Jump to winners | Jump to methodology

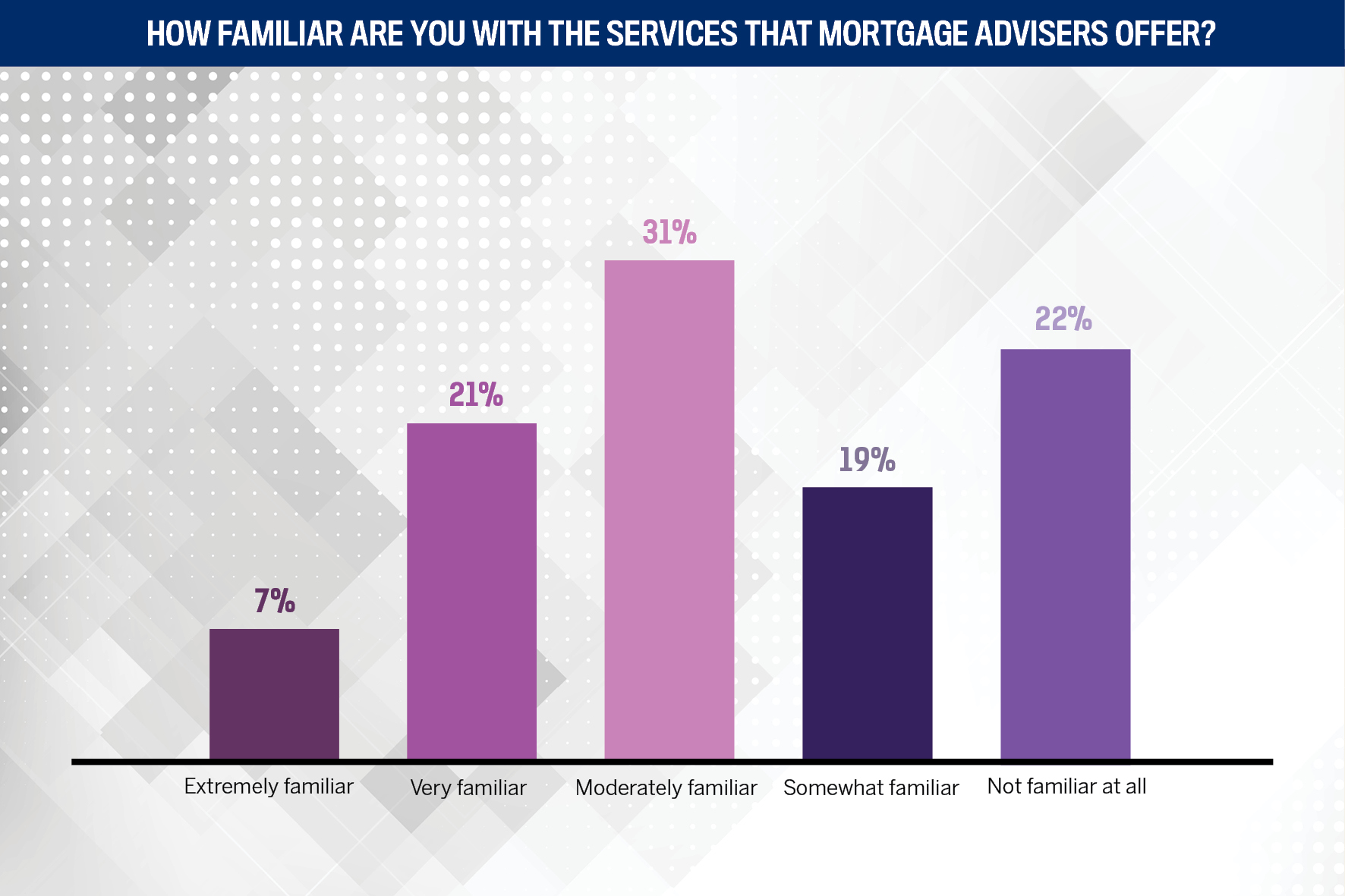

New Zealand’s fastest-growing mortgage brokerages are driving notable growth in the adviser channel despite low public awareness, with only 28% of Kiwis highly aware of their services, according to an inaugural study from the fledgling Finance and Mortgage Advisers Association of New Zealand (FAMNZ).

