Brexit has not only shocked the world economy; it’s set in motion a process that will take years and have very real consequences for Australian brokers

In a year of drama, Brexit is the undisputed star of the show. As word came through on the afternoon of 24 June that British voters had defied politicians and experts worldwide in voting to leave the European Union, the financial markets reacted immediately, overshadowing Australia’s federal election and even Donald Trump.

Brexit was almost immediately framed as a financial disaster, and the initial effects read like a ticker tape of woe: the pound dropping to a 30-year low, the UK losing the prized AAA rating it had held since the 1970s, and over US$3trn wiped from stock markets in the two days of trading following the Brexit vote, easily surpassing the GFC to rank as the worst day of global trading ever.

A webinar, held by ratings agency Standard & Poor’s to discuss its downgrading of the UK, summed up the mood of bewilderment. Moritz Kraemer, global chief ratings officer, sovereign ratings, was asked about the benefits of Brexit.

“I don’t think I can see any obvious benefits here,” Kraemer responded, “beyond lawyers and duty-free shops.”

What about brokers? The speculation has already begun on Brexit’s consequences for Australian property; and as MPA has found, its consequences for brokers are more complicated but no less important.

Brexit for lenders and the economy

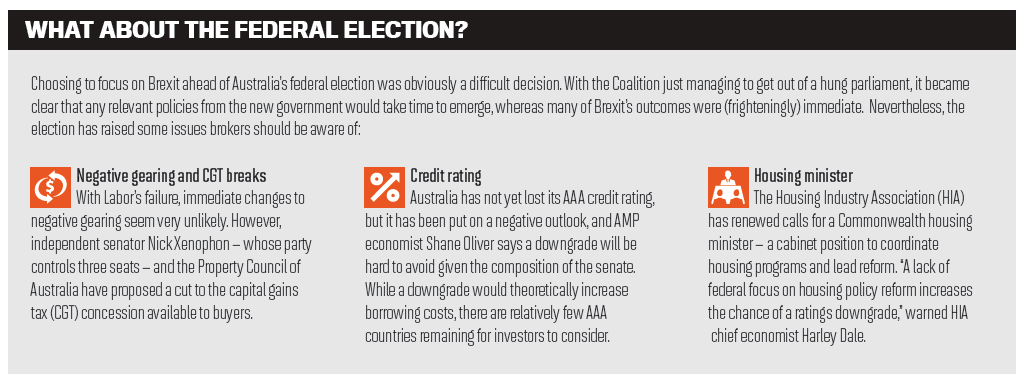

For a start, Brexit is a long-term phenomenon. The reaction of the market to Brexit was astonishing, but the market is fickle: indeed, by the Wednesday after the vote the UK’s FTSE 100 stock index had fully recovered its value. Moreover, Brexit is officially yet to happen: the UK first has to trigger Article 50, which begins a two-year countdown to Britain leaving the EU, and Britain’s new Prime Minister, Theresa May, has said she will not activate Article 50 before the end of 2016. Therefore Brexit, a second Scottish referendum, an EU-wide recession and any spin-off effects are all possibilities but none have actually materialised thus far.

“There’s a real possibility for an out of cycle rate rise post the Australian federal election as lenders look to pass on the increased cost of doing business”

