Saving up to buy a property has become more achievable in several markets, Zoocasa says

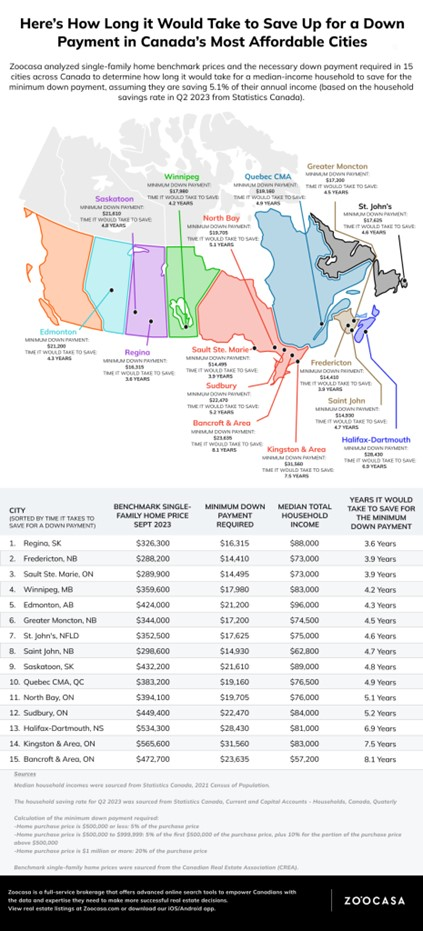

Saving for a down payment on a new home requires five years or fewer in Quebec and Edmonton, according to a new Zoocasa study.

Affordability concerns have been slightly assuaged by the fact that average home prices fell for the third consecutive month in September, reaching $741,400 per data from the Canadian Real Estate Association (CREA).

Assuming a savings rate of 5.1% of annual household income, Regina was the market where saving for a single-family home down payment may prove quickest, requiring just 3.6 years of savings.

“Though Regina may not boast the most affordable single-family home prices, with homes at $326,300 in September 2023, it does enjoy one of the highest median household incomes among the cities we analyzed,” Zoocasa said.

“At $88,000, the high median household income in Regina provides home buyers with an edge over other cities that have lower benchmark prices and lower median household incomes.”

However, Zoocasa stressed that these figures might not be representative of the country’s long-term affordability situation.

“Home buyers need to note that as home prices fluctuate, and typically increase over time, the exact number of years you will need to save for a down payment will likely be longer than the time it takes to buy a home priced at the September 2023 benchmark,” Zoocasa said.