This recent industry statistic alone highlights how effective NZ Adviser’s Fast Brokerages of 2024 are at winning clients with the right mix of education and trust.

Leigh Hodgetts, country manager of FAMNZ, says, “One of the key attributes that top-performing mortgage advisers demonstrate is that they have built great trust and are very client-centric in their approach to business.

“They need to be professionals, experts in their field and embrace technology to connect with clients and deliver efficient services in a timely manner. Relationships are everything in this business.”

The FAMNZ Consumer Access to Mortgages 2024 report also discovered that nearly half – 46% – of borrowers who took out a mortgage in the last 12 months reported applying for a mortgage through a mortgage adviser.

That is higher than the rate of all borrowers, including the last 12 months and any period before, which sits at 35%. This 11% increase in channel market share highlights significant growth in the mortgage advice channel.

The report also found:

46% of recent mortgage applicants used advisers, up from 35% previously

87% satisfaction among adviser clients, higher than 80% for proprietary channels

86% trust advisers, with 41% expressing complete trust

44% of borrowers plan to use advisers for future transactions

49% of future first-time buyers prefer advisers

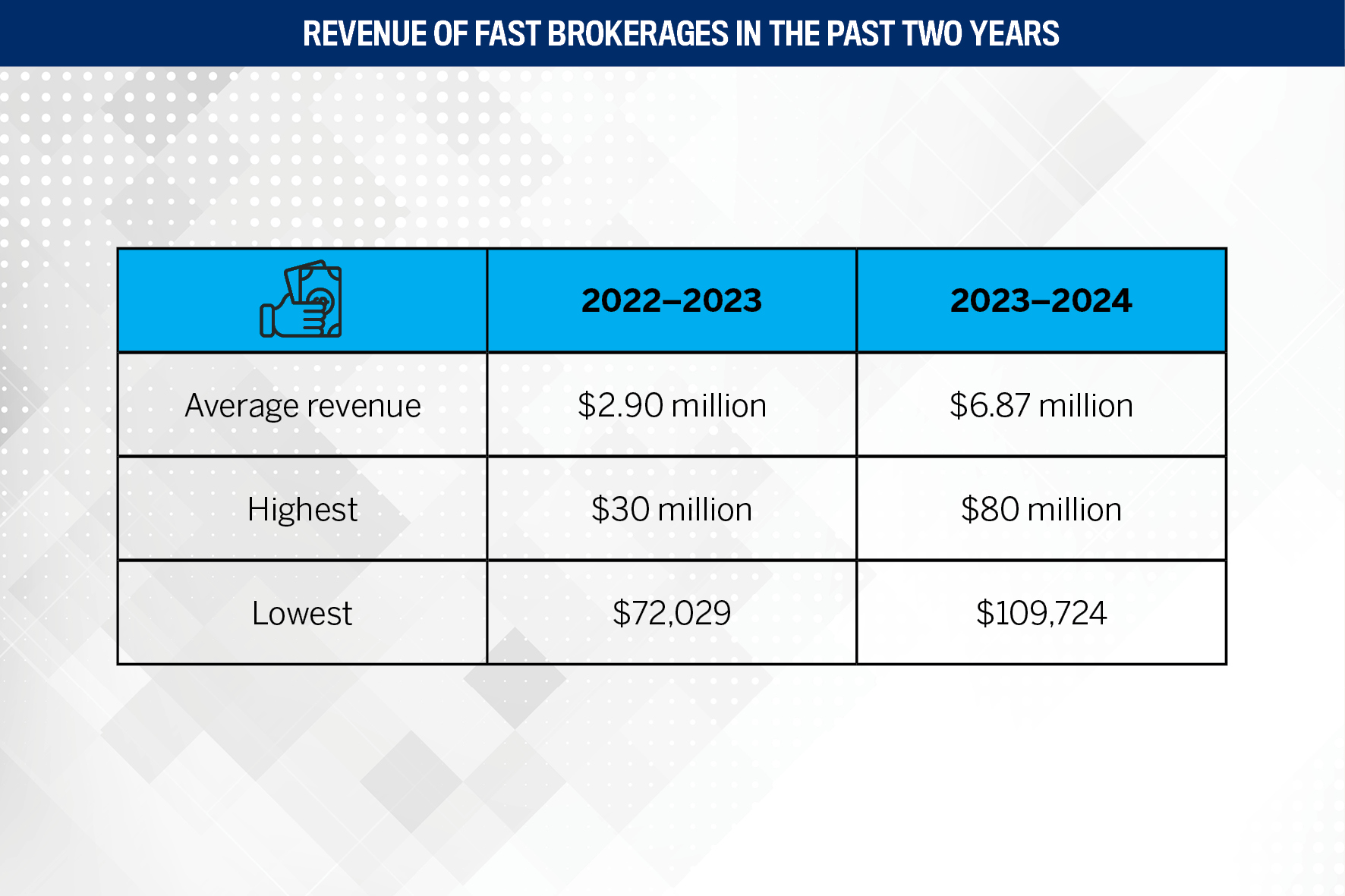

These positive numbers are driven by the sector’s top performers, who are featured in the fourth annual Fast Brokerages awards. NZA invited submissions from mortgage brokerages, asking for data on revenues, settlement volumes and growth milestones for the 2022/23 and 2023/24 financial years.

