MPA's Consumer on Brokers report is out and we take a look at who is seeking out a broker and how they choose.

In 2016, we all work in the interests of the consumer. Or at least that’s the message put out by regulators, bankers and most of all brokers, whose value proposition rests on putting the consumer first. Unfortunately, there’s been relatively little independent research into what the interests of the consumer actually are when it comes to the broker channel, which is why we’ve run our Consumers on Brokers report for a second year.

Consumers on Brokers is about getting real consumer opinions, good and bad, to the people who really need them – brokers. Our survey ran for five weeks on Key Media’s consumer-facing yourmortgage.com.au comparison website, and on the website of Your Investment Property magazine. These databases are closely monitored. Furthermore, we made sure all our respondents had actually used a broker – this survey is about real experiences, not just perceptions.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

As for the headline results, there are quite a few. On the plus side, our respondents were accepting of commission structures, but also relatively open to fee-for-service arrangements. However, they were highly critical of brokers’ after-sales service, with two in five never having been contacted by their broker since settling the loan, even about the out-of-cycle rate rises in 2015.

When it comes to consumer trust, all these issues are linked. Many respondents were critical of ongoing trail commission, because they didn’t receive ongoing support, for example. We recommend you therefore read this entire report, and we hope the findings can help you make the right changes and investments in your business.

WHO USES A BROKER?

To get the most out of this report, it’s important to understand our respondents and this survey.

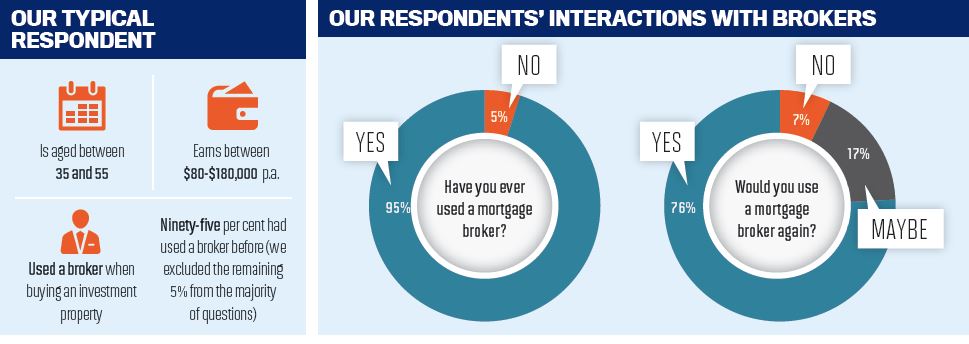

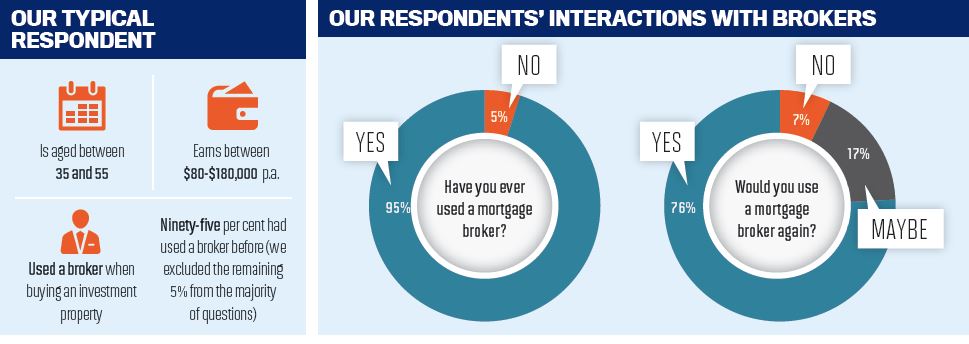

Before going through the results of this survey, it’s essential to understand who we surveyed. The fi rst point to note here is that this survey is not representative of the entire Australian public. Our typical respondent – the characteristics of which you’ll see in the box below – is far more likely to use a broker than the average Australian.

Both facts are connected with how we marketed this survey – to the readers of Your Investment Property magazine and visitors to the yourmortgage.com.au website. We made it obvious in our marketing that this survey was about respondents’ experience with brokers. Additionally, we asked respondents whether they’d previously used a broker and excluded those who hadn’t from most questions. We did this to ensure this survey was based on real experience and not simply perceptions or assumptions.

We do believe this survey is representative of customers that use brokers, dominated by investors (49%) but with pockets of first time buyers (20%), upgraders (13%) and refinancers (the vast majority of the 18% of replies to ‘other’). In terms of income distribution, 83% of our respondents earn between $37,000-$180,000 p.a., covering the average Australian wage with a slight weighting towards the relatively wealthy. Geographically, our respondent share by state very closely mirrors the most recent figure from the Australian Bureau of Statistics, with NSW, VIC, and QLD making up 75% of respondents. This survey was marketed nationally.

