Jump to winners | Jump to methodology

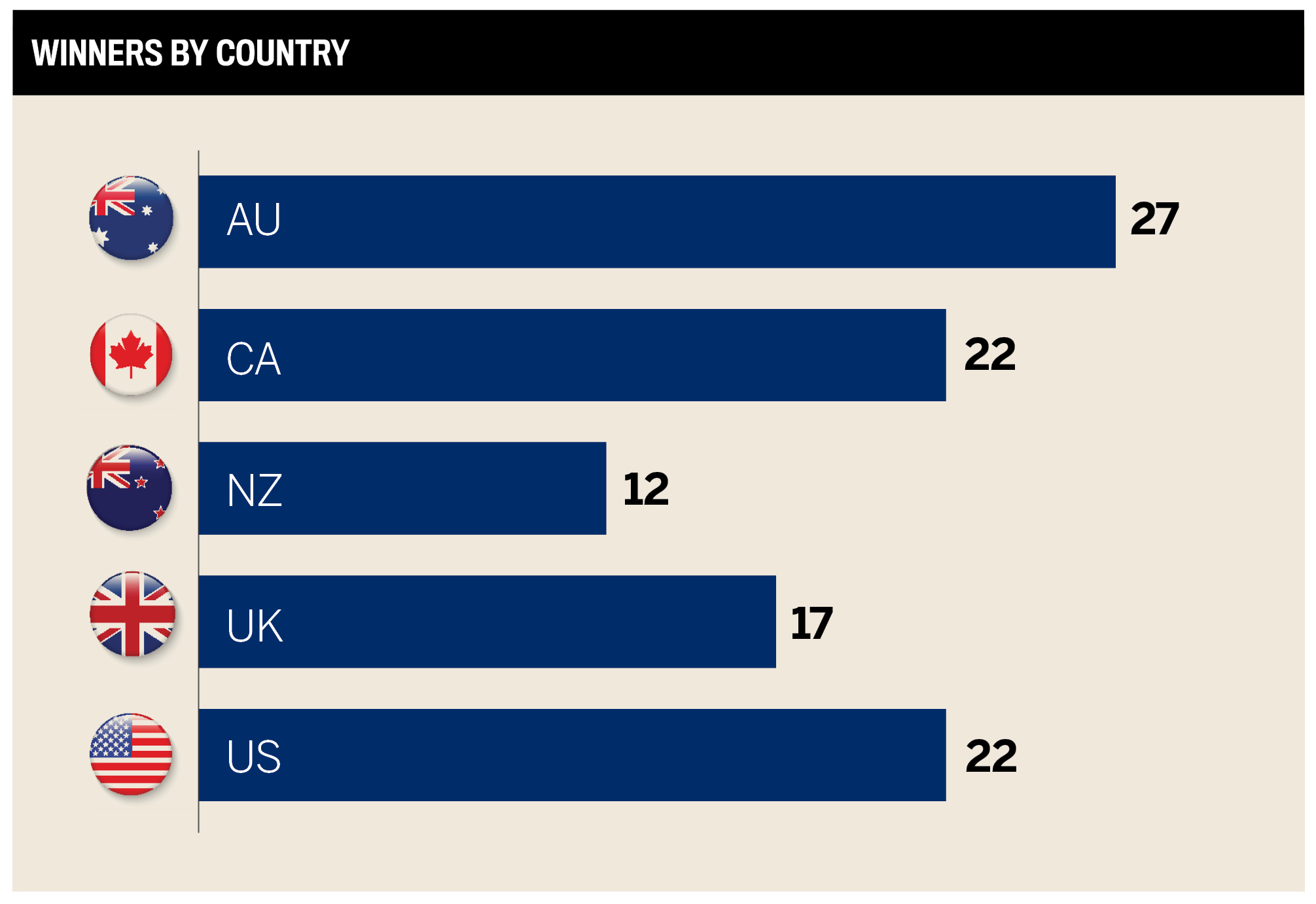

The best 100 mortgage professionals have been selected across five key markets as Mortgage Professional America, along with its sister publications, Canadian Mortgage Professional, Mortgage Introducer, Mortgage Professional Australia and NZ Adviser, leverages its status as a global publication.

