But are today's youngsters willing to follow their advice?

Blindsided by an unexpected pandemic-triggered housing boom, countless millennials and other hopeful Canadian house hunters stood by and watched as prices in the formerly affordable communities they had considered potential purchase destinations rapidly inflated past the point of attainability.

Many of them are now rightfully wondering if they will ever be able to purchase homes of their own.

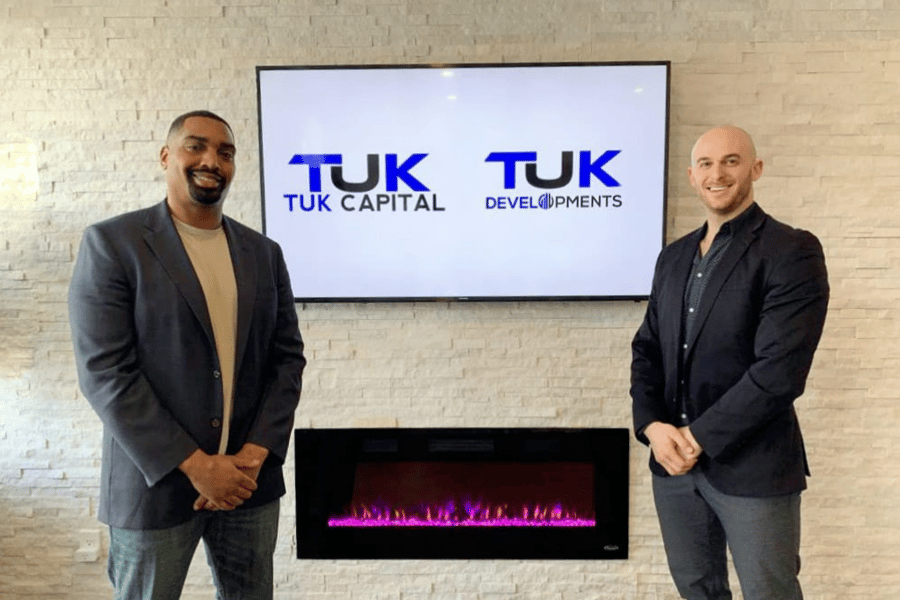

The two millennials behind real estate investment company TUK Capital, which specializes in acquiring and rehabbing distressed properties in Ontario’s Golden Horseshoe region, say all is not lost. Mortgage Broker News caught up with Jordan King and Evan Ungar earlier this week to dredge up some good news both for first-time buyers and the mortgage brokers who hope to nail them down as future clients.

This interview has been edited for length and clarity.

Mortgage Broker News: Let’s get the important question out of the way first. Are millennials, Gen Zs, and other first-timers who haven’t already gotten into the market screwed?

Evan Ungar: Absolutely not. There’s no such thing as being screwed when it comes to getting a first property. Anybody can get their first property. They might be screwed if they’re trying to buy their first property on minimum wage at the heart of Toronto.

Jordan King: I think it depends on where. As long as people are open-minded to owning real estate in cities that they’re sometimes not familiar with, I think there’s always an opportunity to get into the real estate market.

MBN: What should a buyer’s expectations be as they approach the market for the first time?

EU: They should have realistic expectations. I think that’s really what they need to focus on. They need to determine what they’re pre-approved for and base all of their expectations off of their income. People are thinking, “Well, my parents have a million-dollar home, so I should have a $700,000 home.” But some younger people make more than their parents, some make less. It’s about how much debt you can afford to service.

JK: Everyone’s different, right? It’s what makes sense for you, and setting realistic expectations around what you can do and what you have an appetite for is huge. As long as you’re doing that and not overleveraging yourself, you should be OK.

MBN: So you’d say start with the pre-approval?

EU: If you’re buying as a primary residence, I would always recommend starting with a pre-approval. And it doesn’t mean that you have to stick to that pre-approval exactly. There are ways to stretch that pre-approval to be bigger if needed, but that will give you a great general understanding. If you’re planning on taking a mortgage from an A-lender, then you have to play on their court.

MBN: How would you stretch a pre-approval?

EU: There are different ways to make those pre-approvals work. Maybe you need to look at doing your taxes differently. Maybe you’re employed and there’s a T2200 you can use. Maybe there’s money that you didn’t incorporate into your pre-approval that you were looking at, such as an RRSP or your parents supplying you with x amount of dollars. Maybe you have a co-signer come in. These are things that can change the entire pre-approval, especially the co-signer, and increase what the bank considers your risk threshold to be.