Comparing between surveys is always fraught with difficulties. We ran this survey in 2015 (see MPA 15.06, which you can find on mpamagazine.com.au), using the same marketing approach, and the characteristics of respondents from both years are relatively similar. Whilst we can’t be sure, we suspect a number of respondents completed both surveys, so we therefore feel it’s acceptable to compare between years. If comparing our survey to those by banks, the MFAA or others, bear in mind ours is biased towards Australians who have actually used a broker.

Finally, there remains the question of whether our survey is positively or negatively biased regarding brokers. The language we used in our marketing was neutral, and we used a prize to incentivise potential respondents so it wasn’t only extremely positive or negative people who took the survey. The fact that our respondents are positive about brokers – 76% of our respondents would use a broker again; only 7% wouldn’t – should therefore be seen as an effect of brokers’ hard work.

CHOOSING A BROKER

Consumers want your help more than a sharp rate, and they’ll find you with a little help from their friends

For the second year running, consumers have named ‘help with the application’ as their top reason for using a broker. Forty per cent of respondents picked this option, with large minorities picking ‘access to specialist lenders’ (27%) and ‘lowest interest rate’ (25%) – all similar shares to last year, and similar across all income categories.

The survey’s core message to brokers therefore remains the same – primarily market the assistance you provide, whilst paying attention to other factors. Before you initiate any marketing, however, consider another finding of this year’s survey – 49% of respondents ended up using the very first broker they talked to.

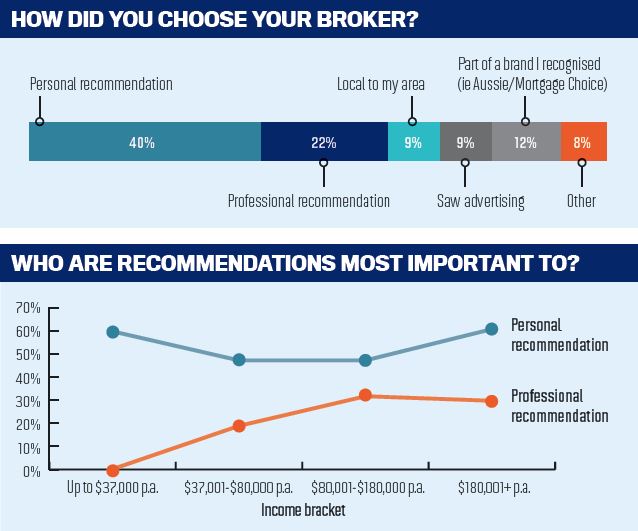

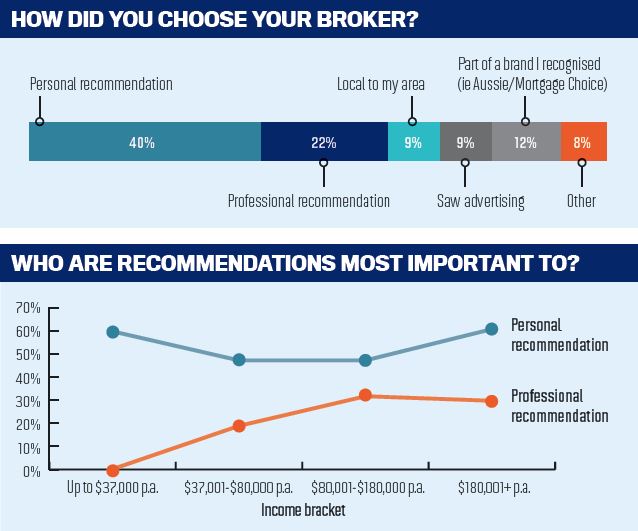

Is marketing therefore pointless? Many leading brokers tell us they rely only on referral and repeat business, and our survey gives some clues as to why. Personal recommendations are enormously important when selecting a broker, with 40% of consumers using them to choose their broker, followed by 22% using professional recommendations. Furthermore, personal recommendations are particularly important to ultra-high net worth clients (those earning $180,000+ p.a.) and professional recommendations were disproportionately important to those earning $80-180,000 p.a. and $180,000+ p.a.

Our survey suggests that being a local is not enough to attract clients, although 20% of lower net worth clients ($37,000 p.a. or below) did see this as important. Advertising and recognisable branding also don’t play much of a role, although it’s important to note that many respondents selected a combination of options – having a strong brand and local presence can certainly add to the prestige of a recommendation.

Whether you market yourself, or your clients come to you, it’s important to remember that clients may be after more than just a mortgage. We asked clients what other services they’d consider getting from a mortgage broker (other than mortgages) and only 16% answered ‘none’, while 84% of clients are open to getting other services. We saw a fairly even split of respondents between loans for business, vehicle loans, insurance and financial planning, with many clients selecting multiple options. These findings certainly add weight to the argument in favour of brokerages diversifying beyond mortgages.