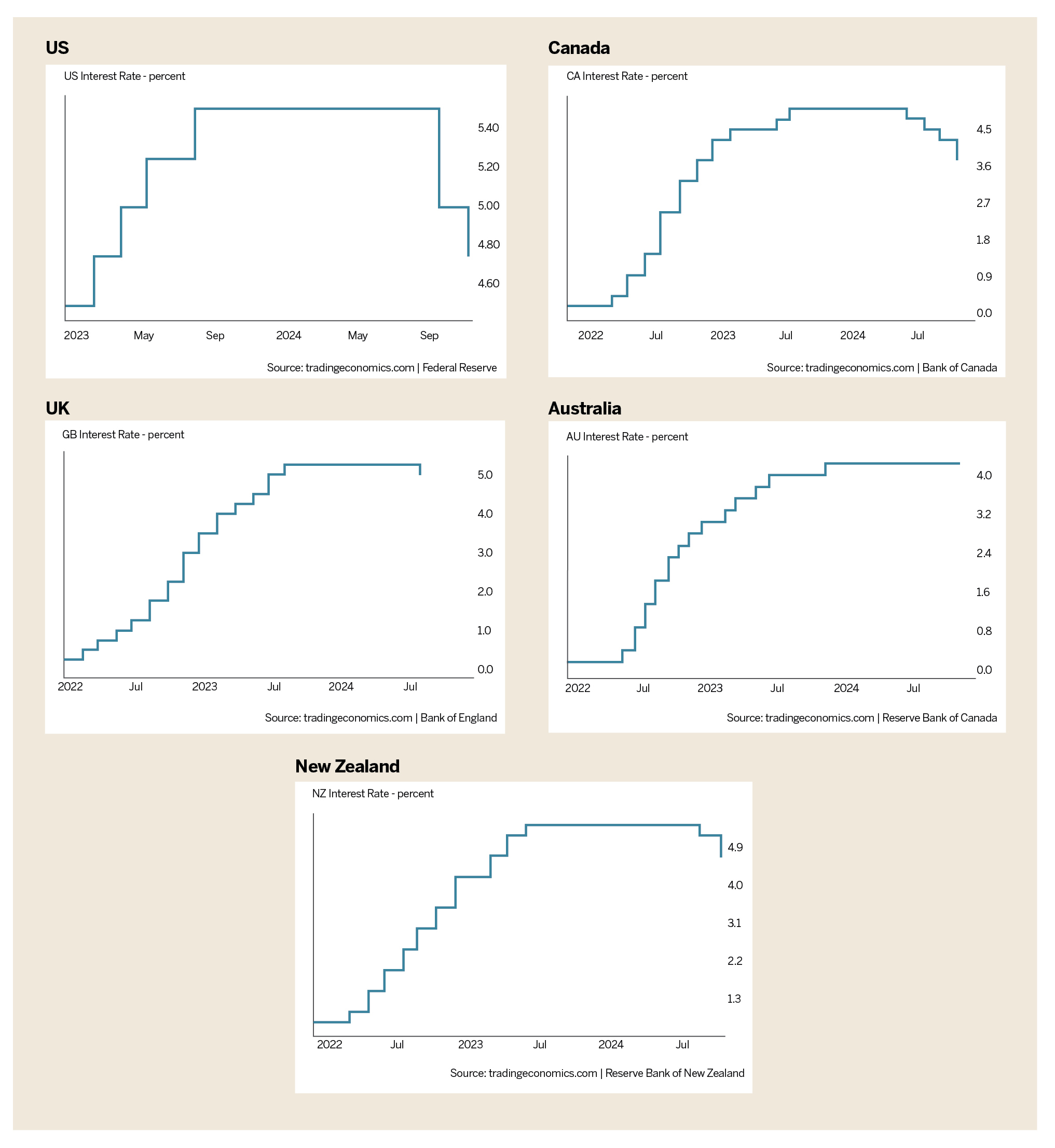

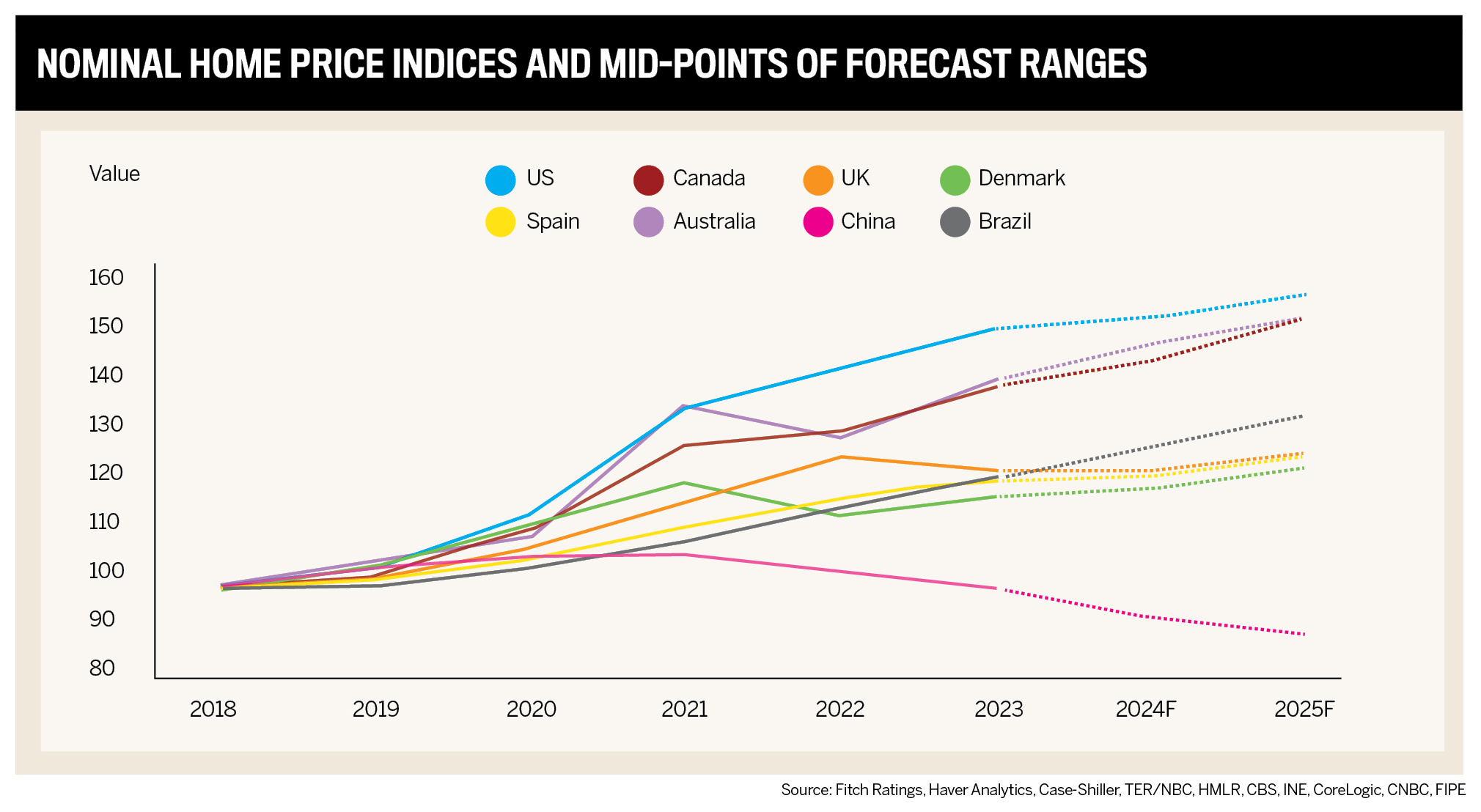

All of the professionals who made the prestigious list have had to contend with the highest interest rates in two decades. All five of the markets weathered the storm of high rates before minor reductions began in the latter part of 2024.