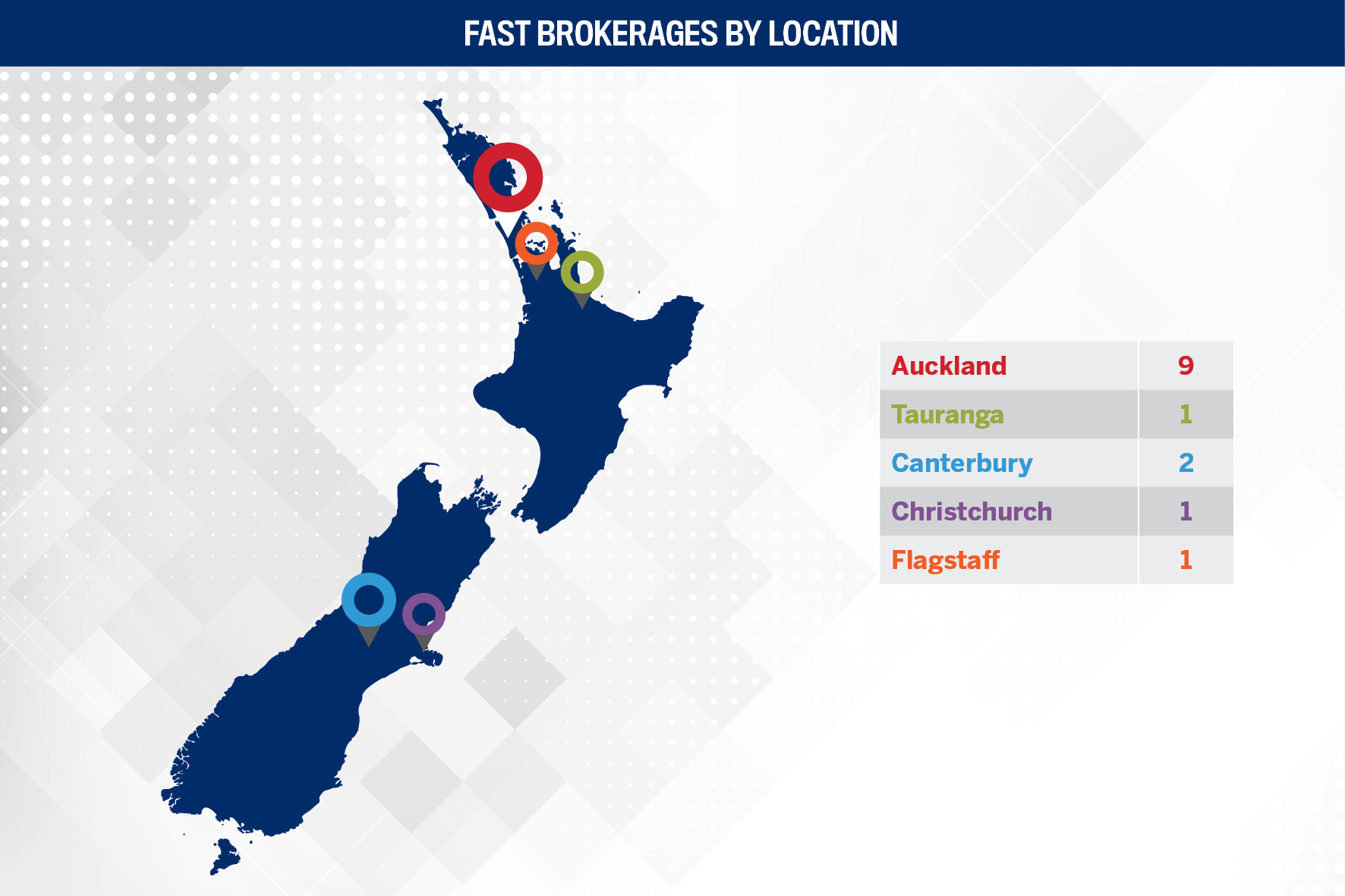

Brokerages achieving over 30% growth in combined revenue and settlement volume were recognised, with 14 brokerages making the final list. NZA also highlighted seven Fast Starters, new brokerages less than three years old, that have already made their mark in the mortgage industry.

Over the two financial years of the survey, the fastest-growing mortgage brokerages have achieved an average:

141% in settlement volume growth

99% in revenue growth

177.71% increase in settlement and revenue growth among seven Fast Starters

Hodgetts also highlights that mortgage advisers are finding success on social media.

She says, “It’s a cost-effective way to build your brand, show who you are, what services you provide and start connecting with more people. LinkedIn, Instagram, YouTube, Facebook and TikTok are being used more broadly by mortgage advisers to connect with their existing and potential customers.

“Generally, advisers select the platforms that their target audience uses to get the best following. Short videos or reels, personalised images/photos and messages seem to be popular now, and it gives potential customers the opportunity to see who you are and if they want to connect to do business.”

83.38% average revenue and settlement growth | Fast Starter

Recognised as Fast Brokerage and Fast Starter for its impressive growth in less than three years, the brokerage has opened its first office in southeast Auckland and employs four mortgage industry professionals.

It is currently on a mission to:

attract new talent who are values-focused

expand its offering further with the recent addition of an insurance arm

“We run a values-driven business, and the three values that resonate with me are transparency, sustainability and collaboration,” says founder and financial adviser Ankur Bajaj, also named one of NZA’s Top 25 Brokers in 2024 and a New Zealand Mortgage Awards double excellence award-winner for new adviser and brokerage of the year in 2024.

