Having a formalised referral relationship with a real estate agent can deliver far more than leads.

MPA editor Sam Richardson examines the strategic advantages of a partnership, and what it means for brokers on the ground.

Professional referral partnerships are the new lead generation ideal for most brokers. That’s for good reason: working with other professionals who understand the challenges of running a small business beats advertising, awkward birthday phone calls and database marketing, and has been utilised to tremendous effect by almost all of MPA’s top brokers and brokerages in 2015.

Times are about to get tougher, however. As Aussie Home Loans CEO James Symond told MPA, “the likely competitor to one mortgage broker is now another mortgage broker”, and you’ll be competing not only for clients but for referral partners. It’s very possible that by this time next year we’ll not be talking about real estate agents, accountants and solicitors as an ‘untapped opportunity’ but as a rapidly drying oasis in a parched referral landscape. Having relied on professional referrals, a large number of brokers will find themselves in dire straits.

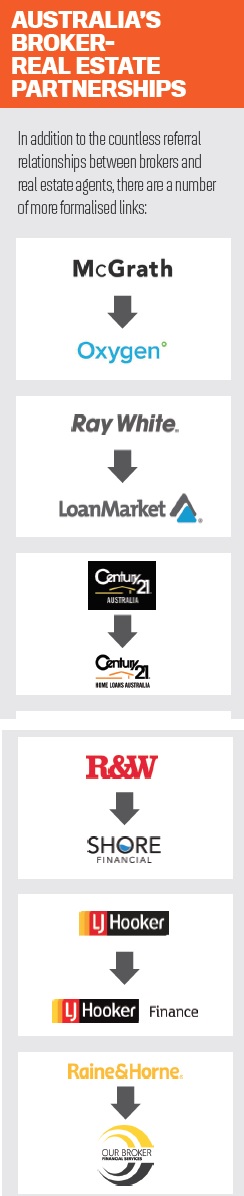

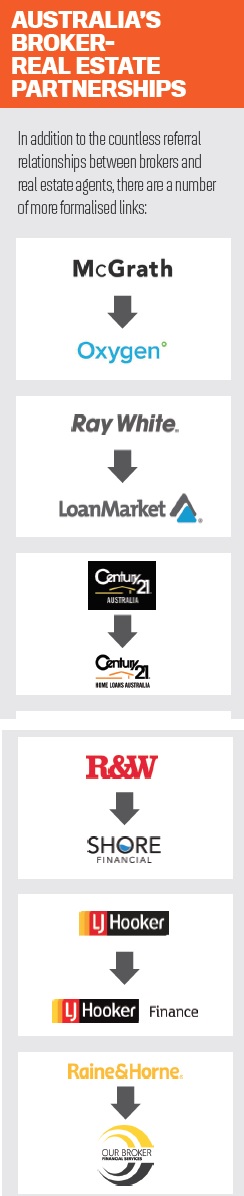

This article is about a group with a particular advantage: brokers in partnership with real estate agents. MPA has brought together Loan Market, the mortgage broking division of real estate group Ray White, and Oxygen Home Loans, an MPA Top 10 Independent Brokerage 2014, which is owned by McGrath.

The advantages for Oxygen’s brokers are obvious, explains general manager Alan Hemmings. “McGrath talks to hundreds of thousands of people a year, and we need to maximise that opportunity and find brokers who are prepared to do the work and follow up the lead,” he says. For Loan Market chairman Sam White it’s the quality of clients that counts. “People who are buying property every day, people at open homes: that’s the database that everyone is spending a lot of money advertising to get,” White says.

SATISFYING REGULATORY REQUIREMENTS

The NCCP Act makes a number of provisions related to referral arrangements, which you can read more about on the website of law fi rm Gadens. Gadens also provides an example of a referral agreement between a broker and referral partner:

If you refer potential borrowers to[name of lender/broker] (us/we), you will be deemed to have agreed to the terms set out in this document.

