Jump to winners | Jump to methodology

Historically a male-dominated environment, Canada’s mortgage industry is moving in the right direction.

Frances Hinojosa, CEO of Tribe Financial Group, says, “I do see the transition happening.”

Canadian Mortgage Professional’s Top 50 Women of Influence are at the forefront of this reshaping of the mortgage industry, pushing boundaries, involving themselves in community-based organizations, and raising the leadership bar within a 15,000-strong professional community nationwide.

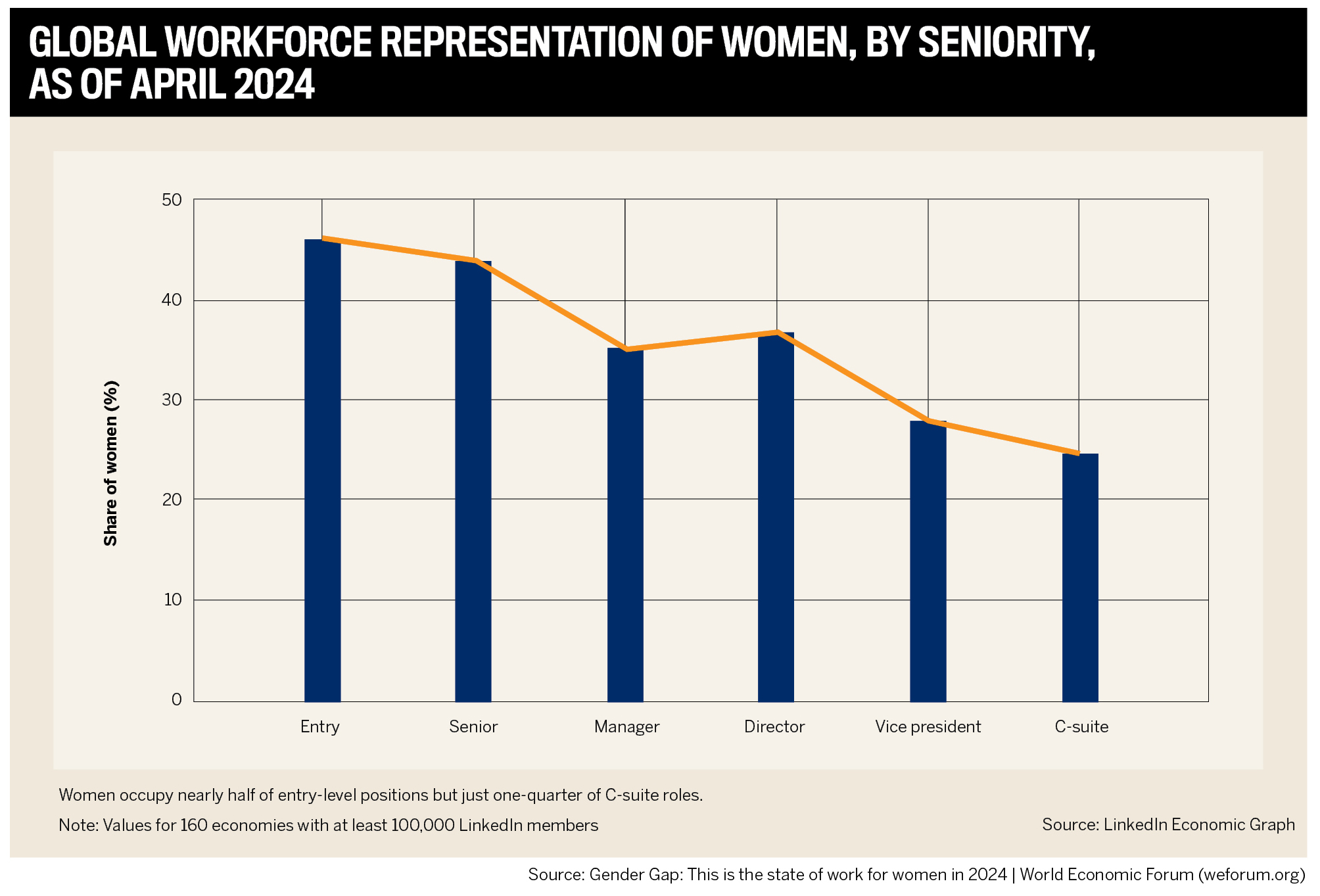

While this year’s best female mortgage brokers and professionals in Canada are making significant strides, women continue to routinely face barriers to advancement across industries, as noted below in the World Economic Forum’s 2024 report on the state of work for women.

