Are interest rate cuts driving optimism?

The Real Estate Institute of New Zealand (REINZ) has released its August 2024 figures, revealing a complex picture of a stabilising property market as sentiment improves.

REINZ chief executive Jen Baird (pictured left) highlighted the sense of stability in the market as the report noted signs of increased confidence, optimism, and activity compared to the previous year.

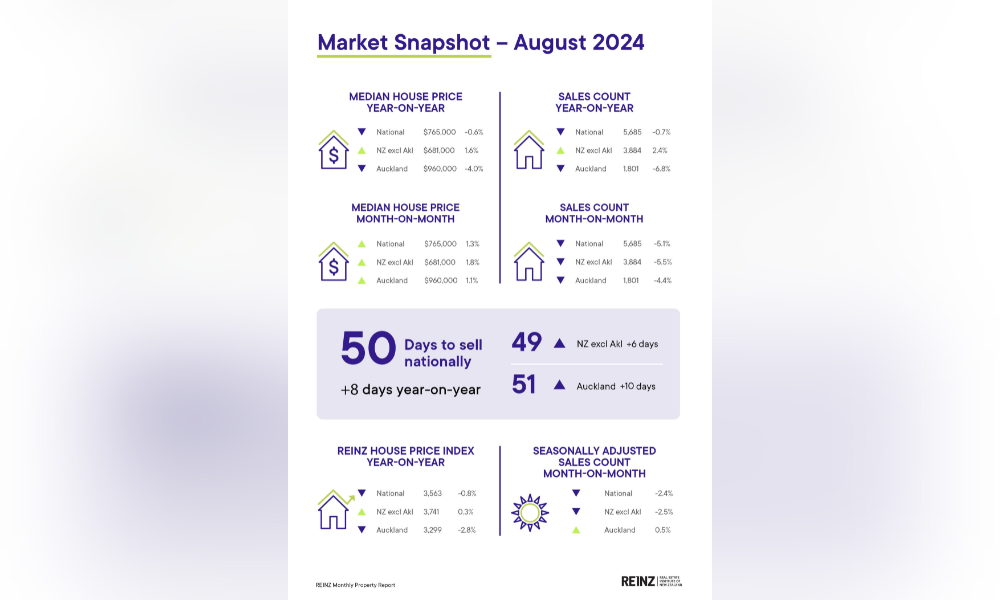

“August data shows a level of stability in the market. Despite a marginal 0.6% (or $5,000) decrease in national median prices year-on-year, we're seeing prices hold steady with a 1.3% increase month-on-month,” Baird said.

While the market appears to be becoming more optimistic, especially with inflation dropping to its lowest rate since 2016, this newfound hope is yet to translate into the data.

ANZ Research, which includes prominent economists Sharon Zollner (pictured right) and Miles Workman (pictured centre), agreed saying it’s still “too early” to see signs in this data that falling interest rates are flowing through to housing market activity.

