Jump to winners | About the Global 100 – Mortgage

The mortgage industry worldwide has faced a challenging 12 months, with rate hikes across the board. However, innovative techniques have been created, business models have changed, and there’s been a recalibration of mindsets. These are all the responses of the Global 100, who are leading from the front as role models to their colleagues and as trusted partners of their clients, who needed them more than ever.

Reacting and adapting are invaluable skills in difficult conditions. La Haye has been able to rely on both to manage a rewarding 12 months.

“I’ve been in this industry for 20 years, and this was the first year that I’ve ever experienced a reduction in business,” he says. “Rates here went up 500 percent; it was the first time I was operating in an environment in which I knew that we were going to do less in terms of volume.”

However, he regrouped and turned things in his favor. La Haye decided to break from the normal operating methods.

He says, “The classic way a broker, at least here in Canada, operates is that you do a lot of marketing and outreach and try to get as many clients as possible. Then we try to find a solution that serves them.”

That model works well and allows brokers to use their toolbox once the client arrives. The secret to La Haye’s success has been reversing that process.

“We would instead look in the toolbox and find a financial strategy, and then go out and find a segment of the market that would really, really need that,” he says.

La Haye’s strategy was to depart from the usual approach of competing at the lowest rates. For example, one initiative was cash damming, which included:

utilizing Canada’s high-income tax rates to attract clients

offering the ability to return 50 percent of their interest at the end of the year

converting the capital gain on the property

overall, transforming the mortgage into a tax-deductible mortgage

He says, “That’s just one of 15 strategies or tools that we identified that clients could potentially benefit from. It’s been a real game changer, allowing us to step out of the rate discussion only and talk about other strategies and possible needs that the client has that we can offer solutions to.”

While it has paid off, conceptualizing and implementing the new way of working wasn’t without its own challenges. One part was getting the message to the clients, all preoccupied by rising rates, but instead La Haye and his team were able to ask questions such as:

Would you like to have your mortgage treated as a tax-deductible debt?

Would you prefer not to make mortgage payments if you’re over 65?

Would you be interested in using the equity in your house to create a more flexible or comfortable retirement?

“So many clients would say yes to those types of questions, and I’d tell them, ‘Then we might have a solution for you,’” he says.

The secondary part that La Haye has had to lead on is changing the mindset of his brokers to work in this way, some of whom were wedded to the methods that have served them well throughout their careers.

“If there’s disruption, doubling down on what you know can maybe be a strategy, but it might also be the end of you,” he says. “We get rigid as we age, I think, both personally and in business, and that can be a pretty big trap.”

Instead of showing the data that backed up his innovative methods, La Haye was able to bring his brokers with him.

He says, “We showed them what the marketing was doing and how it was creating more and more business, and it still is even to this day.”

There’s satisfaction in seeing plans and hard work deliver results. And that’s been the story for White, as the progress he has overseen in the last 12 months includes:

achieving record net member growth for the FBAA

successfully launching a consumer-facing website

concluding plans for expansion into New Zealand

overseeing a global mortgage summit

Creating the website, BeforeULoan.com, involved White leading a large research effort that has been ongoing for three years.

He says, “I wanted to ensure that what we were building was what consumers wanted, not what we thought they wanted.”

Expanding on what the platform will mean to borrowers, White says, “It has the facility to find a broker to sort your loan out, but we looked at what exactly people are trying to achieve. So, it’s been built with that in mind and to bring all the information into one point.”

It will also include collaborative content from the FBAA’s member brokers, and there will be monthly updates across the whole site so it stays relevant as the market evolves with blogs, videos, and podcasts.

Alongside fine-tuning the new web offering, White spent the majority of the year preparing to take the organization to New Zealand. The impetus came from brokers there asking for his organization’s support. Now it’s happening by setting up a presence there to give specialized assistance from an association point of view in the mortgage advice space.

“We are good at dealing with politicians and regulators, and we’re great in the media, plus we’re good at putting on events,” he says. “These are the things that brokers there complain about: there aren’t enough events, and they need more education. By coming over, it will not only increase the awareness of brokers in New Zealand but also their market share. That’s the end goal.”

White has also led efforts on a global scale in his role as chairman of the International Mortgage Brokers Federation (IMBF). He helmed the group’s first global summit, held in Las Vegas back in September.