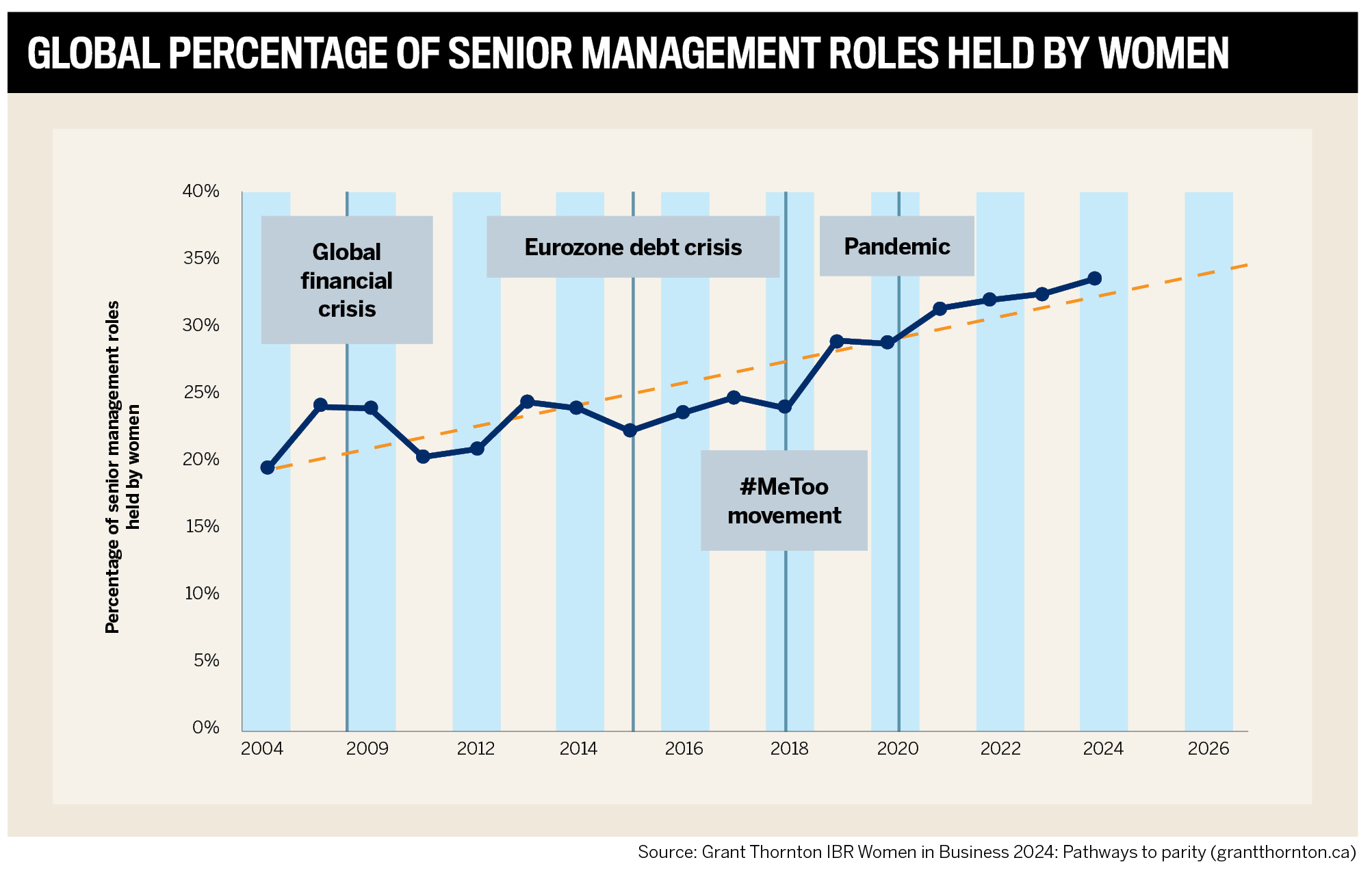

According to Grant Thornton’s Women in Business 2024 report, without a greater focus on equitable opportunities, gender parity in mid-market senior management roles in Canada won’t be reached until 2053.

