Global ratings agency warns that housing market here is over-valued by 20 per cent… Banks could be vulnerable in any housing crash… Consumers remain optimistic despite warnings… And office leasing sees some growth in Toronto…

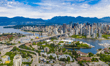

Canada’s housing over-valued by 20 per cent

The latest warning of an over-valued housing market has come from credit ratings agency Fitch. The analysts say that the market needs slow down soon or the federal government may have to take yet another measure to try to reduce the heat. Fitch Ratings says that the high prices caused by low interest rates and a lack of supply in metropolitan areas have been the normality since the start of the recession, but that economic changes could trigger a crash. The main concerns are a rise in unemployment and/or interest rate rises. David Madini from Capital Markets believes the housing sector is in line for a “major correction over the longer term”. The latest stats on prices are expected today from the Canadian Real Estate Association. Read the full story.

Banks exposed to the threat of a downturn

Canada’s banks could find themselves in crisis if a housing market crash was to happen. A report from investment analysts Morningstar says that the likelihood of higher interest rates, falling prices and a slower market at some time in the next year or so could lead to a high level of defaults. The Royal Bank of Canada and CIBC would be hit the hardest. Morningstar predict that there will be a correction in the market within the next five years and are suggesting that it could see property values fall by as much as 30 per cent. Read the full story.

Homeowners confident in the market

While experts continue to express concern about the hot housing market, it seems that consumers are revelling in it. The latest figures from the Bloomberg and Nanos index shows that the level of Canadians predicting increased house prices in the next six months has grown to 47 per cent. That’s a 10 per cent rise since April and the highest ever figure in the index. Read the full story.

Toronto sees growth in office leasing

The Greater Toronto Area has seen increases in the amount of occupied office space after a slow start to the year. The newly released ‘Second Quarter 2014 Greater Toronto Area Office Market Report’ from Avison Young reveals Downtown, Midtown and Toronto West saw leasing activity rise, although Toronto West and North had more offices becoming vacant than the level of new rentals. As a result the overall vacancy rate for the GTA remained at 9.4 per cent but the increased activity is encouraging. The office leasing market is changing due to market demands, with many businesses now seeking ways to use less space more efficiently. Read the full story.

The latest warning of an over-valued housing market has come from credit ratings agency Fitch. The analysts say that the market needs slow down soon or the federal government may have to take yet another measure to try to reduce the heat. Fitch Ratings says that the high prices caused by low interest rates and a lack of supply in metropolitan areas have been the normality since the start of the recession, but that economic changes could trigger a crash. The main concerns are a rise in unemployment and/or interest rate rises. David Madini from Capital Markets believes the housing sector is in line for a “major correction over the longer term”. The latest stats on prices are expected today from the Canadian Real Estate Association. Read the full story.

Banks exposed to the threat of a downturn

Canada’s banks could find themselves in crisis if a housing market crash was to happen. A report from investment analysts Morningstar says that the likelihood of higher interest rates, falling prices and a slower market at some time in the next year or so could lead to a high level of defaults. The Royal Bank of Canada and CIBC would be hit the hardest. Morningstar predict that there will be a correction in the market within the next five years and are suggesting that it could see property values fall by as much as 30 per cent. Read the full story.

Homeowners confident in the market

While experts continue to express concern about the hot housing market, it seems that consumers are revelling in it. The latest figures from the Bloomberg and Nanos index shows that the level of Canadians predicting increased house prices in the next six months has grown to 47 per cent. That’s a 10 per cent rise since April and the highest ever figure in the index. Read the full story.

Toronto sees growth in office leasing

The Greater Toronto Area has seen increases in the amount of occupied office space after a slow start to the year. The newly released ‘Second Quarter 2014 Greater Toronto Area Office Market Report’ from Avison Young reveals Downtown, Midtown and Toronto West saw leasing activity rise, although Toronto West and North had more offices becoming vacant than the level of new rentals. As a result the overall vacancy rate for the GTA remained at 9.4 per cent but the increased activity is encouraging. The office leasing market is changing due to market demands, with many businesses now seeking ways to use less space more efficiently. Read the full story.