In less than a decade, Marcus has been able to cultivate a mortgage portfolio that has helped Morcan Financial, now known as MorCan Direct, achieve a portfolio of approximately $1.75 billion dollars in residential and commercial mortgage origination. Learn more about Marcus here...

.JPG)

A-BUSINESS (75%)

ALTERNATIVE (25%)

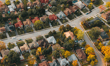

Location: Toronto, Ontario

As an independent, what extra pressures do you feel surrounding volume bonuses? Is there any loss of diversity of product as a result?

With our volumes we are not missing out on volume bonuses. For the select few lenders that pay based on the brokerage’s production, the benefits of being with MorCan Direct far outweigh the small difference in commissions. Our focus is not the dollar amount of commission anyway; if a mortgage product makes the most sense for our client, it is our job to work with the lender providing that product. We try to place as much of our business with lenders who pay trailers, over the years we have found that their products better serve our customers.

What are the advantages of being an independent brokerage?

Being independent means that we can play by our own rules. We can roll out an advertising campaign quickly; we can build our own brand, and we are creating our own valuable brokerage.

Have you considered joining a large network?

MorCan has been approached by several brokerages but it has never seemed to be the right fit. There are some great broker networks in the Canadian marketplace; each network has its own positive and negative attributes.

How do you think independent brokerages can continue to thrive in today’s market?

Independents must play by the same rules as any other player in the mortgage marketplace. We have to keep our customers happy and keep them referring clients. Treat everyone that walks through your door fairly, be totally unbiased and you will see the benefits.

What advice would you offer to brokers who would like to set up an independent brokerage?

Build the right team. Everyone, from the people who deal with your clients to the people who are in the back office dealing with compliance, need to work efficiently in order for your brokerage to stay competitive in the marketplace.

What is your strategy for generating new business?

The bulk of our business comes from our existing clients. We also do a fair bit of Internet advertising in addition to some radio and print. My favourite way to spend marketing dollars is on my existing clients; the goal is to figure out a way to transfer the greatest amount of value from us to them.

What is the most important thing a broker can do to grow their business?

Stay uncomfortable. Always tinker with your business model and process because you can always get better.

What trends have you noticed this year? Have you had to adapt your business strategies to the market conditions?

Working with clients who have been declined by others or who have been told that they have to accept a higher rate and turning them into A-clients makes it easy to come to work in the morning.

What are your goals and strategies for the years ahead?

We will continue to provide an incredibly valuable service. We will stay educated on lender and insurer guidelines. We will listen carefully to our clients and always do what is best for them. We will work to inform the public that there is no better place to get a mortgage than MorCan Direct. We will never get comfortable.

Have you diversified outside of mortgages? If so, how have you incorporated this into your business?

We have a MIC. We started Cannect MIC almost one year ago. We use the MIC to fund some of our first and second mortgages.

What is the secret to building a successful brokerage?

The first step is to make each client that walks through your door happy. We do this by sticking to our mantra: Sound, unbiased mortgage advice. We work with our clients to find them the best product possible. The second step is to find and retain good talent. The final step is to make sure you never get comfortable. The mortgage industry is constantly changing; as a result we are constantly evaluating the way we do things.

FSCO license: 10687