Akber Abbas tells CMP how 8Twelve Mortgage Corporation is positioning itself at the forefront of the industry's digital revolution

The name of 8Twelve Mortgage’s end-to-end mortgage platform, Infin8, was chosen for a very specific reason: to represent the infinite possibilities available to the consumers and mortgage professionals using it. According to Akber Abbas, the company’s president, CIO and principal mortgage broker, the platform was developed with the aim of furthering one of 8Twelve’s core goals: to advance the digital revolution in the broker channel with the technologies and processes at its disposal.

The company itself is made up of three distinct business units: 8Twelve Mortgage Brokerage, a national brokerage; 8Twelve Capital, a mortgage administration company; and 8Twelve Financial Technologies, the holding company that houses those brands.

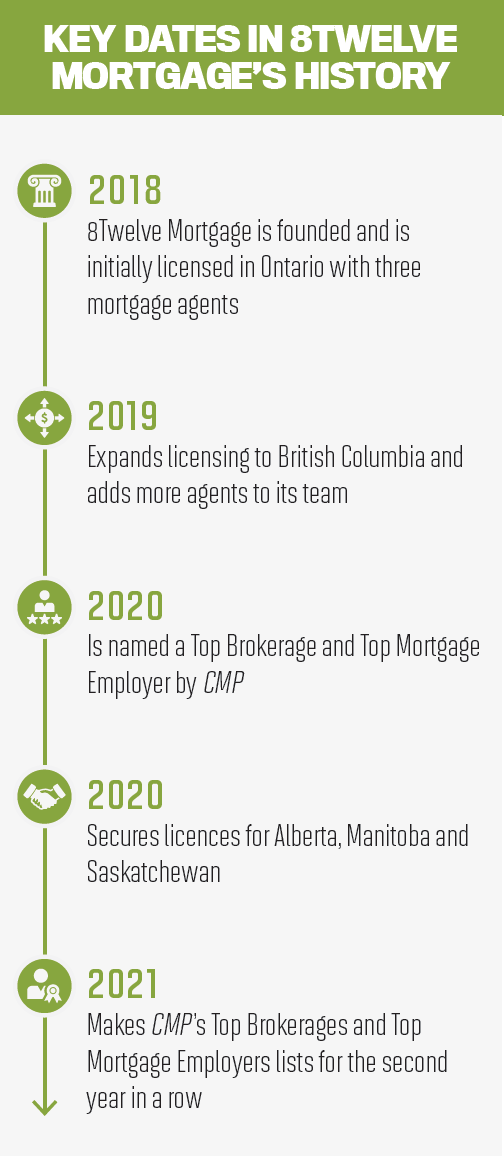

Its forward-thinking, future-focused approach is one of the most striking aspects of 8Twelve Mortgage. Abbas says its founders’ innovation-heavy backgrounds (he worked for various Silicon Valley and technology companies; CEO and broker Gary Fooks has expertise in customer experience) played a key role in ensuring its continued success throughout the challenges of the COVID-19 pandemic.

“Even in 2015, 2016, it was still manila folders and yellow notepads and a lot of paper going back and forth,” Abbas says. “The reason why 8Twelve Mortgage has been growing year-over-year, month-over-month, is because we were pandemic-proof or pandemic-ready. We were ready by being future-forward. We already had technology to be paperless; we were already working on managing Zoom meetings; we were already working on a remote environment, and we were doing that in 2017, 2018 and 2019.”

That technology-centred approach meant that far from flatlining, 8Twelve’s operations actually flourished during the pandemic, helping it attract new talent and ensuring steady growth while many other organiz-ations were facing upheaval during those uncertain early days of the outbreak in 2020. Central to its success among brokers is that intuitive, seamless system that has allowed the company to onboard talent and help new agents hit the ground running, irrespective of their level of experience.

“The system will take your hand and walk you through the steps of the mort-gage; that’s why we’re seeing consistent five-star reviews,” Abbas says. “We have teams in-house that take care of, for example, back-office administration, funding admin-istration and so on. That’s really where our specialty is and why we’re growing really well. We’re taking a different approach on the mortgage brokerage business and how we’re onboarding and treating our staff as well.”

That ability to walk employees through the process, and take care of time-consuming administrative tasks for them, allows mortgage professionals to focus on the areas of their business that really matter to them, whether that’s developing new relationships or cultivating referrals. While mort-gage agents have traditionally been required to find and manage business, working on new leads to the detriment of their productivity, Abbas says 8Twelve’s system lets agents focus on the side of the business that reflects their strengths.

The company has also fully embraced integrations, viewing them as central to the future of the mortgage industry, and it’s always open to new partnerships and enhancements. Its current partners include Filogix, Newton, Zoom, Hellosign and Docusign; standard email platforms are also built into the company’s technology.

“We’ve created a platform that’s open to connect to partners today and in the future,” Abbas says. “Our philosophy has always been that great new technologies are being developed out there.”

“We’ve created a platform that’s open to connect to partners today and in the future,” Abbas says. “Our philosophy has always been that great new technologies are being developed out there.”

The company has also built an impeccable reputation with lenders, which Abbas attributes to its team of diligent underwriters, who work with agents to package deals and information correctly.

“Time and again, I hear from our lender partners that when they see an 8Twelve file, they’re bringing it to the top,” he says. “They know it’s consistent [and that] all the checks and balances are done. That increases our ability to collect fees and deliver value for our clients, but it’s also reducing the operating costs for our lenders, which they love. We’re building those deep relationships, time and time again.”