Although progress is evident, with Canada surpassing by 1.5 points the global 33.5 percent average of women in mid-market senior management roles, there’s a consensus that there is more work to do.

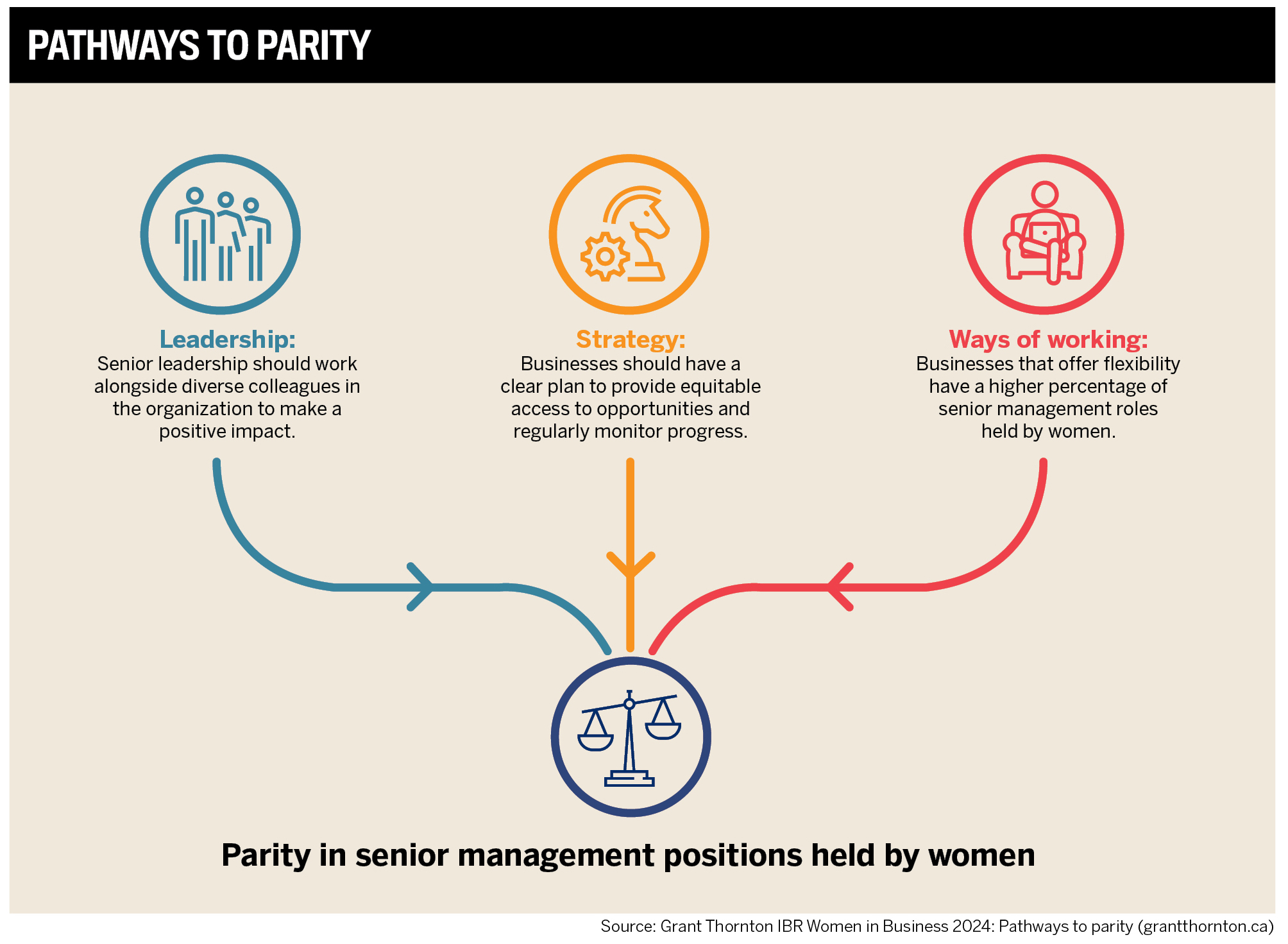

The report suggests that businesses with strategies to ensure equitable access to growth and development opportunities are more likely to achieve their parity goals, as illustrated in the chart below.

