A new report suggests not…

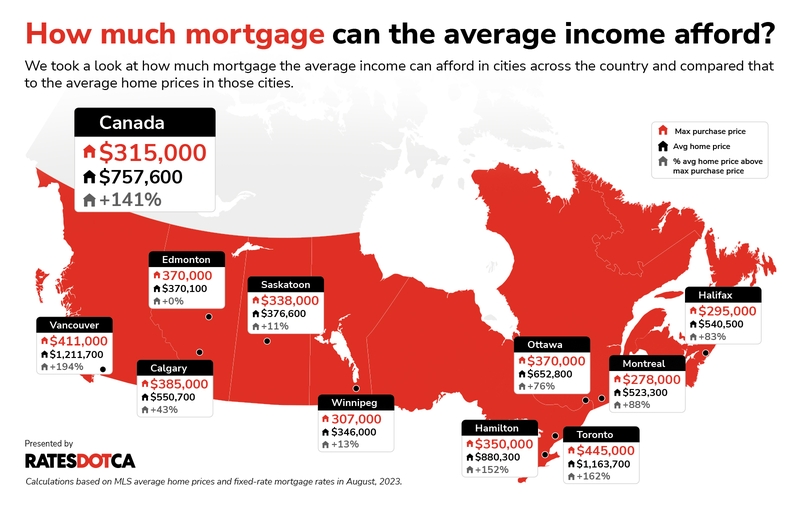

The average Canadian home price significantly outstrips the average median household income by 141%, according to a recent report by RATESDOTCA.

Taking the median income of $79,876 into account, an average household can afford a home valued at $315,000 with a maximum insured mortgage of $299,500. However, the report noted that this amount is far below the average home price of $757,600.

The situation is even more strained in the largest markets, where average prices exceed average incomes by as much as 210% (in Toronto) and 250% (in Vancouver), the report added.

“High inflation and diminished purchasing power, combined with high home prices and borrowing costs, have left many Canadians wondering if the dream of homeownership will ever be within their reach,” RATESDOTCA said.

For markets like Toronto, in particular, the situation is made more complicated by the fact that mortgage insurers do not insure homes valued higher than $1 million.

“[This]increases interest rates and the required down payment, and decreases the amount a borrower can qualify for,” RATESDOTCA said.

“Amid the skyrocketing cost-of-living and dearth of affordable housing, Canada’s most expensive city has seen an exodus of young professionals moving out to the Maritimes and the Prairies.”

“The survey suggests that Canadians believe that real estate is overpriced and a majority would not have an issue if housing prices went down,” said Nik Nanos, chief data scientist at Nanos Research.https://t.co/ZgDOB3oLyq#mortgageindustry #houseprices #affordability

— Canadian Mortgage Professional Magazine (@CMPmagazine) September 14, 2023

Mortgage owners also struggling with ever-growing prices

Even current homeowners have not been spared from the burden of deteriorating affordability, a new Angus Reid Institute report suggested.

The study found that 49% of Canadians believe that they are in a worse financial position now compared to last year, while another 35% anticipate being in a worse position a year from now.

Many mortgage holders said that they are either worried (40%) or very worried (39%) that they will be faced with higher payments come renewal time with their banks, while 57% said that they are “very worried” that their monthly payments will sharply rise as a result.

“The Bank of Canada has hiked rates only twice since March, but many are still feeling the shock of the cost of borrowing jumping significantly since the beginning of 2022, when the BoC’s policy rate was 0.25%,” Angus Reid said.