There were a series of talking points, including:

domestic country issues

common global issues

money laundering

fraud

education

promoting increased female industry participation

White says, “It’s a specialist conversation. We are all basically doing the same thing around the world, just at different speeds. Therefore, we can learn from one another and grow from one another’s learning.”

There is also a white paper due to be published on the discussions at the summit, and the 2024 event is already scheduled to be held in Canada.

One driving force for White is for the federation to be a source of support for brokers internationally and ultimately allow them to work better for their clients.

He says, “Governments will come to understand that we’ve become a very strong and very large global community that works together on resolving issues and challenges.”

“It has been a fun year.” That’s the unexpected verdict from Groomes.

Realizing how tough 2023 was going to be, he recalls sitting alongside business partner Greg Huegel in their South Carolina office back in January as business began to slow down.

Groomes says, “I said we could either choose to be victims, be upset, or blame the market, but I said no, and we decided to change the mindset, flip the switch, and turn the negative energy into positive energy.”

Groomes laid out some goals about what success would look like.

“They weren’t numbers; there were relationships, and we’ve blown them out of the water,” he says.

The strategy has been to focus on connecting with clients, understanding their needs, and investing time in supporting them during these challenging times. A by-product of fewer deals being done meant there was more time to dedicate.

“We were never going to just work four hours a day or scroll on Facebook,” Groomes says. “We made positive use of that time by finding somebody to connect with or by scheduling a meeting. It was about really being intentional about purposeful meetings, and we see stuff moving because of that.”

Most of Lima One’s business occurs outside of its home state, so the company used technology to reach as many clients as possible. It was a significant undertaking, as most of the meetings were not about new business.

Groomes says, “We spent so much time fostering relationships, and what has really pushed us over the edge is truly just getting to know people, getting to know their businesses, what they’re wanting to do, and why they’re wanting to do things.”

The shift in operation ties in with Groomes’ mindset and how he wants to interact with clients. So having the space to change strategy has allowed him and the business to reach a point where they want to be.

“I don’t want to be transactional,” he says. “I want to be a trusted adviser and partner because when we do loans for people, we’re also an extension of their business, and I am there for them.”

Prioritizing relationships is something that will continue at Lima One now that it has developed a powerful model. This preparation positions the business for the future, allowing it to deploy its deeper understanding of its clients’ situations with ease if rates become more favorable.

“Now that we have built those relationships, when we do get better rates, those relationships will still be strong as we understand them on a whole new level,” says Groomes. “So, we’re ready to fire for our clients when times get better and when they need us to.”

Even esteemed firms with successful histories have had to think smarter and adapt over the past 12 months. That’s evidenced by La Trobe Financial, which decided to target three areas of business due to market conditions:

complex credit

commercial property

construction loans

Bannister says, “We’ve been able to lean in and help those segments of the market that perhaps have been left underserved by some of the major lenders based on the macroeconomic environment that we’re faced with.”

It wasn’t a case of simply shifting resources, as Bannister coordinated realigning his staff to be able to deliver in those areas.

“We had the knowledge before, but we certainly had to scale up the teams that handle commercial and construction loans in particular,” he says. “We’ve been able to recruit quite well to ensure that we could scale up accordingly.”

A large part of Bannister’s impressive performance has not only included devising strategy but also motivating his team to deliver. Part of that is making it clear how impactful La Trobe Financial’s work is.

He says, “We always reiterate to our team the importance of their role. We legitimately get a chance to solve some of the biggest pressures and the biggest concerns on the minds of Australians day in and day out.”

Above and beyond the finances, for Bannister, a sense of pride comes from the results he and his team have delivered. Over the last year, several clients have reached out to share their gratitude – a noticeably greater amount than they typically do in less challenging markets.

“We get regular feedback from those customers that we’ve been able to assist; we might have saved them a deposit or given them a roof over their heads,” says Bannister. “We’ve had more commendations for the way our staff have handled their requests this year, more so than ever.”

The Global 100 report shines a spotlight on outstanding professionals who are making a positive difference and helping drive change across the industry.

