Jump to winners | Jump to methodology

NZ Adviser recognises the Elite Women of 2024, an inspiring cohort of mortgage industry leaders who passionately articulate a vision for the future, one that is inclusive and where women of all backgrounds can thrive.

While this year’s winners have made significant contributions to their organisations, the wider industry and their communities, they also aspire to make a lasting impact by championing:

work-life balance: demonstrating that women can successfully balance family and a thriving career

diversity and inclusion: increasing the representation of Māori and Pacific women within the industry

innovation in personal finance: normalising the practice of seeking financial advice by having a financial adviser

mentoring: empowering women through mentorship to overcome challenges in the financial industry

Industry experts stress the importance of resiliency and the ability to navigate through change as crucial elements for standing out in an ever-evolving mortgage industry.

“The ability to bounce back from setbacks and maintain focus under pressure is essential in this competitive sector,” says Sharon Weymouth, head of people and culture at First Mortgage Trust. “This can be especially beneficial for women who often balance home life and work.”

ANZ Bank New Zealand CEO Antonia Watson says, “Having a strong personal purpose and connection to what you do helps you to become an outstanding performer.”

With a decade of experience in financial services, the mortgage adviser Zebunisso Alimova has established a franchise of Mike Pero Mortgages and now leads a team of three loan writers. As a mother of four children, Alimova proves that women can pursue a career while raising a family.

“My hope for the industry is to demonstrate that it’s possible for working mums to succeed,” says Alimova. “This industry needs more females because we are empathetic, which is especially useful when dealing with tricky situations.”

Alimova’s accomplishments are a testament to her dedication and commitment to excellence:

staying ahead of the curve by implementing innovative mortgage solutions and leveraging technology to simplify client processes

fostering an environment where talent and potential are valued over stereotypes

promoting financial literacy

“I’m a big believer in how your mindset can change the trajectory of your life,” she says. “When I help people go from thinking their goal is impossible to achieving their dream of buying a house, it’s exciting.”

Never one to give up, Alimova believes there’s a solution to every problem. She has honed these approaches, which have helped her succeed by:

anticipating clients’ needs and devising solutions

always keeping the clients’ welfare in mind

Alimova says, “If I know that I’ve done 100% for the client, then I can sleep well at night.”

A chartered accountant by trade who has worked for regulators within the financial markets industry, Ballantyne joined Liberty in May 2022. As the general manager of operations, compliance and finance, she supports a national group of over 80 mortgage advisers to develop, grow and add value to their businesses.

A thoughtful and compassionate leader who considers her role a privilege, Ballantyne invests considerable time, energy and care into the wellbeing and development of her team.

“What drives me is being able to support female leaders in the business and our franchise networks, especially Māori and Pacific women, who come from cultures that are some of our most vulnerable regarding financial literacy and advice,” she says. “I hope to encourage and see that representation double in the industry.”

Ballantyne’s achievements reflect her unwavering pursuit of excellence:

being recognised as a valued expert in the mortgage industry, regulatory landscape and franchise models

possessing a superpower in building connections and alignment within an organisation

developing industry-leading governance frameworks that support Financial Advice Provider (FAP) licence holders to meet their obligations

“I learned firsthand the impact of having an advocate who believes in you, and having that foundation helped me grow as a leader and prioritise time for people who need support and advocacy,” Ballantyne says.

Her most successful strategies of continuous learning and a growth mindset have served her well professionally and personally, as well as:

persisting through challenges

taking feedback on board

Ballantyne says, “It’s tough in this industry for women, so surround yourself with the people who inspire you to do better and cheer you on.”

After starting with MyFuture in 2016 as an adviser, Maloney took over sole ownership of the business in 2020 and has grown the team to seven members while raising her two children.

Driven by a passion for building long-term wealth creation plans for clients, she articulates a clear vision for the future of normalising the financial adviser role for the public.

“We want to create a cultural shift and make it normal for people to have a financial adviser,” she says. “If I had a financial adviser in my 20s, my life would be very different right now.”

Maloney’s educational achievements showcase her passion for the industry:

earning a first-class honours MBA, majoring in finance and marketing

completing the investment and insurance strand of the residential lending certificate

contributing 1% of company revenue to Y for YOUTH, a non-profit she founded that provides New Zealand youth organisations access to sustainable funding

“We don’t do transactional relationships; we are in this long term on the client’s wealth creation journey,” Maloney says. “I have a small network who I consider close friends, but I get so much engagement from my work because I’m invested in my clients’ lives.”

The financial advice advocate feels a sense of excitement about what each day will bring.

She says, “My personal value system drives my success strategies for excelling in everything we’re doing.”

After eight years in the financial industry, Wilson branched out on her own in 2021, establishing a boutique mortgage business. As an entrepreneur and Elite Woman, the mortgage adviser welcomes the opportunity to share her success with aspiring young women aiming to make their mark in the industry.

“I have seen where the gaps are in the market, particularly in mentorship of young women, because I had minimal mentorship and support when I was coming through,” Wilson says. “I want to support the younger, driven, successful women by nurturing and encouraging them to discover their potential.”