Consumers on Brokers is about getting real consumer opinions, good and bad, to the people who really need them – brokers. Our survey ran for five weeks on Key Media’s consumer-facing yourmortgage.com.au comparison website, and on the website of Your Investment Property magazine. These databases are closely monitored. Furthermore, we made sure all our respondents had actually used a broker – this survey is about real experiences, not just perceptions.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

As for the headline results, there are quite a few. On the plus side, our respondents were accepting of commission structures, but also relatively open to fee-for-service arrangements. However, they were highly critical of brokers’ after-sales service, with two in five never having been contacted by their broker since settling the loan, even about the out-of-cycle rate rises in 2015.

When it comes to consumer trust, all these issues are linked. Many respondents were critical of ongoing trail commission, because they didn’t receive ongoing support, for example. We recommend you therefore read this entire report, and we hope the findings can help you make the right changes and investments in your business.

A MESSAGE FROM OUR SPONSOR

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank

WHO USES A BROKER?

To get the most out of this report, it’s important to understand our respondents and this survey.

Before going through the results of this survey, it’s essential to understand who we surveyed. The fi rst point to note here is that this survey is not representative of the entire Australian public. Our typical respondent – the characteristics of which you’ll see in the box below – is far more likely to use a broker than the average Australian.

Both facts are connected with how we marketed this survey – to the readers of Your Investment Property magazine and visitors to the yourmortgage.com.au website. We made it obvious in our marketing that this survey was about respondents’ experience with brokers. Additionally, we asked respondents whether they’d previously used a broker and excluded those who hadn’t from most questions. We did this to ensure this survey was based on real experience and not simply perceptions or assumptions.

We do believe this survey is representative of customers that use brokers, dominated by investors (49%) but with pockets of first time buyers (20%), upgraders (13%) and refinancers (the vast majority of the 18% of replies to ‘other’). In terms of income distribution, 83% of our respondents earn between $37,000-$180,000 p.a., covering the average Australian wage with a slight weighting towards the relatively wealthy. Geographically, our respondent share by state very closely mirrors the most recent figure from the Australian Bureau of Statistics, with NSW, VIC, and QLD making up 75% of respondents. This survey was marketed nationally.

Comparing between surveys is always fraught with difficulties. We ran this survey in 2015 (see MPA 15.06, which you can find on mpamagazine.com.au), using the same marketing approach, and the characteristics of respondents from both years are relatively similar. Whilst we can’t be sure, we suspect a number of respondents completed both surveys, so we therefore feel it’s acceptable to compare between years. If comparing our survey to those by banks, the MFAA or others, bear in mind ours is biased towards Australians who have actually used a broker.

Finally, there remains the question of whether our survey is positively or negatively biased regarding brokers. The language we used in our marketing was neutral, and we used a prize to incentivise potential respondents so it wasn’t only extremely positive or negative people who took the survey. The fact that our respondents are positive about brokers – 76% of our respondents would use a broker again; only 7% wouldn’t – should therefore be seen as an effect of brokers’ hard work.

CHOOSING A BROKER

Consumers want your help more than a sharp rate, and they’ll find you with a little help from their friends

For the second year running, consumers have named ‘help with the application’ as their top reason for using a broker. Forty per cent of respondents picked this option, with large minorities picking ‘access to specialist lenders’ (27%) and ‘lowest interest rate’ (25%) – all similar shares to last year, and similar across all income categories.

The survey’s core message to brokers therefore remains the same – primarily market the assistance you provide, whilst paying attention to other factors. Before you initiate any marketing, however, consider another finding of this year’s survey – 49% of respondents ended up using the very first broker they talked to.

Is marketing therefore pointless? Many leading brokers tell us they rely only on referral and repeat business, and our survey gives some clues as to why. Personal recommendations are enormously important when selecting a broker, with 40% of consumers using them to choose their broker, followed by 22% using professional recommendations. Furthermore, personal recommendations are particularly important to ultra-high net worth clients (those earning $180,000+ p.a.) and professional recommendations were disproportionately important to those earning $80-180,000 p.a. and $180,000+ p.a.

Our survey suggests that being a local is not enough to attract clients, although 20% of lower net worth clients ($37,000 p.a. or below) did see this as important. Advertising and recognisable branding also don’t play much of a role, although it’s important to note that many respondents selected a combination of options – having a strong brand and local presence can certainly add to the prestige of a recommendation.

Whether you market yourself, or your clients come to you, it’s important to remember that clients may be after more than just a mortgage. We asked clients what other services they’d consider getting from a mortgage broker (other than mortgages) and only 16% answered ‘none’, while 84% of clients are open to getting other services. We saw a fairly even split of respondents between loans for business, vehicle loans, insurance and financial planning, with many clients selecting multiple options. These findings certainly add weight to the argument in favour of brokerages diversifying beyond mortgages.