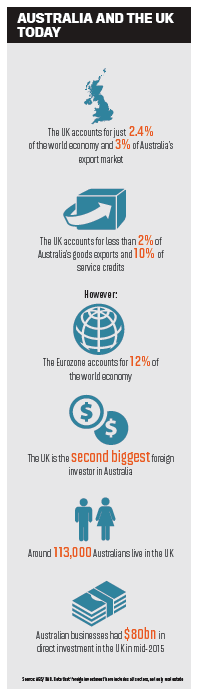

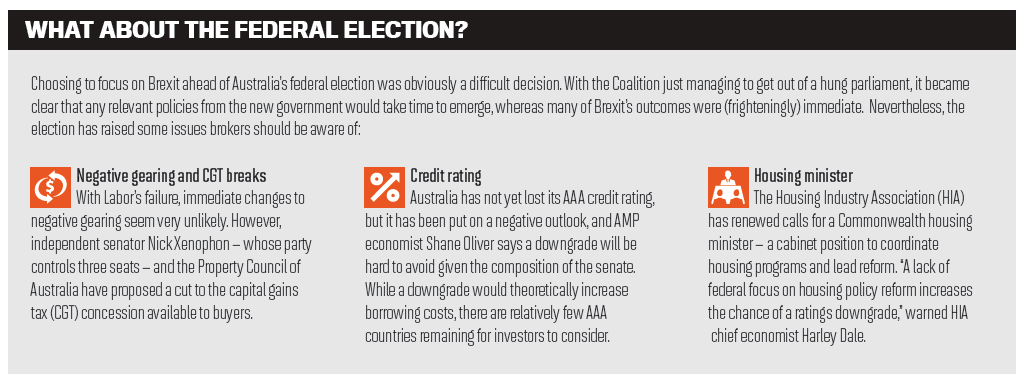

Closer to home, it’s important not to overstate the UK’s economic links to Australia. S&P was not adjusting its forecasts for Asia as a consequence of Brexit, its director and chief economist Asia-Pacific Paul Gruenwald told the webinar, noting that “the direct trade links with the UK are minor across the region”.

Closer to home, it’s important not to overstate the UK’s economic links to Australia. S&P was not adjusting its forecasts for Asia as a consequence of Brexit, its director and chief economist Asia-Pacific Paul Gruenwald told the webinar, noting that “the direct trade links with the UK are minor across the region”.

In fact, the whole of the EU takes less than 5% of Australia’s exports, and the UK doesn’t have the impact on tourism or migration it once did, explains CBRE’s Australian head of research, Stephen McNabb. “Asia/China has replaced Europe as a major source for migration, tourism and trade over an extended period of time. Furthermore, APAC was the largest source of capital into Australian commercial real estate last year, not Europe or Britain.”

Australia’s fortunes are no longer tied to those of the UK, but they are affected by global capital markets and investors. The ASX had its worst day of the year, falling 3.2% after the Brexit vote, with Australian banks hit hard before recovering in the following days.

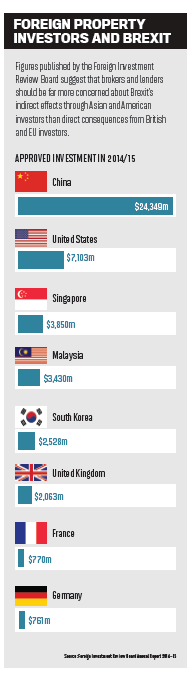

Brexit is expected to set back the US Federal Reserve’s raising of interest rates, and CommSec and many others are predicting the RBA will again cut rates in August, having not done so in July, when the Reserve Bank argued that “any effects of the referendum outcome on global economic activity remain to be seen and, outside the effects on the UK economy itself, may be hard to discern”.

AFG managing director Brett McKeon was one of those predicting a cut, in an article on the impact of Brexit that he published on LinkedIn. The RBA could find itself at odds with the banks, suggested McKeon, as there was a “real possibility for an out of cycle rate rise post the Australian federal election as lenders look to pass on the increased cost of doing business. The RBA may take a waitand- see approach, but if lenders make the first move this may be the catalyst for the RBA to step in”.

In terms of investors, McKeon predicted that new securitisation transactions would struggle – which could make life hard for many non-banks – as investors demand bigger spreads. CBRE expert McNabb expects a ‘waitand- see approach’ from investors as they look for clarity on future investments, adding that investors will also look closely at the results of Australia’s federal election.

Brexit for brokers and their clients

Brexit for brokers and their clients

Global financial turmoil is hitting brokers and clients on the ground. MPA spoke to Home Loan Experts broker Jonathan Preston, who had an Australian client who was hit by the fall in the value of the pound just as they were approaching the settlement of their loan.

“He showed he had plenty of funds and it was actually sitting in an Australian bank account, but in pounds – more than half a million in pounds in there,” Preston explained. “When Brexit happened the pound fell something like 7–10%, and that created a pretty big swing in terms of the realisable balance in Australian dollars … it was nearly a $50,000 move that he saw in that single day.”