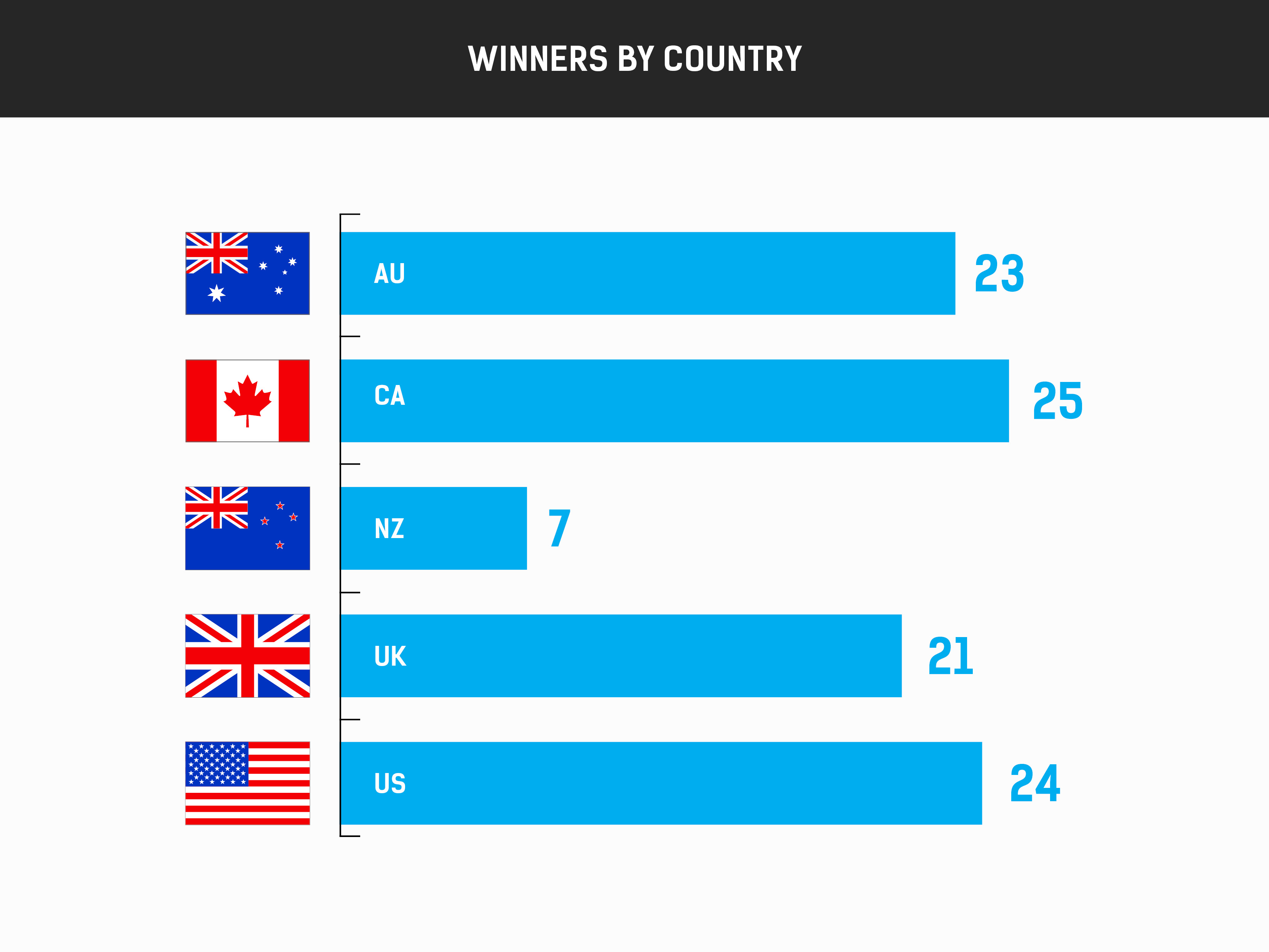

Now in its fifth year, this formidable list of the biggest names in the mortgage industry was put together by MPA and its sister publications, Canadian Mortgage Professional, Mortgage Introducer, Mortgage Professional Australia, and NZ Adviser, leveraging its unique position as a true global publication reaching fix different markets – the US, Canada, Australia, New Zealand, and the UK.