Wilson’s track record of community involvement showcases her leadership:

serving as co-president of the Taranaki Young Professional committee for four years

serving as an On the House Taranaki board member

being a high-impact fundraiser for Roderique Hope Trust in New Plymouth

“I just love going through the journey with my clients, educating them and being a sounding board,” she says. “Seeing the joy it brings them when they’ve achieved whatever they set out is very rewarding.”

Challenges are necessary to grow professionally, and Wilson emphasises a strategy to seize every opportunity. Other approaches that have enabled her to stand out include:

continuously moving forward and finding solutions

learning from mistakes and failures

“I’ve learned heaps of business lessons in the last year, and I had to go through them all to evolve myself and my business,” Wilson says.

These women leaders in mortgage have faced industry challenges and overcome obstacles unique to them.

Alimova: “You have to work outside of the challenging environment we’ve had in New Zealand and the world in the last few years and tap into your skills to help your clients find solutions, figuring out the next steps for them financially.”

Ballantyne: “2023 and even the past three years have brought so much uncertainty. For me, being able to coach people to be intentional with their time by setting clear goals and action plans to help them achieve is how I’ve overcome some of those challenges.”

Maloney: “The market downturn has been challenging, which is evident when we’re doing a client’s annual review and seeing things like devaluations and managed funds being down. I reassure them they’re doing the right things and that we’re here for the long haul – the good, the bad and the ugly.”

Wilson: “Having your own business is challenging because you are one person running it. I have to jump out of my comfort zone and touch base with other professionals to help with certain functions. I try to make connections with others in the industry and beyond.”