Eventually the client managed to plug the gap and satisfy the banks, but it was a shock for both broker and client. Preston had dealt with Aussies buying Australian property with foreign incomes for several years, with increasing demand in recent months, but this experience was a first for him. “Most people do convert their currency prior to getting serious about purchasing. That tends to be the thing. I think he [the client] was feeling comfort based on the pound being a fairly stable currency, and even if it moved a little bit that it wasn’t going to affect him too adversely.”

Preston’s experience of Brexit may not be reflective of all brokers. Australian brokers dealing with EU-based clients buying in Australia are not a large group, and while anecdotally some buyers were frustrated by currency fluctuations, brokers in this space reminded us that dealing with currency fluctuations is a routine occurrence.

To take a long view on the impact of Brexit for Aussies based in the UK and Europe, MPA spoke to Netherlands-based Craig Joslin of The Australian Expat Investor, an author and consultant for Australians looking to invest down under, about the reaction he was seeing in the Aussie expat community.

In common with much of the world, the first reaction was shock, says Joslin. “People didn’t really expect the leave vote to happen, so now there’s a lot of uncertainty with expats in the UK over what it means in the long term.” While Australia’s migration arrangements with the BREXIT UK won’t be directly affected, many Aussies use the UK as a base to access Europe, enjoying a freedom of movement that could be curtailed. Many Australians also work in London’s financial services sector, which is heavily dependent on access to European markets.

Joslin is nevertheless positive about the long term, even if the pound remains poor. “That will have an impact on what people can afford in terms of property, but I don’t think it will turn people off investing in Australia,” he says. “It may even reinforce to people the importance of investing your money back in Australia rather than keeping it in a bank account in the UK.”

Ironically, if and when Aussie expats decide to invest their earnings back into Australia, they’ll need a broker not so much because of the UK economy but because of Australian banks’ policies, says Joslin. “What they’re looking for from a mortgage broker is someone who is knowledgeable about the policies of the different banks, and can direct them to banks that are going to evaluate their circumstances in the best possible way.”

Shooting oneself in the foot

In the months leading up to the Brexit referendum, it appears that the policymakers within Australian banks were not looking at Aussie expats but instead at China, as they oversaw a significant tightening of criteria for non-resident investors. These rules have also affected Australian expat borrowers, explains Home Loan Experts broker Preston.

“Not only has it been tightened by banks but there’s been a significant deviation in policies by the big four and a number of second-tier lenders. They’re not uniform in their policies right now, so there’s a significant need by brokers to set the right bank for the client.”

Most relevantly, the banks are taking their own views on different currencies and restricting lending accordingly, Preston explains. “Some lenders have restrictions now on what currencies they’re accepting, and they’ll take different currencies at different percentages; they’re more trusting of some currencies.”

Nevertheless, as a currency sterling is at present viewed positively by the banks, and Preston doesn’t see that changing. “I think most people will just see this as a blip on the radar; perhaps if we were to see increased volatility over the next six to 12 months that picture might change a little bit, but presently it’s still one of the favoured currencies by the banks as far as I know.”

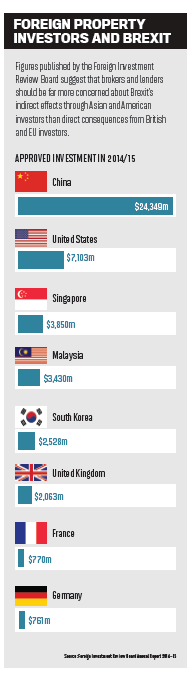

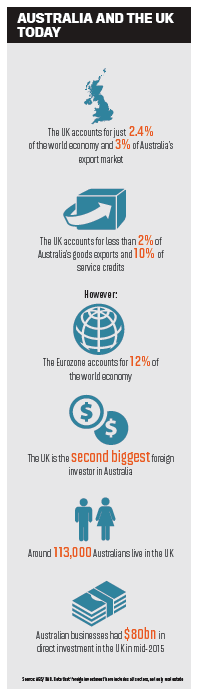

It’s possible that Australia’s banks and state governments, several of which recently raised stamp duty for foreigners, have effectively shot themselves in the foot. Many commentators have predicted that international, and specifically Asian, investors may look to move their money from London real estate to the supposedly more stable environment of Australia. Several property funds in the UK stopped withdrawals in July, with UBS expecting prices for commercial real estate to fall by 20%, and residential prices already showing signs of cooling.

