A $50bn book, $20m in IT investment, 30% growth – Choice Home Loans’ CEO talks about the franchise’s future-focused direction

A $50bn book, $20m in IT investment, 30% growth – Choice Home Loans’ CEO is not afraid of throwing down the numbers as he shows MPA the franchise’s future-focused direction

MPA: You’ve been at Choice for five years – how do you think you’ve changed the brand’s proposition to consumers and brokers during that time?

Stephen Moore: Choice Home Loans is all about tailored advice and a fantastic customer experience. And the Choice value proposition really sums it up, in my view – that is, ‘better advice through better listening’. That applies both at a consumer level, by spending the time to truly understand customers’ needs so Choice Home Loans members can provide the right service, and that applies on the relationship with have with our members, too. By spending the time to understand their individual business needs, we’re in the position to provide tailored support specifically meet those needs.

We reinvigorated Choice Home Loans two and a half years ago now, and that proposition has been there since that time. We’re just doing Choice Business Days right now around the country, and we’re using it as a bit of a reflection: What did we say and think was important two years ago, and where are we at today? It’s just absolutely validated the path we’re on, and the feedback from our members is that we’re exactly where we need to be, so keep going.

I’d also say that, given the current environment where the broker industry has far greater spotlight and scrutiny, to me that’s a positive. If we’re seen in a positive light, more consumers will see brokers. But what it does is focus on an absolute need for high-quality advice for customers, which just plays perfectly into the Choice Home Loans proposition as well.

MPA: What are you doing to highlight Choice Home Loans’ point of difference to consumers?

SM: From a consumer perspective, we are unashamedly focused on online presence. That’s on the back of broker feedback that digital is an important channel, and their strong desire to engage with customers at a digital level, but also the reality of trends when it comes to the consumer. And that is, more consumers choose to educate themselves about financial matters online, shop around and understand what’s available in the market, but we also know consumers absolutely value advice, so what we do is drive more awareness online and then marry that up with high-quality advice that our brokers provide.

MPA: CHL recently launched a new online comparison tool to help generate leads – what was the thinking behind this, and doesn’t it undermine your brokers’ traditional role?

SM: First and foremost, Choice Home Loans is a future-focused business. We absolutely believe that brokers of the future will be digitally aware. The launch of Choice Compare was to address the trend in the use of comparison sites online, plus demand from Choice members … to engage consumers online with a more educational flavour. What we know, and what our members know, is that a more informed client is a better client.

When we launched Choice Compare, we did so with a little bit of hesitancy; in fact, we were probably more hesitant than our members were. Our members were really embracing it, because we’re absolutely making transparent and open the market and the products. The feedback to date has been fantastic, and rather than see online comparison as a threat, our members see it as a value-add to help educate clients, but married up with high-quality, face-to-face advice, so it’s been a real positive for us.

MPA: Is increasing the number of CHL brokers a part of your strategy for the next 12 months?

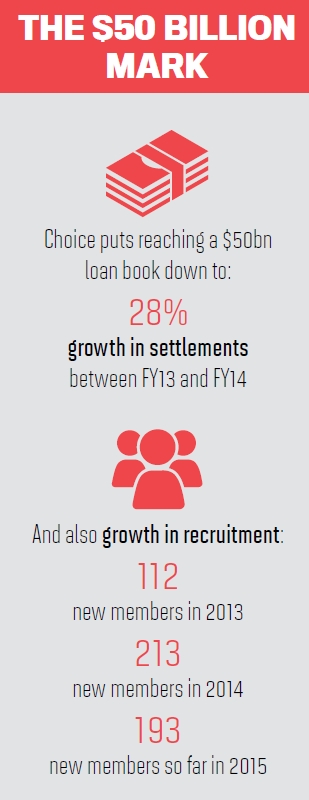

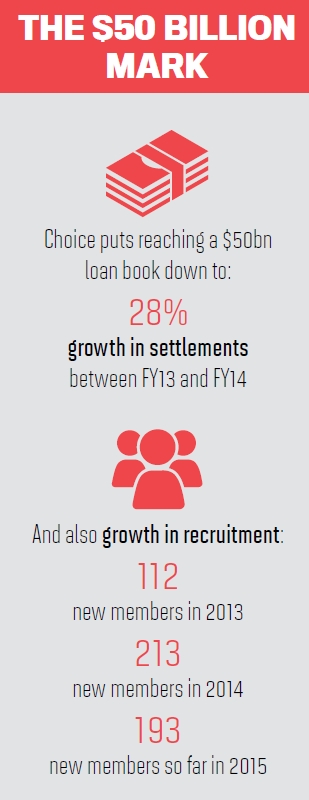

SM: We’re absolutely in a growth phase. We have met the 30% increase in brokers in Choice Home Loans in the last 12 months, and we’re absolutely focused on continuing on that particular growth path.