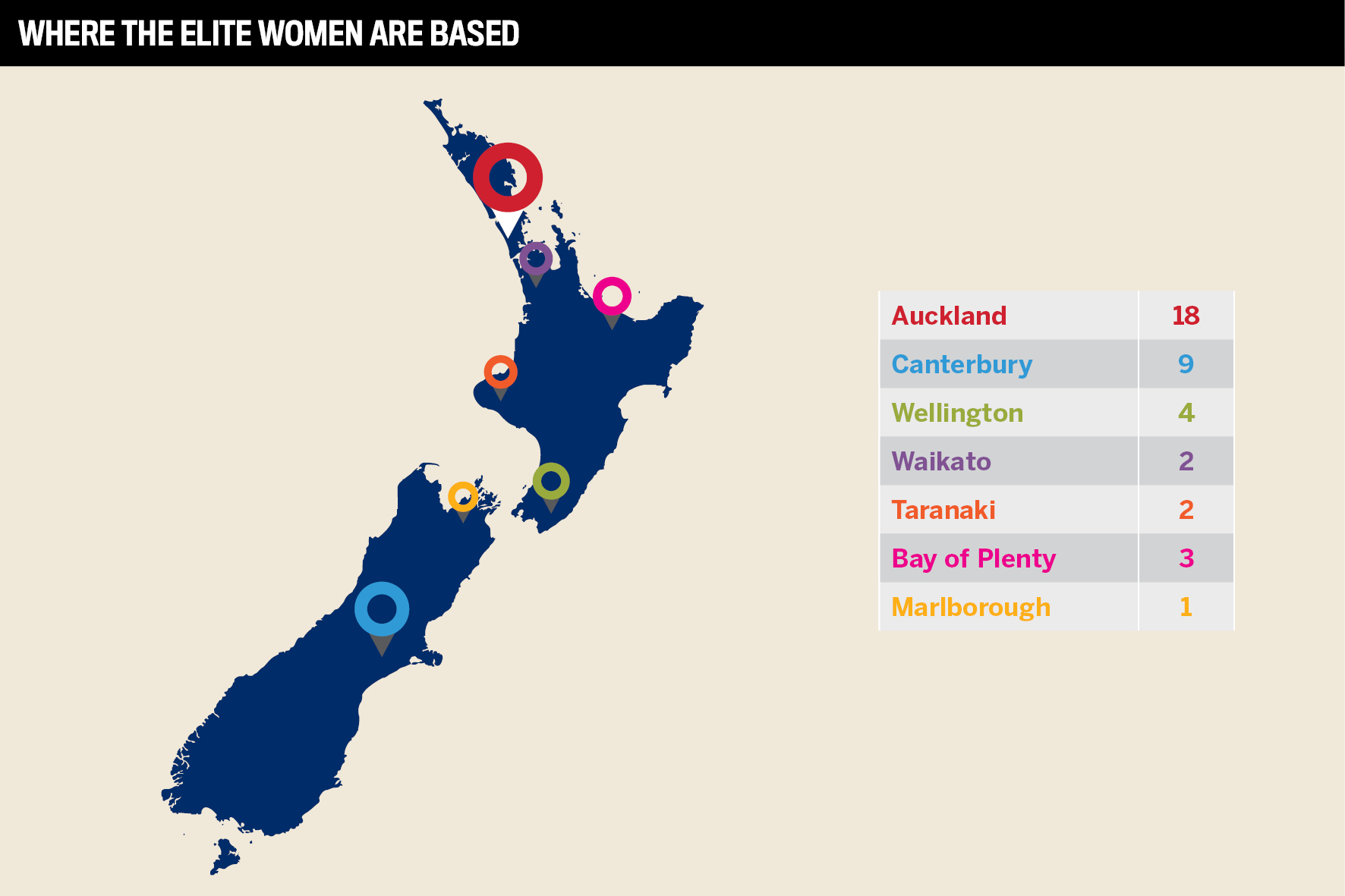

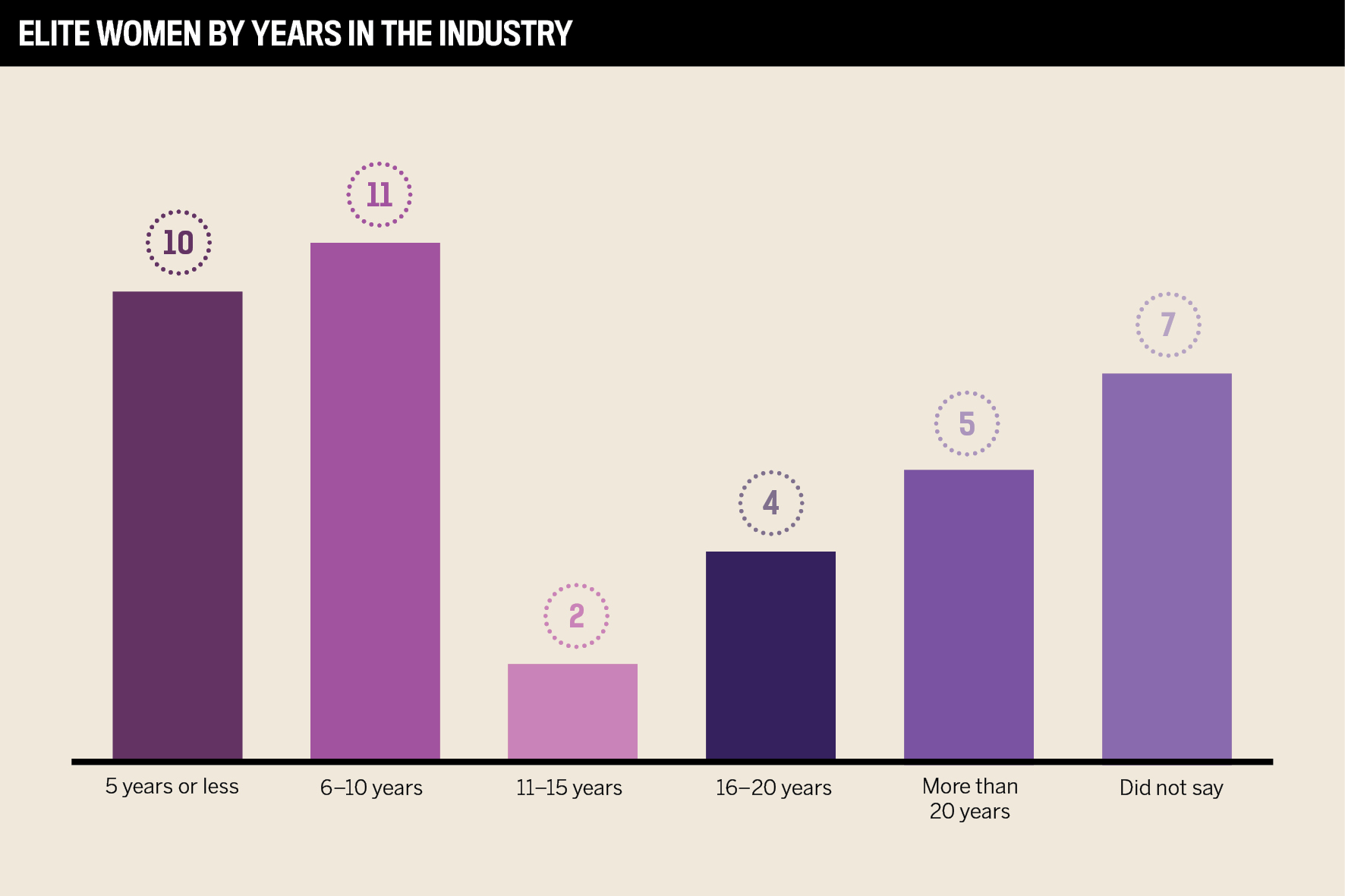

NZ Adviser invited mortgage professionals from across the country to nominate their most exceptional female leaders for its annual Elite Women 2024 list. Nominees had to be working in a role that related to, interacted with, or in some way impacted the industry and should have demonstrated a clear passion for their work.

Nominators were asked to describe the nominee’s standout professional achievements over the past 12 months, initiatives and innovations, and contributions to the mortgage industry.

After a thorough review of all the nominations, the NZ Adviser team narrowed down the list to the final 39 Elite Women who have made their mark in the industry.