Regional sales activity on the rise

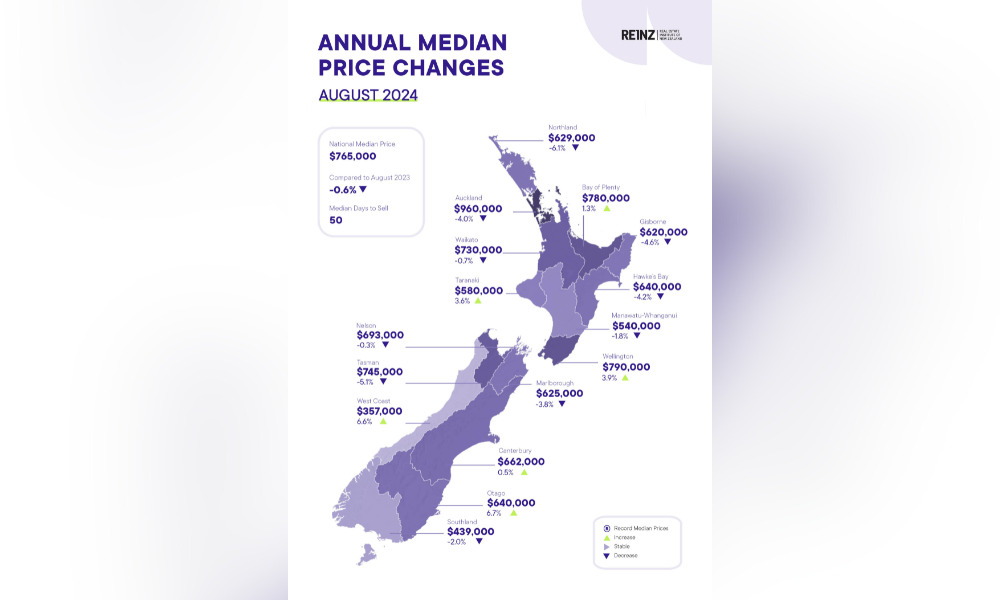

While the total number of properties sold nationally decreased by 0.7% (40 properties) compared to August 2023, several regions showed strong sales growth.

Northland saw a 22.7% increase, followed by Hawke’s Bay at 21.6%, and the Bay of Plenty at 16.2%. Month-on-month, five regions saw an increase in sales volumes.

Six of the 16 regions had a median price increase year-on-year, with Otago leading at 6.7% and the West Coast following closely with a 6.6% increase.

Notable month-on-month increases were observed in Marlborough (+7.8% to $625,000) and Gisborne (+6.0% to $620,000).

Surge in new listings

Thirteen of the fifteen regions experienced a rise in new listings year-on-year, with significant increases in Gisborne (+69.2%), Marlborough (+40.8%), and Manawatu-Whanganui (+39.8%).

Nationally, new listings rose by 8.1% compared to August 2023. However, two regions, Nelson (-18.1%) and Northland (-11.1%), saw a decrease in new listings.

“This month, we saw further signs of a change in market sentiment, with local agents reporting increased confidence in vendors and purchasers, the return of investors, and increased activity, particularly at open homes over the last two weeks of August,” said Baird.

“They attribute this change to the decline in interest rates. However, it would be an overstatement to say that we are at a turning point in the market – we merely have our indicators on.”

Inventory levels, time to sell, and auction activity

The national inventory level increased by 30.0% (+6,830 properties) year-on-year, but saw a slight decrease of 3.2% month-on-month.

For New Zealand excluding Auckland, inventory levels increased by 30.8% year-on-year. The median days to sell increased by eight days nationally compared to August 2023, now averaging 50 days.

“We continue to see an increase in the average number of properties listed. Although the inventory is down slightly compared to last month, the volume of properties for sale continues to provide a lot of choice for buyers,” Baird said.

There were 656 auctions nationally in August 2024, making up 11.5% of all sales, a slight decline from 799 (10.9% of all sales) in August 2023. In Auckland, 335 auctions were called in August 2024, down from 492 in August 2023.

“There is an expectation that rates will fall further towards the end of this year, providing the much-needed relief to property owners and those in the position to buy, which may increase sales volumes nationwide,” Baird said.

Are interest rates the key driver of the market?

Overall, the HPI for New Zealand stood at 3,563 in August 2024, a 0.8% decrease from August 2023. There was no change compared to July 2024.

The average annual growth in the New Zealand HPI over the past five years has been 5.0% per annum, and it is currently 16.7% below the market peak reached in 2021.

Southland is the top-ranked region in August, with a +3.0% increase year-on-year.

ANZ Research said the recent momentum suggests further downside risk to our forecast that house prices will fall 1% over 2024.

“But it could be a timing story, with near-term weakness increasing the scope for a recovery in 2025,” the major bank’s research arm said.

While interest rates are a key driver of the housing market, ANZ Research noted they aren’t the only driver.

“There’s still plenty of headwinds facing the market from a weakening labour market and stretched affordability,” the team said.

“On the other hand, tax and policy changes are supportive. The next few months of data will be key for getting a better sense of the trajectory from here.”