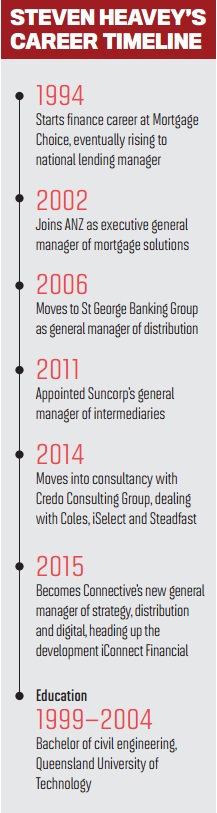

Connective are betting their new retail aggregation service will revolutionise the industry. Their general manager of strategy, distribution and digital tells MPA editor Sam Richardson why.

Connective are betting their new retail aggregation service will revolutionise the industry. Their general manager of strategy, distribution and digital tells MPA editor Sam Richardson why.

MPA: How do Connective define ‘retail aggregation service’, and how will this differ from the industry’s traditional franchise models?

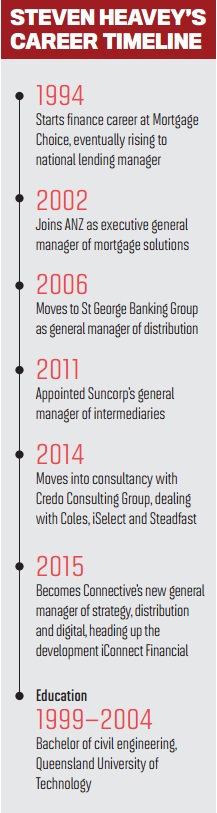

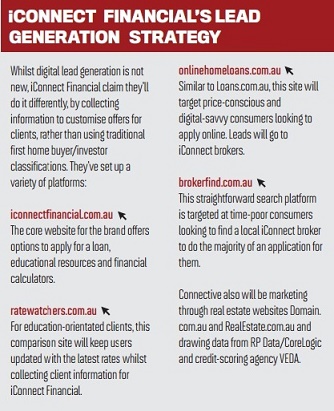

Steven Heavey: I suppose the definition is fairly similar to the traditional retail aggregators out there – the Aussies, Mortgage Choices and Smartlines of our industry. We’ve been very successful in wholesale aggregation, but we’ve identified that there are some brokers, especially moving into this new age of digital disruption, who could use more support.

It could make sense to actually use a common brand for certain brokers so we can leverage digital, SEO and social in a way that puts the responsibility on us to develop goodquality content for consumers who are online doing research for home loans. That is taking a different approach to how banks look for consumers, as first home buyers or investors.

To be able to do this effectively, we’ve had to develop our own infrastructure and resources – the appointment of

Leith Wickstein as our head of iConnect, and our head of strategy and performance planning, Andrew Gannon, who’s responsible for developing a whole raft of data and information around the industry for our digital assets.

They’ll be fullblown infrastructure. Similar to other retail aggregators, they’ll be state-based franchise development managers, of which we already have some. They’ll be digital experts and marketing people building and developing content for our digital assets on a regular basis.

I think what’s really important for success, and something that you have to do in the digital age, is actually having relevant content. The key to this will be making sure we have enough resources that are building and driving content that we can serve up to each of those digital assets.

MPA: Should existing Connective members who don’t join iConnect Financial be concerned that resources will be pulled away from them?

Financial be concerned that resources will be pulled away from them?

SH: No, it’s a totally new team of people [at iConnect]; there’s no impact on the existing business. All of the resources are in addition to what we already provide our network through wholesale aggregation.

MPA: Could you explain how the commission structure will work, both

before and after iConnect Financial’s national rollout next year?

SH: We’ve launched the business today to only Connective brokers, and are giving them alongside our wholesale aggregation offer for brokers to choose, whether they’re part of Connective or not.

To be able to do this effectively, we’ve had to develop

I think what’s really important for success, and something that you have to do in the digital age, is actually having relevant content. The key to this will be making sure we have enough resources that are building and driving content that we can serve up to each of those digital assets.

MPA: Should existing Connective members who don’t join iConnect Financial be concerned that resources will be pulled away from them?

SH: No, it’s a totally new team of people [at iConnect]; there’s no impact on the existing business. All of the resources are in addition to what we already provide our network through wholesale aggregation.

MPA: Could you explain how the commission structure will work, both before and after iConnect Financial’s national rollout next year?

