Edmonton has endured economic headwinds of late, but should the newly-greenlit pipeline commence construction, those days will be firmly in the rear-view mirror

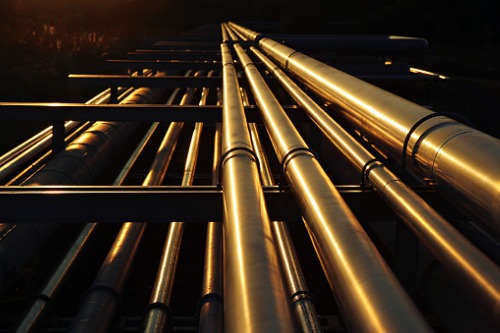

Edmonton has endured economic headwinds of late, but should the newly-greenlit Trans Mountain pipeline commence construction, those days will be firmly in the rear-view mirror.

“Now that we have pipeline approval—that was the headwind that had influenced the market—the headwind is still that the proof is in the pudding,” said Matthew Boukall, vice president of product management and data solutions at Altus Group. “We want to see construction happen because approvals haven’t necessarily meant construction in the past. Consumer confidence will revolve around whether or not the pipeline actually goes ahead.”

That said, Altus Group’s Edmonton Flash Report 2019 forecasts a stronger market through the remainder of the year.

“We’re expecting more strength in the market; it was a slow start to the year because of a number of factors, including the election, a horrible winter and general market malaise,” said Boukall. “But we’ve seen strength coming into the resale market and there’s a new condo project launching downtown right now and it’s driving a bit of market demand. We’re optimistic that the market will start to improve a little bit.”

The Canadian Federation of Independent Business’s (CFIB) business confidence index shows there was a notable increase in Alberta in May and June, bringing it to mid-2017 levels, the strongest it’s been since a steep plummet in 2016.

Gordon McCallum, founder, president and CEO of Edmonton-based First Foundation, says that while it takes a while for optimism to turn into investment, CFIB’s assessment is welcome news nonetheless.

Still, he calls for measured optimism.

“It looks to me as though sales for 2019 are still below 2017 and 2018 numbers for both homes and condos,” said McCallum. “The concern I still have is employment; it’s the biggest factor. Our unemployment rate is 6.8% in Edmonton, which is quite a bit higher than the national average of 5.4% and well below the 4.5% range we’ve been in for a decade when things were going well here. It’s a concern weighing on a lot of people’s minds.”

Capital expenditure is down 38.9% from its 2014 peak and still declining, and McCallum believes good policy—or lack thereof—has a lot to do with why.

“It’s expected to come in at $59.7 billion in 2019. It was $97.8b in 2014—that’s almost a $40b drop in investment annually in the province of Alberta,” McCallum said of capital expenditure. “Policy matters and if the provincial and federal governments send a message to the marketplace that it’s an anti-business environment, it makes it harder to attract investment into the region and the resulting job loss and slower economy are predictable. Bad stuff happens and markets are cyclical, but governments can make the situation better or worse depending on how they react.”