Figures released by the ABS provide a complete view of lending – from residential to commercial to car finance and beyond.

Once a month, our inboxes fill up with the same old headlines: ‘Housing finance jumps 10%’, ‘Commercial finance stabilises’, etc. And while a large jump – or even better a large fall – can get our attention, it doesn’t necessarily give a great view of the directions the housing market and Australian economy are moving in.

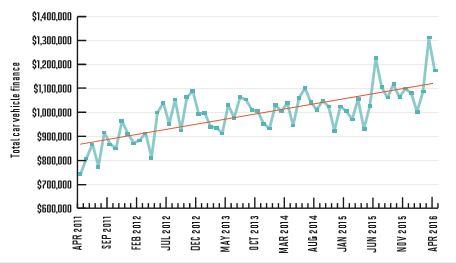

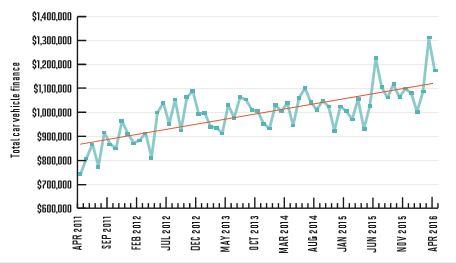

You need to take a longer-term view and a much wider view. Figures from the ABS provide exactly that. Some of its series run from the 1970s onwards; a five-year view can show long-term growth, as it does for car finance, for example (see graph, opposite page). For other measures, a 12-month view with comparison between the same months (ie April to April) may be most appropriate.

Now that brokers offer far more than housing finance, it’s vital to look at a wider range of lending figures. Here we discuss commercial lending, car finance and rural lending, but the ABS reports on a number of surprisingly specialised categories, such as finance for motorbikes. Diversified brokers can find these statistics on the ABS website.

Most of all, considering a range of lending statistics helps cut through the ‘good news/ bad news’ hype, which assumes all brokers across the country experience economic changes in the same way. As always, the economic picture is mixed, with different consequences for different brokerages.

.jpg)

WHAT HAPPENED TO COMMERCIAL FINANCE?

The ABS stats show that new commercial finance fell 3.3% in seasonally adjusted terms, with business lending experiencing a 14.4% fall, since April 2014.

Brokers may find this surprising given the vast amount of marketing and attention focused by lenders on commercial lending opportunities. This may have more to do with lenders turning their attention away from residential lending, in light of restrictions; the RBA’s Financial Stability Review in April noted that “competition among lenders for non-residential property investment loans … appears to have intensified: banks report that margins narrowed further over the second half of 2015”.

That competition, however, was mainly focused on commercial property lending. Competition for business lending had “stabilised” after increasing for a number of years, said the RBA, adding that “margins on large business loans remain at historic lows”.

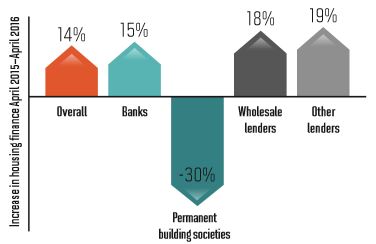

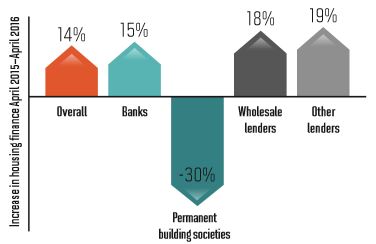

WHICH LENDERS ARE WINNING

The ABS splits up housing finance data by types of lenders. Using this data and comparing it to the ‘overall’ figure, we can see which sectors are growing above and below system growth. Bear in mind that banks, which provide the vast majority of housing finance, therefore largely determine system growth, which is an average.

THE LONG ROAD FOR CAR FINANCE

April lending figures from the ABS suggest car finance has experienced long-term growth over the last five years, despite a number of single-month peaks.

GRASS IS GREENER IN RURAL AUSTRALIA

If you’re disappointed by the prospects for commercial lending, it may be time to get out of your office and escape to the country: loans to agriculture, forestry and fishing reached a 6.5-year high. Totalling $23.3bn, finance in the sector in the year to April 2016 was just below the all-time record of $23.5bn.

CommSec’s Economic Insights report noted that “keen global interest in Australia’s food and beverage products are driving interest in the farm sector”. Rural brokers have also been doing relatively well of late. Robinson Sewell Partners not only picked up the regional trophy at the MFAA’s NSW Excellence Awards but were also recognised as the state’s best brokerage with two to five writers, and won another award for customer service.

You need to take a longer-term view and a much wider view. Figures from the ABS provide exactly that. Some of its series run from the 1970s onwards; a five-year view can show long-term growth, as it does for car finance, for example (see graph, opposite page). For other measures, a 12-month view with comparison between the same months (ie April to April) may be most appropriate.

Now that brokers offer far more than housing finance, it’s vital to look at a wider range of lending figures. Here we discuss commercial lending, car finance and rural lending, but the ABS reports on a number of surprisingly specialised categories, such as finance for motorbikes. Diversified brokers can find these statistics on the ABS website.

Most of all, considering a range of lending statistics helps cut through the ‘good news/ bad news’ hype, which assumes all brokers across the country experience economic changes in the same way. As always, the economic picture is mixed, with different consequences for different brokerages.

.jpg)

WHAT HAPPENED TO COMMERCIAL FINANCE?

The ABS stats show that new commercial finance fell 3.3% in seasonally adjusted terms, with business lending experiencing a 14.4% fall, since April 2014.

Brokers may find this surprising given the vast amount of marketing and attention focused by lenders on commercial lending opportunities. This may have more to do with lenders turning their attention away from residential lending, in light of restrictions; the RBA’s Financial Stability Review in April noted that “competition among lenders for non-residential property investment loans … appears to have intensified: banks report that margins narrowed further over the second half of 2015”.

That competition, however, was mainly focused on commercial property lending. Competition for business lending had “stabilised” after increasing for a number of years, said the RBA, adding that “margins on large business loans remain at historic lows”.

WHICH LENDERS ARE WINNING

The ABS splits up housing finance data by types of lenders. Using this data and comparing it to the ‘overall’ figure, we can see which sectors are growing above and below system growth. Bear in mind that banks, which provide the vast majority of housing finance, therefore largely determine system growth, which is an average.

THE LONG ROAD FOR CAR FINANCE

April lending figures from the ABS suggest car finance has experienced long-term growth over the last five years, despite a number of single-month peaks.

GRASS IS GREENER IN RURAL AUSTRALIA

If you’re disappointed by the prospects for commercial lending, it may be time to get out of your office and escape to the country: loans to agriculture, forestry and fishing reached a 6.5-year high. Totalling $23.3bn, finance in the sector in the year to April 2016 was just below the all-time record of $23.5bn.

CommSec’s Economic Insights report noted that “keen global interest in Australia’s food and beverage products are driving interest in the farm sector”. Rural brokers have also been doing relatively well of late. Robinson Sewell Partners not only picked up the regional trophy at the MFAA’s NSW Excellence Awards but were also recognised as the state’s best brokerage with two to five writers, and won another award for customer service.