We’re focused on both new-to-market and existing brokers. New-to-market includes individuals from other unrelated industries, Home Loans. That’s counter-trend; you often see high-performing brokers outgrow a brand, but we’re seeing the opposite. The reason why is a recognition of the value of having more sophisticated practice management support, documenting processes, having a strong brand and having a significant online presence. That’s something all brokers value, not just high-performing brokers.

MPA: How do you reward and support your long-term and particularly successful CHL brokerages?

SM: The uniqueness of Choice Home Loans is, in fact, the culture we have within the business. It is such a conducive, collegiate, sharing culture, something that is absolutely valued by brokers. The trend that we’re seeing is high-value brokers looking to move into Choice Home Loans, a polar opposite trend to what we see in more traditional franchise businesses.

We simply provide more sophisticated support as needs change. For example, HR becomes more important, such as the best ways to recruit staff, how to embed performance management into a business, etc. We recognise that when groups get to a certain size, their learning styles change also. Last year for the first time, we ran a top group summit, a learning approach specifically designed for successful businesses that are already groups; we tailor support specifically for them.

Back to existing members, we’re performing particularly well: satisfaction of 89%, net promoter score of 29 points. Choice members are highly engaged and so continue to stay with us.

MPA: Recommendation 40 of the Financial System Inquiry recommended brokers disclose their ownership – if implemented, what implications would this have for CHL brokers, given the link with NAB?

SM: We absolutely welcome ownership disclosure. And the reason why is that we have a fundamental belief in transparency – where consumers are better informed, it’s a positive.

It’s a little bit of a non-event, in that today many Choice members already disclose Choice’s ownership. The reason why is that what NAB brings to the table is strength, stability and security, and those are traits that customers absolutely value. How we position the business is having all of those great traits that come with institutional ownership by NAB, but it’s the tailored advice and personal service that you get with an individual broker – it’s the best of both worlds, if you like.

When I talk about NAB’s ownership, I do so with absolute pride. And I say that because I know we absolutely would not be able to provide the level of service today if were still under private ownership. It’s with NAB’s backing that we’re able to provide that fantastic level of support that we do for our members. So it’s a real positive.

MPA: Our Brokers on Aggregators survey showed that IT is highly important in attracting and keeping brokers – what can Choice Aggregation and Choice Home Loan members expect?

SM: We’re invested well over $20 million in Podium, our IT platform. That’s $20 million to date, and that’s absolutely going to increase as we progress.

It’s unashamedly a comprehensive business platform, and our development agenda, first and foremost, is based on member feedback. The feedback we get on Podium today is that it is absolutely highly rated – arguably the best business platform in the broking industry today.

We’re not stopping on that; the feedback we’ve had from members is a sign of broker appetite to grow their business. For example, two areas we’re currently focused on enhancing are both CRM and marketing capability – that’s a recognition that there’s strong demand from members to more actively grow their business, and a recognition that the underlying value in their business is their customer base. That’s a real area of focus for us going forward.

In Choice Home Loans, we also expand beyond that, and we expand that to online presence as well. We have a website with members present … linked through social media. That’s a big part of the future for us.

MPA: Where would you like Choice Home Loans to be 12 months from now?

SM: Our ambition is to continue with our strong growth path. We’re 30% growth in the last 12 months, and I’d like to see that growth trajectory continue in the next 12.

MPA: You’ve been at Choice for five years – how do you think you’ve changed the brand’s proposition to consumers and brokers during that time?

Stephen Moore: Choice Home Loans is all about tailored advice and a fantastic customer experience. And the Choice value proposition really sums it up, in my view – that is, ‘better advice through better listening’. That applies both at a consumer level, by spending the time to truly understand customers’ needs so Choice Home Loans members can provide the right service, and that applies on the relationship with have with our members, too. By spending the time to understand their individual business needs, we’re in the position to provide tailored support specifically meet those needs.

We reinvigorated Choice Home Loans two and a half years ago now, and that proposition has been there since that time. We’re just doing Choice Business Days right now around the country, and we’re using it as a bit of a reflection: What did we say and think was important two years ago, and where are we at today? It’s just absolutely validated the path we’re on, and the feedback from our members is that we’re exactly where we need to be, so keep going.

I’d also say that, given the current environment where the broker industry has far greater spotlight and scrutiny, to me that’s a positive. If we’re seen in a positive light, more consumers will see brokers. But what it does is focus on an absolute need for high-quality advice for customers, which just plays perfectly into the Choice Home Loans proposition as well.

MPA: What are you doing to highlight Choice Home Loans’ point of difference to consumers?