You must:

• only engage in credit activities as a referrer incidentally to another business you are carrying on

• not charge a fee to the consumer for the referral

• only inform the consumer that we are able to arrange loans and leases but not any particular product, and not provide any recommendations or advice concerning loans or leases

• inform the consumer of any commissions or other benefi ts you may receive

• obtain the consent of the consumer to pass their name, contact details and a short description of the purpose for which the consumer may want the credit or lease

• pass on the consumer’s contact details to us within fi ve business days of informing the consumer that we are able to arrange loans and leases but not any particular product

A shared history

The link with real estate agents goes back to broking’s roots. In 1993 the White family were faced with a major decision, recalls Sam White. One of their competitors had been bought out by a bank, and “we were concerned they would be able to off er better products. We didn’t want to sell out to a bank, so we decided to get into mortgage broking, which was just beginning”. In McGrath’s case, they quickly realised that their in-house lender, who represented one of the major banks, simply couldn’t help all their customers, and founded Oxygen in 2002.

While Loan Market and Oxygen were founded by real estate groups, over the years they moved further away from their parent companies. The name Loan Market resulted from a request by brokers who were concerned that the previous label, ‘Ray White Financial Services’, was “too limiting as a brand”, White explains; and Oxygen brokers are independent, as they hold their own credit licences.

Both White and Hemmings insist their brokers don’t get handed leads on a plate. Loan Market brokers often pay referral fees. And as Hemmings puts it, “brokers can’t just think they’ll come in and get leads from day one; it’s about building that personal relationship, the same as they were doing with any external referrer”.

Now both groups are intent on building closer links with their real estate arms, using technology and sophisticated marketing, and strengthening the links between the broker and real estate arms.

Regulation has also played a role, White notes: “In a marketplace where there’s more pressure on new deals, given the APRA restrictions, it’s a good opportunity to get customers buying new homes rather than refinancing old investor books, and we think that’ll be a really important part of the future.” The objective is to deliver more leads for brokers, more reassurance for agents, and ultimately a smoother transition for customers, starting from the ground up.

Partnerships at the broker level

Donna Beazley has been at Oxygen for four years, following time spent at Westpac and as a broker. Like other Oxygen brokers she’s based in McGrath offices – four offices to be exact – across NSW’s Sutherland Shire region. Placing brokers in McGrath offices is meant to help them build a rapport with the agents. Nevertheless, Beazley recalls that the process was “very challenging. You’ve got to be very in-their-face; you’ve got to work with them and get them to know you and trust you and see what you can do, because their clients are extremely important to them of course, so building a bit of a rapport up.”

Loan Market has a more mixed approach. MPA talked to Josh Bartlett, double-AMA Franchise Broker of the Year winner and No. 16 in the 2015 Top 100 Brokers. He is based in his own office in the Bayside region of Victoria. This gives him independence, he says, particularly in the eyes of clients.

That’s fine, Loan Market boss White comments, but “it’s better for [new brokers] to be part of a team … we recommend when people start they look at [being in the office], and then once they develop their business they often go out on their own”, a transition that usually occurs after one to two years, he adds.

In terms of the clients they get, Beazley notes that her clients vary across the four offices, although they are predominantly upgraders or downgraders like in most of the Shire. Loan Market’s Bartlett has found that his client base has changed as he’s gained experience and the trust of agents. Originally he dealt with first home buyers, but “I’m getting a lot more traction now around the $1.5–$2m mark; there’s a lot more people there because of my skill set, and they refer a bit better as well”.

Both brokers put enormous emphasis on building and maintaining relationships with their local real estate agents. Indeed, Bartlett has over 80 real estate partnerships and says he “loves” the transaction.

“I say out loud that I see myself as real estate agent–mortgage broker. My skill is in helping the client buy a property, helping negotiate, but in the background I’ve got the finance knowledge to be able to handle the transaction at the same time,” he says.

“It’s a trust thing in the Shire,” Oxygen’s Beazley explains. “They need to know who you are.” She helps build that trust by being physically present, both in the office and at open homes. “I go around to the offices and I train their staff, so you’ve got the trust in each other. The thing with real estate agents in McGrath is they’ve got so much going on and compliance to do that referrals don’t come naturally; I have to be in their face to remind them I’m here.”

The focused training of real estate agents by brokers is one of the things that distinguish the most successful partnerships. This is partially necessitated by regulation, observes White. “We do a lot of training with agents about descriptive dialogues, when and how to refer and why to refer – is it in the interests of their customer?”

