Non-major banks respond to your key concerns and tell MPA what they’re doing to improve

Brokers on Banks tells us what banks could improve, but it doesn’t tell us if they actually will improve. As the recent debate over handing on RBA rate cuts demonstrates, banks need to balance a number of interests – savers and borrowers, brokers and direct channels – and so don’t always respond to brokers’ feedback as you’d expect. The only way to determine what the banks will do is by going direct to Australia’s non-majors and asking what exactly they are doing to improve their standing in the broker channel.

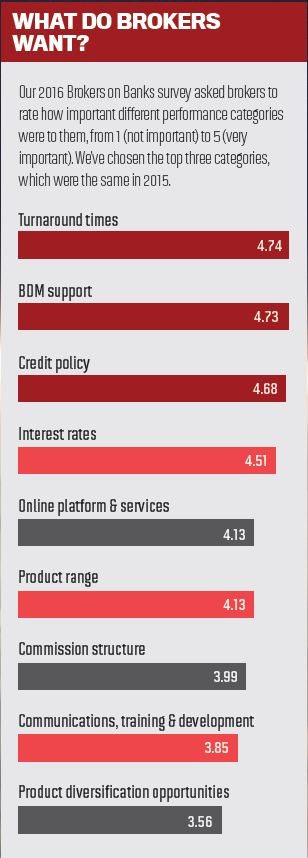

To be more specific, we wanted to know what the banks were doing to improve in the three areas brokers consistently say are most important: turnaround times, BDM support and credit policy. These performance categories were largely dominated by the major banks in last year’s Brokers on Banks survey, so the non-major banks, with few exceptions, most definitely have something to prove.

To be more specific, we wanted to know what the banks were doing to improve in the three areas brokers consistently say are most important: turnaround times, BDM support and credit policy. These performance categories were largely dominated by the major banks in last year’s Brokers on Banks survey, so the non-major banks, with few exceptions, most definitely have something to prove.The answers the banks gave us reflect a tension and transition in the space. Non-majors in recent years have put considerable effort into specific competitive offers, such as low rates, loosened serviceability, great commission, but this has backfired with turnaround time blow-outs and occasionally poor service. Some banks are now looking to move towards the type of consistent turnaround times, BDM support and credit policies you might associate with the major banks. Other banks are looking to distinguish themselves from a marketplace in which many lenders are increasingly interchangeable, through targeted offers, policies and systems. This feature talks to both camps.

Before reading this survey, have a look at MPA’s Brokers on Banks survey, from which the topics of this feature are drawn. You can find it in MPA 16.4, which is available online as an e-magazine.

Turnaround times

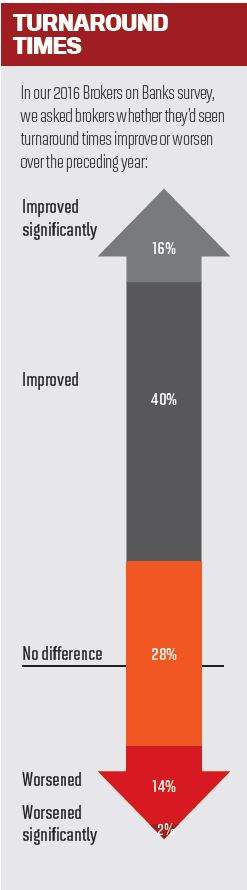

Not only were turnaround times brokers’ number one concern in our Brokers on Banks survey, they have been their number one concern for over five years. Unfortunately for banks, the relationship between turnaround times and overall success is generally a negative one: brokers expect a bank will have good turnaround times, but poor turnaround times can cause major damage to banks, regardless of competitive interest rates, good BDMs and the like.

Many non-majors have found this out the hard way, through limited time offers which lead to blow-outs as low-capacity processing teams and systems become overwhelmed. Unlike their larger counterparts, the non-majors have been relatively open about these blow-outs, and it seems that openness about turnaround times is here to stay, with three out of our four banks telling us their target turnaround times. Adelaide Bank is at 2.8 days (plus time to receive the valuation), AMP is at 2.45 days, Bankwest is at 24–48 hours, and Suncorp is at one day for initial assessment and two days for more complex applications. AMP says it tracks turnaround times daily, while Suncorp’s brokers can find the current turnaround times on their broker portal.

Turnaround times have been increasingly equated with technology, and the 56% of brokers who thought turnaround times had improved gave hundreds of examples of how technology had sped up the process. The most obvious way to improve technology is to replace legacy systems, which Suncorp is doing, gradually replacing its core banking platform, explains Steven Degetto, head of bank intermediaries. “While there will only be minimal changes for our brokers in the way they interact with the system, they will experience faster application times and more accurate back-channel messaging.” Similarly, Adelaide Bank is at the “business end” of developing their new LendFast platform, which will be rolled out over the next few months, says third party general manager Damian Percy. ME is also developing a new broker platform.

