Financial stress is keeping many Australians awake at night. What can employers do to improve the situation?

Financial stress is keeping many Australians awake at night. What can employers do to improve the situation?

As the line between work and home continues to blur, it stands to reason that employers are taking more of an interest in the wellbeing of their employees. While this focus has traditionally been on physical and, increasingly, psychological wellbeing, today there’s growing interest in financial wellbeing.

Tony Hanly, director of Your Financial Wellness, says employers can play a critical role in plugging the financial literacy gaps that many Australians have – so this newfound interest is well and truly justified.

“Knowing how to make sound money decisions is a core skill in today’s world, regardless of age,” Hanly says. “It affects quality of life, opportunities we can pursue, our sense of security, and the overall economic health of our society. But we don’t learn about managing our finances in high schools, universities or most workplaces. So, what impact is this critical gap in our financial education having on Australian workers and their families?”

At night many Australians ponder how to make ends meet. They worry over children who are finding it difficult to enter the workforce and friends who have lost their jobs. When morning comes, these same Australians take their places in factories and offices where they are expected to do their best to compete in a global economy. But these workers don’t leave their money worries at home, and this impacts workplace performance – their stress becomes the employer’s problem as well.

“Knowing how to make sound money decisions is a core skill in today’s world, regardless of age” - Tony Hanly, Your Financial Wellness

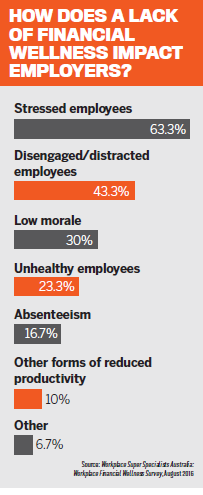

This is of great concern to employers, with research revealing that nearly three million working Australians are feeling financially stressed – across all industries, income levels and job roles. That’s one quarter of all Aussie employees. What’s more, employees who suffer from financial stress are less engaged at work and more likely to underperform – spending an average of seven hours per week trying to solve their financial problems while they’re in the workplace.

This is having a significant impact on Australia’s productivity, with financial stress costing employers an estimated $47bn every year.

Fortunately, employers are willing – and able – to assist. Indeed, according to MetLife’s 2016 Australia Employee Benefit Trends Study, 68% of employers believe in helping staff make better financial decisions.

Support where and when it’s needed

Many employers already provide wellness and employee assistance programs alongside other benefits to support their employees’ overall quality of life. However, those programs don’t always address the complexities of each employee’s financial situation.

“Multiple studies have shown that offering staff a financial wellness program can result in improved talent outcomes, better business performance, and more engaged employees – a win-win for both the employer and employees,” he says.

There are multiple players in the market who can assist employers with financial wellness programs. For example, the Your Financial Wellness program (yourfinancialwellness.com.au) is a low-cost, high-value solution that has been specifically designed to help Australian workers make more confident and informed decisions regarding their financial futures.

The platform is a comprehensive knowledge hub that incorporates interactive tutorials and strategy guides that make it easy for the average Australian to get their head around the world of personal finance.

Your Financial Wellness also offers a comprehensive suite of budgeting and financial modelling software covering areas such as repaying loans, income tax, stamp duty, and home loan comparisons. In addition, the website is regularly updated with expert commentary, articles, videos and webinars covering a range of topics. Participating employers can also have their existing employee benefits outlined on the site for employees to see whenever they choose.

To support the online service, Your Financial Wellness can conduct on-site presentations to employees on a range of financial topics.

A tailored, personalised approach

As workplace technology is increasingly being personalised to better match individual circumstances and scenarios, it’s no surprise to learn that Your Financial Wellness has also adopted this approach.

Hanly explains: “Our experience has guided us to create a platform that provides interaction to the user, based on their inputs. For example, some users may experience stress in paying regular bills, and the platform will direct them to tutorials and information helping them to create a budget. For others, this may be creating goals for saving, and, for others, protecting the family against risk. This personalised journey is important to provide the user with focused content and guidance that suits their personal situation.”

Any financial wellbeing or education initiative must aim towards changing behaviour to address short-term needs and to plan for the future. Therefore, the programs that Your Financial Wellness implements adapt to the life situation of the user based on their inputs to the platform, and reflect each employee’s situation. Hanly says his company can confidently take each employee on a “personalised journey to financial wellness” in the form of interactive learning modules.There are also modules on offer relating to aged-care costs, which are particularly useful to people who are faced with the prospect of parents entering a nursing home.

Based on the responses and inputs of each employee, Your Financial Wellness delivers content that is relevant to the individual’s situation. For example:

- Millennials will likely be focused on lifestyle and ensuring they can balance everything life throws at them. There is a concern about getting into the housing market and having a better understanding of the process for buying their first house, but they also want guidance on how to save and at the same time spend their hardearned cash responsibly. Credit card debt can easily mount up after that overseas holiday, and they need advice on paying that down without enduring a significantly reduced lifestyle.

- Gen Xers are generally already in the housing market, so it’s a conversation about investments – be it property or shares. Family planning comes into the equation: how can they drop back to one wage with kids on the horizon? Spending can be a lot tighter, so smart decisions are critical to making ends meet.

- Late Gen Xers might be seeking advice on the finances involved in raising a blended family or preparing for retirement; or now being empty nesters, they may be revisiting some of their life goals that have been on hold. People are still taking on significant amounts of debt, so there are also concerns about how long people will be working for. The stability of the kids is important: Gen Xers want to ensure the whole family is on the right path.

- Baby boomers (aged 65 years or three years either side) want to make sure they have enough money in super to fund the lifestyle they want into retirement.

Helping – but not overstepping the mark

Of course, employers must also tread a fine line between caring enough about employees to offer services that will help with their financial wellbeing, and offering advice on anything relating to personal finance.

There are limits and restrictions on the type of advice that employers can offer, especially when it comes to superannuation. That line is crossed as soon as an employer gives an opinion around what someone should do with their finances. It’s advisable to instead guide employees towards where they can get help. Employers are urged to always advise employees to seek the assistance of qualified financial advisers as early as possible.

Importantly, through the Your Financial Wellness service the employer is able to offer employees a secure and private platform where they can explore all things financial. While employers may offer employees participation in the program, no private employee information is ever made available to employers. This gives employees confidence that they may use the platform without judgment, while taking advantage of all the features of the service to create their own household finance system.