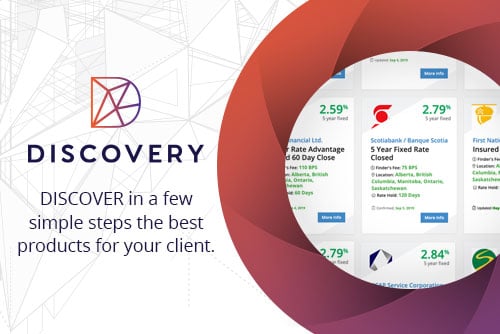

New tool allows brokers to search all available mortgage products in one place, without a subscription

Brokers who have been dreaming of the day that they no longer have to deal with rate sheets can open their eyes. That day is today.

Now, brokers no longer have to reference separate rate updates and policy manuals in order to figure out which lenders might have an interest in their particular client’s profile. Today, using Discovery, brokers will have all that information at the click of a button.

Discovery, developed by Newton Connectivity Systems, matches client profiles with lender-verified product attributes to maximize the chance for the best possible mortgage approval. It features 32 different data points, including loan type, application purpose, term, and insurance status, and results can be sorted by everything from rate to term to broker compensation. Brokers can also sort results by client attributes such as credit score and income type. Searches can be saved, and products can be favourited for another time.

“What we wanted to do is take all these variables and instead of making them something that lay down on a piece of paper that they have to sort on a desk and figure out manually, we wanted to make it digital. We wanted to put it in an environment that was very simple,” said Geoff Willis, president and CEO of Newton Connectivity Systems. It’s the same in many different industries, where people are looking online to match needs against availability and suitability. “We’ve tried to create a match.com for mortgages.”

Up until a couple of years ago, lenders would send out a rate sheet, updated whenever there was a rate change. Lenders would hope that brokers not only see those sheets, but note any available promotions and keep those lenders top of mind when they have an appropriate deal. Now, lenders know that their products and rates are going to be seen and they are also more likely to see a deal that is better qualified to fit their specific parameters. This also levels the playing field for smaller and/or more niche lenders, as everything gets seen based on the search parameters specified.

"The idea is that we’re taking the whole availability of the marketplace and putting it right at the brokers fingertips and making it so that they can truly offer their customer choice in a much more transparent way, and make sure that they’re not also sending deals to lenders that they’re clearly not going to have an appetite to do and just hope for the best," Willis said.

There are other systems in the space that compare lender products and rates, but the difference is that the third-party manages the rate updates, and as a result, the technology is subscription-based. What makes Discover unique for lenders is that rates and product attributes within Discovery are updated and verified directly by lenders with a date stamp of their last update on every card. Discovery is available to all brokers and can be used through the Velocity POS or as a stand-alone solution.

“As Canada's number one mortgage company, we always want to make sure we have the tools and technology to serve the complete 360 of the mortgage cycle, and that means making sure our clients are being served, making sure our brokers are being well supported, and making sure that our lenders feel valued, and we think that we've done that with this product, Discovery,” said Dave Teixeira, executive vice president, business development and public affairs at DLC. "We want to make sure that we are improving the ability to find the right mortgage at the best rate for our clients, making sure that the brokers have the tools to do that."

Discovery was rolled out to 30 brokerages across the DLC group. Effective today, it will be the new rate and product distribution solution for all three networks within that group—DLC, Mortgage Architects, and Mortgage Centre Canada—giving it a minimum of 5,900 users incorporating this asset into their business. There are about 20 lenders currently up and active on Discovery, which Teixeira said represents about 85% of the average brokers’ volume. Kate Henderson, VP of lender experience at Newton said that another 20 lenders are currently in the process of finalizing their products and rates, and Teixeira added that they hope to have another 50-60 lenders added by the end of the year.