SM: From a consumer perspective, we are unashamedly focused on online presence. That’s on the back of broker feedback that digital is an important channel, and their strong desire to engage with customers at a digital level, but also the reality of trends when it comes to the consumer. And that is, more consumers choose to educate themselves about financial matters online, shop around and understand what’s available in the market, but we also know consumers absolutely value advice, so what we do is drive more awareness online and then marry that up with high-quality advice that our brokers provide.

MPA: CHL recently launched a new online comparison tool to help generate leads – what was the thinking behind this, and doesn’t it undermine your brokers’ traditional role?

SM: First and foremost, Choice Home Loans is a future-focused business. We absolutely believe that brokers of the future will be digitally aware. The launch of Choice Compare was to address the trend in the use of comparison sites online, plus demand from Choice members … to engage consumers online with a more educational flavour. What we know, and what our members know, is that a more informed client is a better client.

When we launched Choice Compare, we did so with a little bit of hesitancy; in fact, we were probably more hesitant than our members were. Our members were really embracing it, because we’re absolutely making transparent and open the market and the products. The feedback to date has been fantastic, and rather than see online comparison as a threat, our members see it as a value-add to help educate clients, but married up with high-quality, face-to-face advice, so it’s been a real positive for us.

MPA: Is increasing the number of CHL brokers a part of your strategy for the next 12 months?

SM: We’re absolutely in a growth phase. We have met the 30% increase in brokers in Choice Home Loans in the last 12 months, and we’re absolutely focused on continuing on that particular growth path.

We’re focused on both new-to-market and existing brokers. New-to-market includes individuals from other unrelated industries, Home Loans. That’s counter-trend; you often see high-performing brokers outgrow a brand, but we’re seeing the opposite. The reason why is a recognition of the value of having more sophisticated practice management support, documenting processes, having a strong brand and having a significant online presence. That’s something all brokers value, not just high-performing brokers.

MPA: How do you reward and support your long-term and particularly successful CHL brokerages?

SM: The uniqueness of Choice Home Loans is, in fact, the culture we have within the business. It is such a conducive, collegiate, sharing culture, something that is absolutely valued by brokers. The trend that we’re seeing is high-value brokers looking to move into Choice Home Loans, a polar opposite trend to what we see in more traditional franchise businesses.

We simply provide more sophisticated support as needs change. For example, HR becomes more important, such as the best ways to recruit staff, how to embed performance management into a business, etc. We recognise that when groups get to a certain size, their learning styles change also. Last year for the first time, we ran a top group summit, a learning approach specifically designed for successful businesses that are already groups; we tailor support specifically for them.

Back to existing members, we’re performing particularly well: satisfaction of 89%, net promoter score of 29 points. Choice members are highly engaged and so continue to stay with us.

MPA: Recommendation 40 of the Financial System Inquiry recommended brokers disclose their ownership – if implemented, what implications would this have for CHL brokers, given the link with NAB?

SM: We absolutely welcome ownership disclosure. And the reason why is that we have a fundamental belief in transparency – where consumers are better informed, it’s a positive.

It’s a little bit of a non-event, in that today many Choice members already disclose Choice’s ownership. The reason why is that what NAB brings to the table is strength, stability and security, and those are traits that customers absolutely value. How we position the business is having all of those great traits that come with institutional ownership by NAB, but it’s the tailored advice and personal service that you get with an individual broker – it’s the best of both worlds, if you like.

When I talk about NAB’s ownership, I do so with absolute pride. And I say that because I know we absolutely would not be able to provide the level of service today if were still under private ownership. It’s with NAB’s backing that we’re able to provide that fantastic level of support that we do for our members. So it’s a real positive.

MPA: Our Brokers on Aggregators survey showed that IT is highly important in attracting and keeping brokers – what can Choice Aggregation and Choice Home Loan members expect?

SM: We’re invested well over $20 million in Podium, our IT platform. That’s $20 million to date, and that’s absolutely going to increase as we progress.

It’s unashamedly a comprehensive business platform, and our development agenda, first and foremost, is based on member feedback. The feedback we get on Podium today is that it is absolutely highly rated – arguably the best business platform in the broking industry today.

We’re not stopping on that; the feedback we’ve had from members is a sign of broker appetite to grow their business. For example, two areas we’re currently focused on enhancing are both CRM and marketing capability – that’s a recognition that there’s strong demand from members to more actively grow their business, and a recognition that the underlying value in their business is their customer base. That’s a real area of focus for us going forward.

In Choice Home Loans, we also expand beyond that, and we expand that to online presence as well. We have a website with members present … linked through social media. That’s a big part of the future for us.

MPA: Where would you like Choice Home Loans to be 12 months from now?

SM: Our ambition is to continue with our strong growth path. We’re 30% growth in the last 12 months, and I’d like to see that growth trajectory continue in the next 12.