While new systems are high-profile, many of the improvements the banks highlight are relatively small, such as new tools and ways to apply. One example of a non-major doing this is ME, whose new tools “will automatically assess credit policy, loan profile and available customer information in a matter of minutes”, says general manager of broker sales Lino Pelaccia. “This will complement our automated pre-approvals and coaching of credit assessors already in place.” Suncorp is introducing Docu-Sign to allow “some existing customers” to review documents electronically, as well as electronic signing and emailing of documents.

“We’re introducing new decision and valuation tools that will automatically assess credit policy, loan profile and available customer information in a matter of minutes” Lino Pelaccia, ME

There is a risk of overfocusing on technology. As one broker in the survey told us, “applications are dependent on humans to keep the workflow going”; another, criticising CBA, noted that “CBA is more automated now but that just slows everything up because nobody can make a decision and files continually get stuck in the system”. Brokers told us they wanted a clear process with a single point of contact, which is the approach Bankwest have been taking with their single-case owner structure, introduced in 2015, in which a single person looks after the deal from beginning to end.

The next 18 months will see the bank take this philosophy to the rest of the business, says Stewart Saunders, general manager of broker sales, with the aim of tracking the progress of the loan at any stage in the application by the second half of 2016. The aim is to keep brokers and their customers informed, and the single-person case ownership model is also currently being trialled in the examinations team.

AMP has also adapted its processes, according to head of sales and marketing Glenn Gibson. “We have implemented a new operational structure that allows us to have more file ownership, thereby reducing or eliminating the ‘hand-offs’ that slow the process down.” The focus, Gibson argues, is now on each team member’s “personal responsibility” to improve turnaround times.

Non-majors still need to address brokers’ questions over their ability to handle spikes in applications. AMP has introduced a “consistent customer service initiative”, which Gibson claims will result in “a fundamental shift in our ability to handle spikes in volumes and we will only see this continue to improve over time”. Bankwest says it has had no problems handling spikes since the introduction of the singleperson case owner structure, while Suncorp says daily publishing of turnaround times will help brokers manage client expectations. Adelaide Bank has focused on staffing levels, says Percy, and is “investing in training additional staff who prefer a flexible working arrangement that helps us cope with the peaks and troughs”.

BDM support

Turnaround times can wax and wane, but BDMs tend to stick around: the top three banks for BDM support in 2015 are the same in 2016, even if the order has shifted slightly. BDM support is therefore not only highly important – second only to turnaround times – but a considerable obstacle to challenger banks looking to rise to the top. That’s because introducing a new product or slashing a rate is far easier than expanding or re-recruiting a new BDM team; furthermore, brokers get accustomed to dealing with certain BDMs. Therefore we wanted to know how exactly the non-majors planned to improve their BDM offerings.

Banks could start by simply expanding their BDM teams. ME’s team has been expanded from nine to 15 employees, Pelaccia says, including a team of seven state-based relationships managers. When banks elaborated where they would add extra BDMs, these plans tended to reflect Australia’s differing housing markets. Bankwest, for example, is looking to take advantage of “immense opportunity” on the East Coast and so are adding BDMs in Victoria, NSW and Queensland. Broker chief Saunders explains that the bank is secure in its home state of Western Australia, hence their expansion plans looking east. “We were founded in 1895 and have been working with brokers for decades! Our focus is on maintaining our relationships with brokers,” he says. Additionally, Suncorp is expanding its teams in Victoria and NSW.

Not all banks see recruitment as the best way forward: AMP tells MPA they already have ‘solid coverage’ across their target market. Instead, says Gibson, “our focus over the next 12 months is around what structure can we put in place to support our BDMs to free them up to serve our brokers even better”. Additionally, Adelaide Bank doesn’t have plans to expand. All the banks we talked to pointed to restructuring as a way to improve BDM service to brokers. For AMP, having multiple contact points – BDMs, contact centre and processing staff – is important to help get applications back on track.

Complementing traditional on-the-road BDMs with desk-based BDMs is a priority for Adelaide Bank, Suncorp and Bankwest. “We have also introduced a number of phone-based BDM roles to help us support a greater us regularly, and those who may use us less frequently.” At Bankwest all brokers are assigned a BDM and a desk-based ‘broker support manager’ (BSM), as well as a Credit Support Hotline.

“We’ve extended the reach of our phone-based team into areas where we have no – or limited – boots on the ground” Damian Percy, Adelaide Bank

“Sometimes the best way to get an application back on track is human intervention,” says AMP’s Gibson, but the bank is also monitoring application progress behind the scenes to spot delays. At Suncorp, brokers will have access to the same information on their current applications as Suncorp staff through the broker mortgage manager, Degetto claims. Finally, Bankwest will continue to run its online Broker Chat function, which was praised by brokers for ease of use.

Not all of our questions concerning BDM support were adequately answered by the banks. We were interested in the provision of support for brokers in regional areas – a complaint that appears every year in our survey – and none of the banks mentioned regional BDMs. Adelaide Bank does say “we’re getting really positive feedback where we’ve extended the reach of our phone-based team into areas where we have no – or limited – boots on the ground”. But with limited opportunities for residential price growth in these areas, it may be that these banks simply don’t see a reason to invest outside the East Coast boomtowns.