When Bajaj talks about transparency, he ensures it runs through every aspect of the brokerage to build client loyalty and stability. That commitment leads to sustainability, based on a foundation of working with clients and partners to achieve the best possible results.

The fast-growing mortgage brokerage emphasises trust, integrity and ethical business practices, which has driven a solid base of referrals.

“We’ve kept that trust front of mind, whether it’s with the client, stakeholder or bank; we’ve been vocal about what we do and how we add value, rather than keeping that secret to ourselves,” Bajaj adds. “That gives us the ability to put ourselves out there and let people know the business practices we are implementing, and I think that resonates with many people.”

With a banking background, Bajaj naturally leans into assisting first home buyers, investors and development clients. The brokerage has leveraged social media from day one to connect with clients, highlighting the exceptional efforts of its freelance social media manager.

Over the past year, Bajaj has learned that there is no one-size-fits-all approach, and risk appetites vary. As such, he and his team tailor lending solutions to each client, ensuring they offer a flexible and customised approach that meets clients’ needs in a changing environment.

“Holding our brand high in the market and focusing on our reputation has been our biggest strategy,” he says. “I’m a big believer that this country survives on word of mouth, having been in New Zealand for 16 years. Social media will give you awareness, but people will only be confident in giving you a shot when someone’s put in a word for you.”

280.71% average revenue and settlement growth | Fast Starter

The Fast Starter has come a long way since the early days of operating out of a small, rented office in Kingsland, providing asset finance for vehicle loans.