An agent’s dialogue is important for improving the quality of leads, according to Bartlett. “If they just say, ‘Someone from our finance team will be giving you a call’, that isn’t very warm, but [they could] say, ‘You’ll be getting a phone call from Josh Bartlett, the AMA Broker of the Year two years running; he’ll be a good person to talk to’.”

Technology is helping Beazley and Bartlett take the uncertainty out of partnerships. After meeting a client at an auction or open home, Beazley checks with the agent and sends the client an email explaining what she does and her experience. She has a staff member specialising in lead generation who will then call and ask if the client needs any help from Beazley. Similarly, Bartlett uses video messaging to ensure clients bring the right documents to his appointments. Furthermore, Loan Market is trialling sending video messages explaining a broker’s role to attendees at open homes, with joint Loan Market–Ray White branding, White explains. “We’re trying to integrate open-for-inspection marketing to those clients.”

Bartlett has actually built an app – eBroker – to track the flow of leads; it is being rolled out across the entire Loan Market group. Agents wanted feedback on how their clients were doing, Bartlett recalls, and manually delivering this information to all his referral partners was taking up a huge amount of time. The new system automatically informs all parties, but its main role is as an ‘accountability tool’. “It makes the broker accountable to the name and number and builds the relationship.”

Oxygen is planning to develop its own lead management system, Hemmings says. “There may be a way to build a linkage between our software and McGrath software so we can provide updates around what’s happening. The agent creates a lead and we could have an application to automatically send a message to the agent to say, ‘Your lead has gone to lodgement’, or what have you.”

Dealing with multiple referral partners nevertheless requires a lot of work, and Beazley has a team of three support staff covering processing, lead generation and appointments, to help her concentrate on the interviews. At Loan Market they’re promoting the use of ‘broker teams’, where a group of brokers will share and allocate leads from referral sources to ensure at least one broker is still available. White explains: “We’re seeing that teams can have a bigger impact than an individual.”

The strategic dimension

At management level, both Oxygen and Loan Market are also trying to build a rapport between their broking and real estate arms. “We get [the team] in front of John McGrath,” explains Oxygen’s Hemmings. “Some mentoring and coaching from John always helps! He holds a couple of big sessions twice a year and they get invited to that. They get speakers in; they get to interact with all the agents and senior management.” They also run lead generation competitions for agents, with holiday vouchers as rewards.

There’s an increasing amount of cross-marketing at both groups. Oxygen gets mentioned in McGrath’s marketing material, as does Loan Market in Ray White’s advertising, White observes. “Sometimes in brochures we’ll illustrate how much an extra bid will cost you, so if you bid an extra $5,000 what’s the cost in terms of interest rate. We’ll have a chart that’ll be co-branded Ray White and Loan Market.” Ray White is expanding into Indonesia and Loan Market is following them, he adds, although he concedes, “It’s a long-term play.”

While most brokers will mention cross-marketing, there’s a common concern about brokers and estate agents being seen as too close by clients. “We do get asked the question quite often,” notes Hemmings. “I think it’s just putting the customer at ease, letting them know what we do discuss with the agents, what we don’t discuss, and being quite upfront about it. It’s when you try and hide it that you get in trouble. Yes, we’re owned by McGrath but we don’t disclose any personal information about the clients at all, and the brokers are well versed in having that conversation.”

Bartlett is similarly straightforward in his client dealings: “I just say ‘I work from my own independent office, and if I was to share your information I’d lose my job’. Saying that straight away gives the client confidence.”

In fact, brokers at Loan Market are far less locked in than you’d imagine. According to White, they’re allowed to partner with whichever real estate agents they choose (and vice versa). “We’re not just about Ray White; we think we have some good DNA about working with agents, and we’re very happy to support any broker around the country to establish a partnership, regardless of whether they’re Ray White or not,” he says.

Oxygen brokers are required to refer to McGrath, although there are no restrictions on their dealings with other partners such as accountants and solicitors.

All broker-real estate agent partnerships do struggle with a fundamental question over conflicts of interest; that a broker represents the buyer and the real estate agent represents the seller, and therefore they shouldn’t cooperate. Oxygen boss Hemmings is eager to set the record straight: “Ultimately the broker is working for the client. Although we’re employed by McGrath, I’m quite upfront with John [McGrath] that we work for the client.” That includes advising clients against a course of action recommended by an agent, if the client’s finances wouldn’t support it. “We do work for the client and we’re governed by the rules around that, so under responsible lending we do everything in our power to make sure the client can afford that property.”