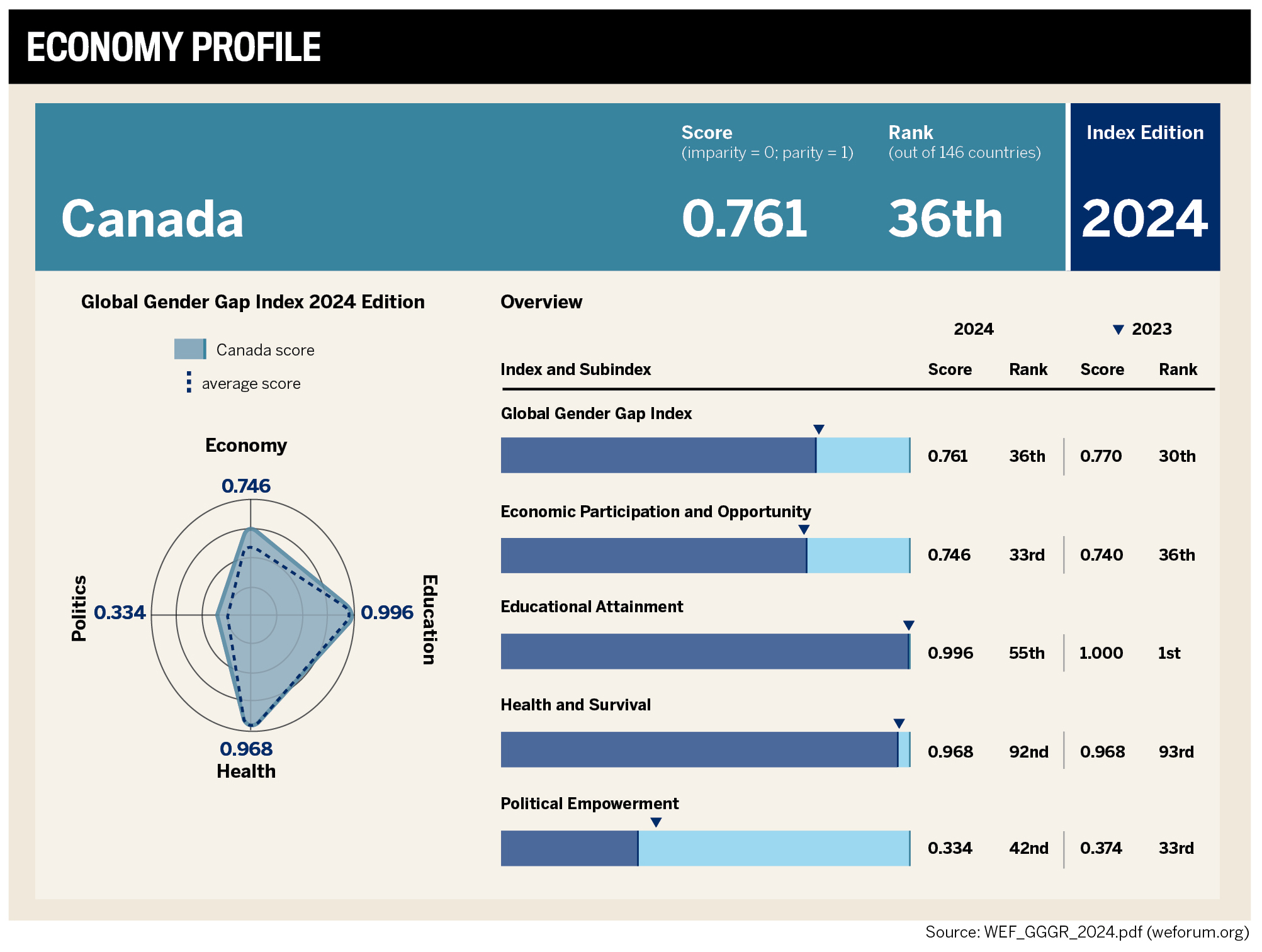

Given Canada’s gender parity ranking slipping this year from 30th to 36th place in the World Economic Forum’s Global Gender Gap 2024 report, recognizing and celebrating women leaders is more crucial than ever.