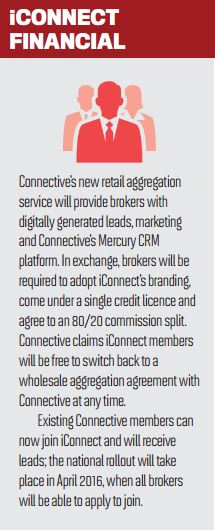

SH: We’ve launched the business today to only Connective brokers, and are giving them an opportunity to participate in this model. We’ll switch on leads from day one in the second week of October, from all of those digital sources and above-the-line advertising. There is absolutely no change to the arrangements for existing Connective brokers, in terms of commission and compliance and licencing. Over the course of the next six months, we’ll be investing heavily in a raft of marketing initiatives and lead-generation strategies and investing in building brand equity around the iConnect brand.

Then next year, the brokers who are with us will have to make a decision about whether or not they want to go down a commissionsharing model, as against a fee-based model.

If they do, they will no longer have to pay the monthly fee – they go down a commissionsharing model, which is an 80/20 split.

They will make that decision; if we haven’t demonstrated our value within the fist six months, then they’re quite within their rights to stay with our existing wholesale arrangement, and they can go back.

However, it’s important to remember that every single broker – if they’re earning 100% of the commission – still needs to have a website, still needs to build content, still needs to generate leads and still needs to train staff members. This is about understanding the 20% and determining what sort of time you as a small broker are investing and what that costs you … and deciding in your own mind whether this is right for you. And it won’t be for everyone.

MPA: Why won’t brokers be locked in to arrangements with iConnect Financial?

SH: The culture of the organisation is a fairer agreement. And we want to provide a fairer arrangement to brokers; there are those horror stories you hear from most of the people who have been with multiple franchises or retail aggregation businesses, who have had to leave loan books behind.

What we’re providing is cradle-to-grave; you come in at a certain level, and at some point you may or may not outgrow the iConnect Financial brand. If you do, and you want to revert back to your own brand or the business becomes more about you than the brand, then we would welcome you back with open arms to the wholesale aggregation. No fees whatsoever will be involved.

MPA: Why is iConnect Financial launching in New South Wales and Victoria fist, and when will it be available to brokers in other states?

SH: The national rollout is in April of next year, and we wanted to look [fist] at our two largest markets. There has been significant interest outside of those areas, so we will be taking on some brokers in other states, because obviously when you’re running a digital platform, you cannot control where those leads come from. We will be going to other states and having small groups able to fulfill some of those leads that we get. Part of the whole value [judgment] the broker will have to make after these fist six months is about the quality of those leads and their ability to convert those leads, and we wanted to invest in those two markets fist, take those learnings and apply them nationally.

MPA: When will training arrangements for new staf and new-to-industry brokers become available?

SH: When the national rollout happens [in April 2016]. So far we’ve only talked to Connective brokers; they already have all of their licencing requirements, and they’re already writing loans today. We’ve already appointed a training manager for iConnect; we’ll have in a place a full induction program, a bit like what you see with Aussie and Mortgage Choice – a three-week initial induction program. That offer will be made to existing people in iConnect who want to employ staff we’ll train them on their behalf.

MPA: Is there a conflct between Connective’s traditional emphasis on flexibility and iConnect Financial, which appears to be all about committing to the brand?

SH: It’s really about maintaining a really good customer experience that’s consistent with the brand. Certainly some of the large organisations we’ve been talking to about fulfiment, organisations that are getting into the industry, [are concerned that] there’s a risk to them in opening that up to potentially hundreds of different brands without any structure about how that customer experience will play out.

Being able to defie best practice, being able to educate brokers on our expectations around response rates and getting back to customers [is therefore important]. That experience for all of the participants and lead-generation sources, we can control under the iConnect banner far more efficiently then we can if it’s out in the open.

MPA: Where do you want iConnect Financial to be 12 months from now?

SH: In a year’s time, if we had 100 brokers nationally, we’d be very happy. Part of what we’ll learn over the next six months is what sort of volume of leads we will be able to generate from those platforms. It will be about what sort of volume we’ll have to generate to keep brokers happy so they can see the value of the commission-split arrangement.

MPA: How do Connective define ‘retail aggregation service’, and how will this differ from the industry’s traditional franchise models?

Steven Heavey: I suppose the definition is fairly similar to the traditional retail aggregators out there – the Aussies, Mortgage Choices and Smartlines of our industry. We’ve been very successful in wholesale aggregation, but we’ve identified that there are some brokers, especially moving into this new age of digital disruption, who could use more support.

It could make sense to actually use a common brand for certain brokers so we can leverage digital, SEO and social in a way that puts the responsibility on us to develop goodquality content for consumers who are online doing research for home loans. That is taking a different approach to how banks look for consumers, as first home buyers or investors.