Beyond lead generation

Broker-real estate partnerships began as a lead generation strategy, but after two decades of evolution they’re fundamentally reimagining the role of the broker. Brokers like Bartlett are coming to see themselves as experts in both spheres; an increasing number of brokers are setting up their own real estate offices, supported by head offices of national real estate networks.

Hemmings believes that support is a huge advantage. “For a broker looking to incrementally grow their business, McGrath can give them that opportunity, through the leads, through the support we give them,” he says.

For White, partner ships are part of a wider diversification play: “The mortgage broker is the old branch manager of the ’70s; they were the trusted adviser of the community. If you’re trusted, and you have the right services to offer the customer at the right time … it enhances the customer relationship. If brokers keep doing that, they can keep growing market share.”

Finally, for Beazley the partnership is a gateway to a whole range of possibilities. “I believe they’re leads that you never would have seen. You’ll meet and greet people that you never would have met, ever, so I think the opportunity’s huge,” she says. “You’ve got dozens of people attending open homes at any time, which you can get in front of, and even if you impress just one or two of them, they’re people you wouldn’t have met … most people need finance and assistance with getting a home.”

Developed by AppCloud and Loan Market broker Josh Bartlett, the eBroker app became available to Loan Market brokers nationally in May 2015 and has seen 225 brokers sign up and more than 3,400 leads captured.

Developed by AppCloud and Loan Market broker Josh Bartlett, the eBroker app became available to Loan Market brokers nationally in May 2015 and has seen 225 brokers sign up and more than 3,400 leads captured.

As well as saving time by automatically updating referrers on the progress of a loan, the app allows brokers, referrers and head office to track the number of conversions of leads. It’s in that final use that Bartlett sees the most potential.

“A lot of aggregators want to grow people businesses and write more volume, and eBroker is allowing Loan Market to know exactly how many leads each broker is getting every month and how many they’re converting. Aggregators want to help their brokers grow, but if they don’t have the right information they can’t grow,” he says.

In 2006, major UK real estate agent Foxtons was accused by the BBC’s Whistleblower program of sharing information with its in-house mortgage broker, Alexander Hall. The BBC claimed that Foxtons’ agents knew exactly how much borrowers could afford, having access to confidential income information held by Alexander Hall.

In 2006, major UK real estate agent Foxtons was accused by the BBC’s Whistleblower program of sharing information with its in-house mortgage broker, Alexander Hall. The BBC claimed that Foxtons’ agents knew exactly how much borrowers could afford, having access to confidential income information held by Alexander Hall.

Although Alexander Hall denied these accusations – and no prosecution ever took place – the ramifications of inappropriate sharing of information is huge. While Oxygen and Loan Market seek client information from real estate agents in order to smooth the transition, they have taken steps to prevent any backflow of confidential information.

In Oxygen’s case the brokerage stores details on a totally different IT system to that operated by McGrath, and although they can reveal to an agent that a client has been pre-approved, they won’t disclose for how much. Loan Market educates both brokers and agents and has a privacy policy that prohibits such sharing of information.

Professional referral partnerships are the new lead generation ideal for most brokers. That’s for good reason: working with other professionals who understand the challenges of running a small business beats advertising, awkward birthday phone calls and database marketing, and has been utilised to tremendous effect by almost all of MPA’s top brokers and brokerages in 2015.

Times are about to get tougher, however. As Aussie Home Loans CEO James Symond told MPA, “the likely competitor to one mortgage broker is now another mortgage broker”, and you’ll be competing not only for clients but for referral partners. It’s very possible that by this time next year we’ll not be talking about real estate agents, accountants and solicitors as an ‘untapped opportunity’ but as a rapidly drying oasis in a parched referral landscape. Having relied on professional referrals, a large number of brokers will find themselves in dire straits.

This article is about a group with a particular advantage: brokers in partnership with real estate agents. MPA has brought together Loan Market, the mortgage broking division of real estate group Ray White, and Oxygen Home Loans, an MPA Top 10 Independent Brokerage 2014, which is owned by McGrath.

