A major bank is focusing its efforts on providing brokers with the resources to identify customers suffering financial abuse

AS COVID-19 continues to drive us indoors and away from society as we once knew it, many people are being put into more vulnerable situations than ever before.

According to NSW Victims Services, the number of people formally seeking urgent assistance due to family or domestic violence increased by 10% in May 2020. Google searches on domestic violence also increased 75% year-on-year.

Concerned about the risk of growing financial abuse, Westpac is helping brokers and staff look for the signs.

“With many Australians’ homes or work situations changing in the past eight months due to the bushfires, floods and now COVID-19, it’s only natural that levels of stress and anxiety rise,” says Belinda Wright, Westpac executive manager broker partnerships.“Unfortunately, it’s not uncommon that individuals turn to their family when releasing their stress, which may come in the form of emotional, physical or financial abuse.”

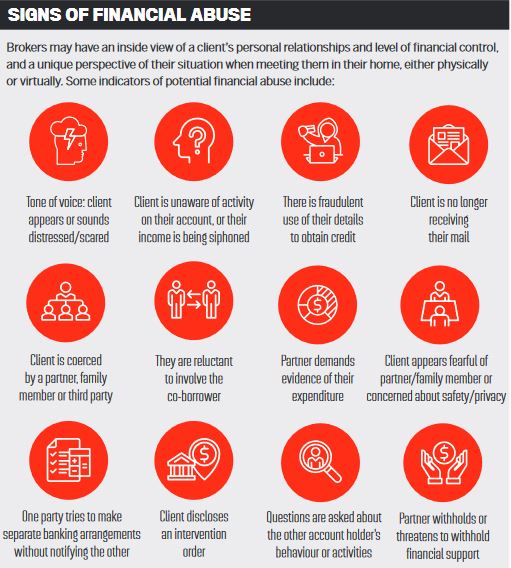

Financial abuse can occur when someone misuses money, financial resources, property or assets without the owner’s knowledge or consent or by influencing them to do so.

It can include, but is not limited to, someone taking complete control of another person’s finances, stopping them from working, making them take out loans or credit from which they will not benefit, restricting access to bank accounts, or siphoning income.

Anyone can experience financial abuse, whatever their age, gender, ethnicity, education or social status, and often the person does not realise they are a victim. Wright says this makes it more important to be aware of the signs.

Even though brokers and the rest of the finance industry are switching to virtual meetings, she says they should still be able to look out for signs like a distressed tone of voice, certain body language or other behaviours.

“There are things we can all look out for in customer conversations. For example, sometimes a person does not realise they are being financially abused, so recognising the signs is extremely important,” Wright says.

“This may include witnessing an attempt to fraudulently use a partner’s identity, reluctance to involve the other co-borrower, or finding out a client is unsure why they are not receiving mail or emails regarding their home loan.”

Westpac has produced a training module on vulnerable customers to help brokers learn the signs of financial abuse and the steps they can take to help in that moment.

The bank’s Davidson Institute also recently relaunched a website with content to educate brokers. This covers terms like LMI and compound interest, which are often foreign to many customers. The series of ‘Jargon Buster’ videos provides information for brokers to help customers become more financially confident and create stronger relationships through the process.

The major bank’s BDMs also provide digital educational sessions and actively encourage brokers to familiarise themselves with a range of vulnerable circumstances that clients may face, to help them feel confident in supporting them.

Wright reminds brokers that for customers in a vulnerable position it can be difficult. When a broker suspects financial abuse or is told directly by their client that they are in a vulnerable position, it is important that they act with sensitivity, compassion and respect. The client needs to feel heard, so brokers should take the time to listen to them.

“It is essential that they follow up with a friendly phone call to check in with the client,” Wright says.

Brokers can also contact a number of expert support services, as well as the Westpac Broker Hotline, which will escalate the matter so the client receives the appropriate level of care.

But Wright adds that when brokers do spot the signs, they should “care, but not carry”.

“Acknowledging or witnessing financial abuse can be confronting, and while it’s important to help where we can, it’s also equally important for brokers to look after themselves and their colleagues who may be exposed to difficult customer interactions,” she says.

Recognising the importance of diversity and inclusion more widely, Westpac works with aggregators on a range of digital events to support this, including Connective Empower, FAST Digital Women in Business, and Loan Market Leading Ladies. It has Employee Action Groups such as ‘GLOBAL’, which focuses on LGBTQI+ inclusion, and a newer group to support veterans transitioning into corporate roles from military service.

Westpac was also the first bank to have a dedicated Women’s Markets team focused on understanding the needs of female clients. This team was brought to life through Ruby Connection, an online community for Australian women that focuses on what women want to know about things like finance, business and career.

“We’re focused on continuing to support diversity and inclusion in our organisation and community, including our broker networks,” Wright says.

It’s important to remember that there are no circumstances in which financial abuse is acceptable, she says, so if you think this might be happening to you, don’t be afraid to get help.