Non-banks drive competition in the sector, says S&P Global Ratings

The future looks bright for mortgage brokers operating in the SMSF lending space, with credit ratings firm S&P Global Ratings’ latest report showing growth in the sector when it comes to residential mortgage backed securities transactions.

The report, Australian RMBS and the Growing SMSF Factor, shows that more non-bank lenders are originating SMSF loans to diversify their credit offerings, increasing competition in this niche sector.

It also found that SMSF loan performance has been solid to date, with low levels of arrears and losses.

“Interest in SMSF loans will likely continue to grow,” the report stated. “But SMSF loans are nuanced products and not without risks – some of which are harder to mitigate.”

S&P Global Ratings held a webinar on Wednesday to discuss SMSF loans, which featured directors of structured finance Erin Kitson (pictured above left) and Alisha Treacy and managing director structured finance Narelle Coneybeare (pictured above right).

SMSF characteristics

Kitson said the SMSF sector made up about a quarter of Australia’s $3.9 trillion superannuation assets.

SMSFs are regulated by the ATO, unlike industry, retail, public sector and corporate super funds, which are regulated by APRA.

“SMSFs are set up and run by individuals who are the members and often also the trustees to manage personal retirement savings,” Kitson said.

“All members of an SMSF – the members, trustees or in the case of corporate trustees, directors of the corporate trustees, are personally responsible for managing the fund’s investments, in addition to complying with all associated laws and regulations.”

SMSFs that don’t comply with these laws can attract significant penalties from the ATO. In industry and other super funds the compliance risk is borne by professionally licensed trustees.

Kitson said ATO data on SMSFs showed that most SMSFs had two members (typically a couple), who were older, with two-thirds of members older than 55, and about 10% aged between 35 and 44.

The average assets per SMSF member are $780,254 and the average assets per SMSF are A$1,450,642 as of the 2021-2022 financial year.

The total number of SMSFs has grown from less than 560,000 in June 2018 to 600,000 in June 2023.

Kitson said SMSFs were popular due to the flexibility and autonomy they offered their members to directly manage personal retirement savings.

“SMSFs also enable couples to combine their super into a single fund which can have tax advantages and unlike APRA regulated super funds SMSFs can directly invest in residential and commercial properties,” she said.

“So what this enables members to do, particularly self- employed members, is to purchase a commercial property, for example, for their business premises, and they're able to do that tax effectively through an SMSF.”

Banks and brokers

It’s clear that major and second-tier banks exited the SMSF lending sector a few years ago and a growing number of non-bank lenders are moving into this space, with Pepper Money and RedZed announcing their entry into the SMSF loans market recently.

MPA asked S&P Global whether the growing number of SMSFs and increase in SMSF lending would see the banks return to the sector.

“We don’t expect the major banks to re-enter this segment in the near term,” Coneybeare said.

“Higher capital requirements and more complex and nuanced underwriting requirements were why the banks exited this space and believe that those factors would still be the case.”

Coneybeare acknowledged the growing interest in SMSF lending from brokers.

“With the increased number of lenders offering SMSF lending, and as well as demographic shifts it follows that this type of product may be something that more mortgage brokers have in their suite of products for borrowers.

“As there are specific requirements and complexities associated with SMSF lending we expect that this will remain a more specialised area of lending activity.”

Matt Spears, the managing director of Sydney brokerage Evoke Capital, said his business had seen an uptick in SMSF loan inquiries in the last 12 months.

Spears said this was purely driven by the higher interest rate environment, with borrowing capacity dropping about 40% due to the rate rises.

“Investors still want to invest and they believe that there's opportunity in the market. Self-managed super fund lending is a great way to add potentially a property or two to your portfolio because that assessment sits outside the traditional bank serviceability for a home loan or an investment loan,” said Spears.

Treacy said more non-banks had entered the SMSF space recently.

“We think this is to diversify their loan portfolios away from the prime borrowers,” Tracey said. “We are hearing from non-banks that it is getting harder to compete with the banks in the private space.”

She said exposures to SMSF loans included in the RMBs portfolios had been increasing and now made up about 5% of total loans in S&P Global-rated RMBs.

“We have seen some changes in lenders credit policies over time for SMSF loans. For example, we're starting to see some increases in maximum LTV ratios and loan amounts.”

Some lenders had also recently lowered their interest rate buffers in their serviceability calculation for SMSF loans.

Treacy said increased competition in the space had resulted in margin compression over the past few years.

SMSF lending

Treacy explained that SMSF loans allowed fund members to leverage their SMSF to buy an investment property, either residential or commercial but they could only be purchased in limited circumstances, including a limited recourse borrowing arrangement (LBRA) under certain conditions.

