Jump to winners | Jump to methodology

The mortgage technology train is moving full steam ahead, and there are stops along the way to make the ride smoother for brokers and lenders throughout the country.

With the implementation of in-house technology hubs and the ability of mortgage brokers to access technology services enabled by mortgage technology providers, the digital side of the mortgage business is on a roll.

Canadian Mortgage Professional (CMP) is cognizant of the vital role that technology plays in the daily work of mortgage brokers. To honor these industry experts and technology providers, the CMP team has narrowed down a competitive list of achievers to round out the list of Brokers on Technology for 2022.

Based on extensive market research compiling information through a detailed survey format sent out to the Canadian broker community, the team came up with a list of the top mortgage-based technology providers in addition to the leading technology initiatives geared for the mortgage sector.

“[Brokers and agents] want to be able to control and have independence in terms of the workflows and the style of communication, and this is exactly what BluMortgage provides”

Tom Hall, BluMortgage

Despite the prolonged pandemic, the mortgage sector has continued to thrive over the last year. Brokers are kept busy with high client demand for mortgage financing in the face of limited housing inventory.

Broader economic factors directly related to the pandemic, in addition to other overall economic trends, have also worked in favor of the mortgage industry.

Mortgage rates still hover at one of the lowest levels seen in decades, housing appreciation continues to reach the double digits in some markets across the country, and commercial construction is booming in the face of high demand for housing and commercial spaces.

Mortgage rates still hover at one of the lowest levels we have seen in decades, housing appreciation continues to soar into the double digits in some housing markets throughout the country, and commercial construction is booming in the face of high demand for housing and commercial spaces.

Despite the Bank of Canada’s recent announcement hinting at an upward trend in the overnight lending rate, coupled with increased inflation, most mortgage industry insiders are optimistic about the prospects of the Canadian mortgage and housing sector.

“We feel really excited and are humbled to be recognized for providing a tool that is helping make brokers’ lives easier”

Jeremy Viault, DocuSign

As in any other thriving business sector, the use of technology to help streamline the business model is more prevalent today than at any other time. Ironically, the pandemic has played a key role in driving the technology forward.

As more brokers work remotely and customers expect a streamlined and painless customer experience, the mortgage sector is forced to make important decisions and investments in technology software and platforms to remain competitive.

With technology at the center of broker-client relationships, it’s not surprising that CMP’s survey found that mortgage brokers gave top marks to software platforms that included several features: general ease of use, ease of implementation, overall value added for the broker, value for investment, and level of customer support that is open to brokers when utilizing various tech platforms.

CMP’s survey also found that brokers make decisions relating to technology platforms very quickly. Asked about their buying timeline when purchasing software, a whopping 45% responded with “less than three months” out of a timeline of up to 12+ months.

The brokerages that participated in the survey were also asked to list how many vendors they would shortlist as possible contenders when choosing technology platforms. Most respondents (55%) listed between three and five, while only 6% answered more than six vendors, and another 39% listed between one and two vendors as the perfect number to shortlist.

“We will continue to focus on bringing [Lender Spotlight and Finmo] together to complete a fully digital journey on behalf of the mortgage broker”

Alex Conconi, Lendesk

With so many innovations to choose from, the tech platforms at the top of the survey rankings had just the right mix of elements to serve up the perfect technological recipe for broker success.

For TMG The Mortgage Group, which won for their software platform called Hurricane, the key to the perfect mortgage software boils down to the ability of the technology to seamlessly integrate the multiple elements of the mortgage process.

“Our platform helps with the workflow of management documents, e-signatures, status of clients, integrating with third-party providers for creditors, creditor insurance, and bank payment data through links,” says Dan Pultr, senior executive overseeing strategic initiatives with the company.

“We have always had a very strong focus on ensuring that we provide our brokers with the best possible tools so they can do their job as efficiently and effectively as humanly possible,” Pultr adds.

He says that the program, which was launched in January 2020, is a tool that helps brokers be more effective and efficient with their mortgage transactions.

“[Hurricane] provides a secure way to go to deal with their clients as well.”

Integrating with other widely used platforms including Filogix, the broker experience is made easier with TMG’s Hurricane software, effectively freeing up more time for its brokers to deal directly with the clients’ needs.

