Platform Plus model provides strong support for brokers

Starting out as a mortgage broker is no easy journey, and the learning curve is steep. New brokers need to build a client base from scratch, navigate complex industry regulations, and establish trust and credibility in a competitive market.

Then as brokers progress in their careers, this brings the challenge of scaling a business and managing an increasing workload efficiently. In this environment, it is vital to ensure that brokers from all backgrounds and experience levels can thrive.

This has been a key area of focus for Lendi Group and its subsidiary Aussie Home Loans, which has rolled out its Platform Plus support model to help solve common challenges faced by brokers at all career levels.

The value of mentorship

Siobhan Bryson (pictured above right), a relatively new broker who joined Aussie in South Australia in 2022, says belonging to a large broker network has been invaluable. By tapping into the support offered by Platform Plus, Bryson was able to settle over $30 million in business in her first year as a broker. Today, her momentum is unstoppable, and she appeared on MPA’s Rising Stars list in 2024.

Speaking to MPA, Bryson says she didn’t have any finance industry experience when she joined Aussie, and instead applied skills from her 14-year career in sales. As a result, the mentorship she received from more experienced brokers was crucial to propelling her career forward.

“Being able to workshop scenarios with experienced brokers and leverage their experience is so helpful,” Bryson says. “I’ve also accessed all of the learning and development opportunities provided by Aussie, as well as events and resources offered by the MFAA.”

Bryson notes that the need for strong financial advice has never been higher, and so now is a critical time to provide a boost to new brokers.

“In today’s complex property landscape and amidst various challenges like high interest rates and cost of living pressures, customers are looking to brokers more than ever for their support,” she says.

“Helping early-career brokers find their way is incredibly important, as it ensures a pipeline of skilled professionals establishing themselves in the industry so that customers can continue to have access to guidance and expertise.”

This sentiment is echoed by Samer Demerdash, an established broker with seven years of experience under his belt. Demerdash has been with Aussie since 2017 and has established himself in the top 2% of performers in the network.

However, he hasn’t stopped there. Demerdash scaled his business up significantly in FY24 and has seen a 30% rise in settlements as a result.

Demerdash says constant learning, and leaning on his extensive professional networks, has been vital to his success. “In the early days, this included activities like trade shows and community activations, where I was able to connect with locals in the area and establish relationships,” he tells MPA.

“I also leveraged my own personal networks as best as possible and shared information about my new business with friends and contacts, which helped land me a few clients.”

Demerdash notes that since day one he has strived to provide his customers with an exceptional experience – and as the years have progressed, referrals have become his biggest contributor of leads. He also works closely with a select group of real estate agents, solicitors, accountants and buyers’ agents who direct customers his way.

“I really love being a broker, and Aussie’s centralised support allows me to direct more time and attention to engaging with customers,” he says. “This translates to positive interactions with customers, who then feel more comfortable to commit to the transaction quickly.”