The advantages for Oxygen’s brokers are obvious, explains general manager Alan Hemmings. “McGrath talks to hundreds of thousands of people a year, and we need to maximise that opportunity and find brokers who are prepared to do the work and follow up the lead,” he says. For Loan Market chairman Sam White it’s the quality of clients that counts. “People who are buying property every day, people at open homes: that’s the database that everyone is spending a lot of money advertising to get,” White says.

SATISFYING REGULATORY REQUIREMENTS

The NCCP Act makes a number of provisions related to referral arrangements, which you can read more about on the website of law fi rm Gadens. Gadens also provides an example of a referral agreement between a broker and referral partner:

If you refer potential borrowers to[name of lender/broker] (us/we), you will be deemed to have agreed to the terms set out in this document.

You must:

• only engage in credit activities as a referrer incidentally to another business you are carrying on

• not charge a fee to the consumer for the referral

• only inform the consumer that we are able to arrange loans and leases but not any particular product, and not provide any recommendations or advice concerning loans or leases

• inform the consumer of any commissions or other benefi ts you may receive

• obtain the consent of the consumer to pass their name, contact details and a short description of the purpose for which the consumer may want the credit or lease

• pass on the consumer’s contact details to us within fi ve business days of informing the consumer that we are able to arrange loans and leases but not any particular product

A shared history

The link with real estate agents goes back to broking’s roots. In 1993 the White family were faced with a major decision, recalls Sam White. One of their competitors had been bought out by a bank, and “we were concerned they would be able to off er better products. We didn’t want to sell out to a bank, so we decided to get into mortgage broking, which was just beginning”. In McGrath’s case, they quickly realised that their in-house lender, who represented one of the major banks, simply couldn’t help all their customers, and founded Oxygen in 2002.

While Loan Market and Oxygen were founded by real estate groups, over the years they moved further away from their parent companies. The name Loan Market resulted from a request by brokers who were concerned that the previous label, ‘Ray White Financial Services’, was “too limiting as a brand”, White explains; and Oxygen brokers are independent, as they hold their own credit licences.

Both White and Hemmings insist their brokers don’t get handed leads on a plate. Loan Market brokers often pay referral fees. And as Hemmings puts it, “brokers can’t just think they’ll come in and get leads from day one; it’s about building that personal relationship, the same as they were doing with any external referrer”.

Now both groups are intent on building closer links with their real estate arms, using technology and sophisticated marketing, and strengthening the links between the broker and real estate arms.

Regulation has also played a role, White notes: “In a marketplace where there’s more pressure on new deals, given the APRA restrictions, it’s a good opportunity to get customers buying new homes rather than refinancing old investor books, and we think that’ll be a really important part of the future.” The objective is to deliver more leads for brokers, more reassurance for agents, and ultimately a smoother transition for customers, starting from the ground up.

Partnerships at the broker level

Donna Beazley has been at Oxygen for four years, following time spent at Westpac and as a broker. Like other Oxygen brokers she’s based in McGrath offices – four offices to be exact – across NSW’s Sutherland Shire region. Placing brokers in McGrath offices is meant to help them build a rapport with the agents. Nevertheless, Beazley recalls that the process was “very challenging. You’ve got to be very in-their-face; you’ve got to work with them and get them to know you and trust you and see what you can do, because their clients are extremely important to them of course, so building a bit of a rapport up.”

Loan Market has a more mixed approach. MPA talked to Josh Bartlett, double-AMA Franchise Broker of the Year winner and No. 16 in the 2015 Top 100 Brokers. He is based in his own office in the Bayside region of Victoria. This gives him independence, he says, particularly in the eyes of clients.

That’s fine, Loan Market boss White comments, but “it’s better for [new brokers] to be part of a team … we recommend when people start they look at [being in the office], and then once they develop their business they often go out on their own”, a transition that usually occurs after one to two years, he adds.

In terms of the clients they get, Beazley notes that her clients vary across the four offices, although they are predominantly upgraders or downgraders like in most of the Shire. Loan Market’s Bartlett has found that his client base has changed as he’s gained experience and the trust of agents. Originally he dealt with first home buyers, but “I’m getting a lot more traction now around the $1.5–$2m mark; there’s a lot more people there because of my skill set, and they refer a bit better as well”.

