industries. Improved professionalism and education requirements will also mean the industry will attract younger graduates. New blood and diversity of backgrounds will bring fresh ideas and vigour to the industry, which I believe will further contribute to supporting a broader range of customer needs.

MPA: With all the scrutiny focused on the broking sector, what should brokers do to ensure their businesses remain sustainable and continue to grow?

SM: Brokers need to continue to push for quality – in processes, documentation and customer experience. To ensure business sustainability and growth, brokers need to engage in in-depth conversations with their clients to obtain a full picture of their needs, ensure these conversations are well documented, and deliver the best possible service and outcomes on an ongoing basis.

Developing and actively managing a business plan with a consistent focus on professional development should also be top of brokers’ agendas, and partnering with the right aggregator has also never been more important.