ANZ moves forward cash rate forecast

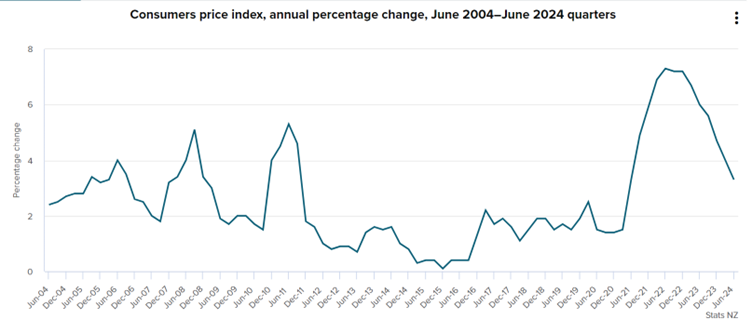

The latest inflation data has come in lower than expected, with New Zealand’s consumers price index (CPI) increasing 3.3% in the 12 months to the June 2024 quarter, according to figures released by Stats NZ today.

The figure is just above Reserve Bank of New Zealand’s (RBNZ) target range for consumer inflation is between 1%-3% and well below the June 2022 peak of 7.3%.

The June quarterly data follows the 4.0% increase in the previous quarter.

“The 3.3% annual price increase is below what was seen during the peak in 2022, and is similar to three years ago,” said Stats NZ consumers prices senior manager Nicola Growden (pictured above left).

With inflation rising after COVID-19 pandemic funding measures stimulated the NZ economy, the RBNZ hawkishly hiked the Official Cash Rate (OCR) to 5.50% to curb activity.

But with New Zealand entering a recessionary environment as the cost-of-living crisis bites causing rising mortgage arrears and financial stress, calls for a rate cut have amplified.

At July’s meeting, the RBNZ surprised markets and economists with its softened language around future cuts despite pausing the OCR on that occasion.

With the latest soft inflation numbers potentially acting as a harbinger of future rate cuts, Christopher Luxon (pictured above centre), prime minister of New Zealand, was quick to give a message to Kiwis.

“Inflation is down to 3.3%. We are turning our economy around and winning the fight against rampant inflation,” Luxon said. “So many folk are still struggling with the ongoing cost of living crisis.”

“Our work isn’t done yet and we’re committed to rebuilding our economy so that workers, businesses and families can get ahead.”

ANZ moves forward rate cut forecast

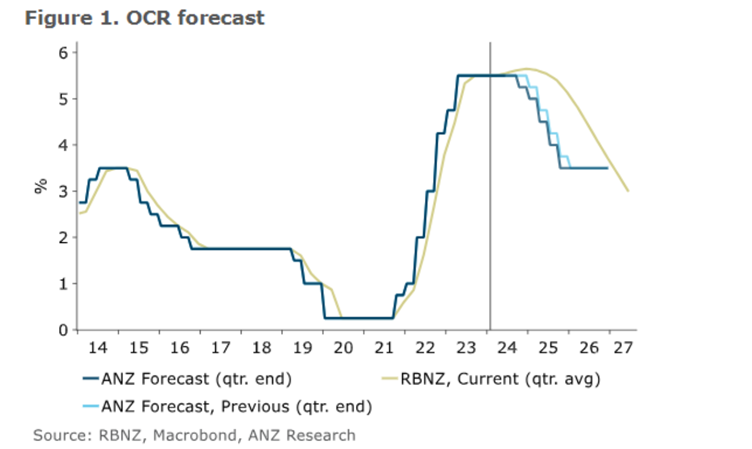

Following the announcement, ANZ brought forward its forecast timing of the first 25-basis-point cut in the Official Cash Rate (OCR) to November, rather than in February.

“We see the balance of risks around that as tilted towards earlier (October) rather than later,” said ANZ chief economist Sharon Zollner (pictured above right).

“Beyond that, we are forecasting a steady run of 25bp cuts at each meeting to a terminal rate of 3.5% as before.”

ANZ said today’s Q2 CPI data “should alleviate the RBNZ’s concerns” expressed in May about upside domestic inflation risks.

“While non-tradables did technically deliver a fifth consecutive upward surprise for the RBNZ (and us), it was small (0.1%pt), and as it happens, there was a one-off methodological change to the measurement of road user charges that added 0.13%pt,” said Zollner.

“There were plenty of details across the release showing inflation pressures are reducing.”

Zollner said there is an “enormously wide gulf” between the RBNZ’s May MPS forecast of no cuts until August 2025, and both market economists’ evolving forecasts and particularly current market pricing.

“But the RBNZ is not afraid to change its mind when the facts change.”

What was driving inflation?

Looking into the details of the inflation figures, housing and household utilities was the largest contributor to the annual inflation rate.

This was due to rising prices for rent, construction of new houses, and rates. Rent prices increased 4.8% in the 12 months to the June 2024 quarter, while construction of new houses and rates increased 3.0% and 9.6%, respectively.

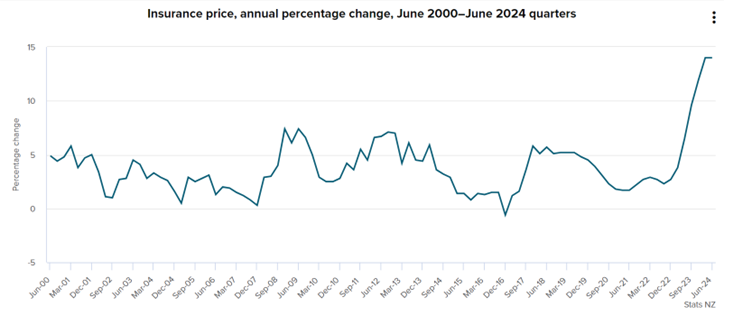

The next largest contributor to the annual increase was miscellaneous goods and services, due to rising prices for insurance.

Prices for insurance increased 14% in the 12 months to the June 2024 quarter, following a 14% increase in the 12 months to the March 2024 quarter.

“Insurance prices increased 14% annually to June 2024 – nearly double what we saw 15 years ago in June 2009, which was the previous highest peak in the series,” Growden said.

“Increases in dwelling and vehicle insurance premiums largely drove the higher insurance prices.”

Alcoholic beverages and tobacco was the next largest contributor, driven by rising prices for cigarettes and tobacco, and beer.

How far and fast will the cash rate drop?

A key question for the market is not only when the first cut will come, but also how quickly and how far the OCR will ease.

ANZ said it’s difficult to take a strong view on this at present.

“We have left in a simple 25bp cut at each meeting to a terminal rate of 3.5% for now, and will reassess the medium-term outlook when we undertake our quarterly forecast round in mid-August,” Zollner said.

“If the data continues to head south, the odds will increase that the RBNZ will have to cut below their estimate of neutral (long-run currently 2.75%) in order to minimise an inflation undershoot, all else equal - which it never is.”

ANZ said the market is pricing a “solid chance” of 50bp cuts in the months ahead, but large cuts are typically seen in response to sudden large negative economic shocks, rather than just weaker-than-expected starting point data.

“It could happen, of course, but it would likely require significant downward revisions to the RBNZ’s growth forecasts, which are currently very similar to our own,” Zollner said.

“An extra consideration for the November meeting is that there is then a three-month gap before another scheduled opportunity to move the OCR, whereas for the earlier meetings, it’s just a six-week gap.”