Both brokers put enormous emphasis on building and maintaining relationships with their local real estate agents. Indeed, Bartlett has over 80 real estate partnerships and says he “loves” the transaction.

“I say out loud that I see myself as real estate agent–mortgage broker. My skill is in helping the client buy a property, helping negotiate, but in the background I’ve got the finance knowledge to be able to handle the transaction at the same time,” he says.

“It’s a trust thing in the Shire,” Oxygen’s Beazley explains. “They need to know who you are.” She helps build that trust by being physically present, both in the office and at open homes. “I go around to the offices and I train their staff, so you’ve got the trust in each other. The thing with real estate agents in McGrath is they’ve got so much going on and compliance to do that referrals don’t come naturally; I have to be in their face to remind them I’m here.”

The focused training of real estate agents by brokers is one of the things that distinguish the most successful partnerships. This is partially necessitated by regulation, observes White. “We do a lot of training with agents about descriptive dialogues, when and how to refer and why to refer – is it in the interests of their customer?”

An agent’s dialogue is important for improving the quality of leads, according to Bartlett. “If they just say, ‘Someone from our finance team will be giving you a call’, that isn’t very warm, but [they could] say, ‘You’ll be getting a phone call from Josh Bartlett, the AMA Broker of the Year two years running; he’ll be a good person to talk to’.”

Technology is helping Beazley and Bartlett take the uncertainty out of partnerships. After meeting a client at an auction or open home, Beazley checks with the agent and sends the client an email explaining what she does and her experience. She has a staff member specialising in lead generation who will then call and ask if the client needs any help from Beazley. Similarly, Bartlett uses video messaging to ensure clients bring the right documents to his appointments. Furthermore, Loan Market is trialling sending video messages explaining a broker’s role to attendees at open homes, with joint Loan Market–Ray White branding, White explains. “We’re trying to integrate open-for-inspection marketing to those clients.”

Bartlett has actually built an app – eBroker – to track the flow of leads; it is being rolled out across the entire Loan Market group. Agents wanted feedback on how their clients were doing, Bartlett recalls, and manually delivering this information to all his referral partners was taking up a huge amount of time. The new system automatically informs all parties, but its main role is as an ‘accountability tool’. “It makes the broker accountable to the name and number and builds the relationship.”

Oxygen is planning to develop its own lead management system, Hemmings says. “There may be a way to build a linkage between our software and McGrath software so we can provide updates around what’s happening. The agent creates a lead and we could have an application to automatically send a message to the agent to say, ‘Your lead has gone to lodgement’, or what have you.”

Dealing with multiple referral partners nevertheless requires a lot of work, and Beazley has a team of three support staff covering processing, lead generation and appointments, to help her concentrate on the interviews. At Loan Market they’re promoting the use of ‘broker teams’, where a group of brokers will share and allocate leads from referral sources to ensure at least one broker is still available. White explains: “We’re seeing that teams can have a bigger impact than an individual.”

The strategic dimension

At management level, both Oxygen and Loan Market are also trying to build a rapport between their broking and real estate arms. “We get [the team] in front of John McGrath,” explains Oxygen’s Hemmings. “Some mentoring and coaching from John always helps! He holds a couple of big sessions twice a year and they get invited to that. They get speakers in; they get to interact with all the agents and senior management.” They also run lead generation competitions for agents, with holiday vouchers as rewards.

There’s an increasing amount of cross-marketing at both groups. Oxygen gets mentioned in McGrath’s marketing material, as does Loan Market in Ray White’s advertising, White observes. “Sometimes in brochures we’ll illustrate how much an extra bid will cost you, so if you bid an extra $5,000 what’s the cost in terms of interest rate. We’ll have a chart that’ll be co-branded Ray White and Loan Market.” Ray White is expanding into Indonesia and Loan Market is following them, he adds, although he concedes, “It’s a long-term play.”

While most brokers will mention cross-marketing, there’s a common concern about brokers and estate agents being seen as too close by clients. “We do get asked the question quite often,” notes Hemmings. “I think it’s just putting the customer at ease, letting them know what we do discuss with the agents, what we don’t discuss, and being quite upfront about it. It’s when you try and hide it that you get in trouble. Yes, we’re owned by McGrath but we don’t disclose any personal information about the clients at all, and the brokers are well versed in having that conversation.”