During this period, the Global 100 have devised ways to enable brokers to diversify, created educations programs for both brokers and clients and also introduced new technology to enable more efficient and quicker mortgage decisions. They have all played a part in making the industry respond to the challenges of 2024 and come out stronger.

This trajectory has meant mortgage professionals have had to be innovative and proactive, as high interest rates prevailed until a gradual decline in the second half of 2024.

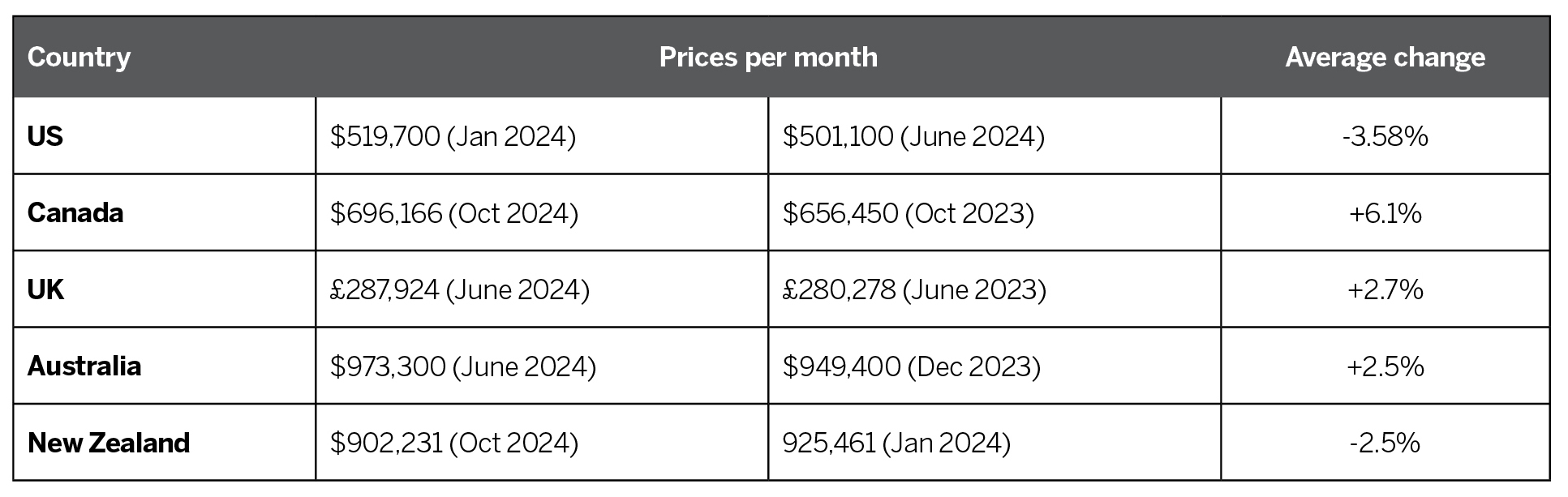

Average house prices also moved by approximately 3% in each of the markets, apart from Canada, which is the outlier with a jump of 6.1%.

Speaking about the brokers, Anja Pannek, CEO of the MFAA, stresses the need to remain current.

“The broking industry operates in an incredibly dynamic environment, with regulatory requirements in Australia being principles-based,” she says. “This combination of factors means that, as a broker, staying connected and up to date is critical. At its core, education is essential to our ability to self-regulate, identifying where there are opportunities to improve, addressing key issues and providing clarity to our members.”