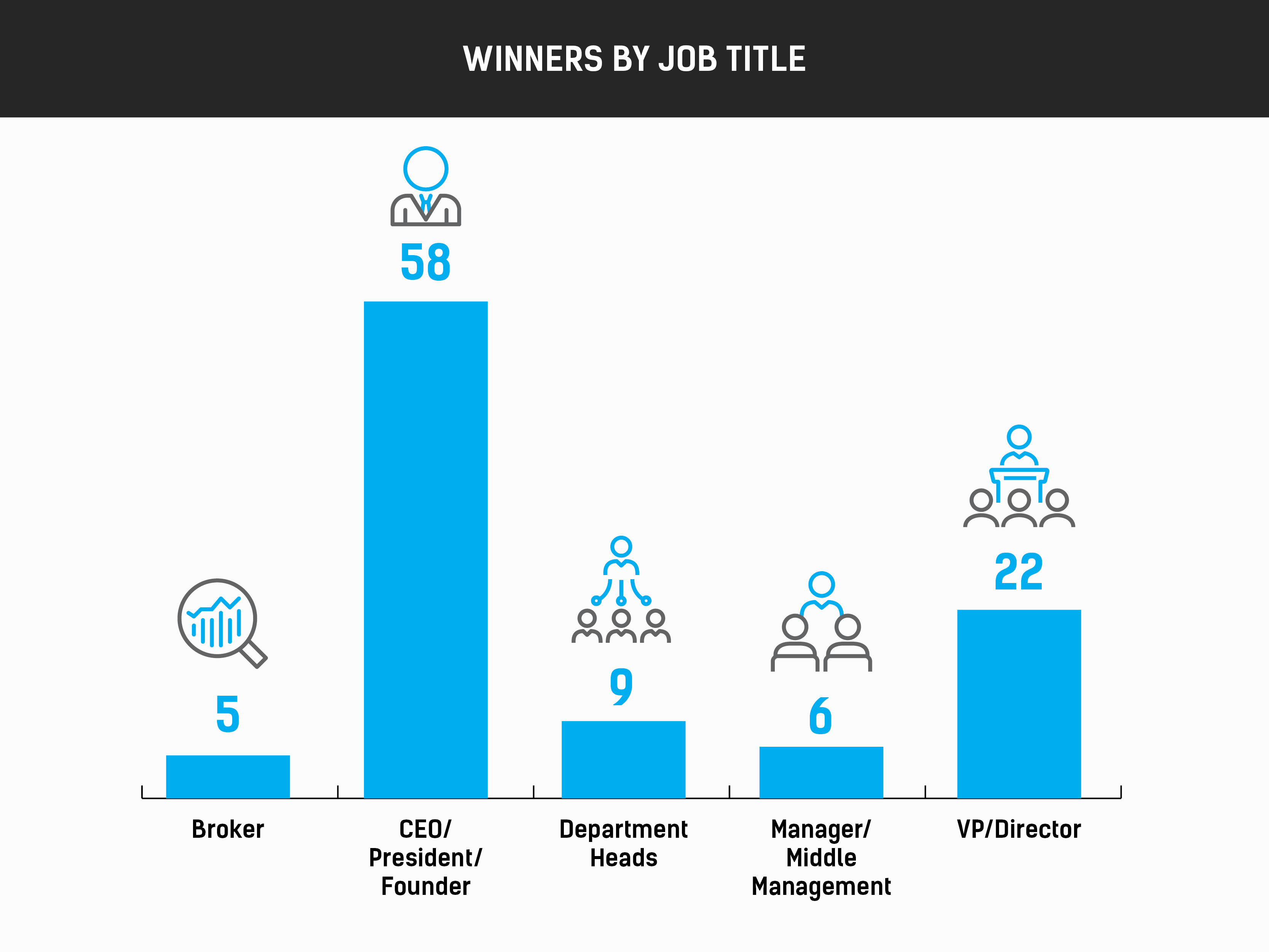

The team collectively deals with hundreds, if not thousands, of mortgage professionals throughout the year for its daily newsletters, special reports and surveys, industry awards, and events. This range makes the team well-placed to tackle the intimidating task of whittling down the industry’s high achievers to just 100.

The leaders featured on this year’s Global 100 have been selected for their outstanding commitment to their companies and their people over the past 12 months. This exclusive list is a combination of renowned names and leaders within the market who have been making incredible advancements at their own companies, lifting associations to new heights, offering education to improve the industry, or championing key issues that seek to carry the sector into a new era.