Property giant rebuffs Australian mortgage brokerage owner's huge offer

Australian property and mortgage group REA, owned by Rupert Murdoch’s News Corp, has seen its attempt to acquire UK real estate giant Rightmove rebuffed, despite offering a substantial cash and shares package worth approximately £5.6 billion ($11bn AUD).

Rightmove, which dominates the UK property listing market with an 80% share, rejected the bid, labelling it as “opportunistic” and undervaluing the company’s long-term growth prospects.

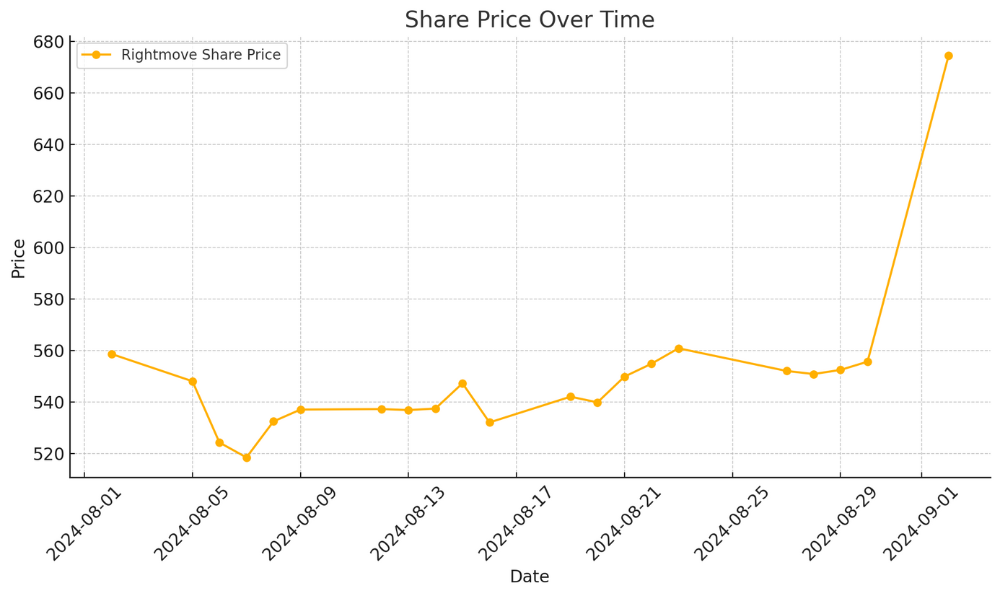

REA’s initial proposal valued Rightmove’s shares at 705 pence, representing a 27% premium on its share price before the offer became public. The bid comprised 305 pence in cash with the remainder in REA stock.

Rightmove countered that the offer was only worth 698 pence per share after Australian investors baulked at the news causing a subsequent fall in REA’s stock value.

Rightmove shares had risen 25% following the news of the bid, bringing its market capitalization close to £5.4 billion.

REA owns one of Australia’s largest mortgage broker networks, Mortgage Choice, which it acquired in 2021. Mortgage Choice is a well-established Australian mortgage broking company, and it has been integrated with REA’s Smartline broker franchise, bolstering REA’s position in the financial services sector.

The acquisition expanded Mortgage Choice’s network to over 940 brokers and 720 franchises across Australia, significantly increasing its influence in the profitable Australian mortgage market. This year the company, which now boasts over 1,000 brokers, announced a loan book of $88bn (£45.48bn) and financial service revenues of $73m (£37.48m) after franchisee commissions.

REA had stated that if the takeover were successful, Rightmove’s shareholders would own 18.6% of the merged entity. The Australian firm emphasised the “significant premium” of the offer and the potential for UK shareholders to benefit from future growth in a combined business.

Nevertheless, analysts remain sceptical of the deal’s potential, given the companies’ different geographical markets, with some, such as Citi’s Siraj Ahmed, suggesting that a 40-50% premium might be necessary for REA to sway Rightmove.

REA Group CEO Owen Wilson, praised for his strategic approach, characterised the deal as a “common sense” move that would deliver long-term economic benefits.

The acquisition would offer REA a foothold in the larger UK market, which is triple the size of Australia’s, while enabling Rightmove to expand its mortgage and digital solutions offerings, areas that CEO Johan Svanstrom had previously identified as key growth sectors.

Others have speculated, however, that this may be an attempt to shore up the media mogul’s UK press offerings.

“This is a way for News Corp to protect its weakening news properties in the UK,” said one former executive to The Guardian.

“Too many are loss-making or near loss-making businesses and they need a way to find growth and protect their UK news holdings. Profits at News Corp’s media division have slumped by nearly a quarter over the last year to June 2024.

However, REA’s investors have shown less enthusiasm for the move. REA’s share price dropped by 7% after the takeover interest was made public, with concerns over potential equity raising needed to fund the acquisition.

Some believe that increasing the cash portion of the deal could be necessary to sweeten the offer, though this might require REA to raise additional capital, something that could lower News Corp’s stake in the company to just over 50%.

The UK’s takeover laws give REA until the end of September to make a formal offer or withdraw its interest. Should REA persist, it could bypass the Rightmove board and present the offer directly to shareholders.

The outcome of this potential acquisition could reshape both the UK mortgage market and REA’s global footprint, adding to its existing operations in markets like the US and India.