In selecting 2024’s best female mortgage brokers and professionals in Canada, members of the judging panel pointed out the breakthroughs made by all 144 nominees who, together, are instrumental in closing the gender gap and paving the way forward for women.

“Seeing that list grow year over year makes my heart swell and gives me hope for the future, where the stigma of being an ‘old boys club’ will start to fade and eventually disappear,” says Hinojosa, a long-serving panellist.

Judge Michelle Campbell, CEO and principal broker of Mortgage District, which proudly supports this report, notes that the Women of Influence made an impression with their balance of skill, heart, and vision.

“What I paid attention to were leadership abilities, innovation, and a proven track record of success,” she says. “I was especially looking for women who demonstrated resilience, adaptability, and the ability to navigate challenges gracefully, pushing boundaries and continually growing in the face of change.”

The increasing prominence and impact women have nationally across the mortgage industry struck the panel as a strong indicator of progress, showcasing that influence and innovation know no bounds.

“I am encouraged that many of my female colleagues are advancing in their careers, with many taking on leadership roles, receiving professional recognition, excelling as entrepreneurs, becoming vocal industry advocates, and making bold contributions to the mortgage industry,” says Fisgard Asset Management founding director and managing director and panel member Hali Noble.

CMP’s Women of Influence are shaping the industry’s future in myriad ways:

leading with strength, innovation, and empathy as they drive policy changes and create more inclusive and supportive environments

leaning into their emotional insight while also leveraging technology to elevate business results

exemplifying integrity, work ethic, and grit, recognizing the unique challenges women face on their career journey

mentoring and sharing their knowledge

positively impacting their communities with a deep commitment to service and charity work

“What I love most is how women in this space are lifting each other up, sharing knowledge, and breaking down barriers that have traditionally made it harder for women to advance,” says Campbell. “It’s clear that the achievements of women in the mortgage industry are recognized more than ever, but there’s still a lot of room for continued progress.”

Hinojosa underscores the importance of the Women of Influence list.

She says, “I want this list to be a checklist for the next generation of aspiring young women. Take this as a call list because the women have gone through it; they would be more than happy to share and help mentor you.”

Armed with an economics degree, the vice president of business development began her career as a bank teller more than two decades ago. Sakic quickly moved into various lending and mortgage roles within a local credit union in British Columbia before diving into financial technology sales, focusing on loan origination and valuation technology.

“Each position allowed me to gain a deeper understanding of the industry and develop a diverse skill set,” she says, reflecting on her ability to keep learning as a standout accomplishment.

With a reputation as a trailblazing sales leader at North America’s largest and most trusted appraisal management company and leading valuations provider to Canada’s top financial institutions, Sakic has played a pivotal role in driving Solidifi’s success and increasing market share.

She is most proud and passionate about mentoring and supporting other women in the mortgage industry, including helping several friends enter the field in various roles, from marketing and brokering to positions within her organization.

“It’s been important to me to help women advance their careers and reach their goals, whatever they may be,” Sakic says.

A combination of resilience, empathy, accountability, integrity, and consistently working to improve those attributes have enabled her to drive positive outcomes for her team, clients, and the company.

Sakic’s professional and community contributions include:

leading her team in launching two new clients and six new channels in Canada in FY 2023 to date

being featured as one of Solidifi’s International Women’s Day 2023 role models, celebrating women in the mortgage market

serving on the board of directors for the East End Boys Club, a charity dedicated to supporting marginalized youth aged 13 to 19

The ever-evolving nature of the mortgage industry ignites a sense of excitement in Sakic, who thrives in the most challenging environments.

