Sales drop, listings rise

The Real Estate Institute of New Zealand (REINZ) released its June 2024 data, indicating a decline in sales and median prices across the nation, while listings continue to increase.

According to REINZ chief executive Jen Baird (pictured above left), the property market in June mirrors the broader economic – and weather – conditions in New Zealand: a little chilly.

Despite a rise in new listings, which has been a consistent trend in 2024, there is a notable drop in buyer activity, reflected in lower national sales figures.

The total number of properties sold in New Zealand dropped by 25.6% year-on-year, from 5,854 to 4,356, and by 32.6% compared to May 2024, from 6,461 to 4,356.

Northland was the only region to see an increase in sales, up by 11.9% year-on-year.

The largest year-on-year declines were seen in West Coast (-51.2%), Tasman (-41.7%), Gisborne (-39.4%), and Auckland (-35.1%). All regions experienced a decrease in sales compared to May 2024.

“The usual winter slowdown, compounded by current economic conditions, has led to lower market activity,” Baird said.

“Seasonally adjusted figures show an 11.1% national sales decrease compared to May 2024, highlighting a market performance below expected levels.”

Adviser experiences market flooded with new builds

On the ground, Lucia Xiao, a mortgage adviser from Property Investment Mentor, said winters are typically quieter for property activities.

“This winter though, real estate agents struggle with low attendance at open homes for new builds,” said Xiao (pictured above right). The comments follow other anecdotal comments made by advisers about tough market conditions, although some say there are still leads to be found.

Xiao said she hopes the market will pick up in Mid-September to November as that time of year sees increased demand due to school zone preferences.

“Spring is usually a good season for property activities where banks offer special promotions. The post-New Year market usually also has activity pick up after a long break.”

However, this year, Xiao said the market is “flooded with new builds from developers”.

“Rate cuts are also delayed, causing people to hold onto their money. And there’s less desire to invest unless there's a need for school zones or relocation.”