Rachel Edwards, senior policy advisor at the Association of Mortgage Intermediaries, describes the top professionals as “requiring the use of many hats” along with technical expertise and ethical standards.

She says, “Outside of these core pillars, there are many other characteristics that are invaluable to a mortgage profession. The last few years with regard to the pandemic and the unstable economy have shown that resilience and adaptability are crucial, and the rollout of consumer duty shows us that mortgage professionals with a consumer-centric approach will feel the benefits of repeat business.”

To gain an insight into how the top mortgage professionals have navigated the market over the past 12 months, we spoke to seven of the Global 100:

Simon Bednar – CEO, Finsure, Australia

Cory Bannister – Senior vice president and chief lending officer, La Trobe Financial, Australia

Tom Ahles – Co-founder, Edge Home Finance, United States

Tony MacRae – Chief commercial officer, Bluestone Home Loans, Australia

Darren Kasehagen – General manager of third-party banking, Bendigo and Adelaide Bank, Australia

Rene Quercia – Senior vice president, broker channel, HomeEquity Bank, Canada

Belinda Wright – Head of partnerships and distribution, Thinktank, Australia

Satyan Mehra – Director and chief adviser, iConsult, New Zealand

Laura Te Kaat – Mobile mortgage adviser, The Mortgage Girls, New Zealand

Bednar lists that the biggest challenge he has overcome is interest rates and their impact on customers affordability.

“What we’re finding is that it’s becoming tougher and tougher for brokers to be able to help customers because they’re effectively tapped out,” he says.

To aid the broking community in such a tough time, Finsure represents 3,700 brokers. Bednar has led calls for a change in the Australian clawback system. If a loan is refinanced within a year, the broker returns 100% of their commission, and within two years, the broker returns 50%.

He says, “We’re starting to see lenders now step down their clawbacks instead of having an absolute cliff. So, every month, it’s slightly less, and while the broker still gets clawed back, it doesn’t necessarily mean at such a high number. That’s just money back in their pocket because they’ve done the work.”

While there’s been economic uncertainty over the past years, La Trobe has been able to thrive. The non-bank relies on brokers for 97% of its originations.

Bannister says, “Brokers have the ability to tap non-bank, and their experience and expertise can send them our way. It’s been an incredible time for a non-bank here in Australia, but equally, we get to show our value proposition, which is we’re able to lean into segments of the market when others, the mainstream banks, are probably leaning back.”

This initiative has been crucial for La Trobe to help clients secure mortgages in Australia, where there is an undersupply of housing, with the government focused on changing that.

“However, the credit availability for that housing is just not there at the moment, outside of the non-banks. We’ve really been leading the way in trying to lean in and assist to repair that shortage of housing in Australia,” says Bannister.

Looking back at the last 12 months, Bannister describes his team’s performance as “phenomenal.” This is underlined by both banks and non-banks in Australia having to operate in such uncertain times.

He says, “For various reasons, they have had to hit the accelerator and hit the brake at various times, but we’ve been able to play consistently for the last 12 months, which we’re very proud of, and been able to keep that flow going to the areas of the economy that need it the most.”

Another Hot List 100 member who has experienced rapid growth is Ahles.

Home Edge Finance has grown to become among the largest independent mortgage brokerages in the US, closing $6.9 billion in production over the trailing 14 months.

The challenge has been to maintain a personalised, relationship-driven approach by:

leveraging technology

fostering a collaborative team culture

staying focused on goals

“We implemented AI and offshore support to streamline non-customer-facing tasks, which allowed our loan officers to concentrate on building client relationships. I also emphasised regular communication with our team, hosting weekly calls and webinars to align on priorities and reinforce our mission,” says Ahles. “This approach ensured we could scale without sacrificing the high-touch service that has made us successful.”

Personally, Ahles concentrated on strategic leadership and focused on expanding partnerships with over 150 lenders, refining processes, and creating platforms such as weekly webinars to engage and educate.