Credit policy

For the last few years of Brokers on Banks, credit policy has been consistently rated by brokers as more important than interest rates. This finding is all the more important to non-major banks, who utilise competitive credit policies and interest rates – and sometimes both – to draw customers away from the majors. With APRA’s tightening of investor lending and a politicised debate over whether banks should pass on cash rate cuts, we wanted to know how non-majors would utilise credit policy in the year ahead.

Making life easier for property investors would be an obvious place for the nonmajors to start. “We are certainly seeing interest rates becoming more competitive,” says AMP boss Gibson. “I don’t foresee a change to LVRs or serviceability in the near future, but with interest rates at their current low levels, affordability for investment purposes is very strong.” Bankwest’s Saunders says that despite rates improving “it is unlikely that the tightened conditions will relax significantly in the short to medium term.”

Not all the banks expect serviceability to improve, however. Adelaide Bank’s Percy “wouldn’t expect to see any change in attitude to serviceability on the part of lenders that is likely to lead to increased capacity, be it investors or anyone else”. Percy’s reasoning is that regulators have not yet relaxed their attitude, and their views tend to dominate. Suncorp sidestepped MPA’s question about investor clients, but their annual report for 2015/16 gives some indication of their stance: “the Bank has taken a cautious approach to investment lending and large scale property development, and has limited exposure to inner city apartment markets”. ME says it doesn’t differentiate between investors and owner-occupiers in its credit policies.

Beyond investors, we wanted to know if banks were targeting specific areas with competitive policies (see ‘‘Credit policy niches”, p36). ME says it is targeting first home buyers by capitalising the LMI up to 97%, although the decision will be “based on appropriate assessment” of the buyer. Similarly, Bankwest says it caps LMI at 98% on owner-occupied loans, in addition to “enhanced cash-out and parental guarantor policies”. Adelaide Bank has gone in a very different direction, with competitive credit policies for low-doc and bridging finance, according to Percy. “Our SmartSuite Commercial product, particularly, is a ripper and our BDMs know the ‘secret sauce’ so I’d encourage brokers to have the chat.”

Suncorp, which has consistently said it is targeting mum-and-dad clients (see MPA 16.1), doesn’t give any indication that change is likely, answering our question with a reference to their score in the Roy Morgan Consumer Confidence survey of June 2016. It’s possible that Suncorp, alongside other banks, is turning away from credit policies as a way to distinguish itself.

“We have also introduced a number of phone-based BDM roles to help us support a greater number of brokers” Steven Degetto, Suncorp

“Not a lot of lenders compete on credit policy niches in today’s market as they would have done in the past,” explains AMP’s Gibson. “Our credit policy wins business due to the fact that it is well balanced and consistently applied.”

Gibson’s point raises more questions than it answers, namely: without credit policies, and with rock-bottom interest rates – and consequently profit margins – across the board, how do non-majors distinguish themselves from the majors?

To see whether Gibson was right, or indeed whether any of these bank’s approaches to turnaround times, BDM support or credit policy have worked for brokers, see our Brokers on Banks survey in MPA 17.4.

.JPG)

“It is unlikely that the tightened conditions [for investors] will relax significantly in the short to medium term” Stewart Saunders, Bankwest

We asked the non-majors: Is there one particular aspect of your credit policy which is significantly better than other non-majors?

Adelaide Bank

“There are quite a few nuances to our credit policy, particularly around our specialised products like low doc and our bridging finance offering. Our SmartSuite Commercial product, particularly, is a ripper and our BDMs know the ‘secret sauce’ so I’d encourage brokers to have the chat”

AMP

“Our credit policy wins business due to the fact that it is well balanced and consistently applied. At AMP bank we share our policies with our brokers so they know exactly what we will or won’t do.”

Bankwest

•“Construction of multiple units on one title (up to four) up to 80% LVR

• Enhanced cash-out and parental guarantor policies

• Cap LMI at 98% on owner-occupied loans”

ME

“As part of our purpose of helping all Australians get ahead, we do have a policy for first home buyers where we will, based on appropriate assessment, potentially capitalise the LMI up to 97%”

Suncorp

“We recently won the national Non Major Lender of the Year Award at the Mortgage and Finance Association of Australia’s (MFAA) National Excellence Award”

Adelaide Bank

As part of Bendigo and Adelaide, residential home loans balance up 4.0%, with total lending up 5.1% (referring to the 2015/16 FY)

AMP

Overall mortgage book growth of 5% “constrained by lower investment property lending” (referring to the 2015 calendar year)

Bankwest

Residential home loans up 5% “reflecting lower system growth in Western Australia and tightening of lending criteria” (referring to the 2015/16 FY)

Suncorp Bank

Residential home loans balance up 5.9% “broadly in line with system growth and management aspirations” with total lending up 4.6% (referring to the 2015/16 FY)

ME

Full year results not available at the time of writing

.JPG)