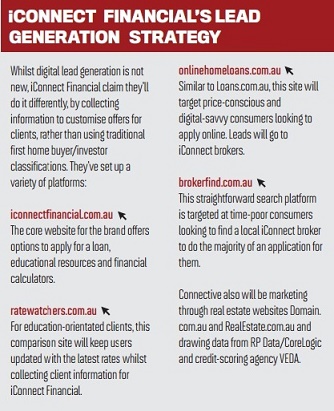

We’re playing in this digital space where we’re looking at consumers who are looking for a trusted brand, process, products and policy. Some are looking at price, some for comparison, and some just want to establish a relationship with a local broker.

With the multiple platforms that we plan to roll out, we believe we’ll be able to access those clients on behalf of the brokers and distribute leads to them.

MPA: What brand are you trying to build here – the iConnect Financial brand or the various other brands you’re launching?

SH: The iConnect brand is the flagship, the brand we’ll be using for all of our above-the line spend, the brand that’ll be used in localarea marketing campaigns and for individual brokers. We are investing in a digital sense in those other four brands; we’ll be doing it purely online. We’ll be investing heavily in social media, and the appointment of Jane Hill, joining us from Loans.com.au on October 7, will be critical in leveraging those digital brands to be able to infiltrate that 80% of consumers online who are looking for information.

MPA: Will iConnect Financial have separate leadership and resourcing within Connective?

SH: This is just another choice that brokers can make when [they] want to join Connective. We’ve been one of the fastest-growing wholesale aggregators in the country, and we’ve realised that there’s not a solution for people who

may want more support or leads. We’ve surveyed a lot of our existing members, and they’ve told us that lead generation is very important to them. So we’ve decided to develop this particular channel and put it alongside our wholesale aggregation offer for brokers to choose, whether they’re part of Connective or not.

With the multiple platforms that we plan to roll out, we believe we’ll be able to access those clients on behalf of the brokers and distribute leads to them.

MPA: What brand are you trying to build here – the iConnect Financial brand or the various other brands you’re launching?

SH: The iConnect brand is the flagship, the brand we’ll be using for all of our above-the line spend, the brand that’ll be used in localarea marketing campaigns and for individual brokers. We are investing in a digital sense in those other four brands; we’ll be doing it purely online. We’ll be investing heavily in social media, and the appointment of Jane Hill, joining us from Loans.com.au on October 7, will be critical in leveraging those digital brands to be able to infiltrate that 80% of consumers online who are looking for information.

MPA: Will iConnect Financial have separate leadership and resourcing within Connective?

SH: This is just another choice that brokers can make when [they] want to join Connective. We’ve been one of the fastest-growing wholesale aggregators in the country, and we’ve realised that there’s not a solution for people who

may want more support or leads. We’ve surveyed a lot of our existing members, and they’ve told us that lead generation is very important to them. So we’ve decided to develop this particular channel and put it alongside our wholesale aggregation offer for brokers to choose, whether they’re part of Connective or not.

To be able to do this effectively, we’ve had to develop our own infrastructure and resources – the appointment of

Leith Wickstein as our head of iConnect, and our head of strategy and performance planning, Andrew Gannon, who’s responsible for developing a whole raft of data and information around the industry for our digital assets.

They’ll be fullblown infrastructure. Similar to other retail aggregators, they’ll be state-based franchise development managers, of which we already have some. They’ll be digital experts and marketing people building and developing content for our digital assets on a regular basis.

I think what’s really important for success, and something that you have to do in the digital age, is actually having relevant content. The key to this will be making sure we have enough resources that are building and driving content that we can serve up to each of those digital assets.

MPA: Should existing Connective members who don’t join iConnect

Financial be concerned that resources will be pulled away from them?

Financial be concerned that resources will be pulled away from them?SH: No, it’s a totally new team of people [at iConnect]; there’s no impact on the existing business. All of the resources are in addition to what we already provide our network through wholesale aggregation.

MPA: Could you explain how the commission structure will work, both

before and after iConnect Financial’s national rollout next year?

SH: We’ve launched the business today to only Connective brokers, and are giving them alongside our wholesale aggregation offer for brokers to choose, whether they’re part of Connective or not.

To be able to do this effectively, we’ve had to develop

our own infrastructure and resources – the appointment of Leith Wickstein as our head of iConnect, and our head of strategy and performance planning, Andrew Gannon, who’s responsible for developing a whole raft of data and information around the industry for our

digital assets. They’ll be fullblown infrastructure. Similar to other retail aggregators, they’ll be state-based franchise development managers, of which we already have some. They’ll be digital experts and marketing people building and developing content for our digital assets on a regular basis.

digital assets. They’ll be fullblown infrastructure. Similar to other retail aggregators, they’ll be state-based franchise development managers, of which we already have some. They’ll be digital experts and marketing people building and developing content for our digital assets on a regular basis.