Already considered a must-use technology in the Canadian mortgage sector, DocuSign was also recognized by CMP’s survey, scoring top points and a winner’s position for its widely used technology services.

“We feel really excited and are humbled to be recognized for providing a tool that is helping make brokers’ lives easier,” says Jeremy Viault, marketing director, Canada at DocuSign. “[The company] has more than a million customers to date. We are able to ease people’s work in a lot of different fields, including the mortgage industry, which is really important for us in North America.”

Viault explains that DocuSign’s mission is to simplify the way “people agree” to specific terms in a document. The purpose is to streamline the old agreement process, from the preparation of the agreements, the signature, and the execution and management of the agreements, he says.

“From a mortgage-specific point of view, where DocuSign is really paying a central role is on the signature and we really differentiate ourselves in the degree of the security we have in place and [the ability] to ensure that all agreements are going to be stored in a secure fashion,” he adds.

Another winner in CMP’s Brokers on Technology 2022 survey was Lendesk for its Lender Spotlight technology platform and its Venmo technology offering.

“We have two main products, both of which have industry‑leading Net Promoter Scores which [represent] leading user satisfaction scores,” says Alex Conconi, founder and CEO of Lendesk.

“Lender Spotlight is the industry’s number one rate and policy database, so it is where all the brokers go to find what rates and product policies are available to them from all the lenders that service the mortgage broker channel in Canada,” Conconi explains.

“Our other product [Venmo] is our point-of-sale system for brokers,” he adds. “We help brokers provide a digital customer experience to their clients and we are the leaders in providing the digital experience in Canada.”

Along with the other winners, Conconi was honored to receive further broker recognition for services that Lendesk is proud to provide.

“We have always made the borrowers experience the number one priority and in doing so, we have set up the brokers who work with us for success. “We will continue to focus on bringing [Lender Spotlight and Finmo] together to complete a fully digital journey on behalf of the mortgage broker” he says.

Working with brokers for eight years, BluMortgage, another CMP survey winner, is also thrilled to be recognized for its technological contributions at this point of its client journey.

“We are just starting to hit a critical mass and a critical amount of feedback, and we are very happy and very thankful,” says Massimo Ianniruberto, co-CEO of BluMortgage.

“We are a CRM for very serious brokers. What that means is that brokers who want to control their leads have a process and can take their business to the next level. We want to work on their business, not in their business.”

BluMortgage is in the unique position of being the only CRM in the country that is integrated with all the big LLS’s such as Filogix.

“For us, integration and intuitive customization are big pieces,” Ianniruberto explains.

Tom Hall, co-CEO at BluMortgage, echoes his colleague’s views on the company’s objectives.

“The tech that we are providing is really helping their [mortgage brokers] way of doing business and making the move forward in a meaningful way,” Hall says.

“I think that brokers are looking for a little bit of independence. For brokers and agents at the end of the day, it’s really their business. They want to be able to control and have independence in terms of the workflows and the style of communication and this is exactly what BluMortgage provides.”

CMP’s survey winners all agree that the technological journey is only in its infancy, as more aspects of the mortgage process become increasingly automated and customers demand digital offerings that make the process more user-friendly.

Two other aspects that stand out for the winners include the push towards further integration of the multiple platforms that are currently available for brokers, as well as moving the industry along the technological path towards a more streamlined digital experience.

“Integration, integration, integration: this is the theme moving forward. [The ability] to have all these technological platforms available, with so much data, the question becomes how to integrate that,” Ianniruberto says.

The pandemic has accelerated the need for the mortgage sector to keep in step with the technological innovation and for tech providers to truly tap into their mortgage broker client base.

“Every business is a technology business these days, so having good technology partners that are committed to innovation is very important for mortgage brokers, more than it has ever been,” says Conconi.

“It’s been 11 years now and I feel like I have been saying the same thing over and over again, that we are making great progress,” Viault says. “We are really going in the direction of simplifying the user experience.”