Supporting success through technology

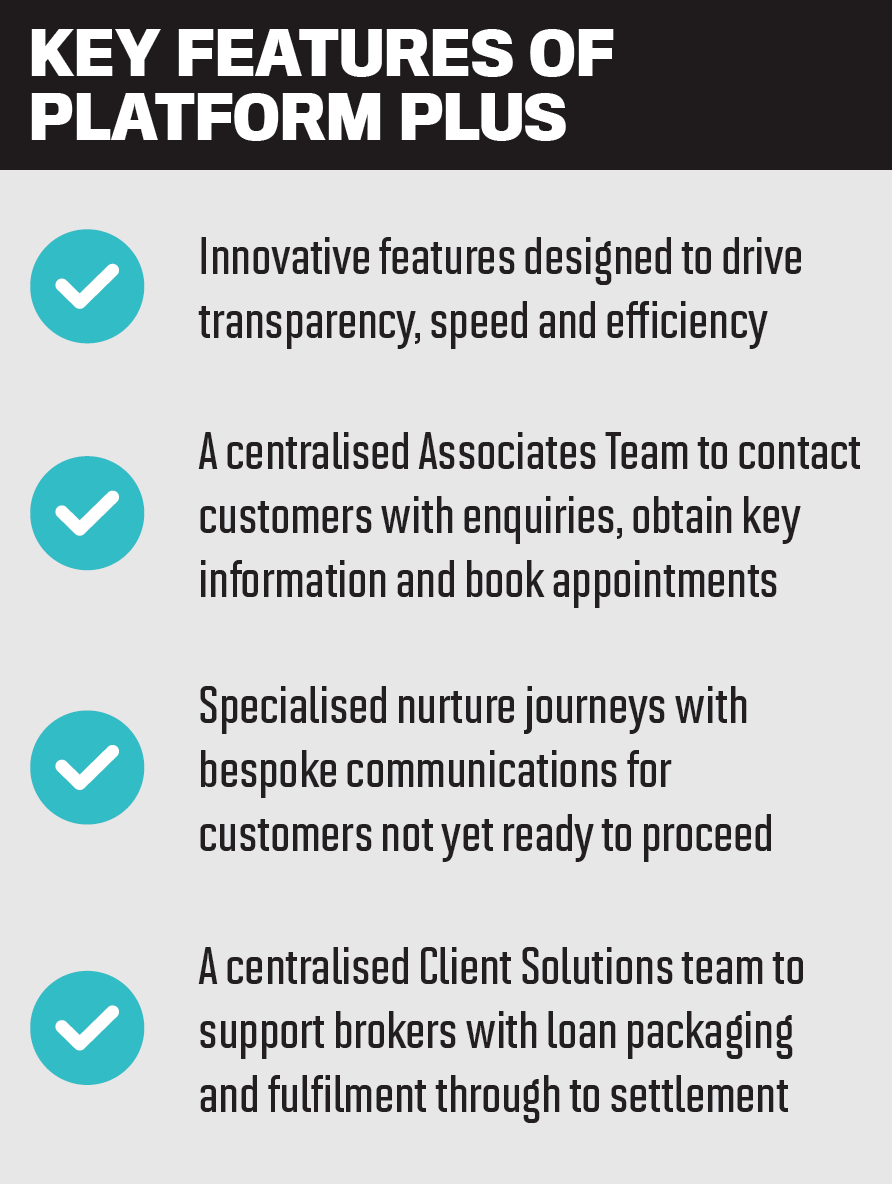

Lendi Group has no shortage of success stories, and its Platform Plus support model has been central to this. The model addresses common challenges brokers face and focuses on automating the ‘mundane’ to allow them to focus on the heart of their business – client relationships.

Lendi Group has no shortage of success stories, and its Platform Plus support model has been central to this. The model addresses common challenges brokers face and focuses on automating the ‘mundane’ to allow them to focus on the heart of their business – client relationships.

Aaron Hockey (pictured above left), general manager, network development at Lendi Group, points out that the average loan takes over 20 hours of broker time to process. For ‘one-man band’ operators, this cuts significantly into the time they could be spending on actively strengthening client relationships, working on their business and generating leads. With the power of automation, this is exactly what Platform Plus aims to change.

“Our brokers are achieving lodgement speeds in excess of four times the industry average,” Hockey tells MPA.

“We have multiple teams of brokers in our business already lodging a deal a day, and we believe Platform Plus is the vehicle that will help brokers across all our channels to reach this milestone. This added capacity can be directed towards doing what they do best – interacting with customers and driving revenue into their businesses.”

Hockey emphasises that the platform is there for all brokers to lean on, regardless of their career stage Everyone from new to experienced brokers can achieve impressive results, which has already been demonstrated brilliantly by the success of Demerdash and Bryson.

“We’re committed to supporting our brokers in all phases of their career, and the two brokers featured in this story are just two of many brokers in our network at different career stages who are still experiencing significant growth,” Hockey says.

Setting new targets

For Lendi Group’s brokers, there is no limit to the level of success they can achieve. Demerdash settled $98 million in FY23 and increased this figure to $127 million in FY24. He notes that this increase was largely due to the Platform Plus-generated appointments with customers who he wouldn’t otherwise have interacted with, which is a fantastic result.

For Lendi Group’s brokers, there is no limit to the level of success they can achieve. Demerdash settled $98 million in FY23 and increased this figure to $127 million in FY24. He notes that this increase was largely due to the Platform Plus-generated appointments with customers who he wouldn’t otherwise have interacted with, which is a fantastic result.

Commenting on his goals for 2025, he says he has no plans to slow down. “The only way is up! The goal is to exceed the $127 million of FY24. This year, I plan to continue leaning into the Platform Plus support model, leveraging the services available to me and continuing to drive exceptional outcomes for my customers so I can generate more referrals and ultimately carry on growing my business.”

As a new business owner, Bryson plans to use every tool that Lendi Group has available to boost her growth – from its mobile app and automation tools to its many networking opportunities. She notes that the Aussie mobile app has been a particularly useful touchpoint with customers, as it gives them key insights on property values and rental yields, and a view of their equity position.

“I’ve been using the app as a tool to keep clients engaged and sustain long-term relationships, and I’m currently topping the leaderboard in the Aussie mobile channel for the broker who has generated the most customer app downloads,” Bryson says.

“With the Platform Plus model, I’m able to focus the bulk of my efforts toward building meaningful relationships with my customers, which is incredibly important, especially as a new business owner, as building strong relationships will help in generating referrals and growing my business.”

For brokers who are new to the industry, Bryson’s advice is simple – be patient but persistent. If you consistently invest time in building strong relationships with your clients and leveraging the expertise of your fellow brokers, you’ll be well on your way to reaching your goals.

“Welcoming new talent into the industry encourages innovation and fresh perspectives,” she concludes.

“Equipping this talent with the support and tools they need to succeed helps to maintain high standards of service and professional integrity, ensuring that the industry can deliver on the expectations and best interests of customers.”