Fee-only product available in 24 hours, says lender

RealtyAssist, a new finance partner of Domain Holdings is allegedly providing vendor loans of up to $5m despite having no credit licence.

The product, which relies on credit law exemptions for short-term credit lending under 62 days, is said to have prompted a wave of complaints to the Australian Securities and Investments Commission, which declines to comment on whether it is investigating.

The real estate services provider said it was not aware of any such complaints received by the regulator.

RealtyAssist provides services to some of Australia’s biggest realtors, including pre-settlement funds, which if approved, allows vendors to draw on funds ahead of the property transaction’s completion.

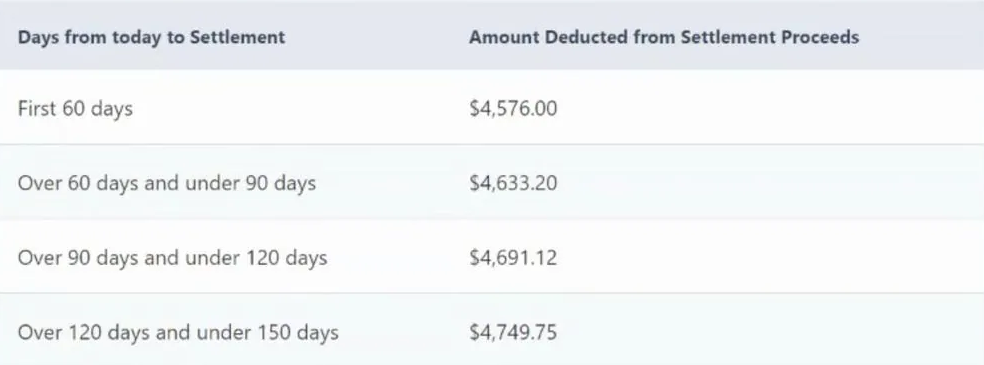

A “simple credit fee” is charged for the product, and the loan term is for 60 days, however potential borrowers are able to request a longer-term – or can say they’re unsure of the exact duration for which funds are required, The Australian reported on Monday.

Upon reaching the 60-day term, borrowers are allegedly charged interest from the following day, and each 30 days thereafter. Applicants are given the option to choose if they require funds “in as little as 24 hours”.

Read next: Funding.com.au enjoys record loan book growth

In a statement, RealtyAssist said it would take any complaints to ASIC (or investigation) “very seriously.”

“RealtyAssist is a successful commercial company in this market, and it is conceivable that its competitors may have lodged complaints (without foundation),” the statement read.

”On the property settlement advance product, RealtyAssist provides between $5,000 to $5m to borrowers and suggests the loans can run longer than 60 days.”

A demonstration given to real estate agents of RealtyAssist’s products included payment terms far exceeding the 62-day exemption period, The Australian said. Marketing materials allegedly told vendors requiring more time before their property settles to contact RealtyAssist for help.

“Your application will only take a few minutes to complete, so you can get your… advance as quickly as possible,” the material read.

In response to questions, The Australian said RealtyAssist’s lawyers replied that pursuant to Regulation 58, exemptions apply for short-term lending where the term of the loan is under 62 days.

“The amount of the loan is not limited and hence this exemption can apply to loans of some magnitude,” lawyers said in their response.

Asked specifically about the settlement products, RealtyAssist said it could be “in excess” of $5m.

“Invariably, however, these loans are only entered into where there is a binding sales contract which provides expressly for a settlement to occur prior to the expiration of 62 days. There is no basis upon which the loan can exceed 62 days,” the lawyers allegedly wrote.

The National Credit Code specifies that to be exempt from legal obligations, short-term credit should not exceed 62 days, and there are limits to the amount of interest charged.

But there’s no reference in the code to a cap on the amount of short-term credit.

RealtyAssist’s lending practices have been labelled by industry watchers as “skirting around” and potentially “flouting the spirit of the credit laws”.

“It certainly sounds like they are providing credit so they should then be compliant with the provisions of the (National Consumer Credit Protection) Act,” Andy Schmulow, senior lecturer at the University of Wollongong School of Law said.

One industry participant, who spoke on condition of anonymity, said: “The drafters of the credit act included the short-term exemption to facilitate companies like Telstra offering 30 days for a consumer to pay their telephone bill.

“It was included in recognition that 30 or 60 (day) payment terms might be construed as the provision of credit if the act was read literally and didn’t include the exemption. Never would have they imagined that the 62-day exemption would be used to make $5m loans to consumers by an unregulated lender.”

Banks and other lenders bound by consumer credit legislation must meet responsible lending and other obligations to ensure borrowers can afford to repay their loans.

Examples of short-term credit providers that rely on legal exemptions include buy now, pay later services, the Australian Finance Industry Association saying on Friday it would bring forward a review of the BNPL code of practice.

Although RealtyAssist does not have an Australian credit licence, given it operates within exemptions from the National Credit Code, it said it was likely to introduce loan products requiring a licence.

“In pursuit of this objective, RealtyAssist is in the process of securing its own ACL and anticipates having this in place in the coming months,” the company told The Australian.

Domain is said to have recently partnered with RealtyAssist after quietly severing ties with its earlier BNPL partner, Limepay. It is currently seeking to transfer customers to RealtyAssist. Domain’s venture with Limepay was aimed at providing sellers of property a BNPL option to access funds to cover the cost of marketing their home to potential buyers.

A demonstration video created for real estate agents by RealtyAssist last year said more than half of customers were using the pay later option for property sale marketing costs. It showed options for the vendor to be able to extend the payment term from 60 days to a period of more than 120 days and less than 150 days.

RealtyAssist provides that BNPL option for property sellers and facilitates other products including an instalment offering for rental bond payments. It pays the bond for the property renter directly to the real estate agent and the amount is repaid by the renter over a 62-day period, at an interest rate of 8%.

Late amounts incur a 24% interest per annum charge.

Read next: When will house prices find their floor?

A Domain spokeswoman said its MarketNow product was “strongly endorsed by agents and achieved rapid take up”.

“We recognised that our customers’ needs had outgrown the products provided by MarketNow, a joint venture with Limepay. Domain has a commercial relationship related to the distribution of RealtyAssist’s products, but all contractual product and lending relationships exist between RealtyAssist and customers taking on their products.

“Domain also has commercial relationships to support the distribution of a number of competitor products to RealtyAssist, as this is core to Domain’s open ecosystem strategy that offers agents choice,” the spokeswoman told The Australian on Sunday.

“Domain undertakes a degree of due diligence on its commercial partners to ensure that they are a partner that they wish to have an arrangement with.”

In addition to RealtyAssist, other companies providing payment services to real estate agents and vendors include MoneyMe and CampaignAgent, both of which hold a credit licence. MoneyMe provides a product called ListReady, providing vendors with funds of up to $35,000 to spend on marketing, home improvements, styling, and auction fees, while CampaignAgent provides a range of services, including funds for vendors footing property marketing costs upfront, or pay later.