MBN: How did you guys buy your first properties?

EU: This is one of my biggest messages to first-time buyers, and Jordan can attest to the same thing. It’s all about sacrifice. You must live by your means or below your means to get your first home, especially if you have a geographical location that you want to invest in.

I bought my first home in Oakville at 23 years old. It wasn’t necessarily within my means, but I was on an upward trajectory with how much I was making at my job and I knew that I could potentially do it. I bought a pre-built home, which is an incredible way to get into the market as a first-time homebuyer because you’re allowing your home to appreciate, without you having a mortgage, while saving your money for that down payment.

I worked out a ridiculously tight budget. A lot of my friends did not see me for a solid year. They were all going out partying and enjoying themselves and I stayed home. My parents moved to a different province and I needed a place to live so I found a commercial building that had a vacant doctor’s office in it. I worked a deal with the owner of that building to actually live in that doctor’s office for 11 months. I lived out of a mini-fridge, I cooked my meals in a toaster oven. This sounds crazy, but I bought that house in Oakville for $465,000, and five-and-a-half years later it’s worth over $900,000.

JK: I got my first condo at the age of 22. Like Evan, it was a pre-build. I was kind of opposed to condos because I wanted my property to be a detached home, but that’s what made sense for me at the time. That’s what I was able to afford.

I was able to purchase this condo for around $317,000. The deposit structure was really, really good on it. I actually had to have help with the co-sign on that condo – my parents – to get it going. After that, the first thing I did was move out of that condo. I moved into a basement for eight months where I paid about $900 a month to really save up some money, and then I took my savings and I purchased a property out in Hamilton that I renovated and rented out the basement in.

Like Evan, my thing was really scaling back, not living beyond my means, and making sure that if anything like COVID were to happen I wouldn’t be panicking and scrambling to make mortgage payments. It worked out beautifully.

MBN: With the so-called “urban exodus” making smaller communities much more attractive to buyers, what would you tell a first-time buyer who thinks he can buy anywhere and still have it be a safe, solid investment?

JK: People are treating real estate like stocks – “Just buy anywhere. It doesn’t matter. It’s going to go up.” But just like stocks, you really want to make sure you know what you’re talking about. You want to be careful.

Interest rates are at a historical low now, so I think people can agree that we can expect them to go up in the future at some point. And when they do, you want to make sure that you didn’t buy something that was way overvalued at such a low interest rate that, when you refinance that mortgage, you’re going to be paying a significantly higher rate that’s not affordable for you.

Make sure you’re doing your research. Make sure you’re getting your comparables. Don’t just jump in blindly to buy something, because this is a market where you can get stuck.

EU: “Stuck” is the polite way of saying it. Just because you bought something at a certain price does not mean that a bank is going to lend at that price. Market value and appraised value are not the same thing. Banks are not lending on market value. If someone plans to buy a house where the market value is $200,000, but they offer $350,000 because they can afford it, when the bank sends an appraiser to the property that person is going to be “stuck.”

MBN: You two approach real estate with an investor’s mindset. Is that something millennials and other first-timers need to do in order to crack the market? Investing can seem pretty daunting and complicated to people not familiar with it.

EU: I think anything to do with a significant amount of money is an investment. If people turn their perception from “I’m buying a beautiful home where I’m going to raise my 2.5 kids and a cat,” into “What are the numbers? How does this actually work for my finances?” they’re going to be much happier in that home later. At the end of the day, when you’re dealing with hundreds of thousands of dollars, you must put your investor cap on and look at the numbers. The fact that you have a big, green backyard doesn’t mean you’re going to be able to afford your home.

You don’t have to necessarily look at it like, “In one year it will have appreciated by 2%, and then if I put in a tenant…” You don’t have to break it down that far. But you absolutely have to look at it from a numbers standpoint.

JK: I completely agree. I always wanted my first property to be a detached home, but at the time I just couldn’t afford it. But I was able to get my first condo, and with the appreciation from that condo, I was able to repurpose those profits to get the detached home.

My biggest thing is, everybody takes different paths and different timelines, so don’t rush it. Don’t stretch yourself.