Bank economists discuss when and if rates will drop

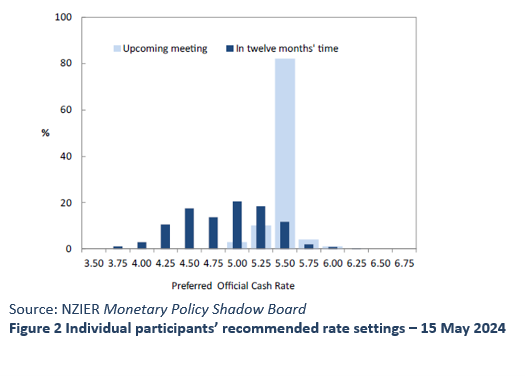

Economists on the NZIER Monetary Policy Shadow Board were unanimous that the Reserve Bank of New Zealand (RBNZ) would keep the official cash rate at 5.50% in the upcoming Monetary Policy Statement on May 22.

However, the cash rate’s trajectory over the next 12 months is less clear.

While there is consensus across the Shadow Board members, which are all independent of reserve bank, that annual CPI inflation is continuing to ease, the persistence of high domestic inflation remained a concern.

Because of this, the Shadow Board believed the OCR should remain unchanged in May. One member also pointed out that the RBNZ should keep the OCR hold in May, given the uncertainty over the government’s budget.

“Our broad view of the world is again unchanged,” BNZ head of research Stephen Toplis (pictured left). “We have a downside bias for rates, which builds strongly over the next 12 months, but equally, we think it is extremely likely that there will be no change in rates at the upcoming meeting.”

This follows a similar trend of past forecasts as the New Zealand economy grapples with overcoming a recent recession.

Regarding where the OCR should be in a year’s time, the Shadow Board’s core view was an easing in the OCR was appropriate, with the majority picking an OCR ranging between 4.50% and 5.25%.

This reflects the consensus that inflation pressures in the New Zealand economy will continue to fall given the slowing in activity and softer labour market demand in the New Zealand economy, which should provide scope for the RBNZ to lower the OCR.

However, a cautious approach by the RBNZ is still needed, given that upside risks to the inflation outlook remain, the board said. Ideally, the central bank wants inflation to track between 2%-3% for economic stability.

What do the major banks think?

Among the board, Toplis and Kiwibank chief economist Jarrod Kerr (pictured right) were the most bullish on interest rates coming down, predicting the cash rate could drop as low as 3.75% in a year’s time.

Toplis also forecasted an equal chance that the RBNZ would drop the cash rate to 5.25% this Wednesday.

Kerr said while headline inflation was moving in the right direction, domestically generated inflation was still “running too hot”.

“Imported inflation is coming off quickly, but we have an awkward outlook domestically. Households and small businesses are struggling with very restrictive monetary policy,” Kerr said.

“Employment intentions, or demand for labour, are easing when the supply, with rapid migration, is surging. Anyone who took a first-year economics course will tell you when demand falls, as supply rises, the price falls.”

“Wage growth is easing and will continue to ease into next year. RBNZ rate cuts are needed in the rebalancing.”

Westpac NZ chief economist Kelly Eckhold (pictured centre) agreed that inflation remained “sticky” and the extent to which this continues and is assisted by an easing in the labour market would be “key in determining how quickly easing proceeds in 2025”.

For this reason, Eckhold was the only bank economist to predict an increase to the cash rate in 12 months’ time, forecasting a possible but unlikely hike up to 6.00%.

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.