Donald Tang, of Top 10 Independent Brokerage Alliance Mortgage Solutions, believes Brexit has worried Asian investors and “will bring more business opportunity for Australia”. However, the immediate effect of Australian bank criteria, Tang notes, has been that “individual Asian buyers were scared off from the Australian property market. There are signs that lots of ‘purchased’ investors are reselling their properties, and that could lead the property market to slow a bit. Also, the majority of ‘planning’ investors are very conservative these days. I do find lots of real estate agents complaining about this situation”.

The rise of the Australian dollar since Brexit has also made potential investors hold back, Tang adds.

.PNG)

“[Brexit] may even reinforce to people the importance of investing your money back in Australia rather than keeping it in a bank account in the UK”

Gavin Norris, head of Australia for Chinese property investment website Juwai.com, believes it’s “too early to tell” if Brexit will push Asian investors towards Australia, noting that many investors are locked in by long-term commitments, such as a child’s university education. “So far, it seems that most investors from China are confident that the UK remains good long-term value, regardless of market fluctuations caused by Brexit in the shorter term,” he says.

Out of the bottle

What we defi nitely know about Brexit is that this is not only a news event but a long-term shift. There is only one precedent for a country voting to leave the EU, noted S&P chief Kraemer: Greenland, in 1985, a process which took three years despite the only contentious issue being fi shery rights. “What you have now is much more complex,” lamented Kraemer. He said it was possible negotiations could take a lot longer or even that “after two years the UK just crashes out of the EU, if the negotiations aren’t handled very carefully”.

This does not mean that the outlook for Australia is negative. As CBRE’s McNabb argues, Australia’s economy is supported by sound fundamentals: “The current situation with Brexit is not necessarily any more challenging than these earlier ‘shocks’, which have been accompanied, for the most part, by rising offshore capital infl ows to Australia.”

What it does mean is that pre-Brexit outlooks are now out of date, and these outlooks matter to brokers, whether you’re talking about RBA policy, bank securitisation or foreign investors. Given time, Brexit will change finance irrevocably, and that process has already started; as Kraemer characterised it, “the genie” is now out of the bottle, and “it’s quite unclear how to put the genie back in”.

Brexit was almost immediately framed as a financial disaster, and the initial effects read like a ticker tape of woe: the pound dropping to a 30-year low, the UK losing the prized AAA rating it had held since the 1970s, and over US$3trn wiped from stock markets in the two days of trading following the Brexit vote, easily surpassing the GFC to rank as the worst day of global trading ever.

A webinar, held by ratings agency Standard & Poor’s to discuss its downgrading of the UK, summed up the mood of bewilderment. Moritz Kraemer, global chief ratings officer, sovereign ratings, was asked about the benefits of Brexit.

“I don’t think I can see any obvious benefits here,” Kraemer responded, “beyond lawyers and duty-free shops.”

What about brokers? The speculation has already begun on Brexit’s consequences for Australian property; and as MPA has found, its consequences for brokers are more complicated but no less important.

Brexit for lenders and the economy

For a start, Brexit is a long-term phenomenon. The reaction of the market to Brexit was astonishing, but the market is fickle: indeed, by the Wednesday after the vote the UK’s FTSE 100 stock index had fully recovered its value. Moreover, Brexit is officially yet to happen: the UK first has to trigger Article 50, which begins a two-year countdown to Britain leaving the EU, and Britain’s new Prime Minister, Theresa May, has said she will not activate Article 50 before the end of 2016. Therefore Brexit, a second Scottish referendum, an EU-wide recession and any spin-off effects are all possibilities but none have actually materialised thus far.

“There’s a real possibility for an out of cycle rate rise post the Australian federal election as lenders look to pass on the increased cost of doing business”

Brett McKeon, AFG

Closer to home, it’s important not to overstate the UK’s economic links to Australia. S&P was not adjusting its forecasts for Asia as a consequence of Brexit, its director and chief economist Asia-Pacific Paul Gruenwald told the webinar, noting that “the direct trade links with the UK are minor across the region”.

