New broker Adrian Bryers takes a forward-looking approach to lead generation, whilst keeping face-to-face interaction at the centre of his broking

New broker Adrian Bryers takes a forward-looking approach to lead generation, whilst keeping face-to-face interaction at the centre of his broking

At just 33 years old, Adrian Bryers is very much a modern broker, and Choice Home Loans Parramatta is very much a modern brokerage. Located on the commuter highway of Church St, they’re ideally positioned to pull in their target clients: young professionals looking to build investment portfolios. Getting in touch with this group of clients requires a very different approach to the traditional broker value proposition.

First, social media at Bryers’ brokerage is a core area of strategy, not just a marketing add-on. With only two support staff, Bryers made the decision to outsource social media management; a virtual PA based in Penrith meets monthly with him to schedule updates, some of which Bryers writes himself, some of which are provided by referral partners and all of which are approved by Bryers prior to publishing. He also is commissioning a series of short videos for social media, which, like all content he puts out, has to be “short, snappy and relevant”.

Part of the reason for Bryers’ emphasis on social media use is the current limitations of Choice’s website. “Presently the website can’t be changed – it isn’t live-feeding; it’s fairly static,” he says. “In the last few months, we’ve had Twitter, Facebook and LinkedIn in particular keeping content fresh.”

Don’t be fooled, however: This is no purely digital brokerage. Bryers places an enormous emphasis on face-to-face contact.

“As much as the digital space is relevant, you can’t get away from the face-to-face stuff,” he says. “We’re not in the business of writing loans; we’re in the business of providing advice … we want to spend some one-one time.”

Maximising face-to-face interaction is built into the brokerage’s loan process. Bryers deals with all incoming inquiries – he believes it’s important to have a meaningful initial conversation to examine how he can help; even if he can’t take the loan on, he always tries to help in some way. A six-page interactive PDF is then emailed to the client to gather essential information and also flag up any potential problems or other involved third parties, such as accountants or financial planners.

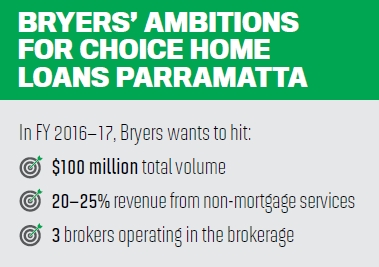

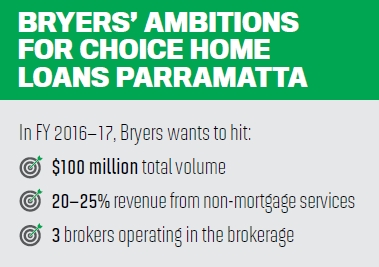

Bryers’ strategy involves doing much more than selling the loan – he partners with accountants and financial professionals to provide advice. He sticks with the old MFAA label of ‘credit adviser’, and is working to diversify the brokerage’s income and possibly increase fee-for-service work “so we can start covering ourselves if commissions start getting reduced for whatever reason – I want to make sure we’re a sustainable business”.

For Bryers, Choice have played a crucial role, both during his own early days as a broker, and in training and guiding the two new brokers he’s on-boarding in the office. He’s also a proponent of the Podium and Salesforce CRM services.

Bryers is set on growth, and on creating a thoroughly modern brokerage culture. “The money will come,” he says, “because we’re creating an ethos and a culture that is so client-centric, and this is resonating with a number of clients in my age bracket.”

This feature was sponsored by Choice Home Loans.

At just 33 years old, Adrian Bryers is very much a modern broker, and Choice Home Loans Parramatta is very much a modern brokerage. Located on the commuter highway of Church St, they’re ideally positioned to pull in their target clients: young professionals looking to build investment portfolios. Getting in touch with this group of clients requires a very different approach to the traditional broker value proposition.

First, social media at Bryers’ brokerage is a core area of strategy, not just a marketing add-on. With only two support staff, Bryers made the decision to outsource social media management; a virtual PA based in Penrith meets monthly with him to schedule updates, some of which Bryers writes himself, some of which are provided by referral partners and all of which are approved by Bryers prior to publishing. He also is commissioning a series of short videos for social media, which, like all content he puts out, has to be “short, snappy and relevant”.

Part of the reason for Bryers’ emphasis on social media use is the current limitations of Choice’s website. “Presently the website can’t be changed – it isn’t live-feeding; it’s fairly static,” he says. “In the last few months, we’ve had Twitter, Facebook and LinkedIn in particular keeping content fresh.”

Don’t be fooled, however: This is no purely digital brokerage. Bryers places an enormous emphasis on face-to-face contact.

“As much as the digital space is relevant, you can’t get away from the face-to-face stuff,” he says. “We’re not in the business of writing loans; we’re in the business of providing advice … we want to spend some one-one time.”

Maximising face-to-face interaction is built into the brokerage’s loan process. Bryers deals with all incoming inquiries – he believes it’s important to have a meaningful initial conversation to examine how he can help; even if he can’t take the loan on, he always tries to help in some way. A six-page interactive PDF is then emailed to the client to gather essential information and also flag up any potential problems or other involved third parties, such as accountants or financial planners.

Bryers’ strategy involves doing much more than selling the loan – he partners with accountants and financial professionals to provide advice. He sticks with the old MFAA label of ‘credit adviser’, and is working to diversify the brokerage’s income and possibly increase fee-for-service work “so we can start covering ourselves if commissions start getting reduced for whatever reason – I want to make sure we’re a sustainable business”.

For Bryers, Choice have played a crucial role, both during his own early days as a broker, and in training and guiding the two new brokers he’s on-boarding in the office. He’s also a proponent of the Podium and Salesforce CRM services.

Bryers is set on growth, and on creating a thoroughly modern brokerage culture. “The money will come,” he says, “because we’re creating an ethos and a culture that is so client-centric, and this is resonating with a number of clients in my age bracket.”

This feature was sponsored by Choice Home Loans.