National median price falls as listings jump

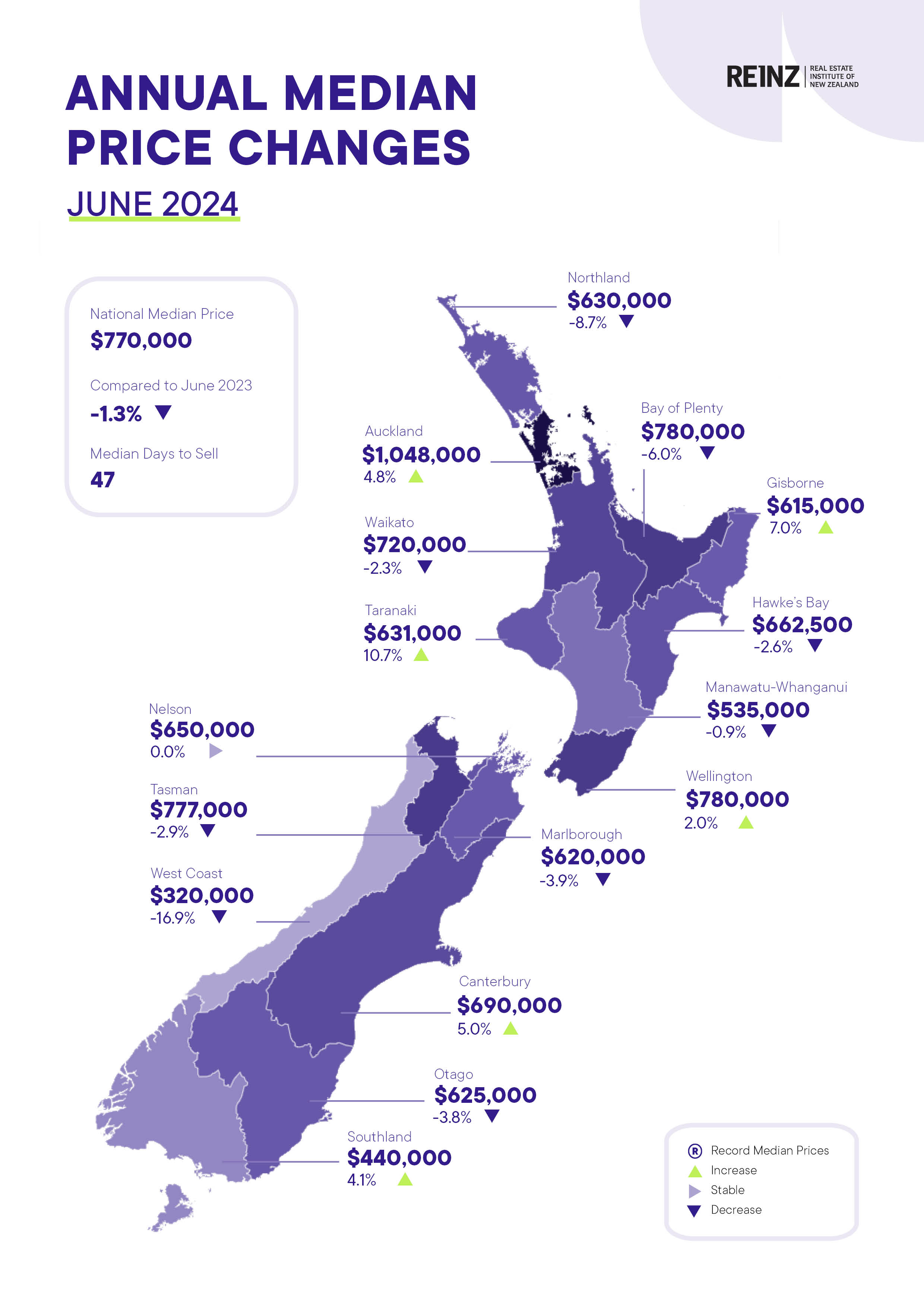

Median prices for June were mixed, with six of the sixteen regions increasing year-on-year.

The national median price decreased by 1.3% year-on-year, from $780,000 to $770,000, and saw no change compared with May 2024.

For NZ, excluding Auckland, the median price was up slightly by 0.4% year-on-year, from $682,500 to $685,000, but decreased 0.6% compared to May 2024, from $689,000 to $685,000.

At the end of June, the national inventory level had increased 28.6% (+7,069) from 24,676 to 31,745 year-on-year and decreased 2.6% from 32,598 month-on-month.

For New Zealand apart from Auckland, inventory levels increased 25.1% (+3,929) year-on-year from 15,655 to 19,583 and decreased 3.2% compared to May 2024 (-647).

Nationally, listings increased by 25.5% year-on-year from 6,218 to 7,805.

Twelve of the 15 regions have seen a rise in new listings year-on-year, with significant increases in Wellington (+50.3%), Hawke’s Bay (+35.6%), Gisborne (+34.8%), Bay of Plenty and Canterbury (+33.6%), Auckland (+33.0%) and Otago (+23.4%).

Only two regions saw a decrease in new listings year-on-year: Northland (-26.0%) and Marlborough (-11.8%). West Coast saw no change compared to June 2023 (49 new listings).

“The increased number of listings coming to market continues the trend we have seen all year, with high levels of choice for buyers nationwide,” Baird said.

“The winter months do tend to see fewer people choosing to sell, and this year is no different. Yet, regardless of the economic conditions, people’s lives change, they grow families and retire and need to make a property decision alongside those changes.

“Salespeople are seeing some properties come to market due to high interest rates, cost of living pressures and changing employment circumstances.”

House Price Index down amid ‘recessionary times’

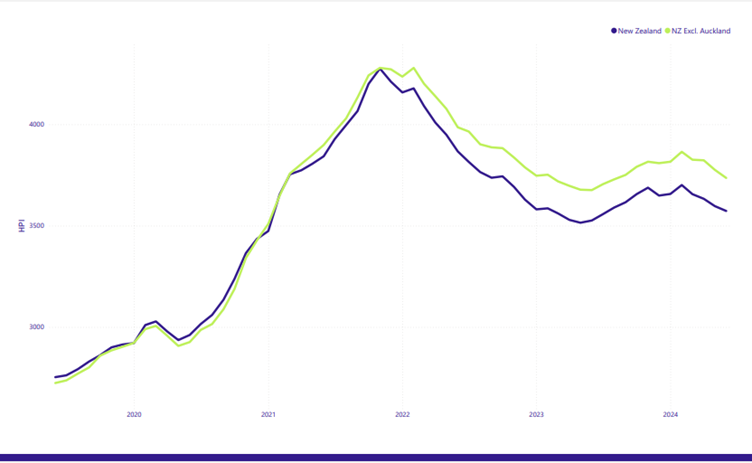

The House Price Index (HPI) for New Zealand stood at 3,573 in June, down 0.7% from May and up by 1.3% year-on-year.

The average annual growth in the New Zealand HPI over the past five years has been 5.4% per annum, and it is currently 16.4% below the market peak reached in 2021.

“There was a notable decrease in buyer activity in June and a reduced sense of urgency. As more listings come to a well-stocked market, those who are in the position to buy are taking their time to carefully select their ideal home,” said Baird.

“While winter has set in, we have just seen a slight change in tone coming from the Reserve Bank suggesting that this cycle of interest rate pain may have an end in sight. This is a key factor in both buying and selling decisions but also has an impact on overall sentiment within the industry.”

Industry analyst Martin North, principal of Digital Finance Analytics, said you can see how the significant economic downturn is spilling over into property prices.

“Probably the bank will turn tail and begin to cut rates but not as early as many hope and of course the property market is in the absolute doldrums as more people are under financial pressure,” said North, analysing the REIZ figures.

“This is a further confirmation of the recessionary times in New Zealand.”