Some of the conditions include:

- Rental income, or capital gains from a property are to be reinvested and only accessed at retirement

- Residential properties can only be purchased for investment purposes and rented out at market rates

- SMSF members cannot live in the property or use it as a holiday home

- SMSF members can purchase commercial properties to use as their business premises. This must be done at market rates

Treacy said SMSF loan structures were a bit more complicated than a standard home loan.

“Typically an SMSF trustees the borrower under the SMSF loan and the property is held in a separate trust or a bear trust,” she said

“The trustee of this bear trust holds security property on trust for the SMSF trustee. The lender’s only recourse legally is to the property itself.”

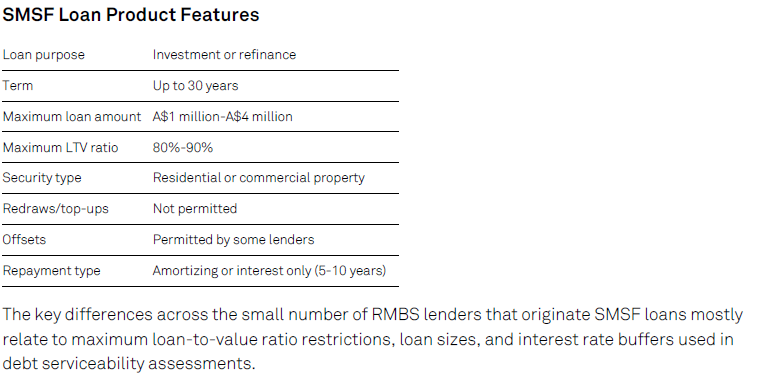

Treacy highlighted some key characteristics of an SMSF loan (see below), including the purpose being investment or refinance, first registered mortgage over residential or commercial properties, and a maximum loan term of 30 years. Redraws were not permitted but offsets were provided by some lenders.

Source: S&P Global Ratings

When it came to credit risk, lenders require a personal guarantee from all SMSF members, said Treacy.

“This is so that in the event of a default of the SMSF, and the proceeds from the property sale are not sufficient, the lender can then draw upon the personal guarantee to enable them to make up the shortfall … in our credit analysis, we treat these loans the same as a full recourse loan.”

Strong asset performance, low arrears

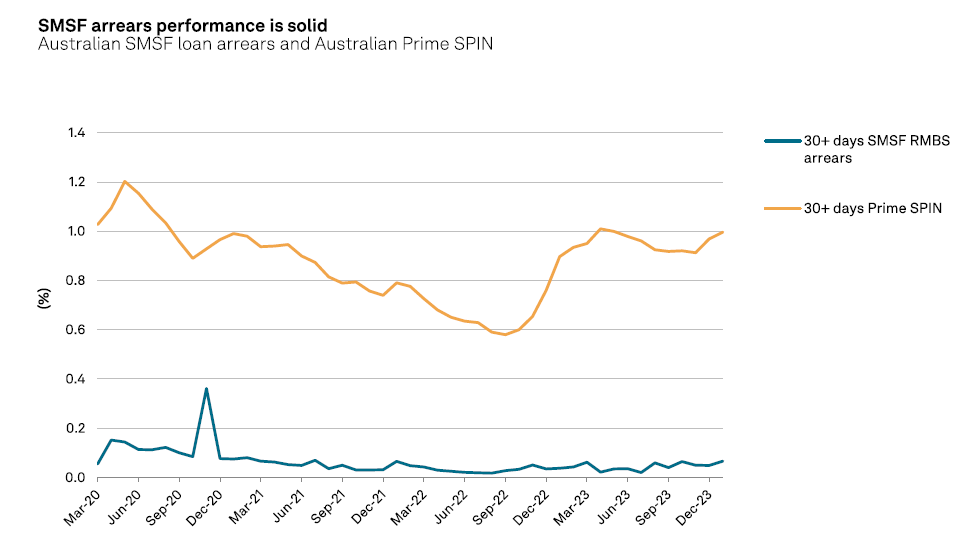

Kitson said the asset performance of SMSFs has certainly been strong, with SMSF RMBS loans in arrears for more than 30 days a lot lower than in Prime SPIN loans.

“They have absolutely performed very well,” she said. “That's the case for both the residential and the commercial loans, and losses have also been negligible.”

Kitson said this was because Australia had experienced relatively benign economic conditions for some time and strong property price appreciation.

Also, SMSF loans skewed towards older borrowers, “many of which probably have a reasonable level of net wealth and net assets”.

Source: S&P Global Ratings

As a broker, have you noticed more clients enquiring about SMSF loans? Comment below