The past two years saw an expansion of Finance Bloom services from a base in Auckland, with founder Aditya Bhardwaj serving as the sole mortgage adviser for construction loans, development finance and first home buyers, and leadership team member Arsh Kaur specialising in asset finance.

“When we opened Finance Bloom, the word bloom came to mind because we wanted to see our clients grow,” Bhardwaj says. “Our slogan is ‘Let’s grow together,’ and that’s our main motive for every client.”

The brokerage’s fast growth has been fuelled by an entrepreneurial spirit that puts clients at the centre of its strategies, which include:

providing tailored advice

going the extra mile to help clients achieve their dreams

maintaining top-tier service, evidenced by its 5-star Google rating

carefully qualifying clients to ensure positive outcomes

giving each client a fresh indoor plant as a gesture of goodwill

“Our main priority is to give free advice and guidance with no obligation,” Bhardwaj says. “We can work with clients for years to get a deal done, such as one that’s been ongoing for two-and-a-half years.”

Bhardwaj emphasises client education and awareness as a key driver to the brokerage’s fast growth. He regularly networks with industry professionals, participates in seminars and utilises social media to simplify the complex lending landscape of deposits and interest rates for current and potential clients.

With nearly eight years in banking and compliance and just as long working in the hospitality sector, Bhardwaj has an in-depth understanding of finance coupled with strong customer service skills.

This blend helps him identify and accurately meet clients’ needs while building long-term relationships that prioritise value over transactions.

He says, “I’m open with my clients and don’t give them false hope, even if that means a loss for me. This is what sets us apart in the industry.”

By zeroing in on what a client wants to achieve, Bhardwaj believes that if he is on the same track with his advice, they will arrive at the same destination.

Kaur Mortgages & Services

107.62% average revenue and settlement growth | Fast Starter

In less than three years, the Tauranga-based brokerage has blazed trails in the first home buyers’ market and kiwifruit orchard lending.

Kaur Mortgages & Services founder and financial adviser Shaihnaz Kaur has earned repeated recognition since joining the industry. This includes being named on NZA’s Elite Women of 2024 list and being named an excellence awardee for brokerage and adviser of the year in 2023 and 2024 and specialist lending in 2023 at the New Zealand Mortgage Awards.

“My business is growing very organically,” she says. “It’s a nice pace of growth because I can learn a lot. The community is interconnected here, and I’ve lived here for over 20 years, so people know and trust me.”

Refining and optimising the brokerage’s processes has been the most important strategy driving fast growth, along with:

creating a smooth workflow to consistently achieve desired results

client-focused philosophy

prioritising clients’ needs and interests at every step of the journey

“Consistency has been key for me, and I always put myself in the customer’s shoes, thinking about what information I would need from my financial adviser as a first home buyer and how I want to be treated,” says Kaur.

With about 90% of her book coming from first home buyers, Kaur’s dedication to educating clients to make informed decisions has fuelled a steady referral base.

She says, “Most of my clients come from word of mouth. I also speak Hindi and Punjabi, and that’s been quite helpful with someone when English is not their first language. That’s become a bit of a niche for me.”

Kaur takes the time to carefully explain the home-buying process to clients, ensuring they understand their options. She also creates informative videos for social media in her native language, breaking down complex subject matter such as economic and industry updates.

“I found that people appreciate this because it also makes them aware of what we do and the services we provide,” she says. “I tend to go above and beyond because I genuinely care about my clients.”

NZ Adviser invited submissions for its fourth annual Fast Brokerages awards on 5 August 2024 as the publication sought to recognise New Zealand’s fastest-growing mortgage brokerages. The research team asked brokerages to list their revenues and settlement volumes for the 2022/23 and 2023/24 financial years, in addition to other growth milestones.

The NZA team then evaluated the nominations to determine which brokerages performed outstandingly. Those that achieved over 30% growth in combined revenue and settlement volume were given awards.

A total of 14 brokerages made the final list this year. NZA also highlights seven brokerages as Fast Starters – those that have been in business for less than three years but have already made their mark in the mortgage landscape. All of these brokerages have confirmed their resilience and cemented their position in the New Zealand mortgage industry.