Closer to home, it’s important not to overstate the UK’s economic links to Australia. S&P was not adjusting its forecasts for Asia as a consequence of Brexit, its director and chief economist Asia-Pacific Paul Gruenwald told the webinar, noting that “the direct trade links with the UK are minor across the region”.In fact, the whole of the EU takes less than 5% of Australia’s exports, and the UK doesn’t have the impact on tourism or migration it once did, explains CBRE’s Australian head of research, Stephen McNabb. “Asia/China has replaced Europe as a major source for migration, tourism and trade over an extended period of time. Furthermore, APAC was the largest source of capital into Australian commercial real estate last year, not Europe or Britain.”

Australia’s fortunes are no longer tied to those of the UK, but they are affected by global capital markets and investors. The ASX had its worst day of the year, falling 3.2% after the Brexit vote, with Australian banks hit hard before recovering in the following days.

Brexit is expected to set back the US Federal Reserve’s raising of interest rates, and CommSec and many others are predicting the RBA will again cut rates in August, having not done so in July, when the Reserve Bank argued that “any effects of the referendum outcome on global economic activity remain to be seen and, outside the effects on the UK economy itself, may be hard to discern”.

AFG managing director Brett McKeon was one of those predicting a cut, in an article on the impact of Brexit that he published on LinkedIn. The RBA could find itself at odds with the banks, suggested McKeon, as there was a “real possibility for an out of cycle rate rise post the Australian federal election as lenders look to pass on the increased cost of doing business. The RBA may take a waitand- see approach, but if lenders make the first move this may be the catalyst for the RBA to step in”.

In terms of investors, McKeon predicted that new securitisation transactions would struggle – which could make life hard for many non-banks – as investors demand bigger spreads. CBRE expert McNabb expects a ‘waitand- see approach’ from investors as they look for clarity on future investments, adding that investors will also look closely at the results of Australia’s federal election.

Brexit for brokers and their clients

Brexit for brokers and their clientsGlobal financial turmoil is hitting brokers and clients on the ground. MPA spoke to Home Loan Experts broker Jonathan Preston, who had an Australian client who was hit by the fall in the value of the pound just as they were approaching the settlement of their loan.

“He showed he had plenty of funds and it was actually sitting in an Australian bank account, but in pounds – more than half a million in pounds in there,” Preston explained. “When Brexit happened the pound fell something like 7–10%, and that created a pretty big swing in terms of the realisable balance in Australian dollars … it was nearly a $50,000 move that he saw in that single day.”

Eventually the client managed to plug the gap and satisfy the banks, but it was a shock for both broker and client. Preston had dealt with Aussies buying Australian property with foreign incomes for several years, with increasing demand in recent months, but this experience was a first for him. “Most people do convert their currency prior to getting serious about purchasing. That tends to be the thing. I think he [the client] was feeling comfort based on the pound being a fairly stable currency, and even if it moved a little bit that it wasn’t going to affect him too adversely.”

Preston’s experience of Brexit may not be reflective of all brokers. Australian brokers dealing with EU-based clients buying in Australia are not a large group, and while anecdotally some buyers were frustrated by currency fluctuations, brokers in this space reminded us that dealing with currency fluctuations is a routine occurrence.

To take a long view on the impact of Brexit for Aussies based in the UK and Europe, MPA spoke to Netherlands-based Craig Joslin of The Australian Expat Investor, an author and consultant for Australians looking to invest down under, about the reaction he was seeing in the Aussie expat community.

In common with much of the world, the first reaction was shock, says Joslin. “People didn’t really expect the leave vote to happen, so now there’s a lot of uncertainty with expats in the UK over what it means in the long term.” While Australia’s migration arrangements with the BREXIT UK won’t be directly affected, many Aussies use the UK as a base to access Europe, enjoying a freedom of movement that could be curtailed. Many Australians also work in London’s financial services sector, which is heavily dependent on access to European markets.