“We’ve seen many changes in regulations and evolving customer expectations,” she says. “Specifically, embracing technology and digital transformation has been crucial in valuations. It’s important to stay informed, learn to pivot, adapt to new advancements, and not be afraid of technology. By doing so, we can better support our careers, clients, and organizations.”

As the daughter of Croatian immigrants, Sakic has contributed passively to diversity and gender equality through her exceptional work performance and leadership skills, shattering stereotypes and inspiring others to challenge societal norms.

“It’s important for women not to be afraid to go out and learn something new, embrace the challenges, the people, and the clients,” she says. “When I work with my customers, I genuinely want them to succeed because if they’re successful, I am, too. I want them to feel better after working with me or my company than they did before.”

In a year characterized by personal and professional challenges, the mortgage broker exemplified resilience as she rebuilt her mortgage business and life, proving that true strength lies in adaptability.

Farrugia joined Vine Group in 2023, navigating a shifting mortgage market while caring for her young son after a separation. She provided stability and support to her clients just as she found it in her own life.

“I had to start from scratch, and despite the difficulties, I found strength in focusing on the relationships I had built and the belief that adversity can be a powerful motivator,” she says.

After nearly two decades in the legal industry, Farrugia took a leap of faith into consulting with brokerages, supporting their business needs and helping them scale their operations.

Although she hadn’t planned on becoming a mortgage broker, her commitment to client service led her to build a substantial book of business, eventually serving in a dual role as operations director and mortgage broker at another company.

Her journey into the industry began with a passion for helping others realize their goals through real estate, but it has grown into much more. She considers every time someone trusts her with their future a “standout moment.”

“In the beginning, I was very quiet about my challenges because I didn’t want to appear weak or like I was struggling,” she says. “But I’ve learned that being honest and genuine, showing vulnerability, attracts clients and referral partners. Many clients, especially those going through tough times like divorces, appreciate that I’ve been through similar experiences and that I’m real with them.”

Farrugia’s influence extends to the broader community, where she has made significant contributions:

actively supporting charities such as Lighthouse for Grieving Children and Milton Autism

creating support networks for minority women and Mamapreneurs, providing a platform for shared experiences and advice

spearheading a mentorship program that pairs experienced professionals with emerging female entrepreneurs, driving growth and development for participants

serving as a keynote speaker at industry conferences, sharing her expertise and inspiring others to pursue their ambitions

Farrugia leads by example and is unwavering about accountability. She believes in doing everything she expects from her team and treating her staff and clients with the same care and attention.

“If my team is struggling, it means I’m not doing my job well,” she says. “It’s not about being in charge; it’s about taking responsibility, particularly in this current environment where market uncertainty is high and integrity is crucial.”

She sees disruption as an opportunity in the ever-changing mortgage industry, where shifts in interest rates, regulatory change, and technological advancements are the norm. By staying informed, adapting to changes, and collaborating with others, she strives to inspire the next generation of women leaders.

“Don’t shy away from change; embrace it,” Farrugia says. “Be proactive in learning and evolving. Surround yourself with people who challenge you to think differently, and never underestimate the power of authenticity. Your unique perspective is your greatest strength.”

The founder, CEO, and principal broker is a trailblazing leader who has positively impacted the industry, the community, and the brokerage team she has led to become a top player within the Mortgage Alliance network since its launch in 2019.

Known for creating a collaborative and inclusive workplace culture, Hastings draws on her nearly 25 years of industry experience to support and mentor over 80 agents, helping them to achieve top producer goals.

“I think a big achievement for me is that, as an individual, my values have not changed. I’m still similar to how I was as an agent, very true to myself,” says Hastings. “Building the brokerage, especially in the first couple of years during the pandemic, while having kids at home with online schooling, was a real challenge. But despite that, we doubled in size during those years.”

As a service-oriented leader, Hastings has shaped the brokerage’s culture and growth by ensuring the experience she provides to her agents is exceptional, just as they aim to do for clients.

“I’m in this business because I love the mortgage industry and truly appreciate the people I work with,” she says. “If the environment were cold and sterile, filled only with technology, it would be a completely different experience. It’s almost selfish because I’m creating the personable, empathetic, and happy environment where I want to spend my time. For that to be successful, I have to create that and give it back to others.”