He says, “I also worked to help retail originators see the benefits of the broker channel, which is a cause I’m deeply passionate about.”

To be an even better leader, Ahles prioritised improving his health, which had taken a backseat during a busy period of growth, by starting a consistent workout routine to boost his physical well-being and sharpen his mental clarity.

MacRae is another mortgage professional who has seized the opportunity to make an impact. With brokers struggling to find loans and clients wary of the cost of living, he put his efforts into providing options.

He says, “At Bluestone, we recognise that not everything is smooth sailing for all customers, and we look below the numbers to actually understand the circumstances and, where possible, find a solution.”

The way that MacRae has gone about this is to connect with brokers directly.

“One of our real challenges is educating brokers so they know that these solutions are available. I go out and speak to brokers, and often at the end of conversations that BDMs and myself will have, the broker will go, ‘I’ve been letting some of this business just walk out or walk by my door’,” he says. “The real challenge is ensuring we're educating more brokers on the solutions that we’re able to provide, which allows them to help more customers and grow their business."

Pushing the envelope has also occupied Kasehagen for the past year. Bendigo Bank has gone through an end-to-end transformation, with the third party division that he leads first to migrate to the new lending platform, which went live 12 months ago.

“It’s one that we built ourselves, that we control and will eventually roll out to all divisions, but it was decided that the broker-based and digital-based division I lead would be first,” Kasehagen says.

A major reason behind the new platform is to adjust Bendigo Bank’s typical customer towards families and to expand into the younger borrower cohort, as it historically has skewed towards older borrowers with larger deposits. Kasehagen feels the new platform is enabling the bank to position themselves more deliberately in the market.

“We’re trying to move away from promising to be able to do everything. That means telling some customers, ‘We might not be quite the bank for you, but if you are in our sweet spot, we are putting our money where our mouth is and giving you good service at the front end’,” he says. “We have independent analysis that we can verify that the platform we've built is in the top two fastest times to yes in the market.”

Another advantage that Kasehagen and his team now have is the ability to incorporate feedback directly into processes. Before, when working with a legacy platform, they were unable to make quick changes, especially important in a challenging market like 2024 has been.

He says, “We were able to adapt much quicker and easier and therefore respond far better than we could have been previously. The feedback comes in, we can react to that quicker and become better, and then we actually get better outcomes. Whereas previously we were always listening, but it was a lot harder to make changes.”

Leading transformation was also the challenge that Quercia faced in 2024 at HomeEquity Bank, which focuses solely on the needs of homeowners 55 and over.

The importance of this group is evident as they comprise one-third of the population, with 70% owning real estate, many of whom are entering retirement and seeking financial solutions.

Quercia plotted a course and successfully revamped the broker servicing model by assigning BDMs to key broker relationships, enabling them to dedicate more time and deliver value-added support to help brokers grow their reverse mortgage business.

“Additionally, we introduced the Business Development Associate (BDA) role to serve as an inside sales team, proactively engaging brokers, educating them on our products, and equipping them to better advise Canadians aged 55 plus,” says Quercia. “Internally, we collaborated with our credit operations partners to realign underwriters to work directly with brokers, fostering stronger relationships and streamlining file submissions and approvals.”

Despite the scope of these changes, the team embraced them and achieved record-breaking growth in originations.

A crucial initiative that has helped the industry weather high interest rates and a greater focus on ESG has been providing education.

Edwards from the Association of Mortgage Intermediaries says, “Offering education to colleagues and fellow professionals in the mortgage industry is not just about improving individual skill sets – it’s about fostering an environment where innovation, compliance and ethical practices thrive. This ensures the industry remains resilient, adaptable and aligned with the needs of consumers and the broader economy.”

Another member of the Global 100 who is helping drive momentum in the industry and be there for brokers is Wright. She is behind a push to enable residential brokers to diversify into the commercial and self-managed super fund (SMSF) space. Typically, they have found this hard due to the differences in processes.