Joslin is nevertheless positive about the long term, even if the pound remains poor. “That will have an impact on what people can afford in terms of property, but I don’t think it will turn people off investing in Australia,” he says. “It may even reinforce to people the importance of investing your money back in Australia rather than keeping it in a bank account in the UK.”

Ironically, if and when Aussie expats decide to invest their earnings back into Australia, they’ll need a broker not so much because of the UK economy but because of Australian banks’ policies, says Joslin. “What they’re looking for from a mortgage broker is someone who is knowledgeable about the policies of the different banks, and can direct them to banks that are going to evaluate their circumstances in the best possible way.”

Shooting oneself in the foot

In the months leading up to the Brexit referendum, it appears that the policymakers within Australian banks were not looking at Aussie expats but instead at China, as they oversaw a significant tightening of criteria for non-resident investors. These rules have also affected Australian expat borrowers, explains Home Loan Experts broker Preston.

“Not only has it been tightened by banks but there’s been a significant deviation in policies by the big four and a number of second-tier lenders. They’re not uniform in their policies right now, so there’s a significant need by brokers to set the right bank for the client.”

Most relevantly, the banks are taking their own views on different currencies and restricting lending accordingly, Preston explains. “Some lenders have restrictions now on what currencies they’re accepting, and they’ll take different currencies at different percentages; they’re more trusting of some currencies.”

Nevertheless, as a currency sterling is at present viewed positively by the banks, and Preston doesn’t see that changing. “I think most people will just see this as a blip on the radar; perhaps if we were to see increased volatility over the next six to 12 months that picture might change a little bit, but presently it’s still one of the favoured currencies by the banks as far as I know.”

It’s possible that Australia’s banks and state governments, several of which recently raised stamp duty for foreigners, have effectively shot themselves in the foot. Many commentators have predicted that international, and specifically Asian, investors may look to move their money from London real estate to the supposedly more stable environment of Australia. Several property funds in the UK stopped withdrawals in July, with UBS expecting prices for commercial real estate to fall by 20%, and residential prices already showing signs of cooling.

Donald Tang, of Top 10 Independent Brokerage Alliance Mortgage Solutions, believes Brexit has worried Asian investors and “will bring more business opportunity for Australia”. However, the immediate effect of Australian bank criteria, Tang notes, has been that “individual Asian buyers were scared off from the Australian property market. There are signs that lots of ‘purchased’ investors are reselling their properties, and that could lead the property market to slow a bit. Also, the majority of ‘planning’ investors are very conservative these days. I do find lots of real estate agents complaining about this situation”.

The rise of the Australian dollar since Brexit has also made potential investors hold back, Tang adds.

.PNG)

“[Brexit] may even reinforce to people the importance of investing your money back in Australia rather than keeping it in a bank account in the UK”

Craig Joslin, The Australian Expat Investor

Gavin Norris, head of Australia for Chinese property investment website Juwai.com, believes it’s “too early to tell” if Brexit will push Asian investors towards Australia, noting that many investors are locked in by long-term commitments, such as a child’s university education. “So far, it seems that most investors from China are confident that the UK remains good long-term value, regardless of market fluctuations caused by Brexit in the shorter term,” he says.

Out of the bottle

What we defi nitely know about Brexit is that this is not only a news event but a long-term shift. There is only one precedent for a country voting to leave the EU, noted S&P chief Kraemer: Greenland, in 1985, a process which took three years despite the only contentious issue being fi shery rights. “What you have now is much more complex,” lamented Kraemer. He said it was possible negotiations could take a lot longer or even that “after two years the UK just crashes out of the EU, if the negotiations aren’t handled very carefully”.

This does not mean that the outlook for Australia is negative. As CBRE’s McNabb argues, Australia’s economy is supported by sound fundamentals: “The current situation with Brexit is not necessarily any more challenging than these earlier ‘shocks’, which have been accompanied, for the most part, by rising offshore capital infl ows to Australia.”

What it does mean is that pre-Brexit outlooks are now out of date, and these outlooks matter to brokers, whether you’re talking about RBA policy, bank securitisation or foreign investors. Given time, Brexit will change finance irrevocably, and that process has already started; as Kraemer characterised it, “the genie” is now out of the bottle, and “it’s quite unclear how to put the genie back in”.