When will the Bank of Canada begin cutting rates?

The Canadian economy is maintaining its slow pace as it grapples with the delayed effects of previous interest rate hikes, according to a new analysis from RBC Economics.

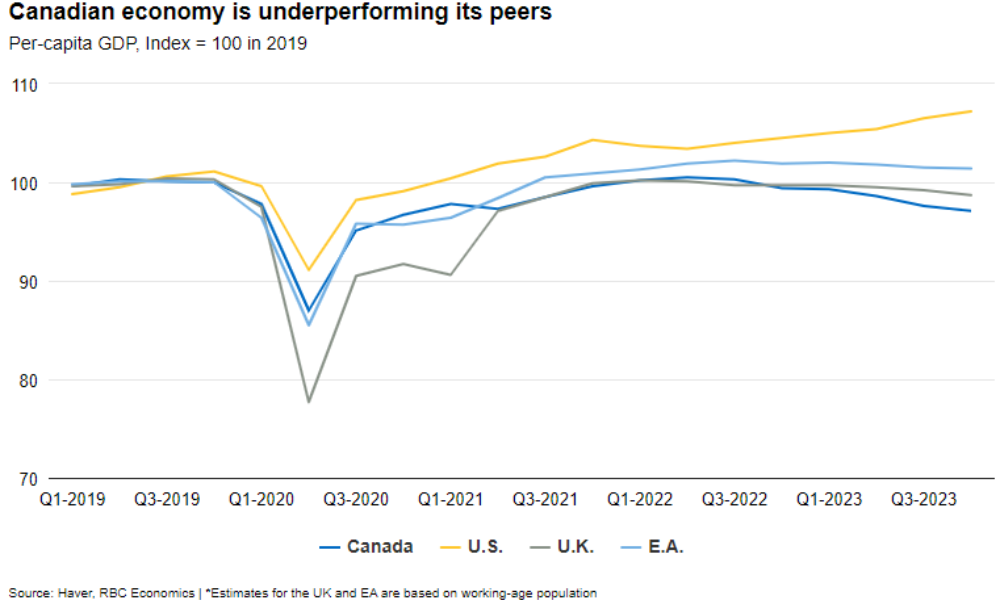

GDP did see a modest increase in the fourth quarter of 2023, but this was not enough to match the pace of country’s rapid population growth.

As a result, per-capita output declined for the sixth consecutive quarter, returning to levels last seen in 2016.

RBC said this downturn has not been as severe as initially anticipated in 2022, when the Bank of Canada began increasing interest rates aggressively to combat inflation.

Still, household debt levels relative to disposable incomes have reached record levels and are expected to climb further as higher mortgage rates kick in at the time of loan renewals.

The period has also seen an uptick in household delinquency rates and a significant rise in business bankruptcies for the first time in decades.

In addition, the housing market’s affordability has continued to deteriorate, impacting household purchasing power amidst persistently high home and rental prices.

On a positive note, inflation has been on downward trend, which could push the Bank of Canada to relax monetary policy by mid-year.

Although the consumer price index has surged by 17% since 2019, with food prices rising by 25%, RBC said future increases will likely be smaller even though prices won’t necessarily decline.

“The economic data hasn’t been soft enough to push the BoC to react urgently with interest rate cuts, but it has been soft enough that the most likely trajectory for future price growth is still lower,” the analysis stated. “We look for the BoC to begin gradually cutting rates in June as inflation pressures continue to slow.”

What are your thoughts on this story? Feel free to comment below.