I think what’s really important for success, and something that you have to do in the digital age, is actually having relevant content. The key to this will be making sure we have enough resources that are building and driving content that we can serve up to each of those digital assets.

MPA: Should existing Connective members who don’t join iConnect Financial be concerned that resources will be pulled away from them?

SH: No, it’s a totally new team of people [at iConnect]; there’s no impact on the existing business. All of the resources are in addition to what we already provide our network through wholesale aggregation.

MPA: Could you explain how the commission structure will work, both before and after iConnect Financial’s national rollout next year?

SH: We’ve launched the business today to only Connective brokers, and are giving them an opportunity to participate in this model. We’ll switch on leads from day one in the second week of October, from all of those digital sources and above-the-line advertising. There is absolutely no change to the arrangements for existing Connective brokers, in terms of commission and compliance and licencing. Over the course of the next six months, we’ll be investing heavily in a raft of marketing initiatives and lead-generation strategies and investing in building brand equity around the iConnect brand.

Then next year, the brokers who are with us will have to make a decision about whether or not they want to go down a commissionsharing model, as against a fee-based model.

If they do, they will no longer have to pay the monthly fee – they go down a commissionsharing model, which is an 80/20 split.

They will make that decision; if we haven’t demonstrated our value within the fist six months, then they’re quite within their rights to stay with our existing wholesale arrangement, and they can go back.

However, it’s important to remember that every single broker – if they’re earning 100% of the commission – still needs to have a website, still needs to build content, still needs to generate leads and still needs to train staff members. This is about understanding the 20% and determining what sort of time you as a small broker are investing and what that costs you … and deciding in your own mind whether this is right for you. And it won’t be for everyone.

MPA: Why won’t brokers be locked in to arrangements with iConnect Financial?

SH: The culture of the organisation is a fairer agreement. And we want to provide a fairer arrangement to brokers; there are those horror stories you hear from most of the people who have been with multiple franchises or retail aggregation businesses, who have had to leave loan books behind.

What we’re providing is cradle-to-grave; you come in at a certain level, and at some point you may or may not outgrow the iConnect Financial brand. If you do, and you want to revert back to your own brand or the business becomes more about you than the brand, then we would welcome you back with open arms to the wholesale aggregation. No fees whatsoever will be involved.

MPA: Why is iConnect Financial launching in New South Wales and Victoria fist, and when will it be available to brokers in other states?

SH: The national rollout is in April of next year, and we wanted to look [fist] at our two largest markets. There has been significant interest outside of those areas, so we will be taking on some brokers in other states, because obviously when you’re running a digital platform, you cannot control where those leads come from. We will be going to other states and having small groups able to fulfill some of those leads that we get. Part of the whole value [judgment] the broker will have to make after these fist six months is about the quality of those leads and their ability to convert those leads, and we wanted to invest in those two markets fist, take those learnings and apply them nationally.

MPA: When will training arrangements for new staf and new-to-industry brokers become available?

SH: When the national rollout happens [in April 2016]. So far we’ve only talked to Connective brokers; they already have all of their licencing requirements, and they’re already writing loans today. We’ve already appointed a training manager for iConnect; we’ll have in a place a full induction program, a bit like what you see with Aussie and Mortgage Choice – a three-week initial induction program. That offer will be made to existing people in iConnect who want to employ staff we’ll train them on their behalf.

MPA: Is there a conflct between Connective’s traditional emphasis on flexibility and iConnect Financial, which appears to be all about committing to the brand?

SH: It’s really about maintaining a really good customer experience that’s consistent with the brand. Certainly some of the large organisations we’ve been talking to about fulfiment, organisations that are getting into the industry, [are concerned that] there’s a risk to them in opening that up to potentially hundreds of different brands without any structure about how that customer experience will play out.

Being able to defie best practice, being able to educate brokers on our expectations around response rates and getting back to customers [is therefore important]. That experience for all of the participants and lead-generation sources, we can control under the iConnect banner far more efficiently then we can if it’s out in the open.

MPA: Where do you want iConnect Financial to be 12 months from now?

SH: In a year’s time, if we had 100 brokers nationally, we’d be very happy. Part of what we’ll learn over the next six months is what sort of volume of leads we will be able to generate from those platforms. It will be about what sort of volume we’ll have to generate to keep brokers happy so they can see the value of the commission-split arrangement.