Hastings has made notable contributions to the industry and her community, including:

establishing MH Peak Performance Coaching, which delivers sessions that transform mindsets and habits into peak performance

launching the podcast The Mortgage Coach: Connecting the Dots in 2023, sharing diverse paths to success and practical takeaways

serving as a regular panel speaker at dozens of events each year

actively supporting charities, donating over $25,000 annually to Red Door Shelter, Period Purse, and others

The fast-moving mortgage industry doesn’t daunt Hastings, who embraces disruptions for the inherent opportunities they provide to advance and improve.

“You have to take it all in stride because it’s always going to evolve and change, just like life,” she says. “You need a clear vision of what you want to achieve in this business; write it down and revisit it, and don’t get hung up on how you’ll get there.”

Across 10 countries, including Canada, women in the workforce continue to face the stubborn challenges of work-life balance, health, and domestic responsibilities, according to Deloitte’s Women@Work 2024 global report.

Among the 5,000 respondents, stress levels have increased by over half, along with more women taking time off for mental health reasons.

Other findings include:

Two-thirds of women don’t feel comfortable discussing mental health at work or disclosing mental health as the reason for taking time off.

Many women worry about discrimination or being laid off, and one in 10 have had negative experiences when discussing their mental health at work in the past.

Women who live with a partner still bear the most responsibility for childcare and, increasingly, care of older adults.

Flexibility and work-life balance are critical for retention.

Hybrid work experiences are improving, but some women say they have adjusted their work and personal lives following the introduction of return-to-office policies.

Women are feeling unsafe in the workplace, and non-inclusive behaviours continue.

Gender equality leaders are still rare.

CMP’s Women of Influence share their experiences and how they’ve overcome obstacles.

IS: “Historically, women have been underrepresented in leadership roles in most industries, including mortgages, despite possessing the right qualities to become good leaders. I navigated this challenge by demonstrating resilience, a commitment to continuous learning, and always building my network of both women and men in the industry.”

NF: “There’s no denying that women face different expectations and pressures in this industry. It can be challenging to balance the perception of being assertive and approachable while managing the demands of family life. I’ve found that leading with empathy, being authentic, and staying true to my values have been key in navigating these waters. It’s about showing up for clients, colleagues, and myself, and recognizing that influence isn’t about being the loudest voice in the room, but the one people turn to for real solutions. I’ve been fortunate to find a community of supportive peers, and I try to pay that forward by mentoring others.”

MH: “Sometimes, it’s about how we show up. When I first opened the brokerage, I was often the only woman in a meeting. I would regularly attend meetings and feel that I was being mansplained to. I’d share an idea, and it would be dismissed, only for someone to bring up the same idea the next month, and suddenly it was considered great. I thought, ‘You’ve got to be kidding me.’ Then, I got some great advice from a mastermind group of women. They asked, ‘How are you showing up to these meetings?’ I realized I tended to sit back, cross my legs, fold my arms, and make myself as small as possible. So, I decided to change how I physically showed up. In the next meeting, I planted both feet on the floor, put my arms on the table, leaned forward, and took up space. By showing up differently, the response was different. When we assume we don’t belong, that’s how we enter the room. But when we show up like we belong, when we take up space, we’re treated differently.”

To compile the 2024 Top 50 Women of Influence list, CMP encouraged mortgage professionals to nominate outstanding female leaders from across the industry. Nominators were asked to provide details of their nominee’s achievements and initiatives over the past 12 months, including specific examples of their professional accomplishments and contributions to the industry as a whole.

The final list was selected by a judging panel made up of industry leaders and previous Women of Influence, including:

Carla Giles, Canadian Mortgage Brokers Association

Daniela DeTommaso, FCT

Fiona Campbell, Manulife

Frances Hinojosa, Tribe Financial Group

Hali Noble, Fisgard Asset Management

Michelle Campbell, Mortgage District

To avoid any potential conflicts of interest, the CMP team voided self-voting and votes for a judge’s own organization.

The 2024 Top 50 Women of Influence special report is proudly supported by the Canadian Mortgage Brokers Association – Ontario.