Wright says, “The broker finds it challenging to learn and feel confident speaking to their clients about commercial lending when the commercial RMs or BDMs maybe haven’t really explained it very well to them or explained it in plain language. What we’ve implemented are a lot of education programs, and our team on the ground now hand-holds the broker to write the commercial business and give them that confidence.”

The Thinktank team even goes to referral partners and speaks to accountants or financial planners with the broker as support.

Wright is also actively injecting a greater awareness of inclusion into the industry. The MFAA data shows the proportion of female brokers in the industry sits at 25%.

Wright recounts a recent meeting where she was the only female around the table.

“It’s something that needs to shift around not only helping women but also educating the men about the language they use and sometimes the unconscious bias they have when they're recruiting for leadership or for brokers,” she says.

Mehra has found himself perfectly placed to deal with the high interest period at the start of 2024 and also as rates have cooled. This is down to his strict adherence to a person-first approach.

He applies this to himself when, at 19, with a deposit and a permanent income from his job at a bank, he was declined three times for a mortgage.

“It’s about putting yourself in the shoes of your client and seeing where they want to be and getting the right outcome. That often involves telling clients what they don’t want to hear and having those tough conversations,” says Mehra. “I want to understand how I can navigate them on that journey, and if I see pitfalls and shortfalls, it’s my role to point them out.”

With rates dropping and more clients requiring his services, Mehra has put a lot of focus in the past 12 months on upskilling his team. This is so he can be sure that all clients will receive top-tier service, particularly necessary during the changeable conditions across 2024.

He says, “I’ve got the right people in my team, and I’ve been putting a lot of trust in them. If they make mistakes, I step in immediately to fix them, and that’s how you learn.

“We continue to deliver similar experiences and journeys for our clients while I am doing other things or onboarding more clients. I’m very focused on uplifting the overall knowledge of client service delivery within the team.”

Similarly finding herself well positioned is Te Kaat, as New Zealand has a relatively low broker penetration rate, at around 50%.

Over the past 12 months, she has been able to service a large demographic seeking expertise and independent advice.

Te Kaat says, “We notice mostly that first-time buyers will come to an adviser just for that advice piece and that hand-holding. The seasoned borrowers are still tending to go direct to the banks, but we are getting our foot in the door there.

“Interest rates are changing so fast, up and down, and people just want that advice. They want to know that what they’re doing or what they want to do is the right thing for them. We’re definitely seeing that in our growth, week on week, month on month and year on year, and it’s pretty crazy sometimes.”

It was a tough personal year for Te Kaat with a marriage separation and family bereavements. However, she has used these tough times in the last year to improve her service to clients, as it’s given her a new appreciation.

“I feel like you attract what you are, and I’ve attracted so many clients in the same position who really value the support because I was going through it too,” says Te Kaat. “I’ve had a lot of success in the marriage separation space, for example. I think that extra level of advice and empathy I now have is something my clients love and has really pushed me forward into being bigger and better.”

The Global 100 report shines a spotlight on outstanding professionals who are making a positive difference and helping drive change across the industry.

Now in its sixth year, this formidable list of the biggest names in the mortgage industry was put together by Mortgage Professional America and its sister publications, Canadian Mortgage Professional, Mortgage Introducer, Mortgage Professional Australia, and NZ Adviser, leveraging its unique position as a true global publication reaching five different markets – the US, Canada, Australia, New Zealand, and the UK.

The team collectively deals with hundreds, if not thousands, of mortgage professionals throughout the year for its daily newsletters, special reports and surveys, industry awards, and events. This range makes the team well-placed to tackle the intimidating task of whittling down the industry’s high achievers to just 100.

The leaders featured on this year’s Global 100 have been selected for their outstanding commitment to their companies and their people over the past 12 months. This exclusive list is a combination of renowned names and leaders within the market who have been making incredible advancements at their own companies, lifting associations to new heights, offering education to improve the industry, or championing key issues that seek to carry the sector into a new era.