Brokers are unlikely to change aggregators, but those that do share many similar characteristics.

Brokers are unlikely to change aggregators, but those that do share many similar characteristics, our recent Brokers on Aggregators survey revealed.

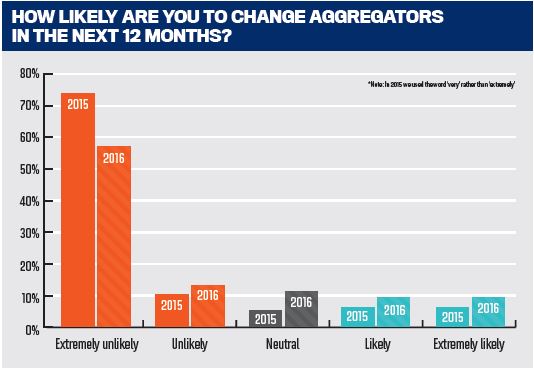

Put simply, our survey’s main message when it comes to brokers leaving their aggregators is that it’s still relatively rare. While the proportion considering leaving may have increased since 2015, we’re still talking about fewer than one in fi ve brokers; furthermore, we don’t know whether these brokers have actually changed aggregators. Frustratingly, this result tells us nothing about the remaining four out of five brokers and whether they think their aggregator is doing something right, or believe it’s simply too difficult to move.

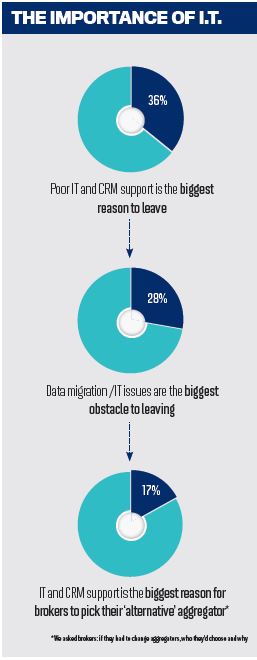

It comes as no surprise that most brokers are pushed to leave their aggregators because their current aggregators are failing them, most notably when it comes to IT and CRM support. One Choice broker complained that they “constantly experience IT issues with Choice to the point where I am unable to lodge applications for several days due to platform issues. This severely affects my business”.

Poor BDMs, commission payments and, interestingly, poor lead generation were other reasons to leave – the latter presumably being driven by beginner brokers for whom lead generation is a more pressing need.

There is a difference of course between an IT system actually failing and an IT system that simply looks worse than a newer, better system being introduced by a competitor. In many cases brokers complained about this relative failure of their systems. One Connective broker recalled that they had “changed to Connective 2 years ago in search of a better IT platform and compliance support. I am much more organized now and am making more money”.

Raising brokers’ expectations when it comes to IT and other systems can backfi re, however: one AFG broker complained that their aggregator’s SMART marketing system was too expensive for them as they had a small loan book.

Given the importance of IT, it’s no surprise that newer aggregators such as My Local Broker are promoting their technological know-how to brokers. To actually get members through the door, however, they will have to make it easier to switch systems, as data migration/IT issues are the biggest deterrent to brokers switching aggregators, bigger even than contractual obligations.

Brokers simply cannot afford to spend time away from their businesses, particularly brokers setting up their own firms. As one AFG member explained, “I made the decision to start my own company with AFG. AFG made the process as smooth as possible and I was up and running VERY quickly”. In this case it was a BDM – not advanced technology – which made the move easy, a reminder that technology can’t always be separated from other areas of service.

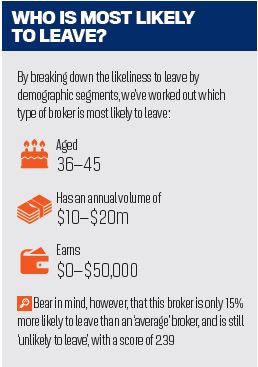

By breaking down likeliness to leave by volume, age and income statistics, we were able to produce a profile of the broker most likely to leave their aggregator (see box below).

By breaking down likeliness to leave by volume, age and income statistics, we were able to produce a profile of the broker most likely to leave their aggregator (see box below).

When you combine this with the brokers’ comments, these numbers start to make more sense. These brokers are writing decent volumes and are no longer beginners, but are not yet seeing the financial returns for the work, often because of a poor commission split; essentially they have outgrown their aggregators.

“We have our own proven systems in place and continue to explore outside options as current marketing material and processes are very limited with [our] aggregator” Plan broker

Correspondingly, national franchises came in for particularly harsh criticism in our survey: one YBR broker complained that the “remuneration model [is] unsustainable with minimum KPIs & disproportionate commission split”. It’s important to note that this survey is not about franchises; we use these comments to explain why brokers move from a branded to a more traditional aggregator model.

What’s most evident about brokers that leave is that the problems they face are quite severe: IT systems that don’t work; commission splits that prevent them from building a business; incompetent BDMs. It’s much easier for aggregators to fix these obvious problems than it is for them to be the

‘best’ in every single category – which means it’s entirely possible to reduce their outgoing broker numbers to close to zero.