Bartlett is similarly straightforward in his client dealings: “I just say ‘I work from my own independent office, and if I was to share your information I’d lose my job’. Saying that straight away gives the client confidence.”

In fact, brokers at Loan Market are far less locked in than you’d imagine. According to White, they’re allowed to partner with whichever real estate agents they choose (and vice versa). “We’re not just about Ray White; we think we have some good DNA about working with agents, and we’re very happy to support any broker around the country to establish a partnership, regardless of whether they’re Ray White or not,” he says.

Oxygen brokers are required to refer to McGrath, although there are no restrictions on their dealings with other partners such as accountants and solicitors.

All broker-real estate agent partnerships do struggle with a fundamental question over conflicts of interest; that a broker represents the buyer and the real estate agent represents the seller, and therefore they shouldn’t cooperate. Oxygen boss Hemmings is eager to set the record straight: “Ultimately the broker is working for the client. Although we’re employed by McGrath, I’m quite upfront with John [McGrath] that we work for the client.” That includes advising clients against a course of action recommended by an agent, if the client’s finances wouldn’t support it. “We do work for the client and we’re governed by the rules around that, so under responsible lending we do everything in our power to make sure the client can afford that property.”

Beyond lead generation

Broker-real estate partnerships began as a lead generation strategy, but after two decades of evolution they’re fundamentally reimagining the role of the broker. Brokers like Bartlett are coming to see themselves as experts in both spheres; an increasing number of brokers are setting up their own real estate offices, supported by head offices of national real estate networks.

Hemmings believes that support is a huge advantage. “For a broker looking to incrementally grow their business, McGrath can give them that opportunity, through the leads, through the support we give them,” he says.

For White, partner ships are part of a wider diversification play: “The mortgage broker is the old branch manager of the ’70s; they were the trusted adviser of the community. If you’re trusted, and you have the right services to offer the customer at the right time … it enhances the customer relationship. If brokers keep doing that, they can keep growing market share.”

Finally, for Beazley the partnership is a gateway to a whole range of possibilities. “I believe they’re leads that you never would have seen. You’ll meet and greet people that you never would have met, ever, so I think the opportunity’s huge,” she says. “You’ve got dozens of people attending open homes at any time, which you can get in front of, and even if you impress just one or two of them, they’re people you wouldn’t have met … most people need finance and assistance with getting a home.”

Developed by AppCloud and Loan Market broker Josh Bartlett, the eBroker app became available to Loan Market brokers nationally in May 2015 and has seen 225 brokers sign up and more than 3,400 leads captured.

Developed by AppCloud and Loan Market broker Josh Bartlett, the eBroker app became available to Loan Market brokers nationally in May 2015 and has seen 225 brokers sign up and more than 3,400 leads captured.As well as saving time by automatically updating referrers on the progress of a loan, the app allows brokers, referrers and head office to track the number of conversions of leads. It’s in that final use that Bartlett sees the most potential.

“A lot of aggregators want to grow people businesses and write more volume, and eBroker is allowing Loan Market to know exactly how many leads each broker is getting every month and how many they’re converting. Aggregators want to help their brokers grow, but if they don’t have the right information they can’t grow,” he says.

In 2006, major UK real estate agent Foxtons was accused by the BBC’s Whistleblower program of sharing information with its in-house mortgage broker, Alexander Hall. The BBC claimed that Foxtons’ agents knew exactly how much borrowers could afford, having access to confidential income information held by Alexander Hall.

In 2006, major UK real estate agent Foxtons was accused by the BBC’s Whistleblower program of sharing information with its in-house mortgage broker, Alexander Hall. The BBC claimed that Foxtons’ agents knew exactly how much borrowers could afford, having access to confidential income information held by Alexander Hall. Although Alexander Hall denied these accusations – and no prosecution ever took place – the ramifications of inappropriate sharing of information is huge. While Oxygen and Loan Market seek client information from real estate agents in order to smooth the transition, they have taken steps to prevent any backflow of confidential information.

In Oxygen’s case the brokerage stores details on a totally different IT system to that operated by McGrath, and although they can reveal to an agent that a client has been pre-approved, they won’t disclose for how much. Loan Market educates both brokers and agents and has a privacy policy that prohibits such sharing of information.