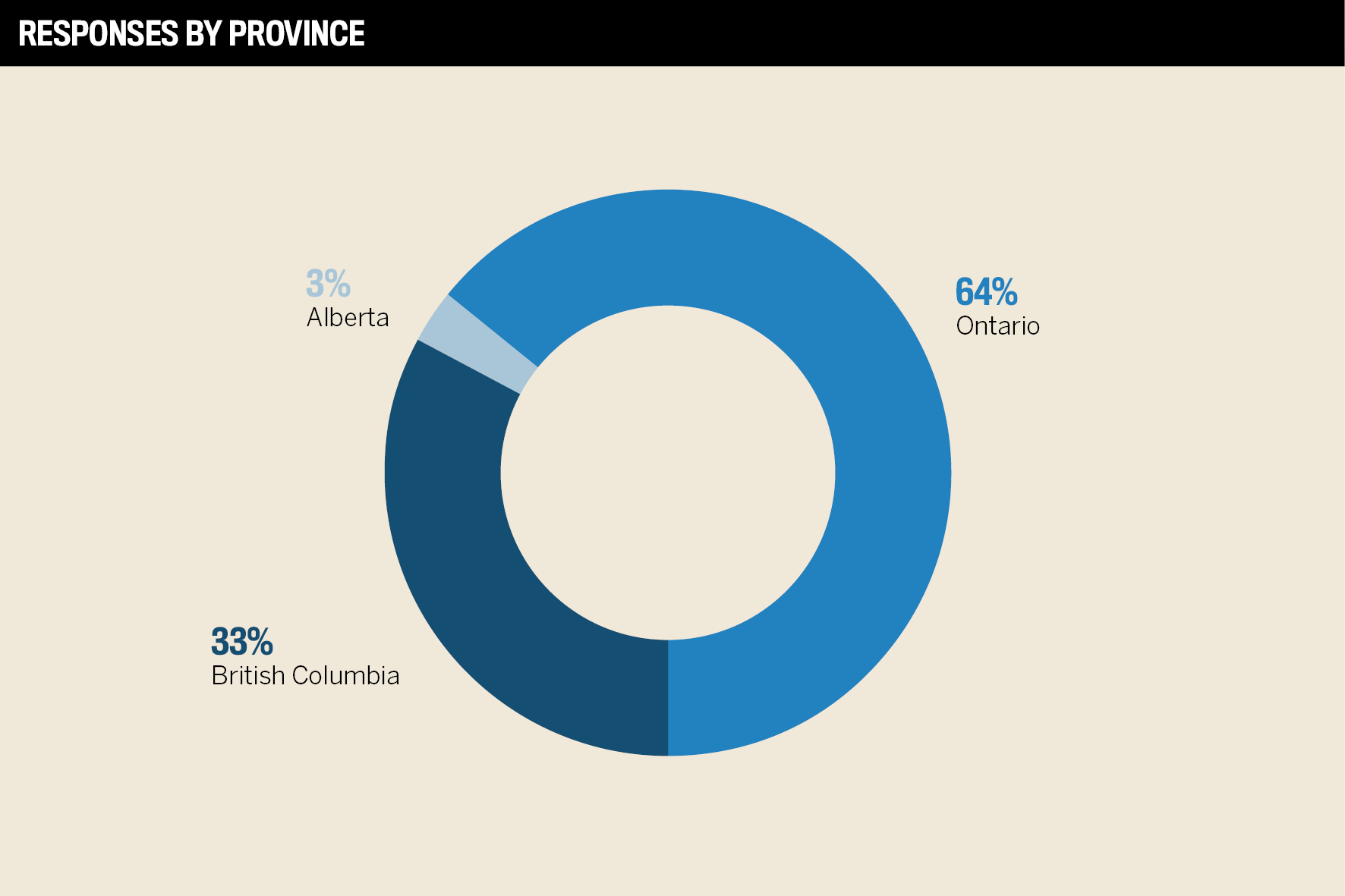

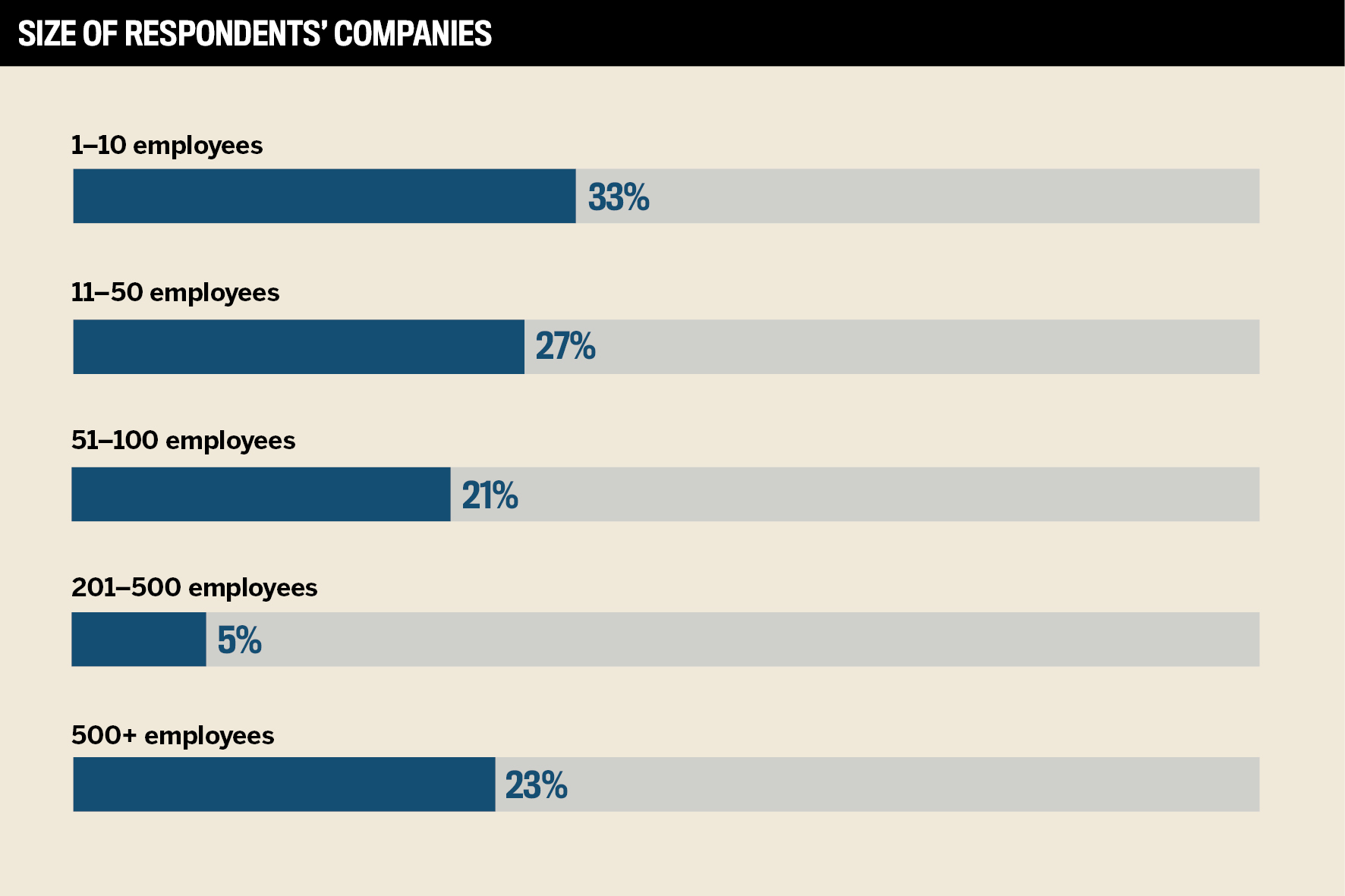

Mortgage brokers across Canada were asked to rate their technology providers and determine which providers they would recommend based on designated criteria provided in the form of a structured survey by Canadian Mortgage Professional (CMP).

Survey categories included lending platform, loan origination, loan servicing, loan management, mortgage application, CRM, document fulfillment platform, document recognition, automated underwriting systems, appraisal technology, loan ecosystem platform, digital signing, loan estimate calculator, and automated borrower retention.

The CMP team asked brokers to rate their satisfaction level with technology providers they have worked with. The top scorers were included in the Brokers on Technology list for 2022.